The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

AMD Elliott Wave: Bullish Sequences Calling the Rally

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of AMD stock published in members area of the website. As our members know, AMD is showing an impulsive bullish sequence in the cycle from the 75.22 low. Recently, the stock has completed a 3-wave pullback […]

-

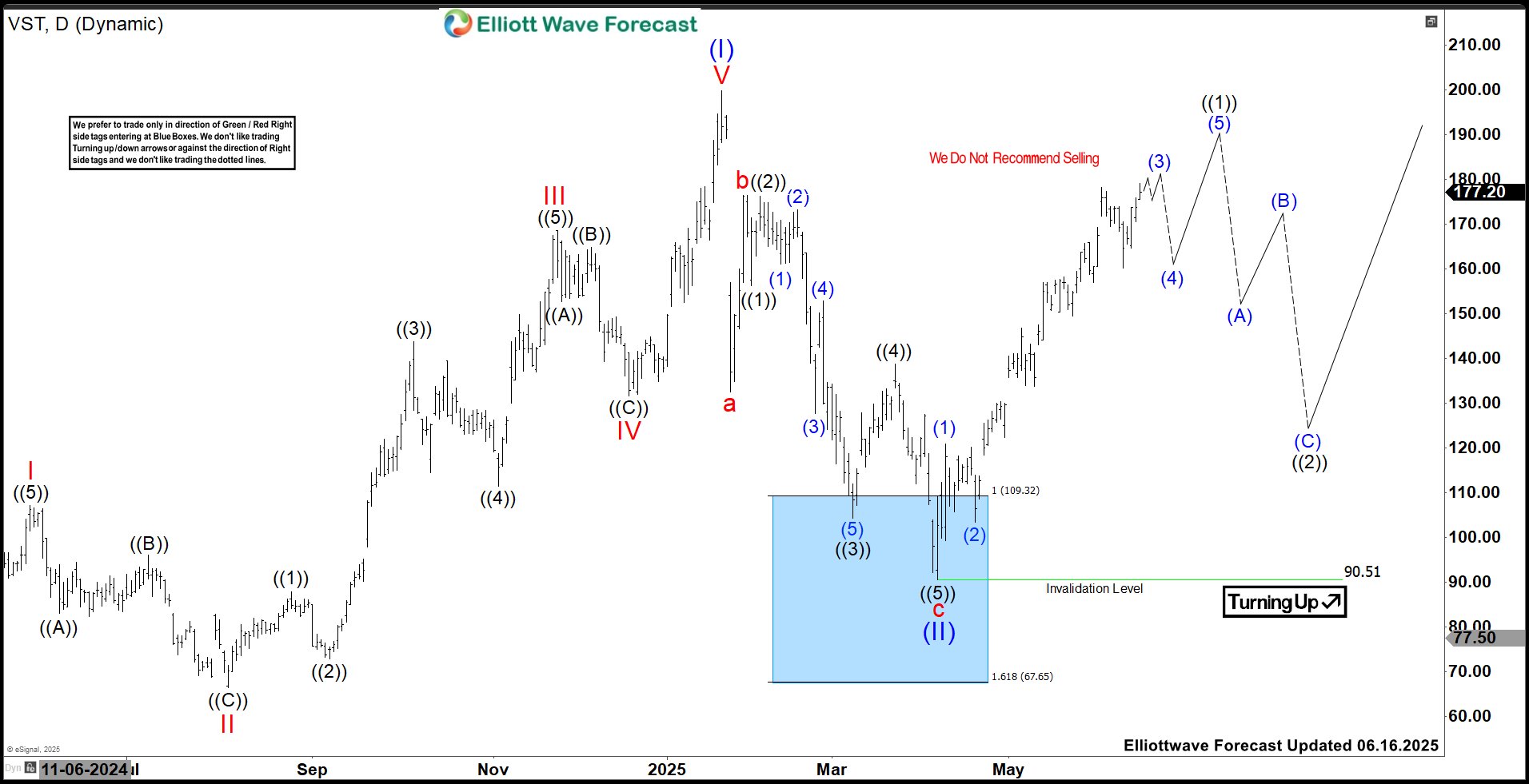

Vistra (VST) Rallies Over 60% from Blue Box Entry – What’s Next?

Read MoreVistra Corp., (VST) operates as an integrated retail electricity & power generation company in the United States. It operates through five segments like Retail, Texas, East, West & Asset Closure. It comes under Utilities sector & trades as “VST” ticker at NYSE. As discussed in the previous article, VST ended corrective pullback in blue box […]

-

AMD Elliott Wave Analysis: 5 Wave Rally Supports Bullish Bias

Read MoreAMD rally from April 10, 2025 low takes the form of 5 waves favoring the bullish bias. This article and video look at the Elliott wave technical path.

