The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

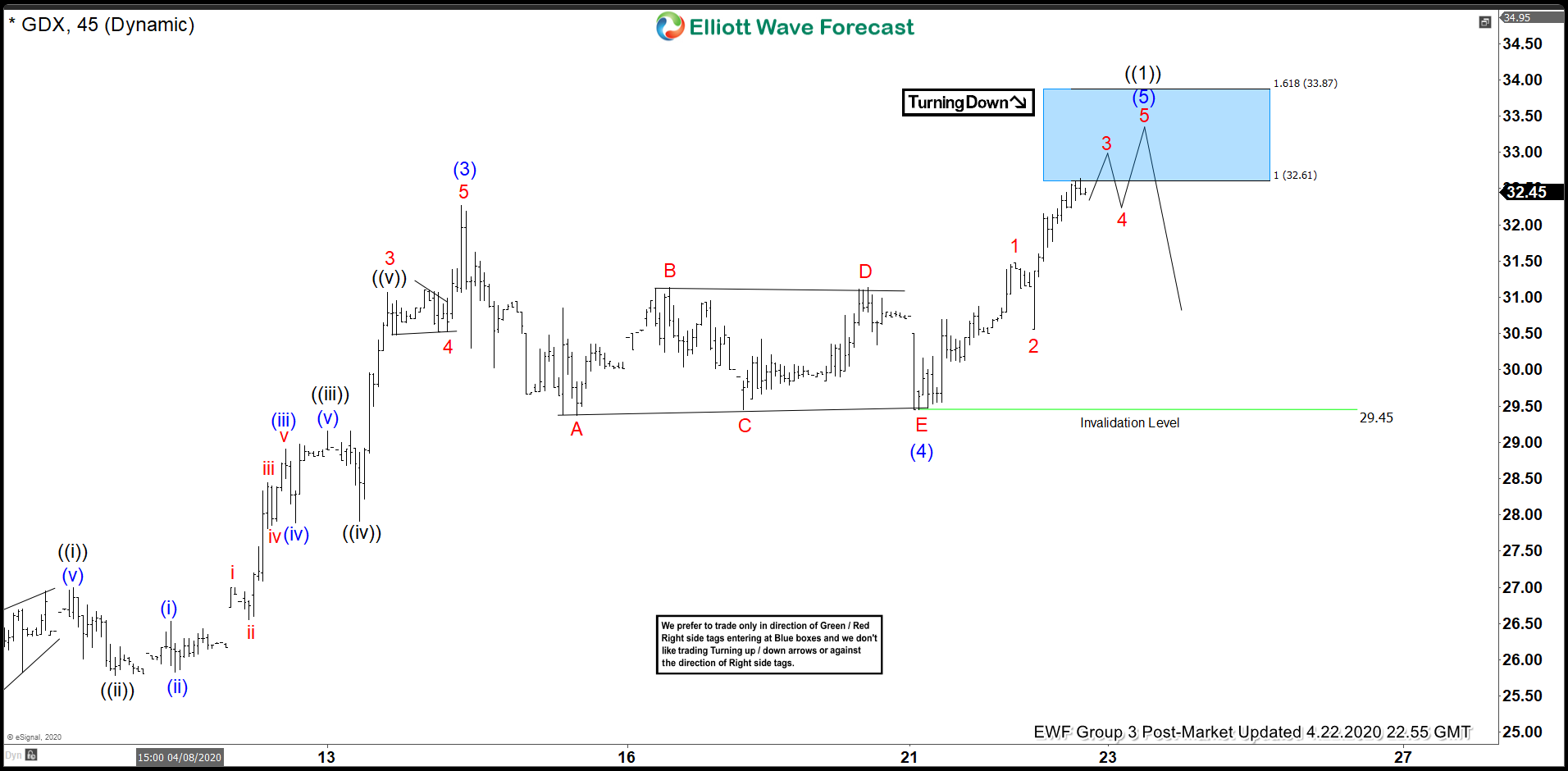

Elliott Wave View: GDX Extends Higher to 7 Year High

Read MoreGDX has made a 7 year high and still shows incomplete sequence to the upside. This article and video looks at the Elliott Wave path.

-

Moderna Inc ($MRNA) Bulls In Control

Read MoreThe next entry in the theme of Corona Virus stocks is Moderna Inc. Moderna has had a more steady advance during the COVID-19 spreading worldwide. As such, it is a bit more stable than other names I have covered. That’s not to say that it hasn’t had astounding returns, which it has, but it is […]

-

Elliott Wave View: Bank of America (BAC) Resumes Lower

Read MoreBAC has ended wave (4) correction and expected to extend lower. This article and video looks at the short term Elliottwave path.

