The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

GE Elliott Wave View: Forecasting Sellers At Blue Box Area

Read MoreIn this blog, we take a look at the past performance of 1 hour Elliott Wave charts of GE In which our members took advantage of the blue box areas.

-

Elliott Wave View: Russell 2000 (RTY) Reaching Short Term Support

Read MoreRussell 2000 is approaching support area soon in which buyers can appear for 3 waves bounce at least. This article & video look at the Elliott Wave path.

-

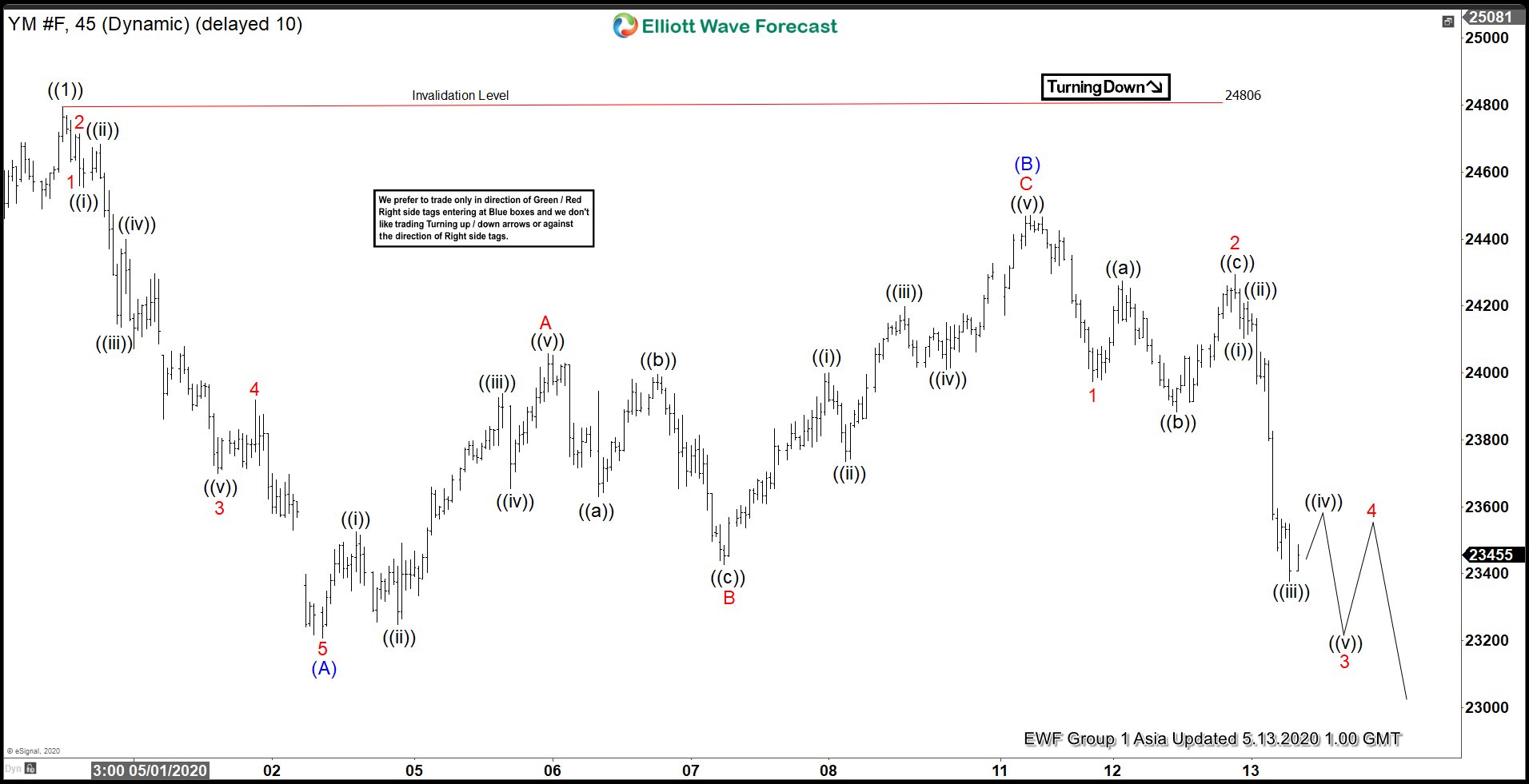

Elliott Wave View: Dow Futures (YM_F) Resumes Correction Lower

Read MoreDow Futures (YM_F) continues lower to correct cycle from 3.23.2020 low. This article & video look at the Elliott Wave path.

