The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Elliott Wave View: Bullish Sequence in DAX

Read MoreDAX shows Elliott Wave bullish sequence from August 15, 2019 low (11266.48) favoring more upside. The rally from 11266.48 to 12497.28 ended wave (1) as a 5 waves impulse Elliott Wave structure. On the chart below, we can see wave 3 of (1) ended at 12471.83, wave 4 of (1) ended at 12141.82, and wave 5 of […]

-

Chinese Vipshop Stock Looking for More Recovery

Read MoreIn today’s blog, we will have a look at the Vipshop stock. The stock is traded as VIPS at the NYSE. Vipshop is a Chinese e-commerce company (www.VIP.vcom) which offers online discount sales which have it’s headquarter in Guangdong, China. It was founded in 2008 which means it is a pretty young online company. Vipshop is one of […]

-

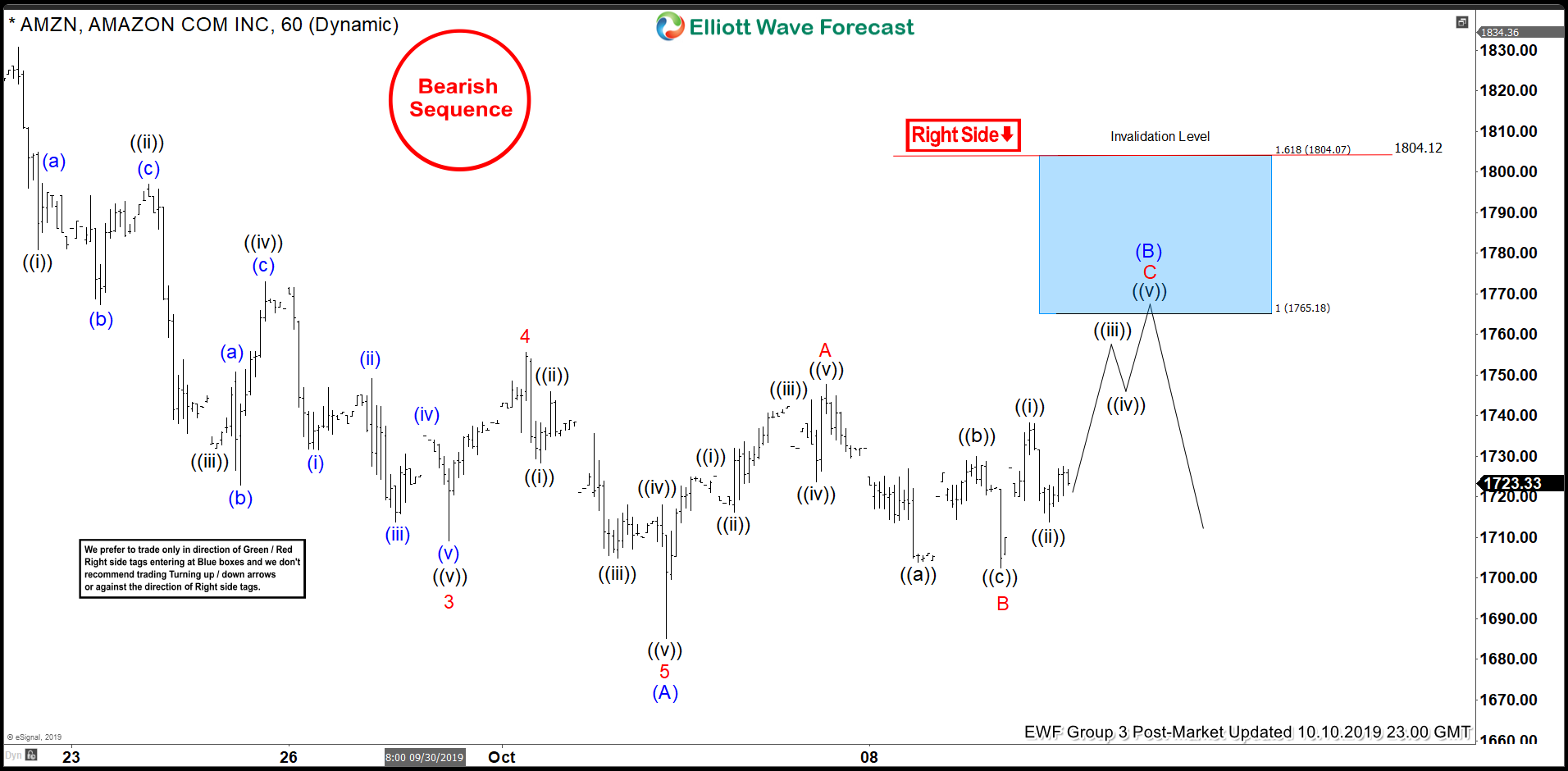

Elliott Wave View: Rally in Amazon (AMZN) Can Fail

Read MoreShort term Elliott Wave view of Amazon ($AMZN) suggests the decline to 1685.06 ended wave (A). Internal of wave (A) unfolded as a 5 waves impulse Elliott Wave structure. On the chart below, we can see wave 3 of (A) ended at 1709.22, wave 4 of (A) ended at 1755.6, and wave 5 of (A) ended […]

