The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

The Nasdaq Tracker QQQ Long Term Cycles & Elliott Wave

Read MoreThe Nasdaq Tracker QQQ Long Term Cycles & Elliott Wave Firstly the QQQ instrument inception date was in March 1999. That was before it ended a larger cycle up from the all time lows in March 2000. The ETF instrument mirrors the price movement of the Nasdaq which did that. As shown below from the […]

-

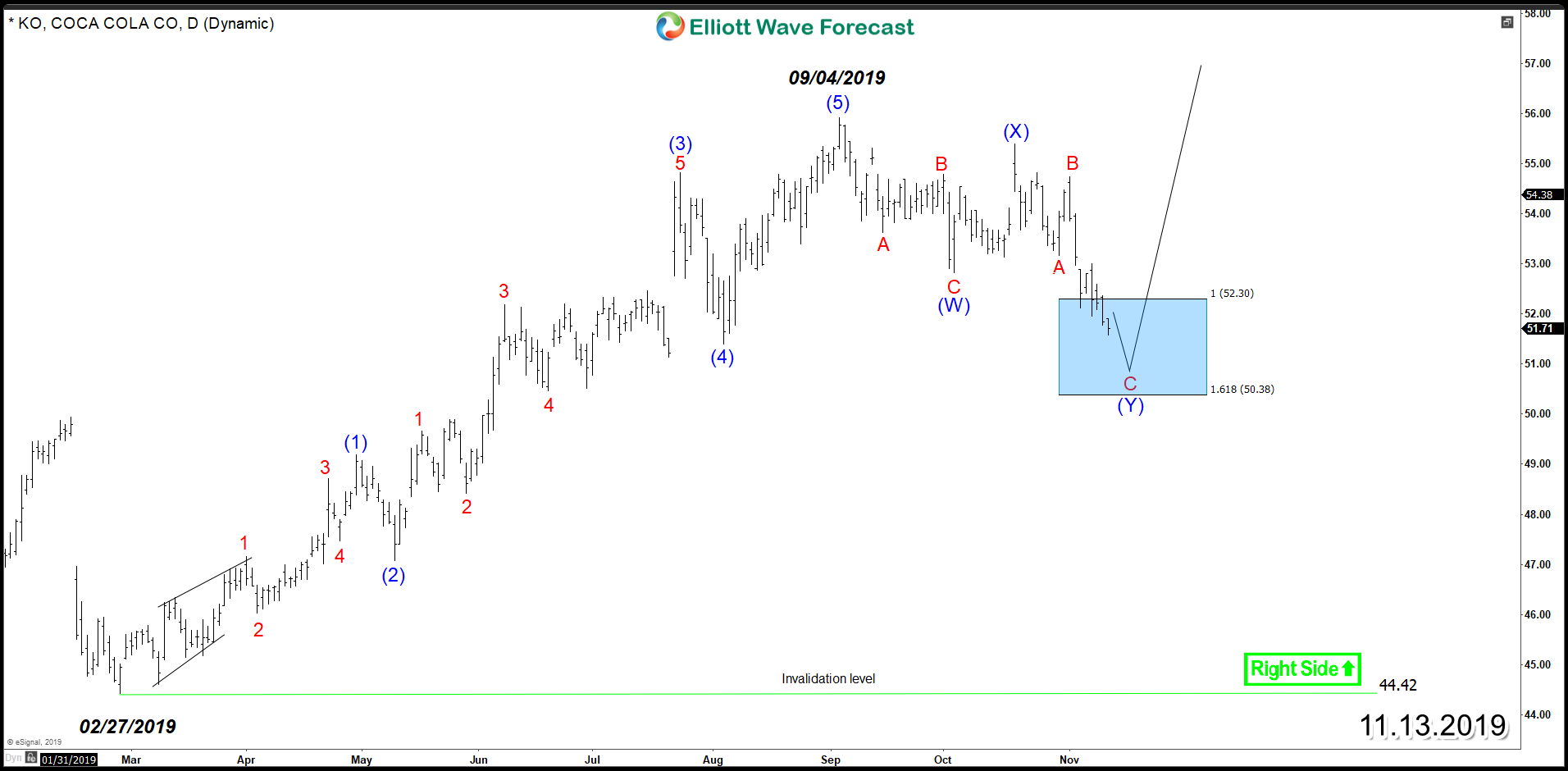

The Coca-Cola Company (NYSE: KO) Looking to Remain Supported

Read MoreThe Coca-Cola Company (NYSE: KO) is an American multinational corporation and it’s the world’s leading soft-drink company. Since February 2019, KO rallied higher within an impulsive 5 waves advance breaking to new all time highs and opening further extension. Down from $56 peak, the stock started a correction lower which is currently unfolding as Double Three Structure which reached the equal […]

