The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Elliott Wave View: Dow Jones Future YM_F Rally Should Fail

Read MoreDow Jones Future (YM_F) is correcting cycle from May 22 but the rally will likely fail. This article and video shows the short term Elliott Wave path.

-

Russell Futures Forecasting The Path using Elliott Wave Theory

Read MoreRussell Futures, today dropped below 5/13/2019 peak and now showing an incomplete sequence down from 5/6/2019 peak. In this blog, we will take a look at how our recent short-term forecasts in Russell Futures have played out and what we are expecting next. Below, we can see the short-term forecast from May 14 when we […]

-

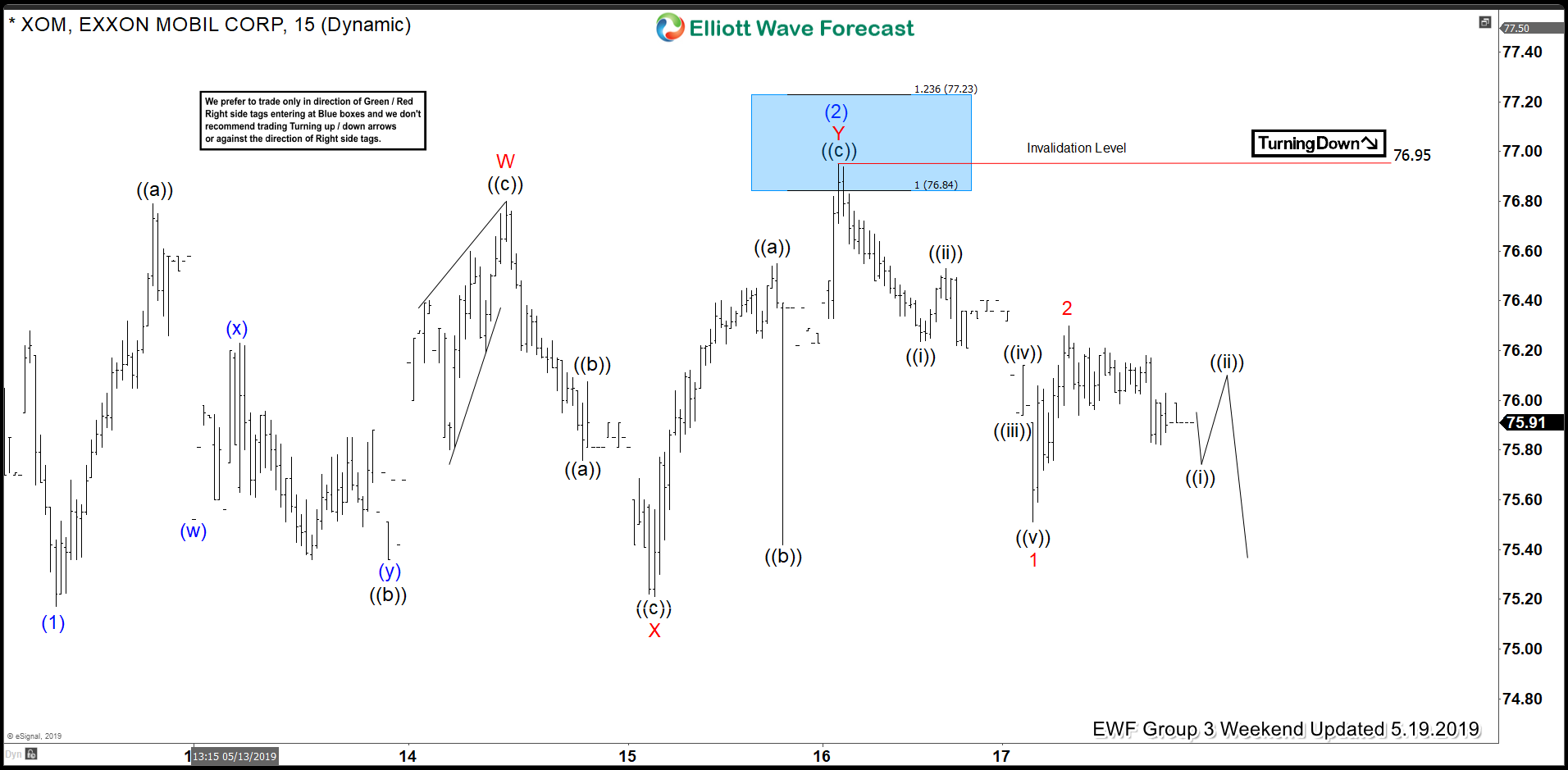

XOM Reacting Lower From Elliott Wave No Enemy Area

Read MoreIn this technical blog, we will review the past performance charts of XOM & explain the no-enemy areas which are reflected as blue box areas on our Charts.

