The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Elliott Wave View Suggest FTSE Close To Reaching Extreme

Read MoreFTSE short-term Elliott wave view suggests that the cycle from 12/27/2018 low is unfolding as elliott wave zigzag structure & soon should be reaching its extreme area at 7191.16-7473.95 expecting more downside or 3 wave reaction lower at least.

-

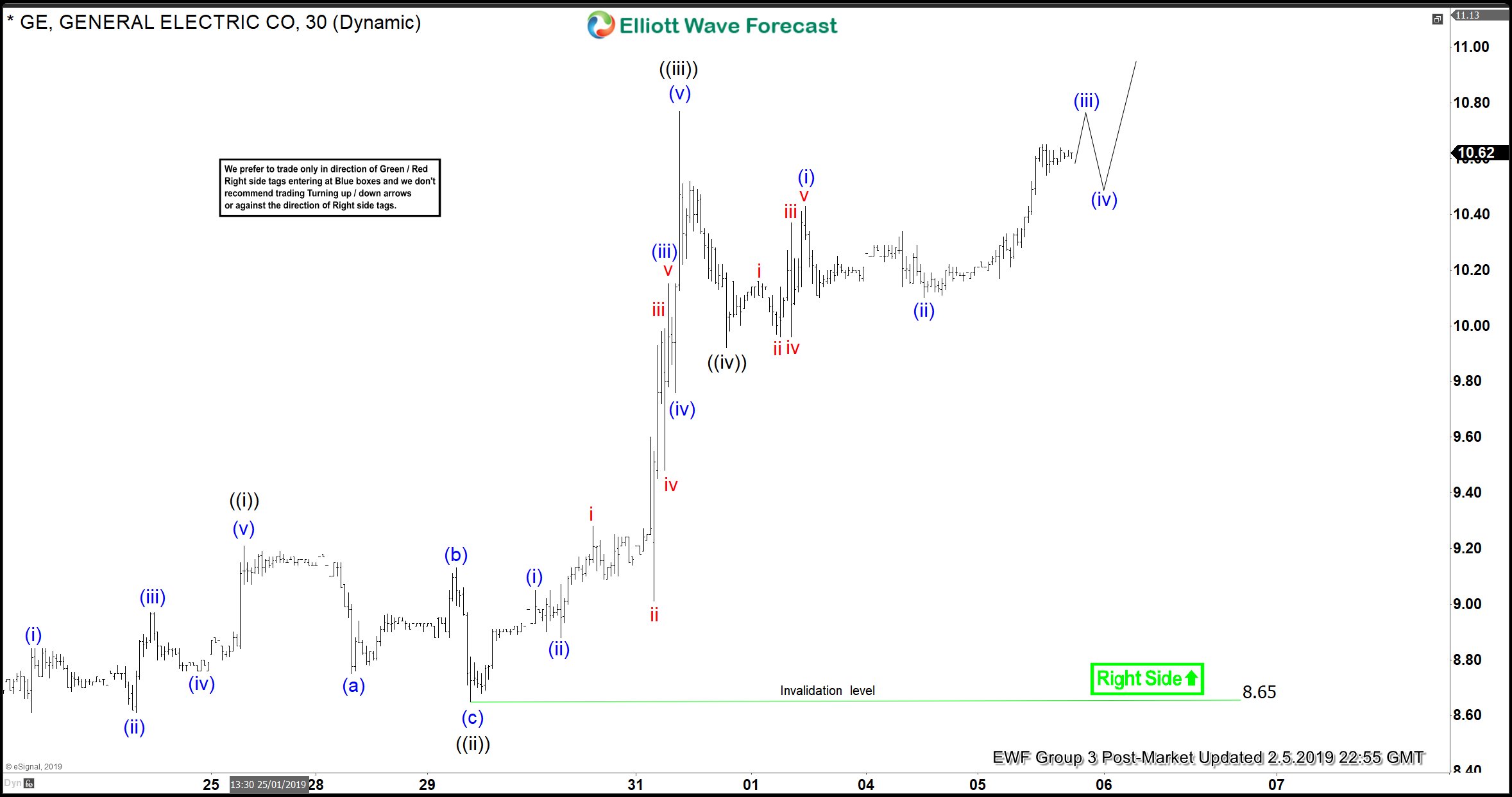

Elliott Wave View Suggest More Upside in General Electric

Read MoreGeneral Electric short term Elliott wave view suggests that the rally from 12/11/2018 low is unfolding as zigzag structure & missing the extreme favoring more upside still.

