The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

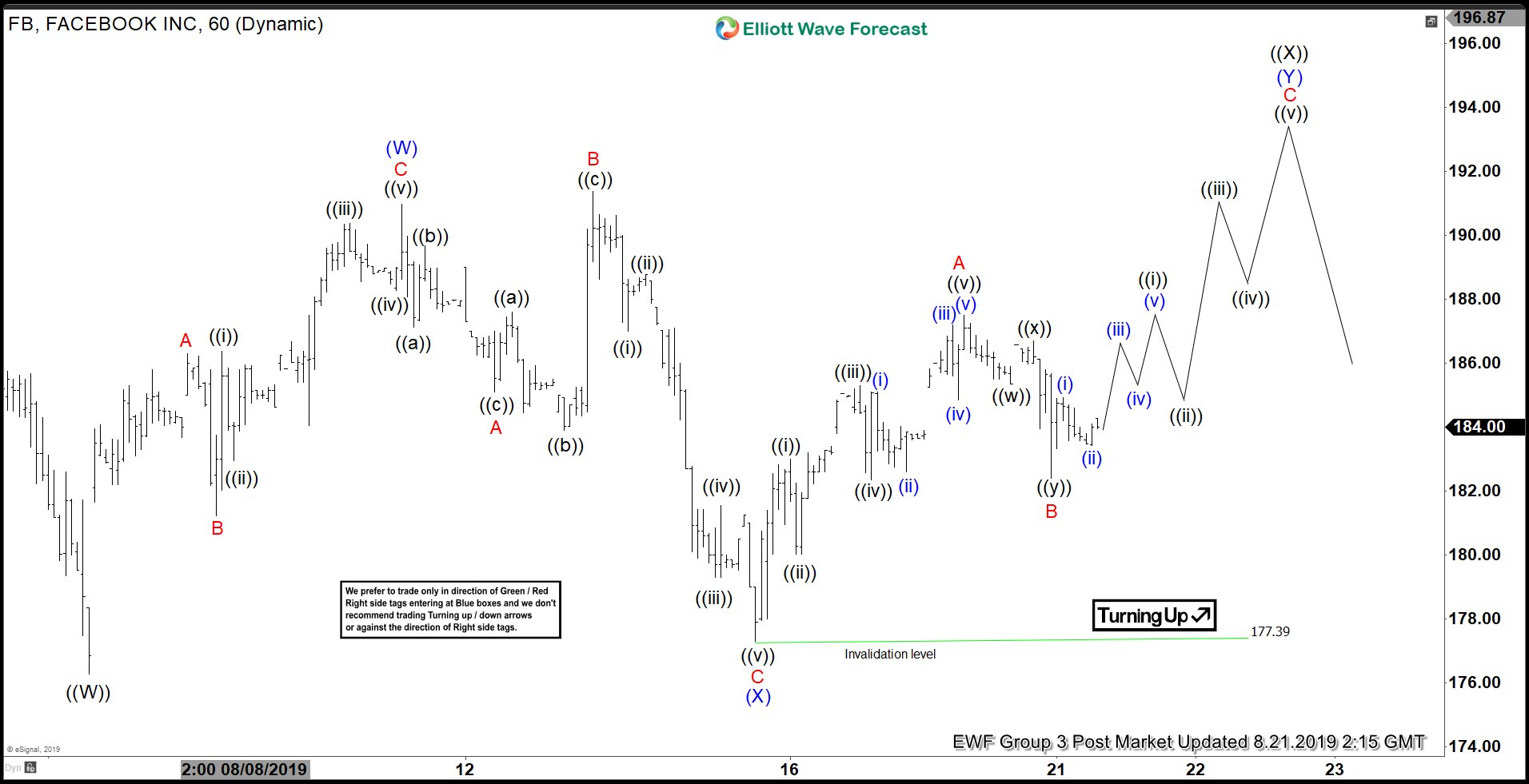

Elliott Wave View: Rally in Facebook is Corrective

Read MoreStructure of Facebook rally from Aug 6 low is corrective and unfolding as a double three Elliott Wave structure before the decline resumes.

