The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

GDX Elliott Wave: Buying The Wave Four Pullback

Read MoreIn this blog, we take a look at the past performance of 1 hour Elliott Wave charts of GDX In which our members took advantage of the blue box areas.

-

Elliott Wave View: Dow Futures (YM_F) Resumes Higher

Read MoreYM_F ended the cycle from July 7 high. From there, Index extended higher. While above July 14 low, expect dips in 3,7,11 swings to find support.

-

Kospi Cycles Longer Term Swing Count Remains Bullish

Read MoreKospi Cycles Longer Term Swing Count Remains Bullish The KOSPI Index in the long term has been trending higher with other world indices since inception in 1983. The index began with a base value set at 100 and trended higher until it ended that cycle in 1994. The index then corrected that cycle with the dip […]

-

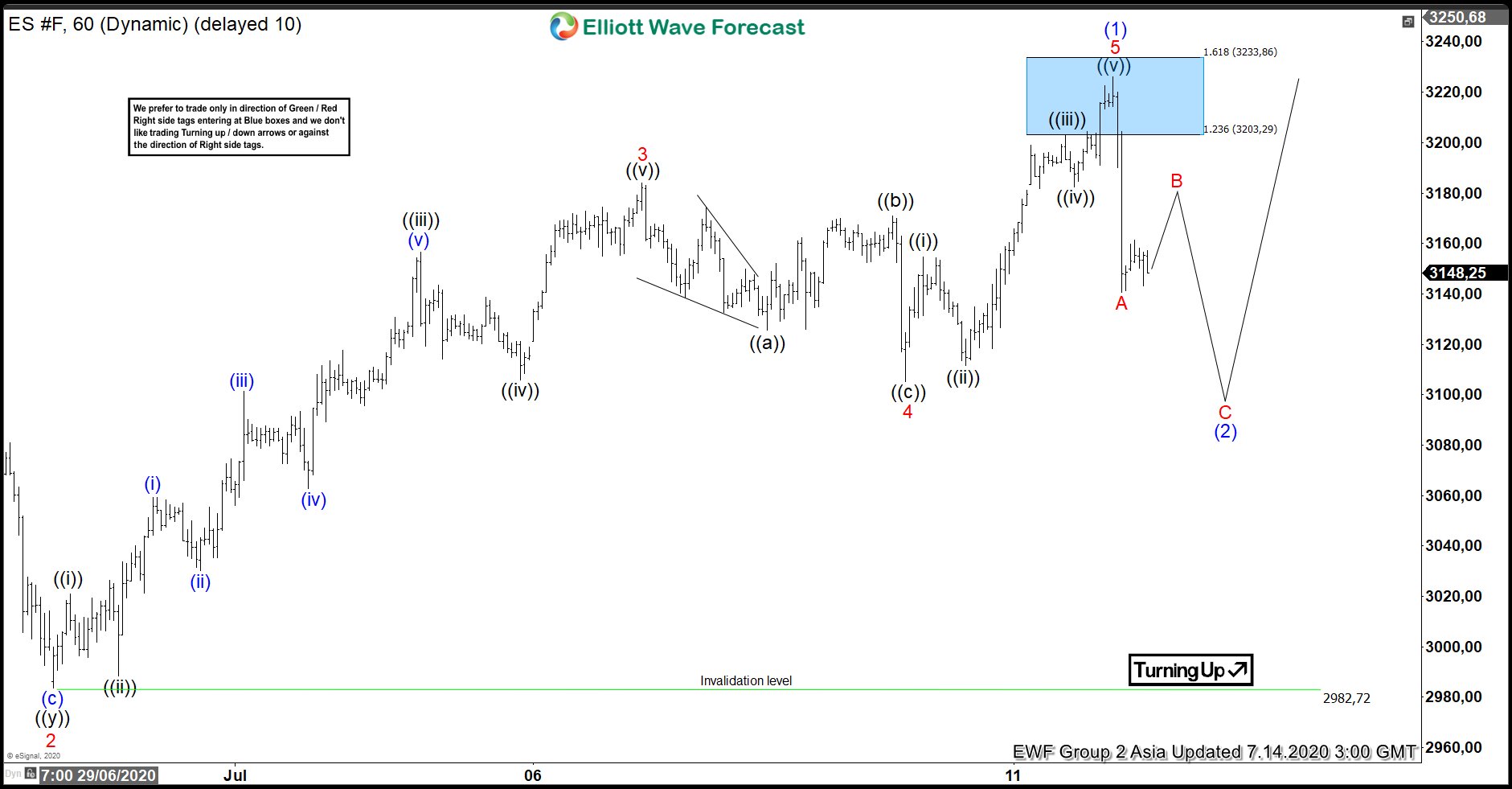

Elliott Wave View: S&P 500 E-Mini Futures (ES_F) Correction in progress

Read MoreES_F ended cycle from June 15 low at 3226.25 high. While pullback stays above June 29 low, expect the dips in 3,7 or 11 swings to find support

