The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

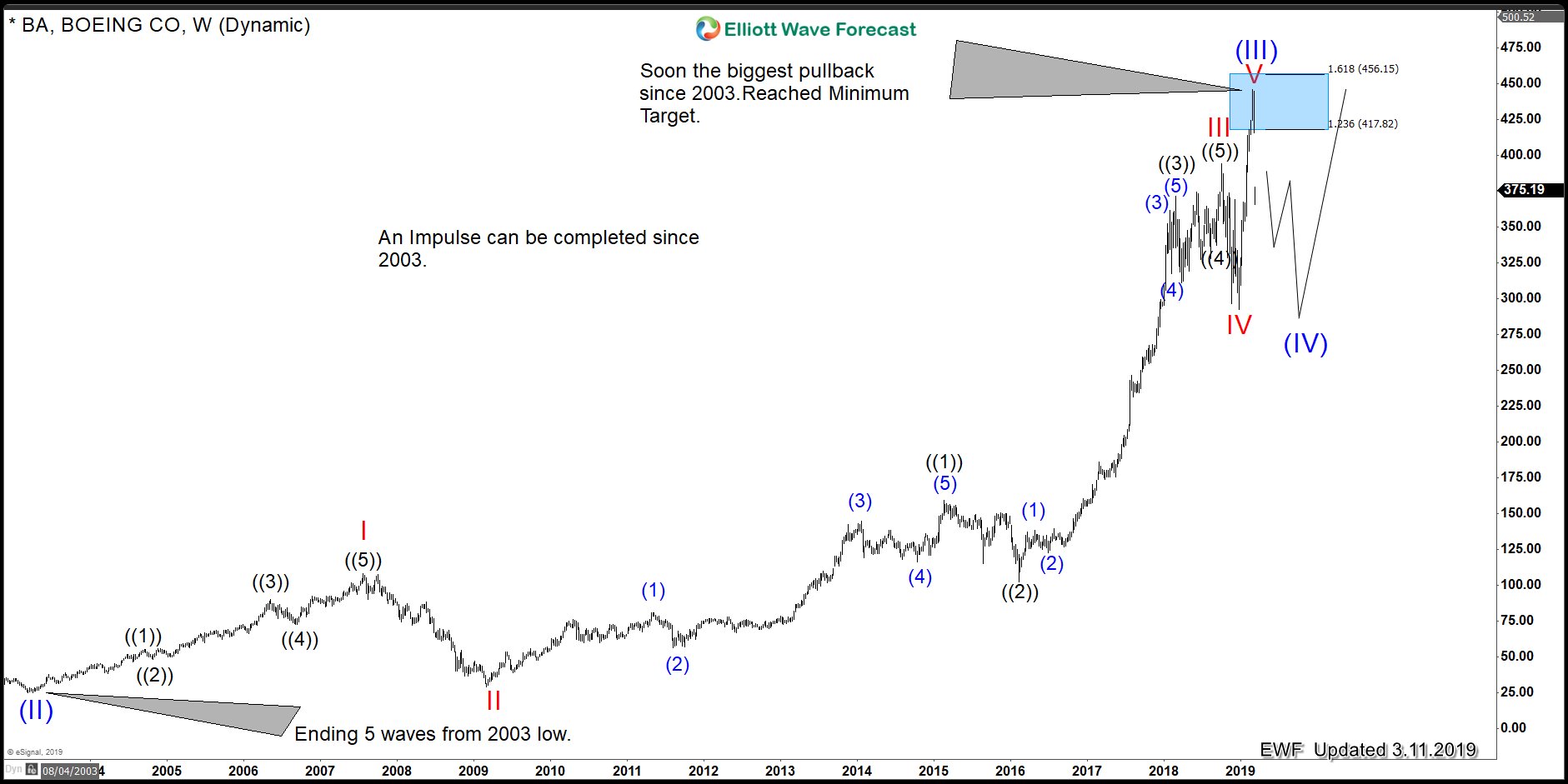

Boeing (BA): Forming the Biggest Peak Since 2003 lows

Read MoreThe Stock is trading within a very technical area and it is showing a very clear 5 waves advance Elliott wave structure from its 2013 lows. When a 5 waves structure can be seen we always should be careful and pay attention to the direction of the 5 waves. Accordingly, to the Elliott Wave Theory […]