-

SPY : More Volatility to Come Due to the Market’s Nature

Read MoreOur observations of the ETF, SPY, on the monthly chart have us expecting a spike in Volatility. The inherent bullish nature of the Market calls for advances (motive waves) as trends and pullback (corrective waves) as countertrend. To add to that nature, Elliott Wave Theory always suggests one of the 3 motive waves within an […]

-

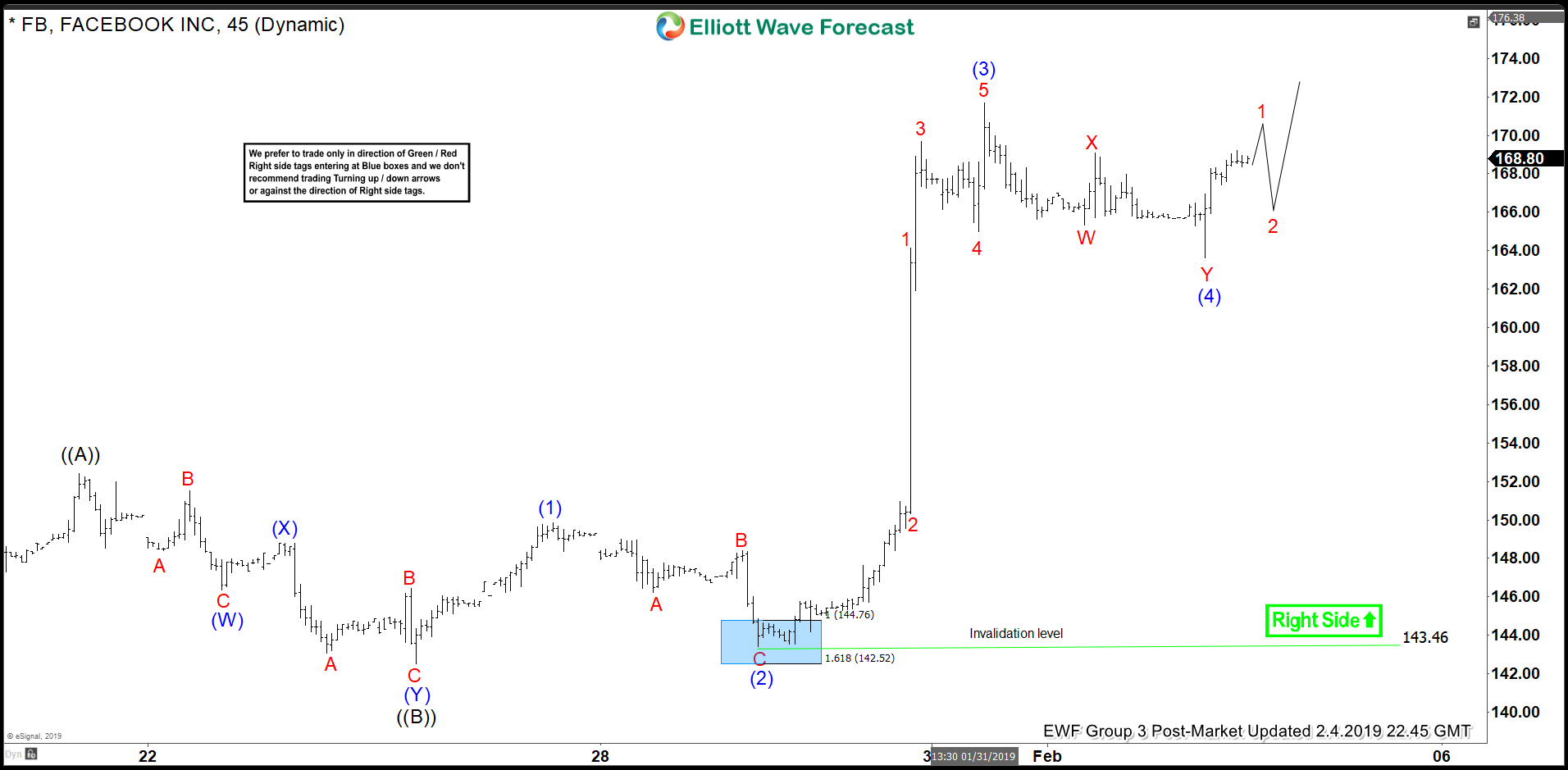

Elliott Wave View Suggest Another Push Higher In Facebook

Read MoreThis article and video explain the short term Elliott Wave structure of Facebook. 1 more high is expected due to incomplete Elliott wave structure.