-

$TSX : Canadian Stock Market Index Waiting for Commodities Breakout

Read MoreS&P/TSX Composite is a Canadian stock market index representing roughly 70% of the market capitalization on the Toronto Stock Exchange. Under the ticker $TSX, one can track the market value of 250 most important companies. From 2009 to 2020, TSX was a rather weak performer. While S&P500 has gained 410% during that period, TSX made an […]

-

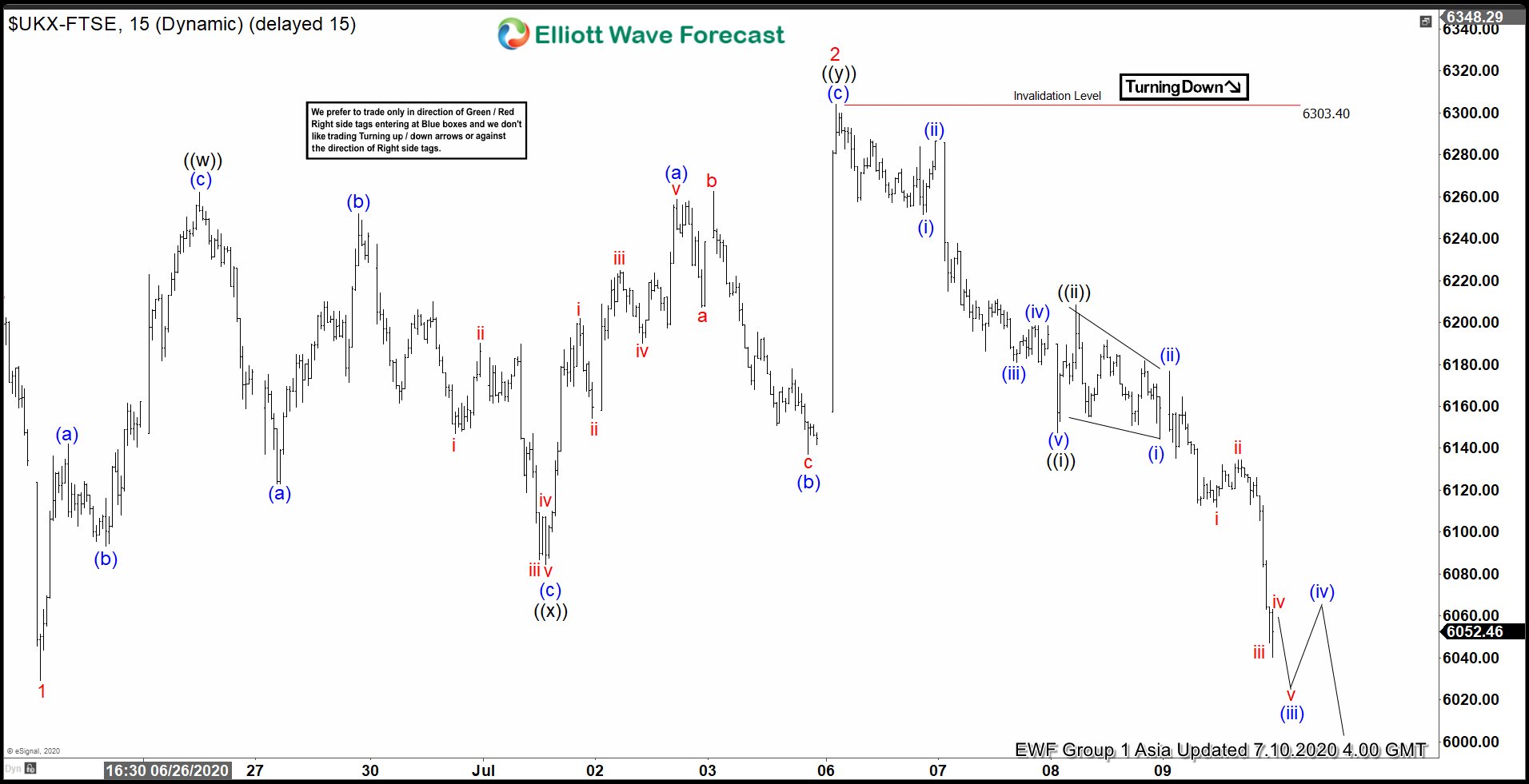

Elliott Wave View: FTSE Resumes Correction

Read MoreFTSE ended the cycle June 25 low as a double three structure. From there, the index has declined lower and resumed the correction from June 8 high.