-

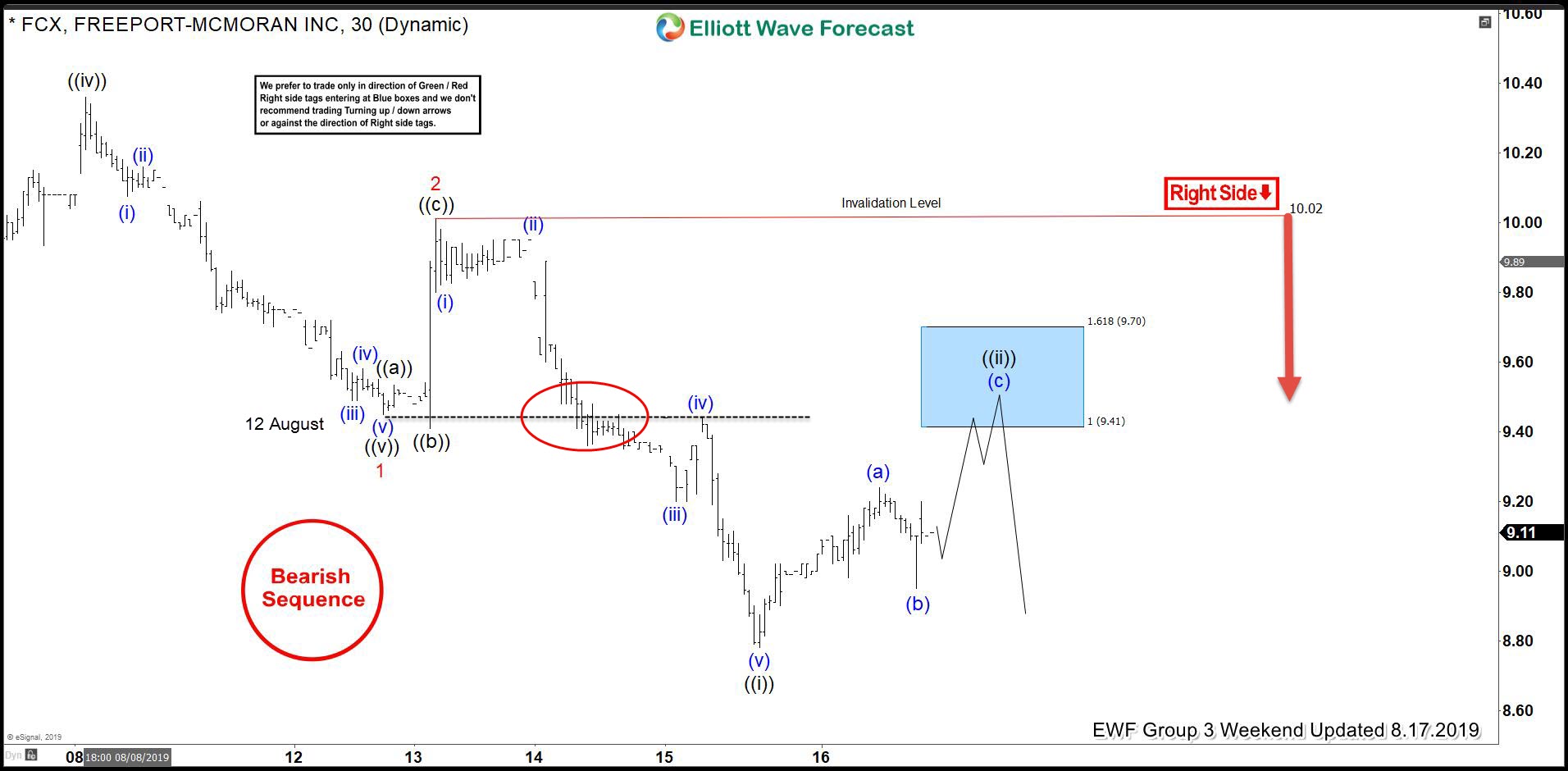

FCX Found Sellers In The Blue Box

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of FCX, published in members area of the website. As our members know, FCX has incomplete bearish sequences in the cycle from the 12.16 ( July 24th) peak. Consequently, we advised members to avoid buying the […]

-

GLD Longer Term Cycles and Elliott Wave Analysis

Read MoreGLD Longer Term Cycles and Elliott Wave Analysis Firstly the GLD ETF fund is one of the largest as well as one of the oldest Gold tracking funds out there since it’s inception date of November 18, 2004. From there on up into the September 2011 highs it ended a larger bullish cycle as did […]