-

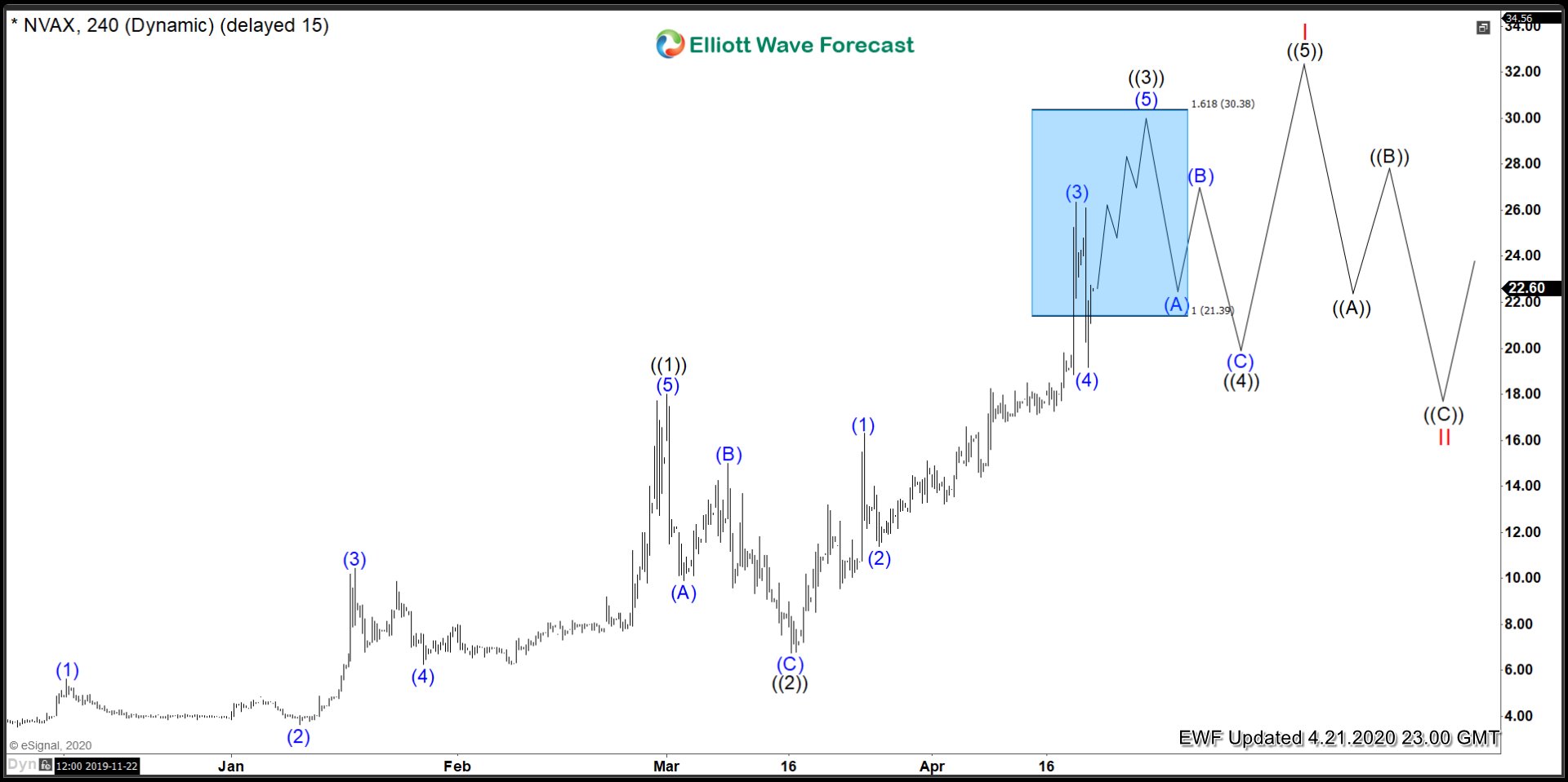

Novavax ($NVAX) Riding The Waves

Read MoreContinuing along the theme of Corona Virus stocks, this week Novavax Inc. is next up in line. Novavax has gone parabolic with the COVID-19 spreading worldwide as with the other names I have covered. It also remains very technical, and I think there could a few more swings up before a longer term top is […]

