The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

TMUS Finds Blue Box Support, Jumps 7%, Starts Bullish Cycle

Read MoreTMUS may have started a new bullish cycle after ending the bearish cycle from 03.03.2025. Meanwhile, the corrective pullback ended with a 7-swing structure within a blue box. In the coming weeks, this resurgence could advance to a new bullish cycle. T-Mobile US (NASDAQ: TMUS) is a leading U.S. wireless carrier, known for its aggressive […]

-

Coinbase (COIN) Enters Bullish Rally: Elliott Wave Analysis Points to Further Upside

Read MoreAfter completing wave II, Coinbase begins a powerful bullish impulse in wave III, with strong momentum and higher targets ahead. Coinbase Global, Inc. (NASDAQ: COIN) is currently showing strong bullish momentum as the stock advances in a new impulsive sequence. The daily Elliott Wave chart suggests that COIN has likely completed a significant corrective wave […]

-

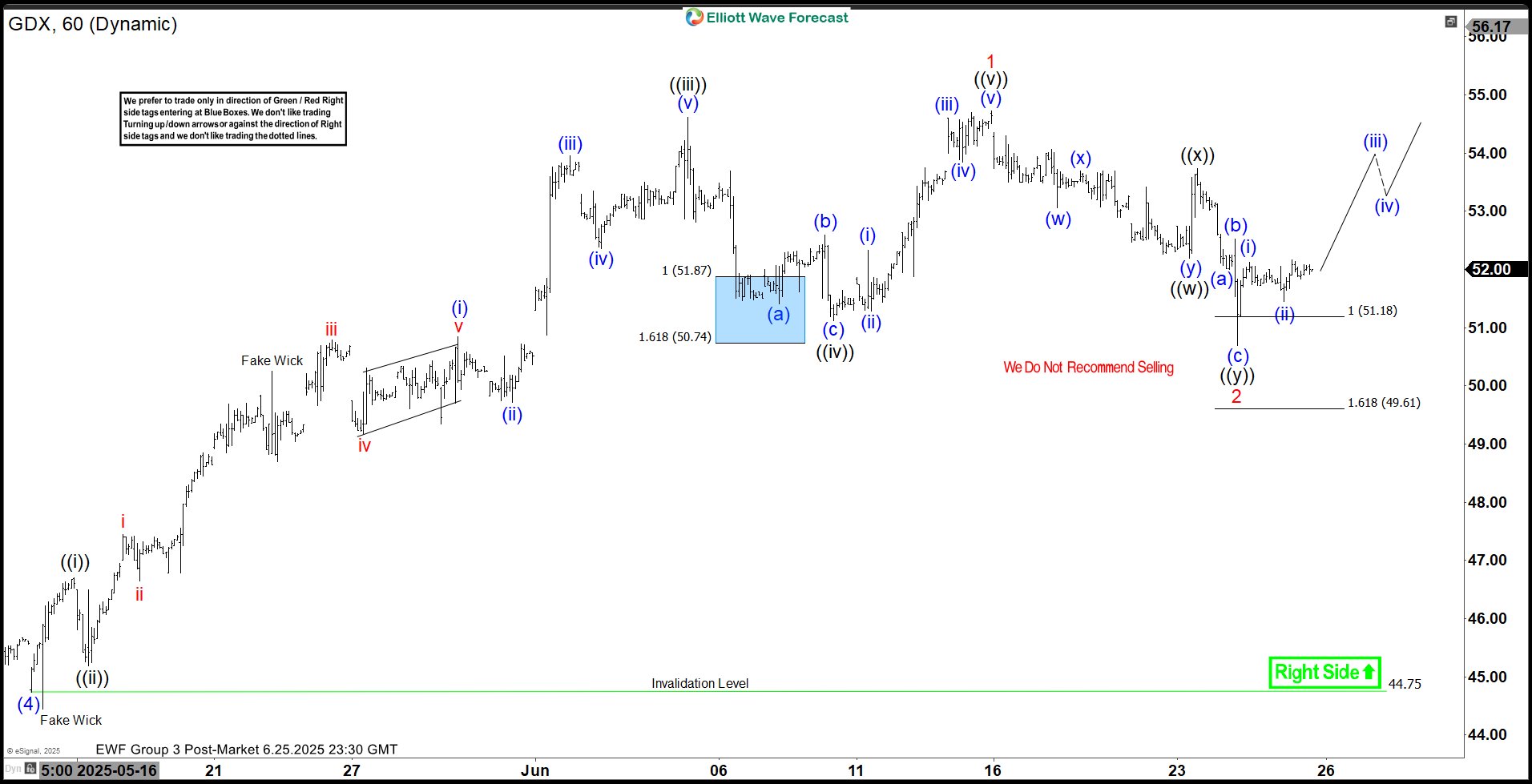

Elliott Wave Insight: GDX Climbs Higher After Three Wave Decline

Read MoreGold Miners ETF (GDX) has bounced after reaching the extreme area and may now resume higher. This article and video look at the Elliott Wave path.