-

Inverted Yield Curve and What It May Mean to the Indices

Read MoreLast week, traders got spooked by the yield curve inversion of the most closely watched 2 year vs 10 year bonds. Yield curve inversion between 2 year and 10 year bond is a powerful predictor of recession. The 2-10 yield curve inversion preceded the past seven recessions from 1969. This means that the interest rates […]

-

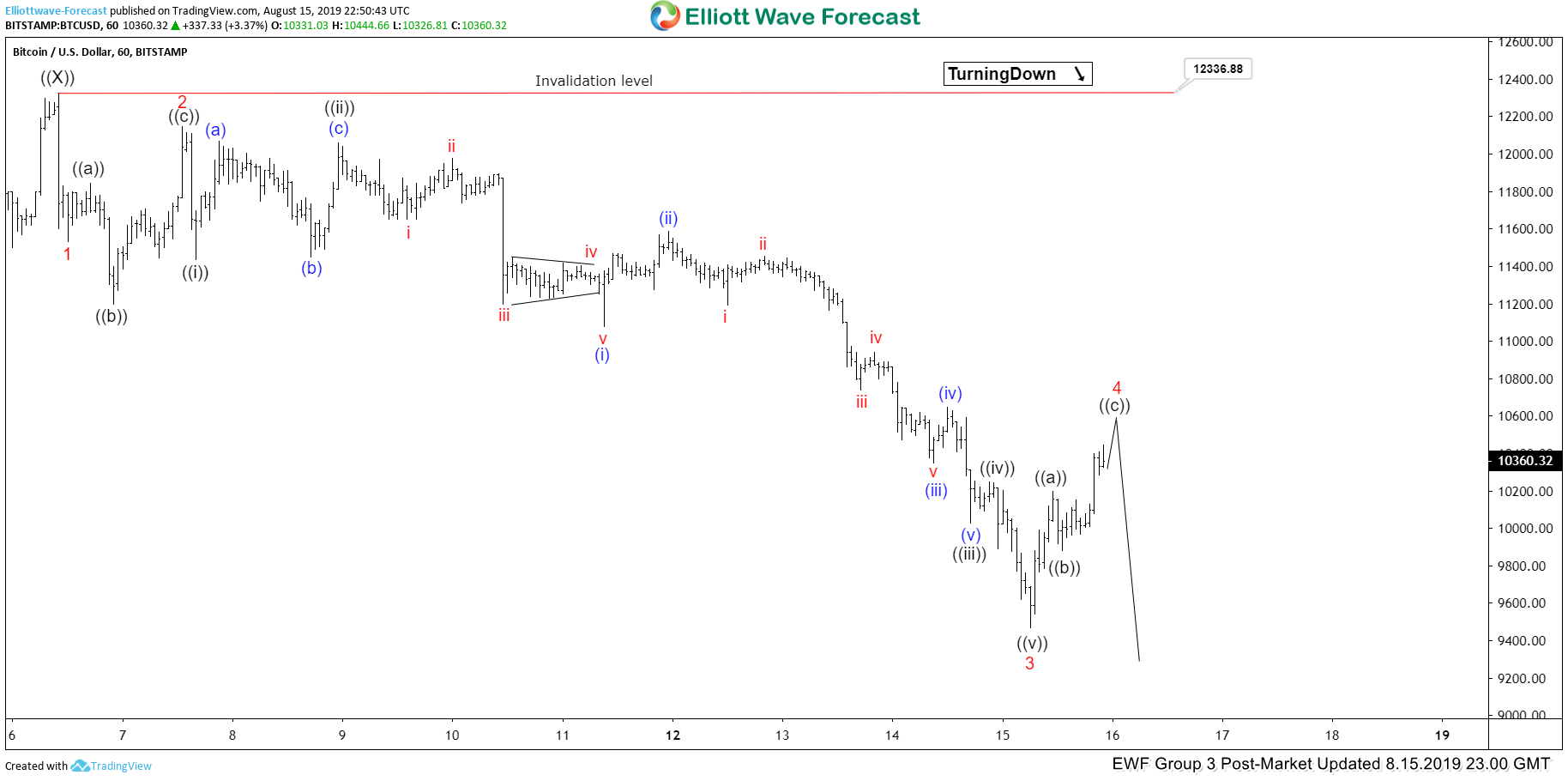

Elliott Wave View: Bitcoin (BTCUSD) Looking for Larger Correction

Read MoreShort term Elliott Wave View on Bitcoin (BTCUSD) shows the rally to 12336.88 on August 6, 2019 ended wave ((X)). The crypto currency declines from there and the structure is unfolding as an impulse Elliott Wave structure. Down from 12336.88, wave 1 ended at 11532, wave 2 ended at 12145.42 and wave 3 ended at […]