-

Paypal (NASDAQ: PYPL) – Bullish Sequence Calling Higher

Read MorePaypal (NASDAQ: PYPL) is an American online payments company that enables digital and mobile payments on behalf of consumers and merchants worldwide. Last week, PYPL broke above February 2020 peak to hit an all-time high few days before its first-quarter results then after the earnings came out it soared again. It’s currently up 30% year-to-date […]

-

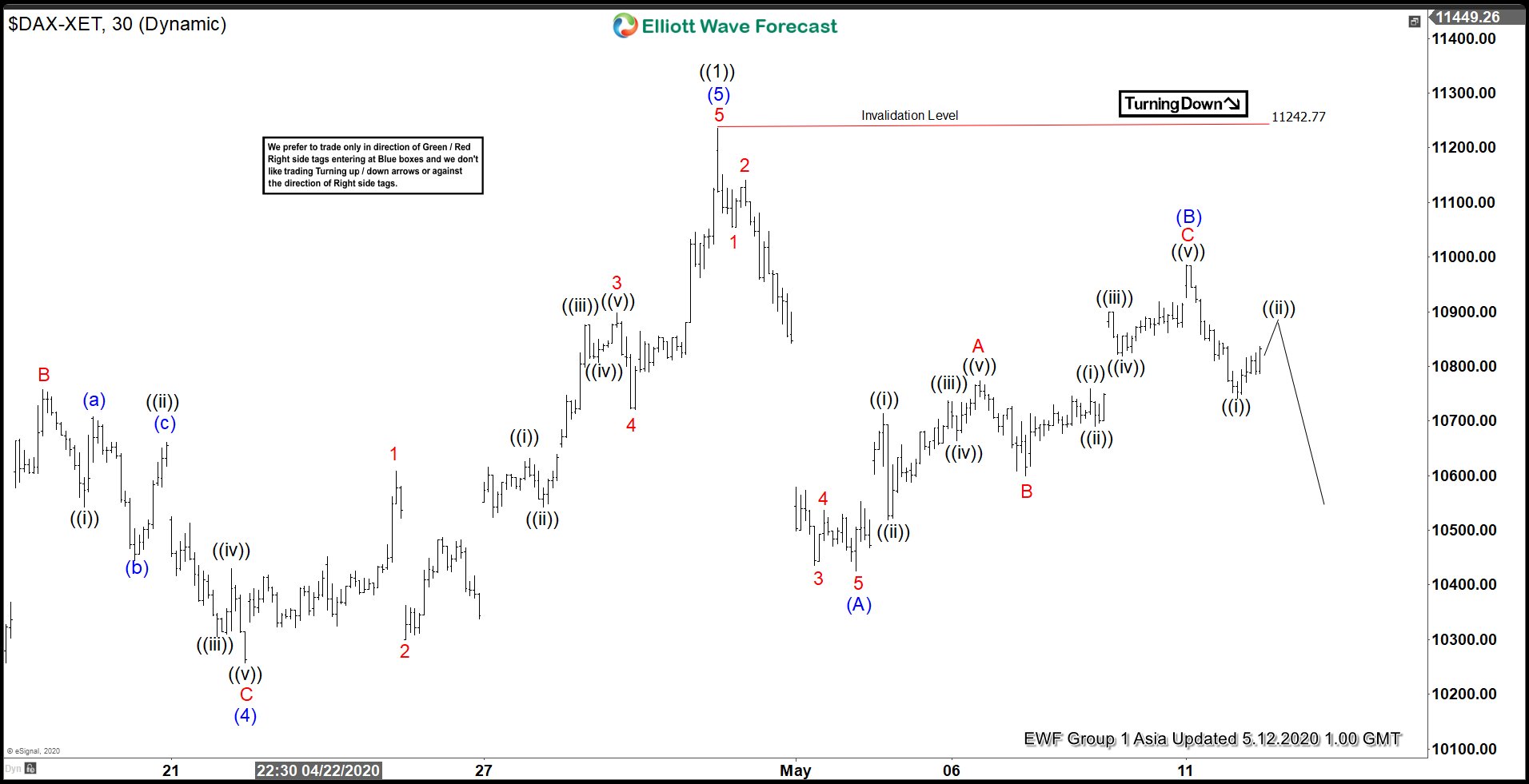

Elliott Wave View: DAX Ended Correction and Turns Lower

Read MoreShort Term Elliott Wave view in DAX suggests the rally from 3.16.2020 low ended at 11242.77 as an impulse structure. Up from 3.16.2020 low, wave (1) ended at 9145.93 and pullback in wave (2) ended at 8257.53. Index then resumed higher and ended wave (3) at 10820.17 and wave (4) pullback ended at 10257.27. The […]