-

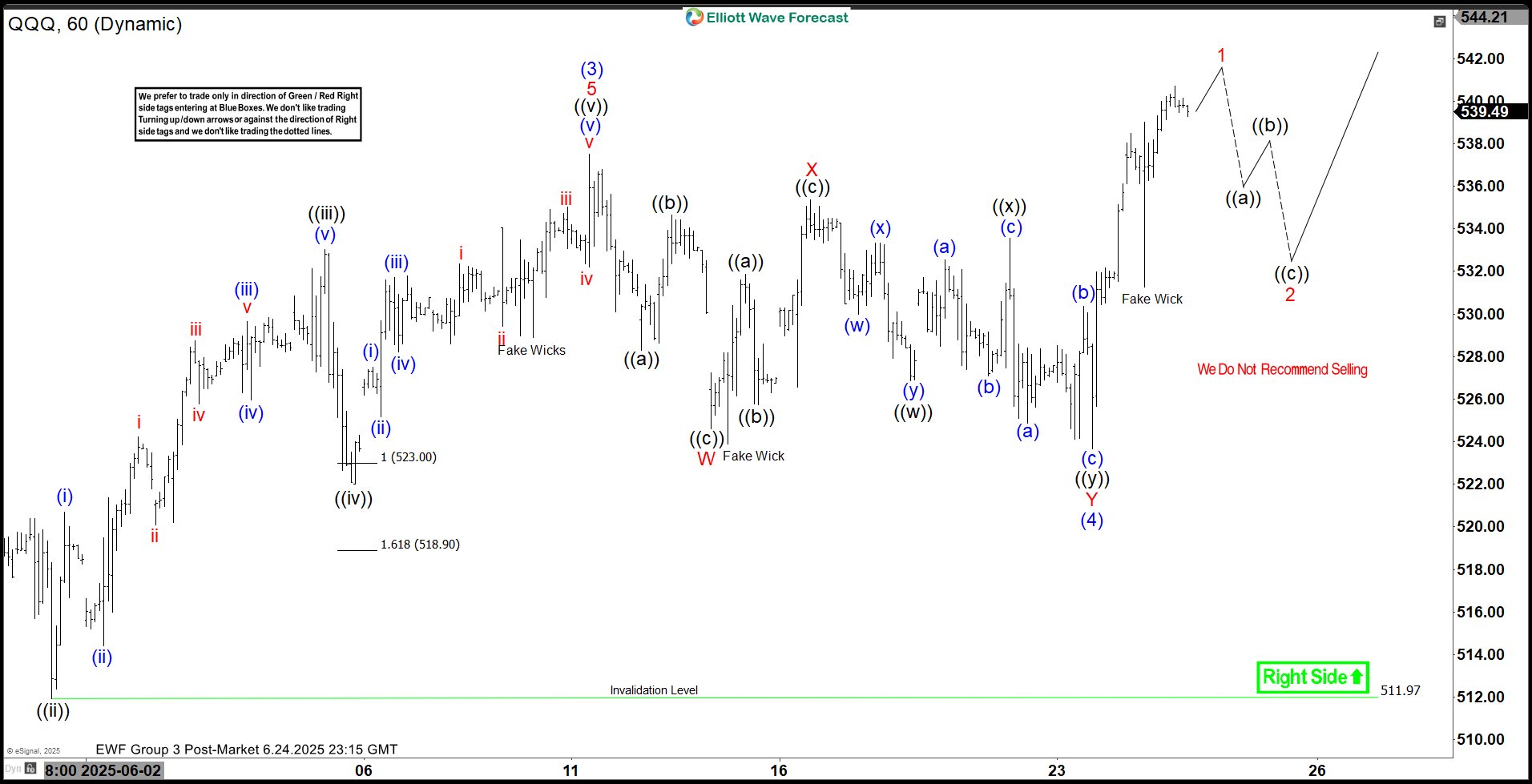

Nasdaq 100 ETF (QQQ) Affirms Bullish Outlook with Five Wave Rally

Read MoreNasdaq 100 ETF (QQQ) extends in 5 waves rally, solidifying the bullish outlook. This article and video look at the Elliott Wave path.

-

Powering the Future: ARM Breakout Potential in a Connected World

Read MoreARM Holdings plc is a relatively new entrant to public markets, yet its technological foundation is anything but inexperienced. Renowned for pioneering energy-efficient, high-performance processor designs, ARM powers billions of devices globally. Its recent IPO signals a strategic leap, positioning the company for strong, long-term growth as demand for smart, connected technologies accelerates. ARM enjoys […]

-

S&P 500 ETF $SPY Extreme Areas Offering Buying Opportunities

Read MoreHello everyone! In today’s article, we’ll examine the recent performance of S&P 500 ETF ($SPY) through the lens of Elliott Wave Theory. We’ll review how the rally from the April 21, 2025 low unfolded as a 5-wave impulse followed by a 7-swing correction (WXY) and discuss our forecast for the next move. Let’s dive into the structure and expectations for this ETF. […]