-

2020: The next U.S. Election Can Create A Big Market Pullback

Read MoreU.S. Election 2020: Many Traders always believe the Market moves are driven by fundamental outcomes. We at Elliott Wave Forecast believe that the Market follows a code which is visible and repeats itself in every single time frame. We operate under the impression that only a few market makers make the Market. It is obvious […]

-

Elliott Wave View: Short Term Support in FTSE

Read MoreFTSE shows incomplete sequence from May 13 low & can see further upside in the shorter cycle.This article & video shows the short term Elliott Wave path.

-

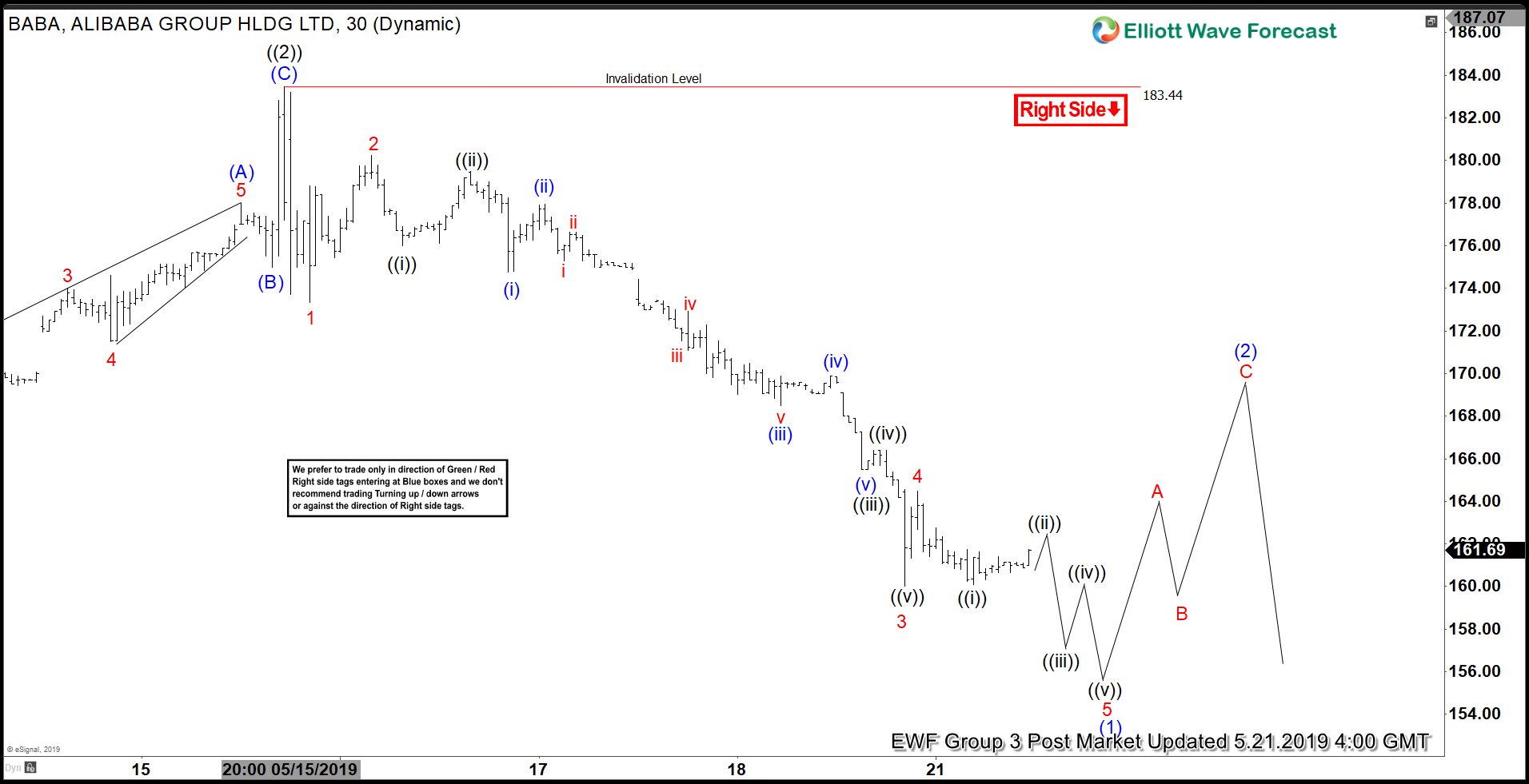

Elliott Wave View: Alibaba Has Started the Next Leg Lower

Read MoreShort term Elliott Wave view in Alibaba (BABA) shows an incomplete sequence from May 4, 2019 peak. The decline from there can either unfold as a zigzag or impulsive Elliott Wave structure. We use the impulsive structure as the chart below shows that the rally to $183.44 ended wave ((2)). This means, Alibaba is now […]