-

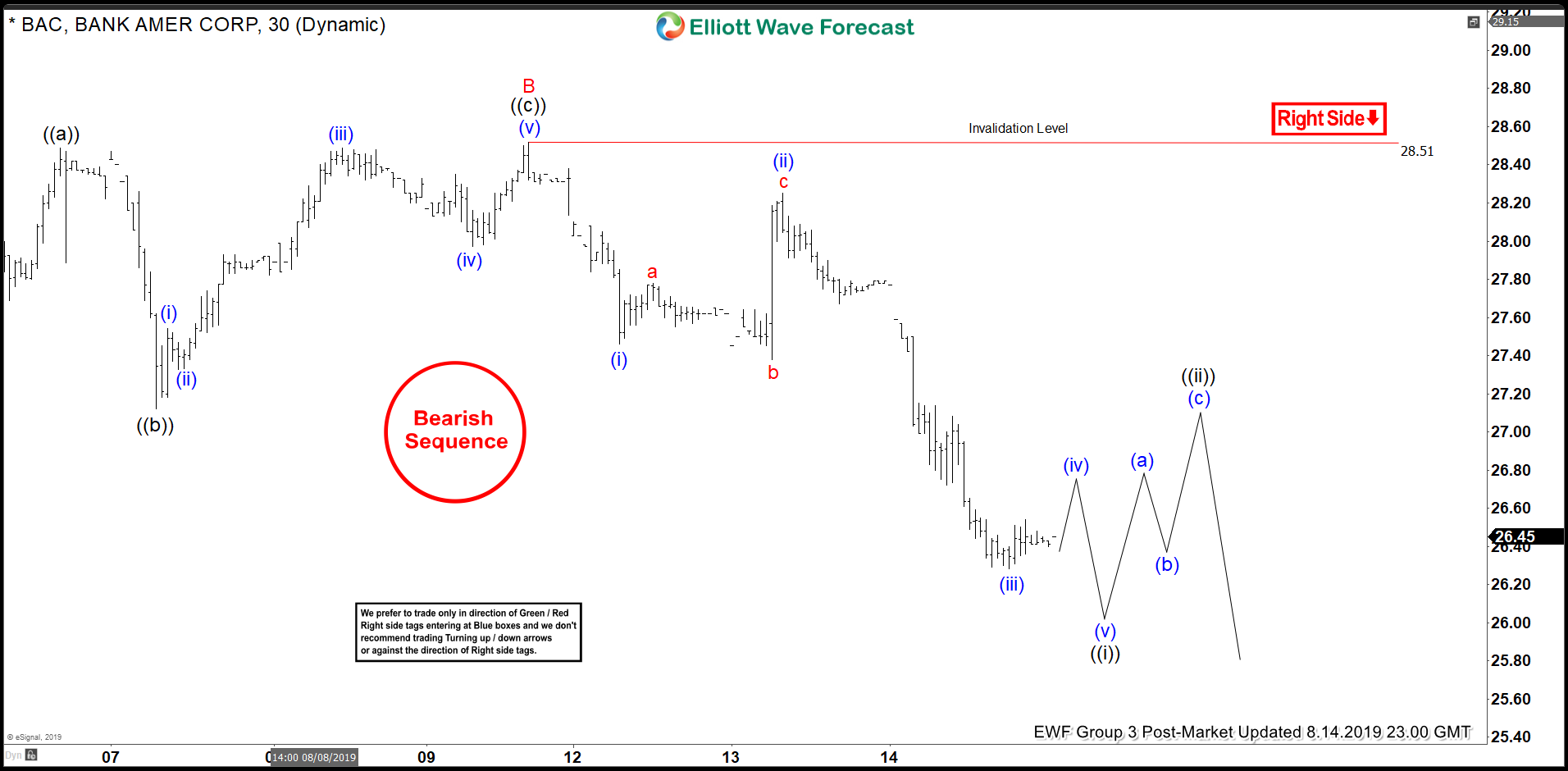

Elliott Wave View: Bank of America (BAC) Extends Lower

Read MoreBAC shows an incomplete sequence from August 1, favoring more downside. While bounce fails below there, the stock can extend lower.