-

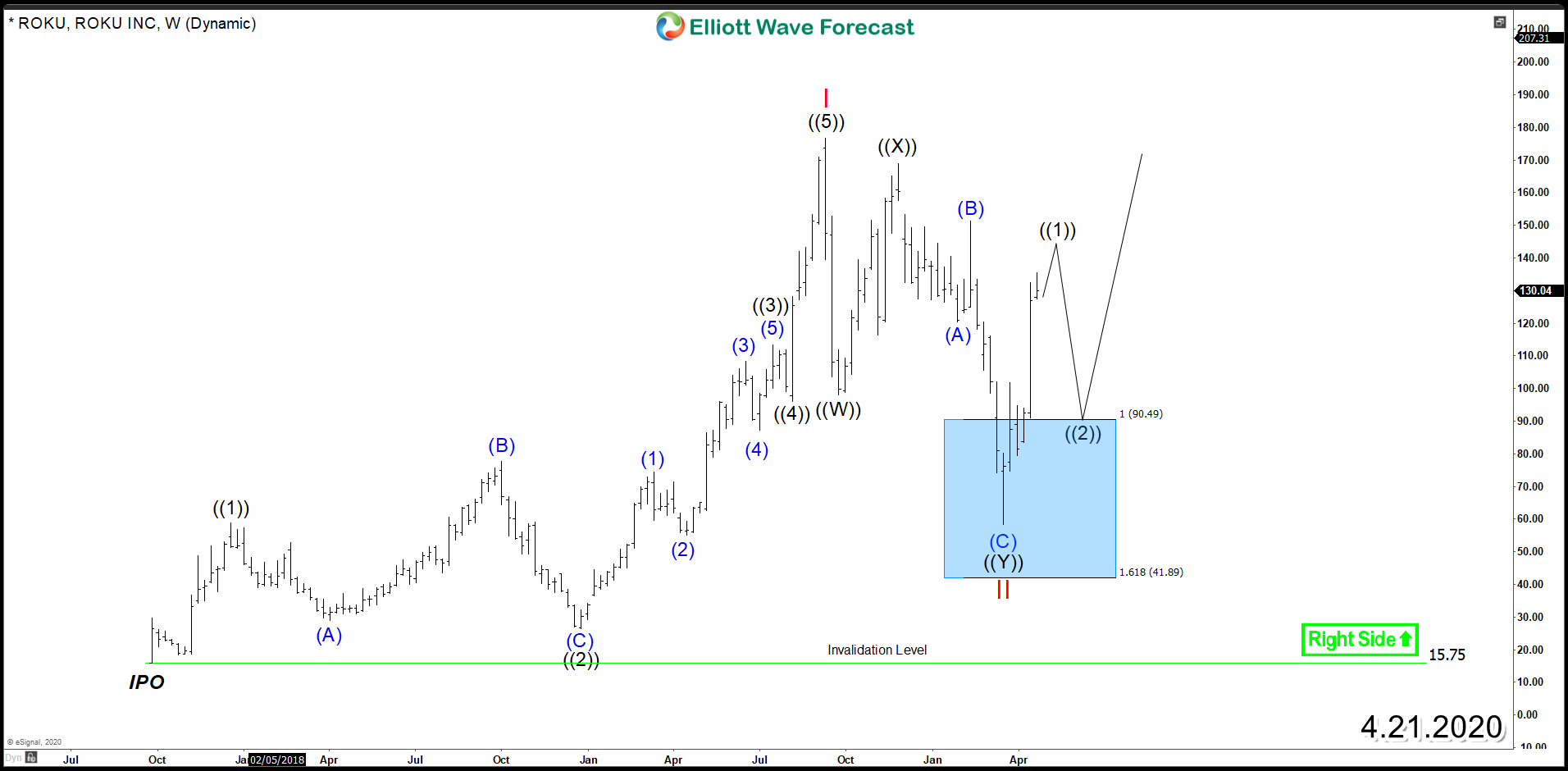

ROKU (NASDAQ:ROKU) – New Bullish Cycle On The Horizon

Read MoreLast year, the streaming TV ROKU (NASDAQ:ROKU) ended the entire rally since IPO as an impulsive 5 waves advance which is a bullish structure followed by a Double Three corrective structure. Based on the Elliott Wave Theory, after an instrument ends the correction it will either resume the rally within the main trend or bounce in 3 […]

-

Elliott Wave View: SPY Looking for Pullback Soon

Read MoreShort Term Elliott Wave view in S&P 500 ETF (SPY) suggests the rally from March 23, 2020 low low is unfolding as a 5 waves impulse. Up from 3.23 low (218.26), wave (1) ended at 263.7, and pullback in wave (2) ended at 242.94. Index has resumed higher in wave (3) as another 5 waves […]