The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

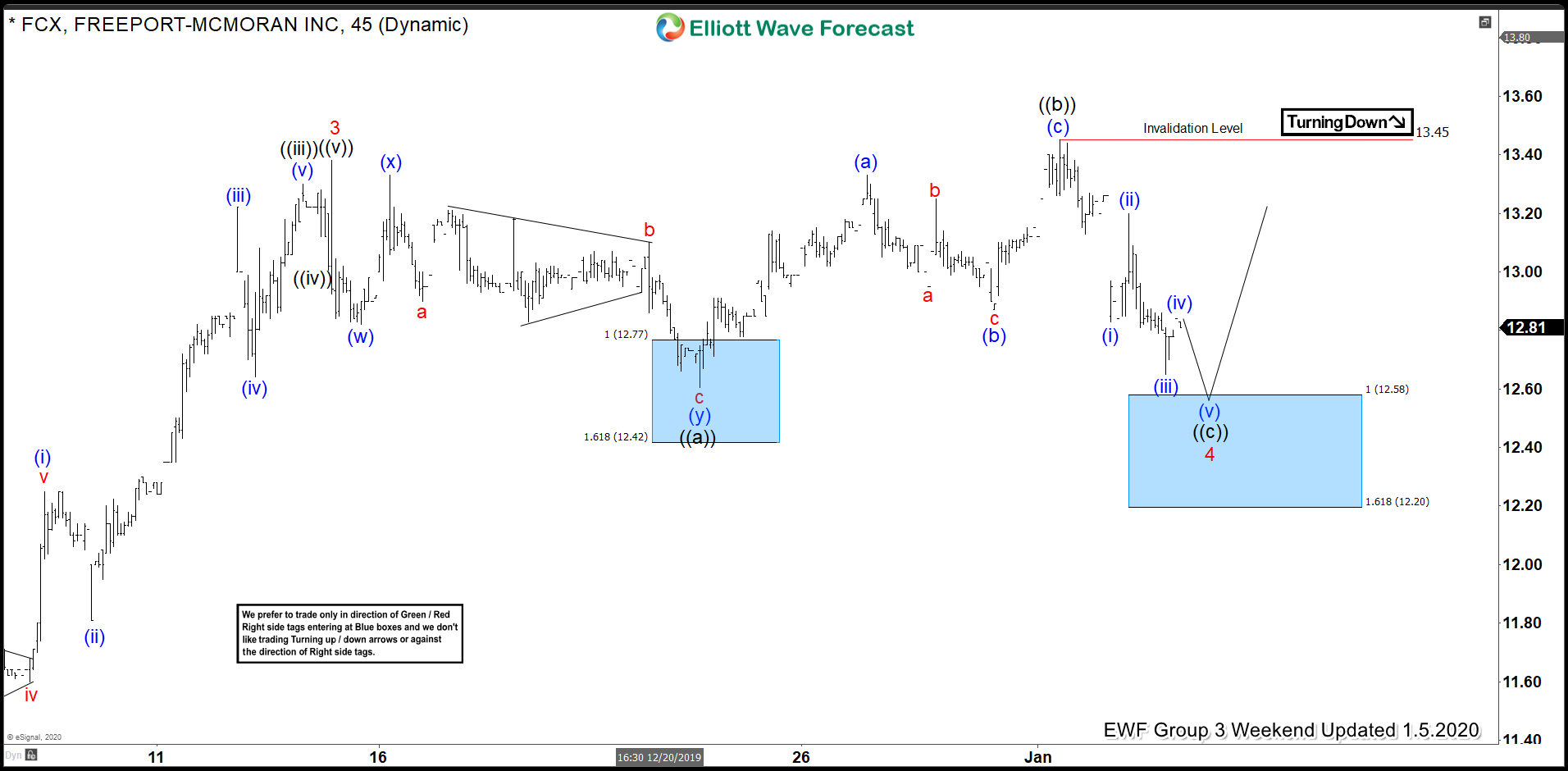

FCX Elliott Wave View: Buying The Wave 4 Pullback

Read MoreIn this blog, we take a look at the past performance of 1 hour Elliott Wave charts of FCX In which our members took advantage of the blue box areas.

-

Elliott Wave View: $DAX Extending Higher

Read MoreShort Term Elliott Wave view on $DAX suggests the pullback to 12886.55 ended wave (4). Index has resumed higher in wave (5) and the internal subdivides into a 5 waves impulse Elliott Wave structure. Up from wave (4) low, wave 1 of (5) ended at 13425.85. The internal subdivision of wave 1 is unfolding as […]

-

Dow Jones Futures ( $YM_F ) Found Buyers & Made New All-Time High

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of Dow Jones Futures ( $YM_F ) published in members area of the Elliottwave-Forecast. As our members know, INDU is showing incomplete bullish sequences in the cycle from the December 2018 low. Consequently we recommended members […]

-

AMAZON ( $AMZN ) Buying The Dips At Blue Box Area

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of AMAZON Stock published in members area of the Elliottwave-Forecast . As our members know, we were calling for further strength in AMAZON within the cycle from the October 25th low. We recommended members to avoid […]

-

Elliott Wave View: Dow Jones Future ($YM_F) Bullish Structure Likely Extends

Read MoreElliott Wave view on Dow Jones Futures ($YM_F) suggests that the rally from October 3, 2019 low is unfolding as an impulse Elliott Wave structure. In the 1 hour chart below, rally to 28893 ended wave (3) and pullback to 28084 ended wave (4). Index has resumed higher within wave (5). Up from 28084 low, wave […]

-

$SMH Elliott Wave and Longer Term Cycles

Read More$SMH Elliott Wave and Longer Term Cycles Firstly as seen on the monthly chart shown below. There is data back to May 2000 in the ETF fund. Data suggests the fund made a low in November 2008. This low has not been taken out in price. The cycles in this instrument tends to reflect the Nasdaq […]