The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

NIKKEI ( $NKD_F ) Incomplete Bullish Sequences Calling The Rally

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of NIKKEI . As our members know, NIKKEI has had incomplete bullish sequences in the cycle from the December 26th 2018 low. The Elliott wave structure had been calling for further strength targeting 22213 + area. […]

-

Elliott Wave View: S&P 500 Futures Eyeing New All-Time High

Read MoreS&P 500 is close to breaking about 2018 high. This article and video explains the short term Elliott Wave path of the Index.

-

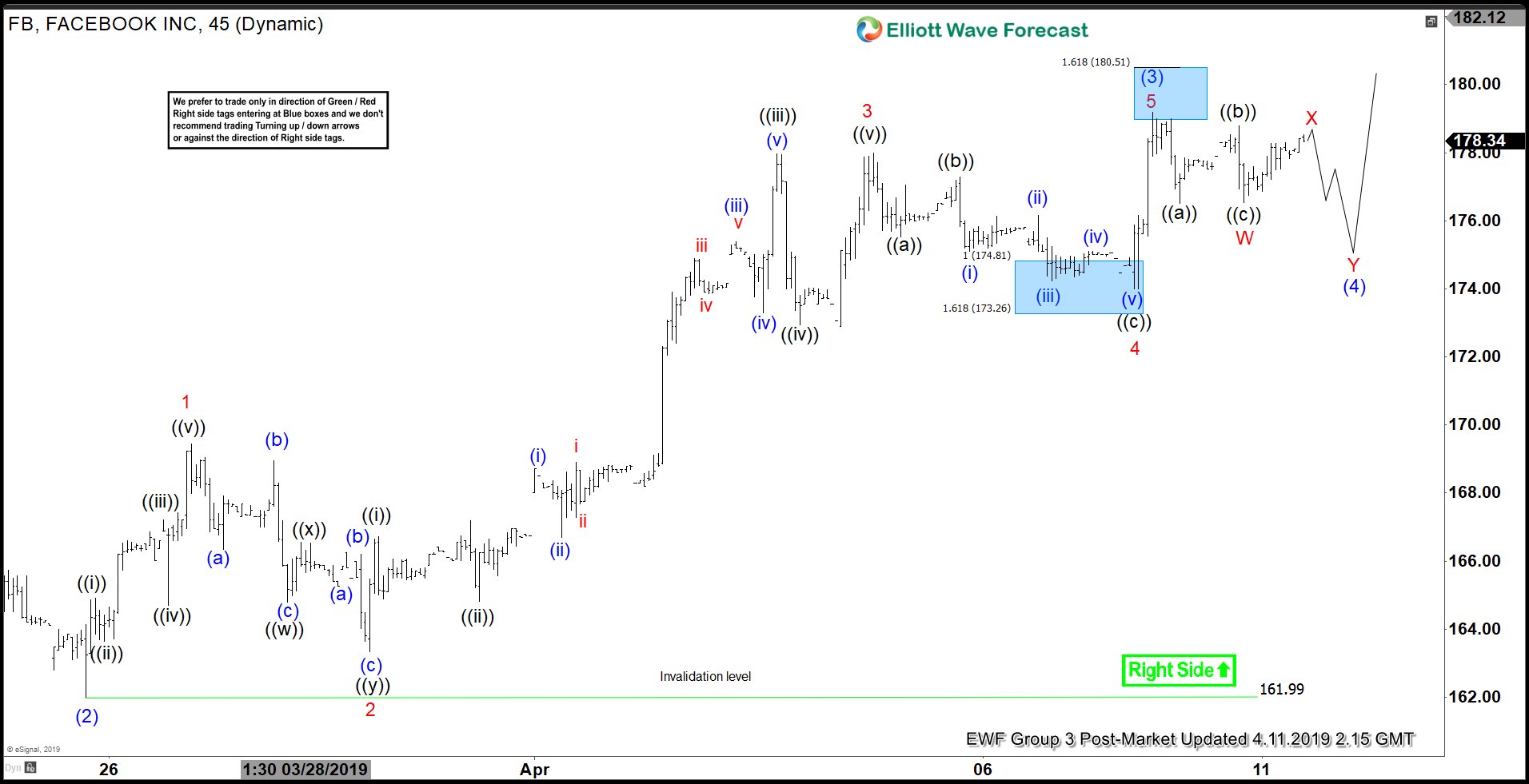

Elliott Wave View Favors More Upside in Facebook

Read MoreFacebook shows incomplete sequence from December 2018 low. This article and video explains the short term Elliott Wave path.