-

American Airlines Group Inc. $AAL Looking For A Bounce From Extreme Areas

Read MoreHello everyone! In today’s article, we’ll examine the recent performance of American Airlines Group Inc. ($AAL) through the lens of Elliott Wave Theory. We’ll review how the decline from the May 14, 2025 high unfolded as a 3-swing correction (ABC) and discuss our forecast for the next move. Let’s dive into the structure and expectations for this stock. ABC correction […]

-

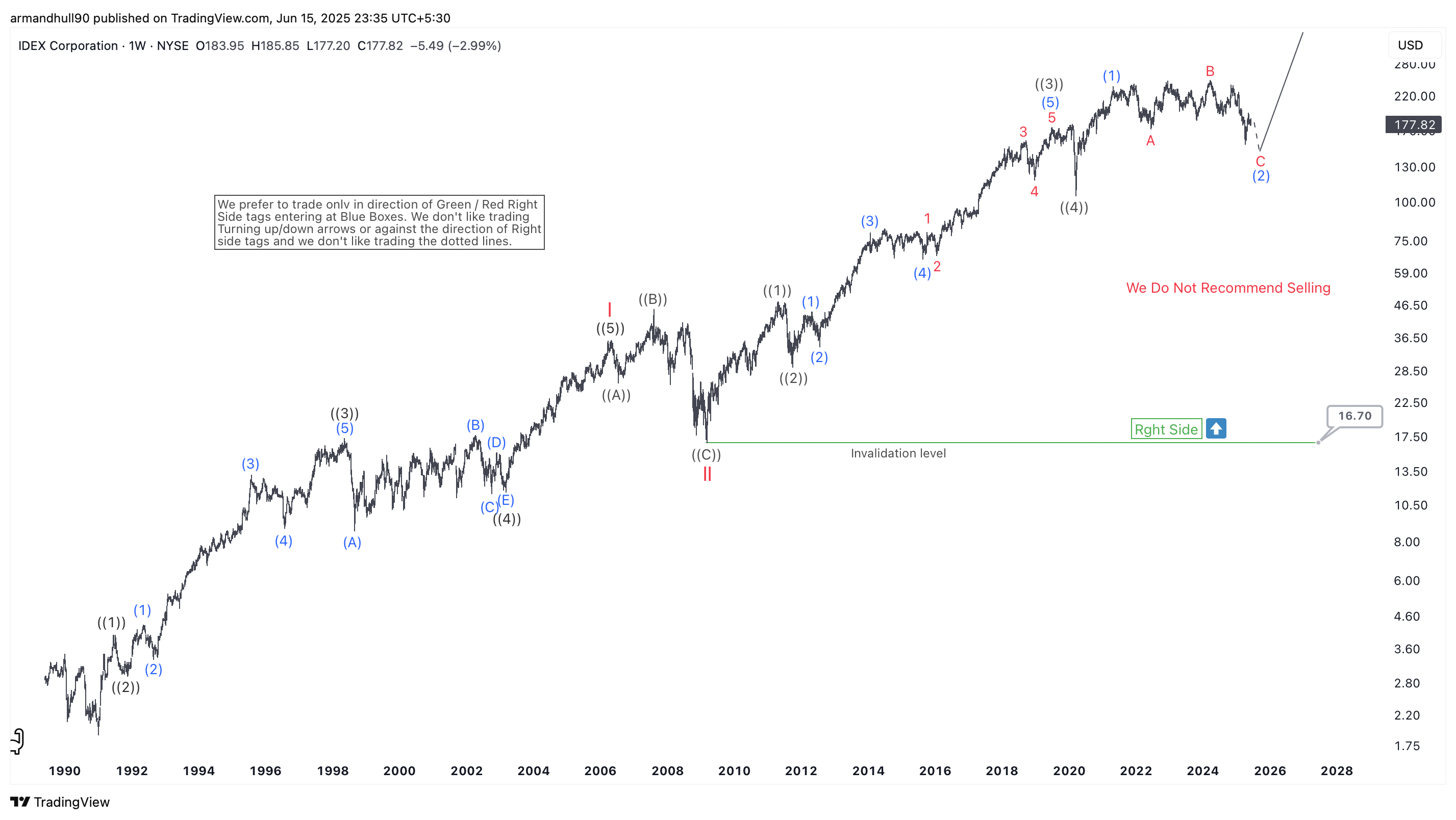

IDEX Corporation (IEX) Elliott Wave Weekly Analysis

Read MoreBullish Continuation Expected as IDEX Sets Up for the Next Impulsive Rally in Wave (3) IDEX Corporation (NYSE: IEX) is showing signs of completing its wave (2) correction within a broader bullish Elliott Wave cycle. The long-term chart highlights a strong impulsive trend that began in the early 1990s. Since then, the stock has advanced […]