-

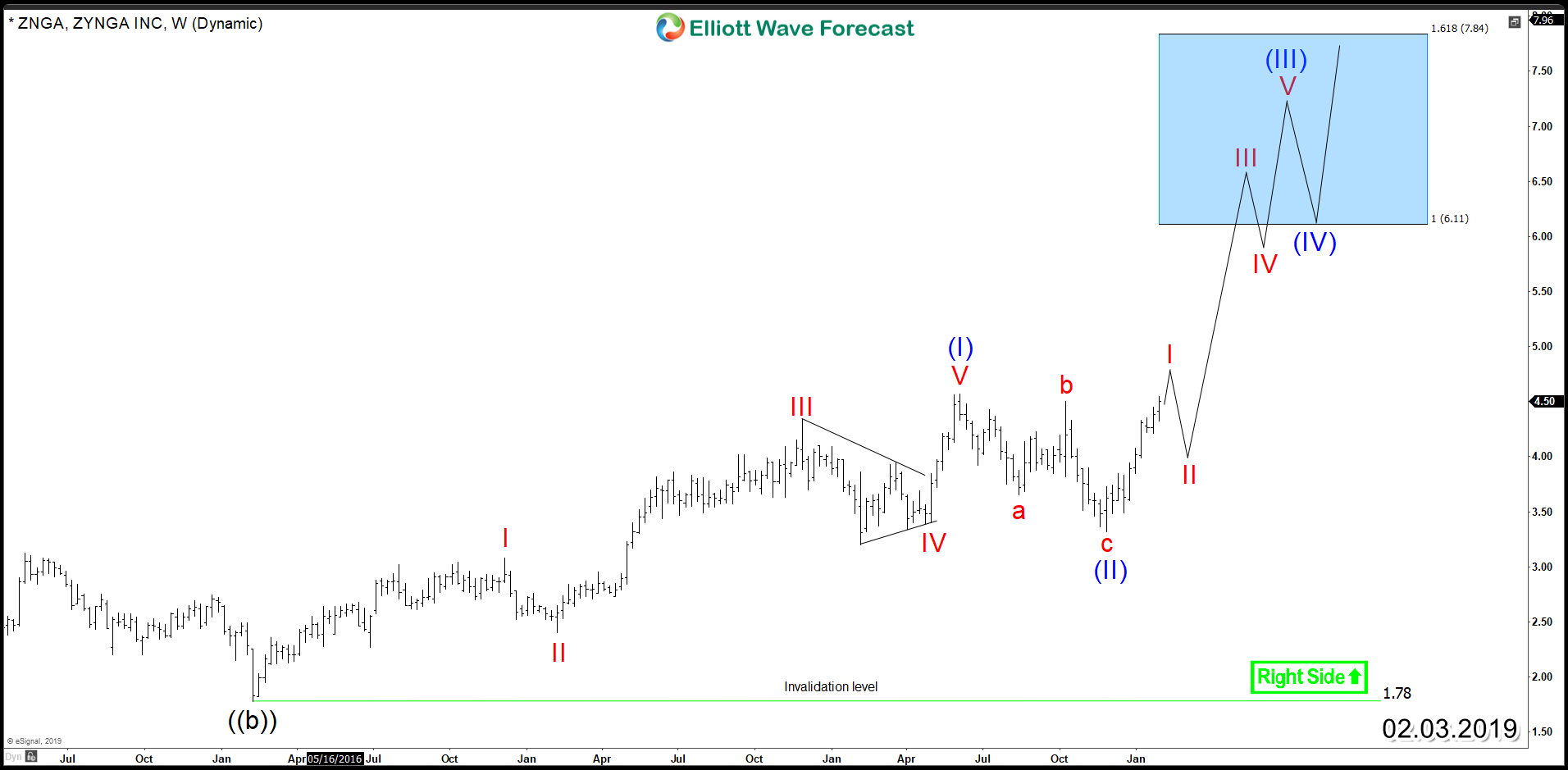

Zynga (NASDAQ: ZNGA) – Starting New Bullish Sequence

Read MoreZynga (NASDAQ: ZNGA) is a video game developer company focused on social mobile gaming. With popular games like FarmVille and Zynga Poker, the American publisher managed to stand out in a crowded market. In the recent decade, the number of gamers grow in a fast pace and leading companies like Activision Blizzard (NASDAQ: ATVI) & Electronic Arts (NASDAQ: […]

-

FTSE Found Buyers In Blue Box And Rallied

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of FTSE. FTSE was correcting the cycle from the 6530.6 low,when the pull back was unfolding as Elliott Wave FLAT pattern. We expected FTSE to trade higher due to 5 waves rally in the cycle from […]