The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

NQ_F Buying Elliott Wave 4 Dip in Blue Box Area

Read MoreNQ_F (Nasdaq Futures) made a sharp decline yesterday evening after New York closing and then reacted higher in a very strong manner. Our preferred Elliott wave count treats the dip last night as a Minor wave 4 and now we are expecting the Index futures to be trading higher in Minor wave 5. Earlier this […]

-

Elliott Wave View: Nikkei Finding Support

Read MoreNikkei has reached 100% in 7 swing and the Japanese Index can see a 3 waves bounce before the next leg lower. This article looks at the Elliott Wave path.

-

Elliott Wave View: Apple Cycle Remains Bullish

Read MoreApple (AAPL) cycle from June 3, 2019 low remains bullish as an impulse. This video shows the short term Elliott Wave path.

-

RTY_F (Russell Futures) Buying dips in Blue Boxes

Read MoreRussell Futures (RTY_F) decline ended cycle from 12/3 and started pulling back. It dropped in 3 waves to 1659.40 and bounced. The bounced appeared corrective so we called for a double three Elliott wave correction lower which was valid as far as price stayed below 12.27.2019 (1687.80). Below, we will present a series of charts […]

-

Hecla Mining (NYSE: HL) Impulsive Rally in Progress

Read MoreHecla Mining (NYSE: HL) is a mining company engaged in the exploration and development of mineral properties also the mining and processing of silver, gold, lead and zinc. Since May 2019, HL established a strong reversal after it ended the decline since 2016 peak and started a new bullish cycle. the stock traded higher within an impulsive […]

-

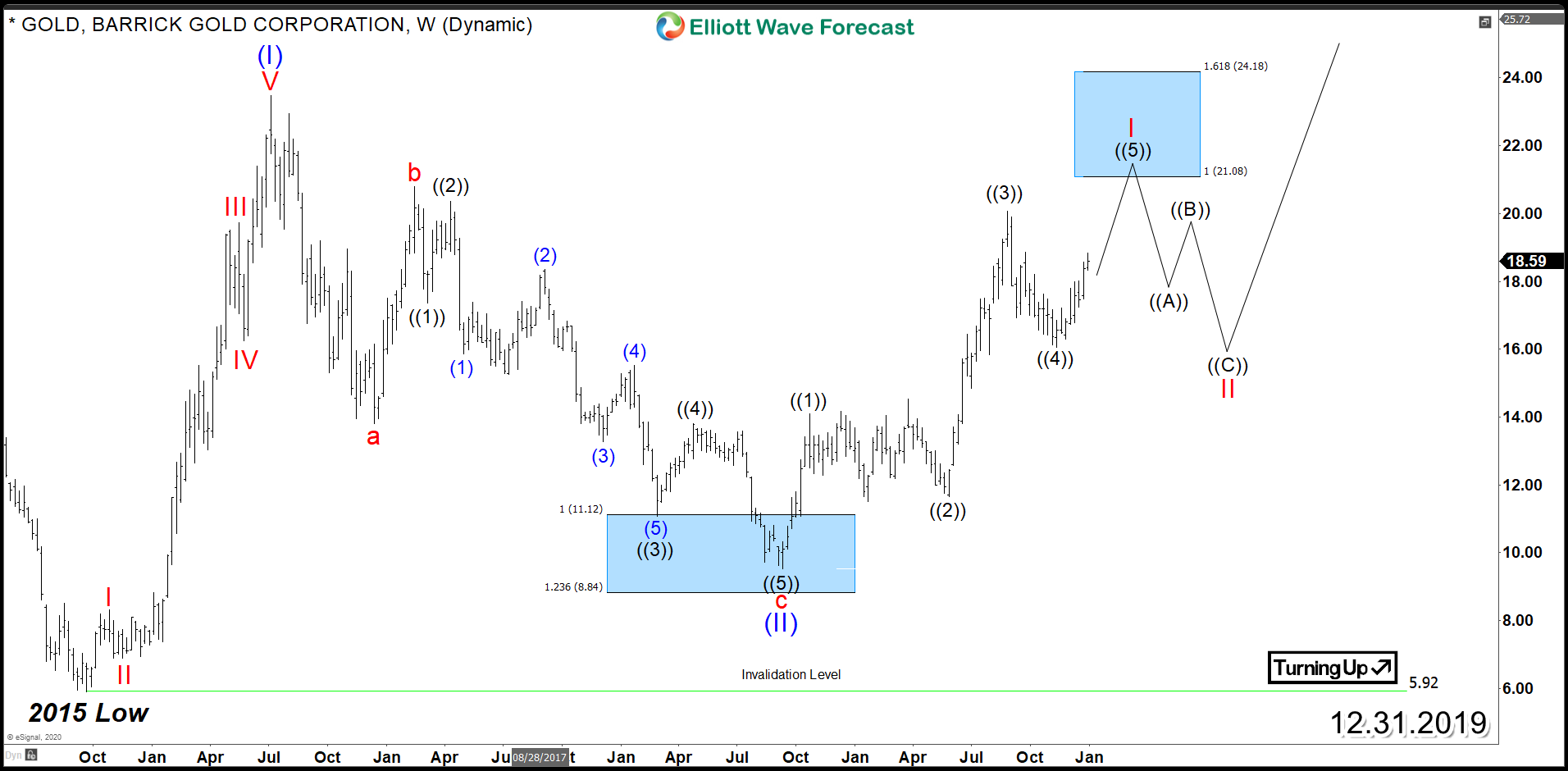

Barrick Gold Corporation (NYSE: GOLD) Looking for Further Upside

Read MoreBarrick Gold Corporation (NYSE: GOLD) is the second-largest gold mining company in the world. As the precious metal price has been soaring recently, let’s take a look at the technical structure of the stock. GOLD established a major low back in September 2015 from where the stock rallied strongly within an impulsive 5 waves advance which was […]