-

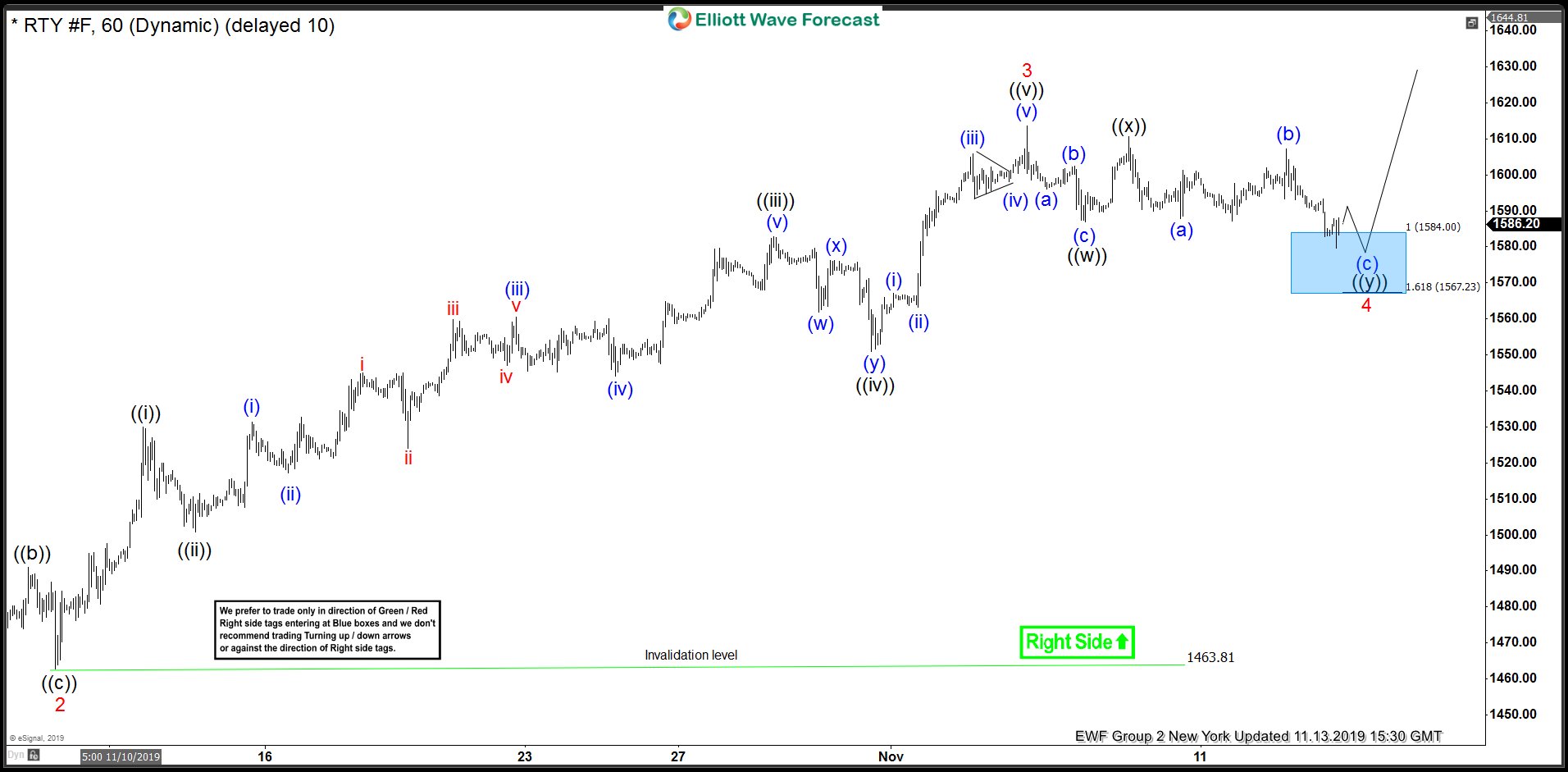

US Indices made New All Time Highs. Will Russell Follow?

Read MoreIn the recent months, we have seen US Indices like $SPX $NQ_F $YM_F and $ES_F making new all time highs but Russell is the one which has been lagging and has not yet made a new high. It is on par in terms of percentage gains with other US Indices but has not made a […]

-

Russell Elliott Wave View: Impulse Rally Calling More Upside

Read MoreRussell is showing 5 swings impulse rally from 10/03/2019 low favoring more upside to take place. This article and video show the next Elliott Wave path.

-

Elliott Wave View: Bullish Sequence in DAX Favors Higher

Read MoreDAX shows an incomplete Elliott Wave bullish sequence from Dec 2018 low, favoring more upside. This article and video look at the Elliott Wave path.

-

Pivotal Software Inc. Reacting From Blue Box

Read MoreIn today’s blog, we will have a look at the latest price action of the Pivotal Software stock. In the previous month, I did a blog about the company. You can read it here. In that blog, we talked about the price action and the reason why the company lost half of its value. But I […]