-

The $TSX.CA Composite Index Cycles & Bullish Trend

Read MoreThe $TSX.CA Composite Index Cycles & Bullish Trend Firstly, the index has rallied with other world indices trending higher into the June 2008 highs. It then corrected the bullish cycle as did most other world indices. The index ended that larger degree correction in March 2009. It is at this point where the index corrected […]

-

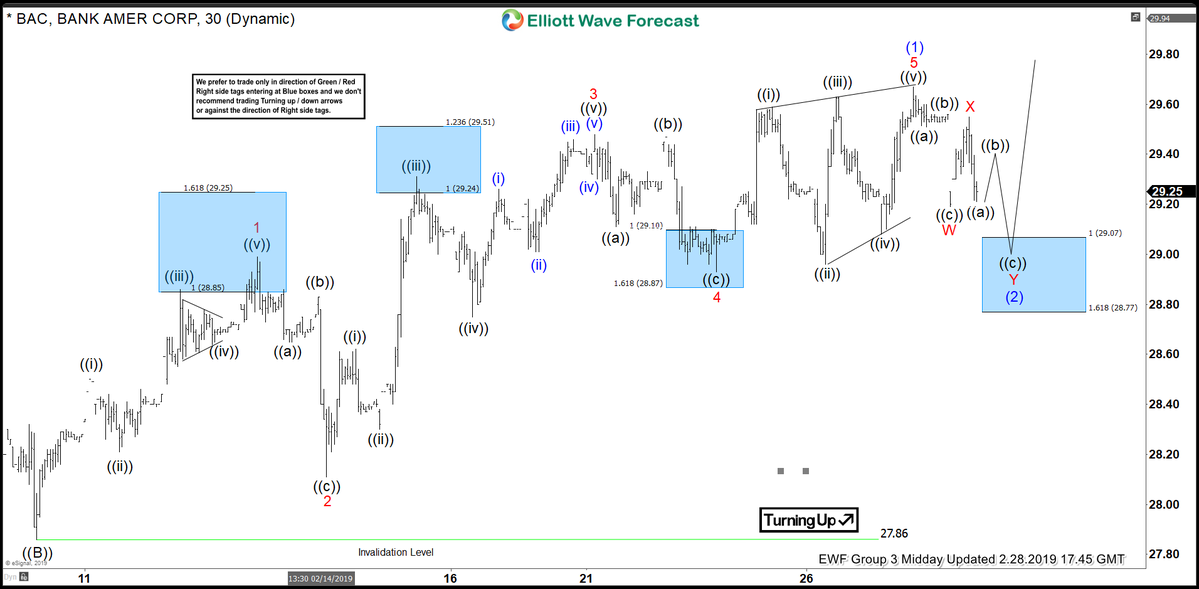

BAC Elliott Wave Analysis: Calling The Reaction From Inflection Area

Read MoreIn today’s blog we will look at Bank of America’s chart (BAC) which shows a blue box. This blue box represents inflection area where a reaction in 3 waves at least can happen. Below, you see the 1-hour updated chart presented to our clients on the 02/28/19. From 02/08/19 low (27.88) the stock ended the cycle at 01/27/19 […]

-

Elliott Wave View: DAX Structure Remains Bullish As Pullback In Progress

Read MoreThis article and video explains the short term Elliott Wave path for DAX. The Index remains bullish and dips should find buyers in 3, 7, or 11 swing.

-

Elliott Wave View: S&P 500 (SPX) Correction Should Find Buyers Again

Read MoreThis article and video explain the short term Elliottwave path for S&P 500 (SPX). The Index is in wave ((4)) correction but should find buyers again for more upside.

-

NASDAQ Found Buyers In Blue Box And Rallied

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of NASDAQ. As our members know recently we got pull back that was unfolding as Elliott Wave Double Three Pattern. We expected NASDAQ to find buyers again and trade higher due to incomplete bullish seqeuences in […]