-

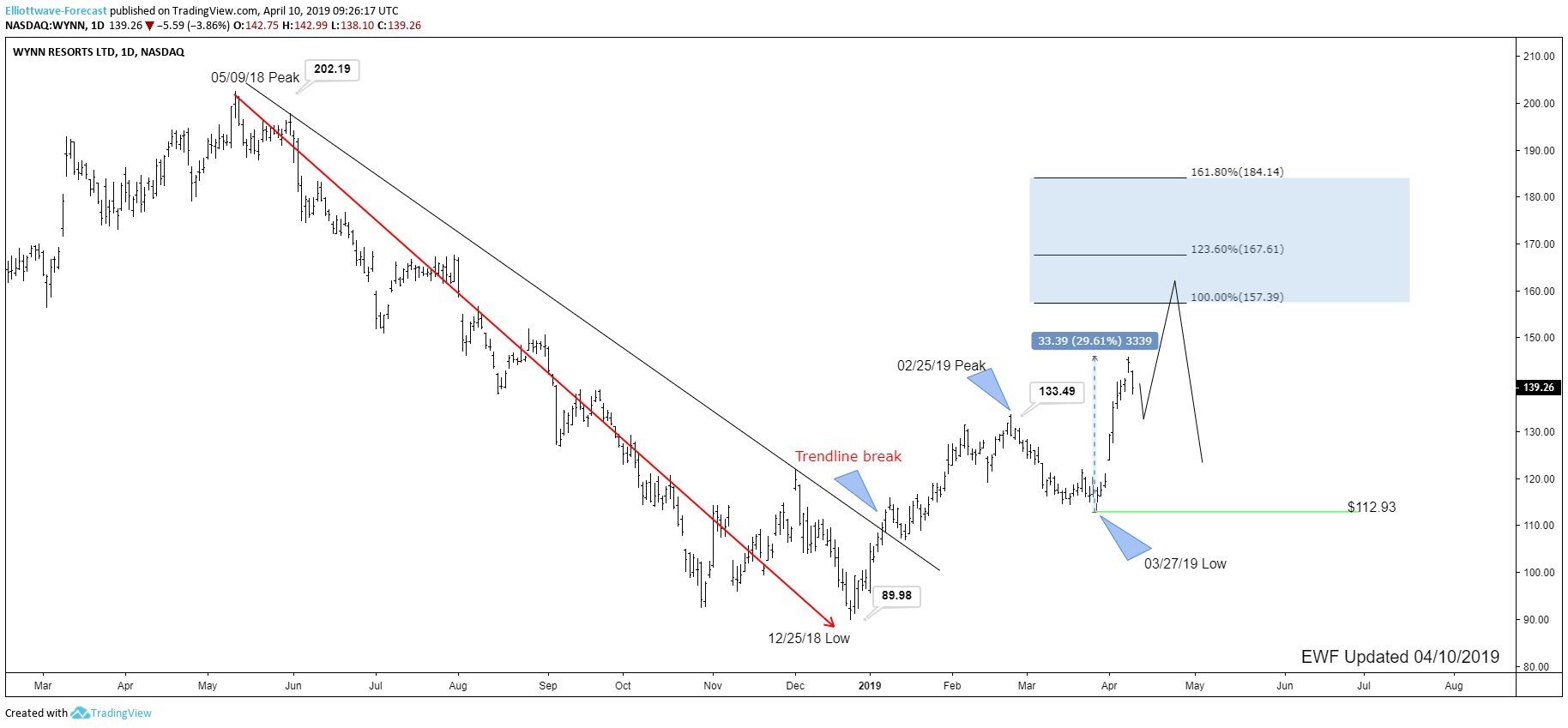

WYNN Resorts Ltd. stock soaring Higher, Can It Continue?