-

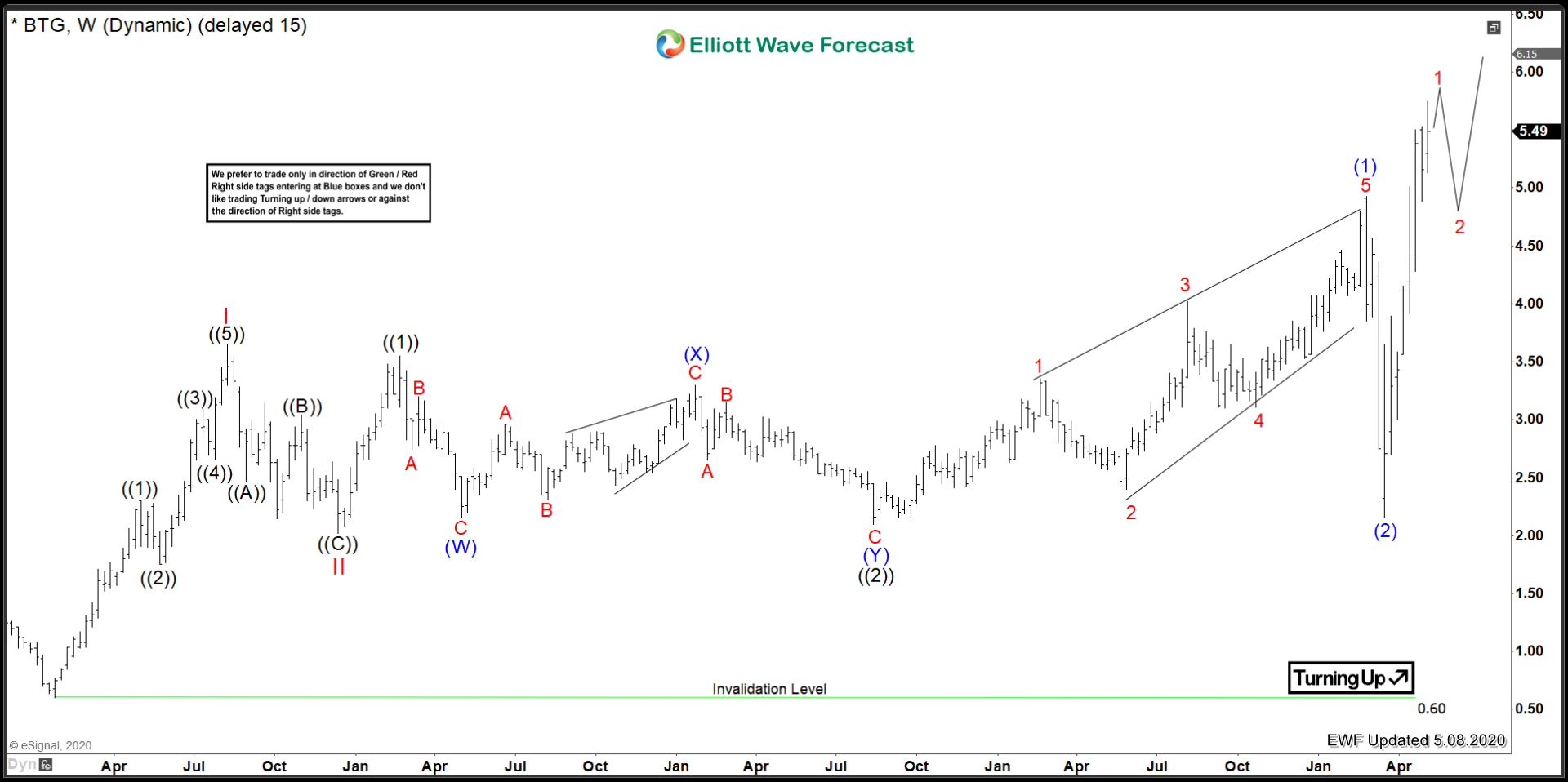

B2Gold Corp ($BTG) Preparing for explosive upside

Read MoreThe Metals sector has been slowly coming back since the lows in late 2015 and is ready for prime time attention. B2Gold Corp is a name that has an exceptional looking chart that is worth examining with Elliott Wave technicals. B2Gold is a low-cost international senior gold producer headquartered in Vancouver, Canada. Founded in 2007, B2Gold […]