-

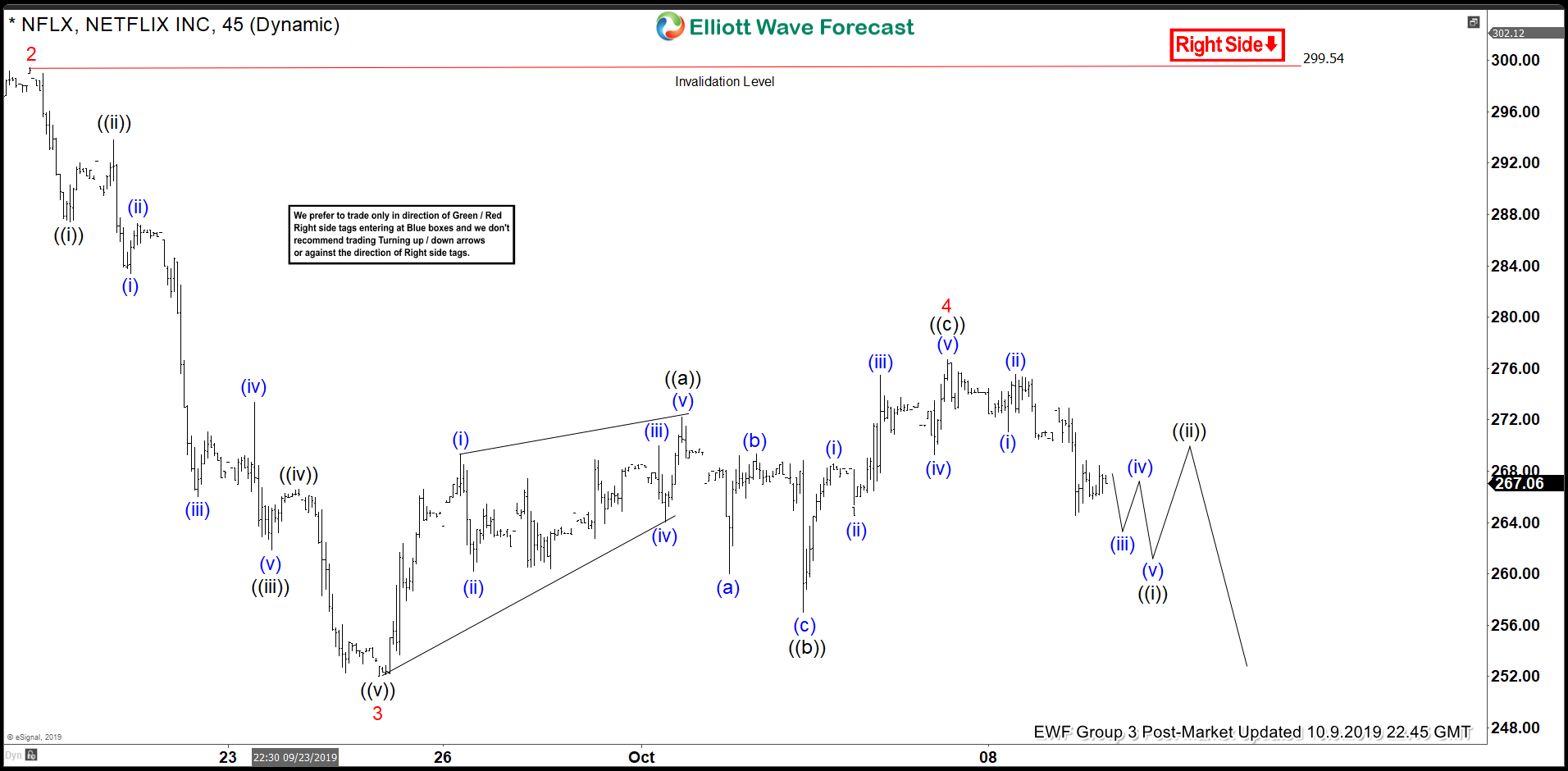

Elliott Wave View: Further Downside in Netflix

Read MoreNetflix shows a 5 waves impulse Elliott Wave structure from Sept 18 high. As far as the bounce stays below there, the stock can see further downside.

-

FXY Longer Term Cycles & Elliott Wave

Read MoreFXY Longer Term Cycles & Elliott Wave Firstly the FXY instrument inception date was 2/12/2007. The instrument tracks changes of the value of the Japanese Yen versus the US Dollar. There is plenty of data going back into the longer term 1970’s time frame available for the currency cross rate in the USDJPY. The foreign […]

-

S&P 500 (SPX) Outlook in the Week of U.S – China Trade Talk

Read MoreThis week’s trade talk is critical to the path of the stock market. This article outlines three possibilities and most likely scenario & Elliott Wave path.