Read MoreHello fellow traders. In today’s blog, we will have a look at the recent price action of the WYNN Resorts Ltd. stock. The stock is listed in the Nasdaq 100 and the S&P500. WYNN Resorts Ltd. is an American company which is based on the Las Vegas Strip in Nevada. It is an operator of […]

-

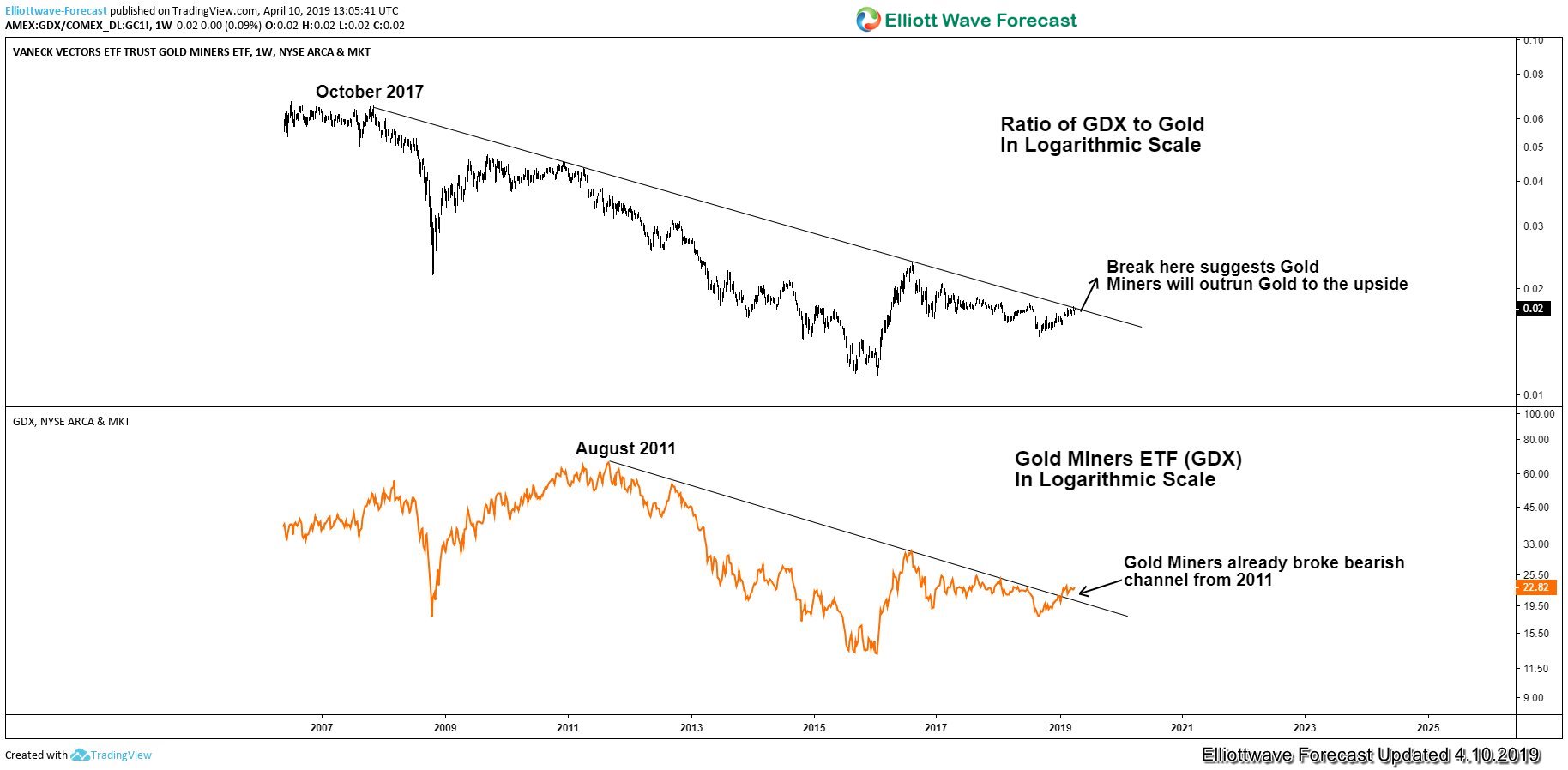

Gold Miners (GDX) Ready for Breakout

Read MoreGold miners as a group is unpopular since it topped in 2011 together with Gold. One well-known Index which represents major Gold Miners is the GDX. The Index topped in 2011 at $67 and declined a massive 81% before forming a low in 2016 at $12.40. None of the ample liquidity from central bank’s money […]

-

Sony Corporation (NYSE: SNE) Impulsive Structure Since 2012

Read MoreSony Corporation (NYSE: SNE) is a Japanese multinational conglomerate corporation. The Company has a diversified business primarily focused on the Electronics, Games, Entertainment and Financial Services. In this article, we’ll be looking at the technical Elliott Wave structure of the stock since late 2012 after a significant drop in Yen value which helped the Japanese stock market […]