-

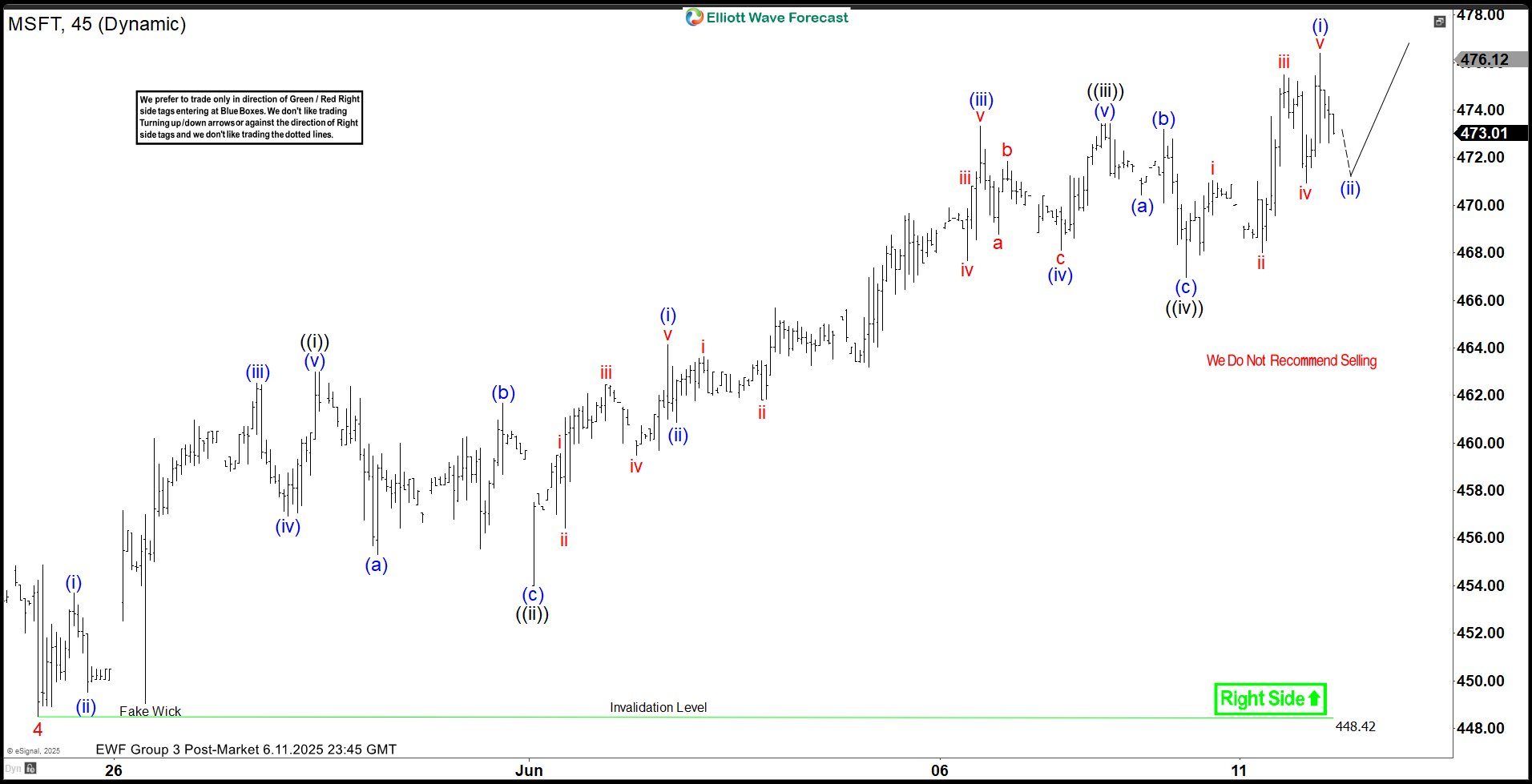

Elliott Wave Outlook: Microsoft (MSFT) Surges to Record High, Sustaining Bullish Momentum

Read MoreMicrosoft (MSFT) has recovered completely from the tariff war selloff and made new high. This article and video look at the Elliott Wave path.