The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

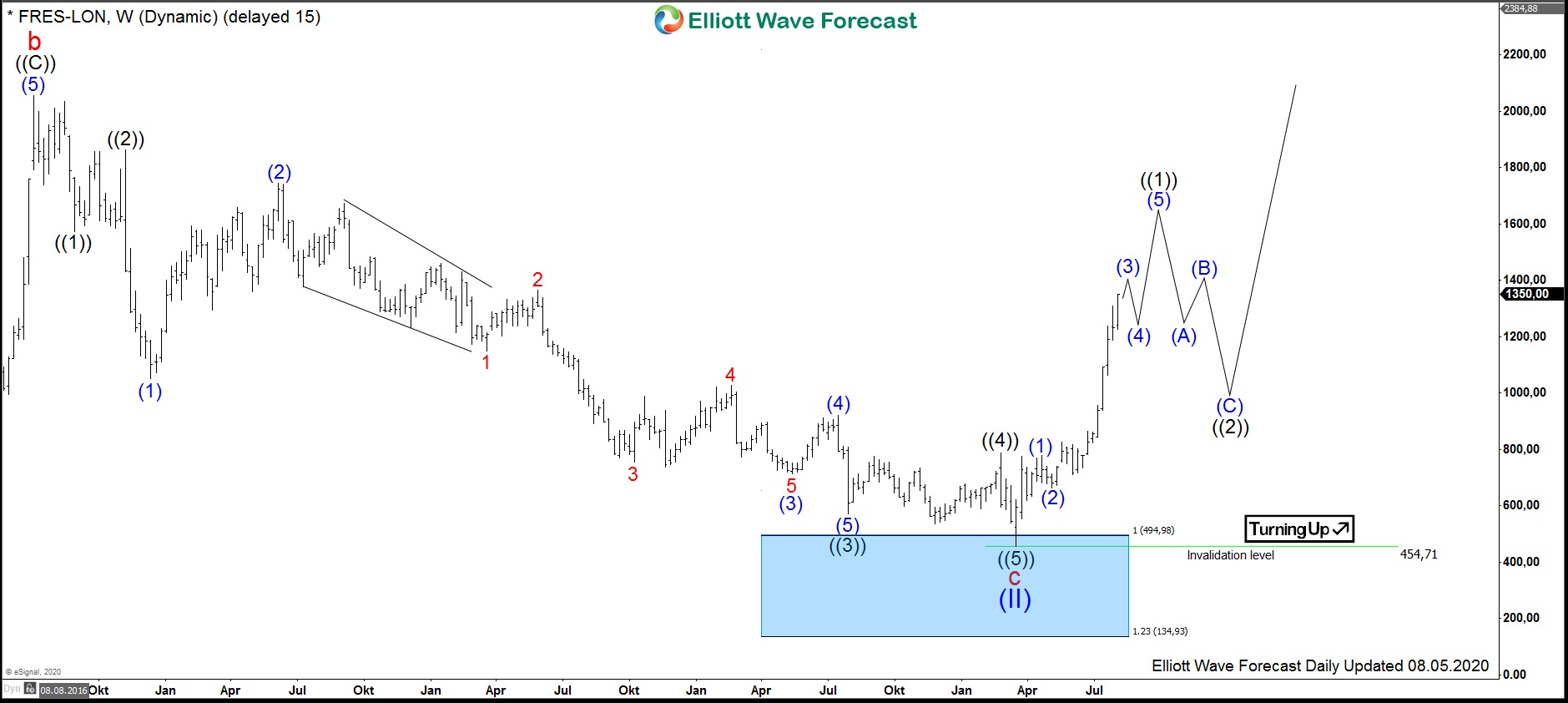

$FRES : Largest Silver Producer Fresnillo Rallies Impulsively

Read MoreFresnillo plc is the world largest silver producer which has its headquarters in Mexico City. Founded 2008, incorporated in UK and traded under tickers $FRES at LSE and $FNLPF in US in form of ADRs, it is a component of the FTSE100 index. Besides its dominating role in silver, Fresnillo plc is also the second […]

-

Elliott Wave View: S&P 500 ($SPX) Bullish Cycle Remains Intact

Read MoreSPX has continued to extend higher. While above July 25 low, expect dips in 3,7 or 11 swings to find support for more upside.

-

NASDAQ Forecasting The Elliott Wave Flat Correction

Read MoreIn this blog, we take a look at the past performance of 1 hour Elliott Wave charts of NASDAQ In which our members took advantage of the blue box areas.

-

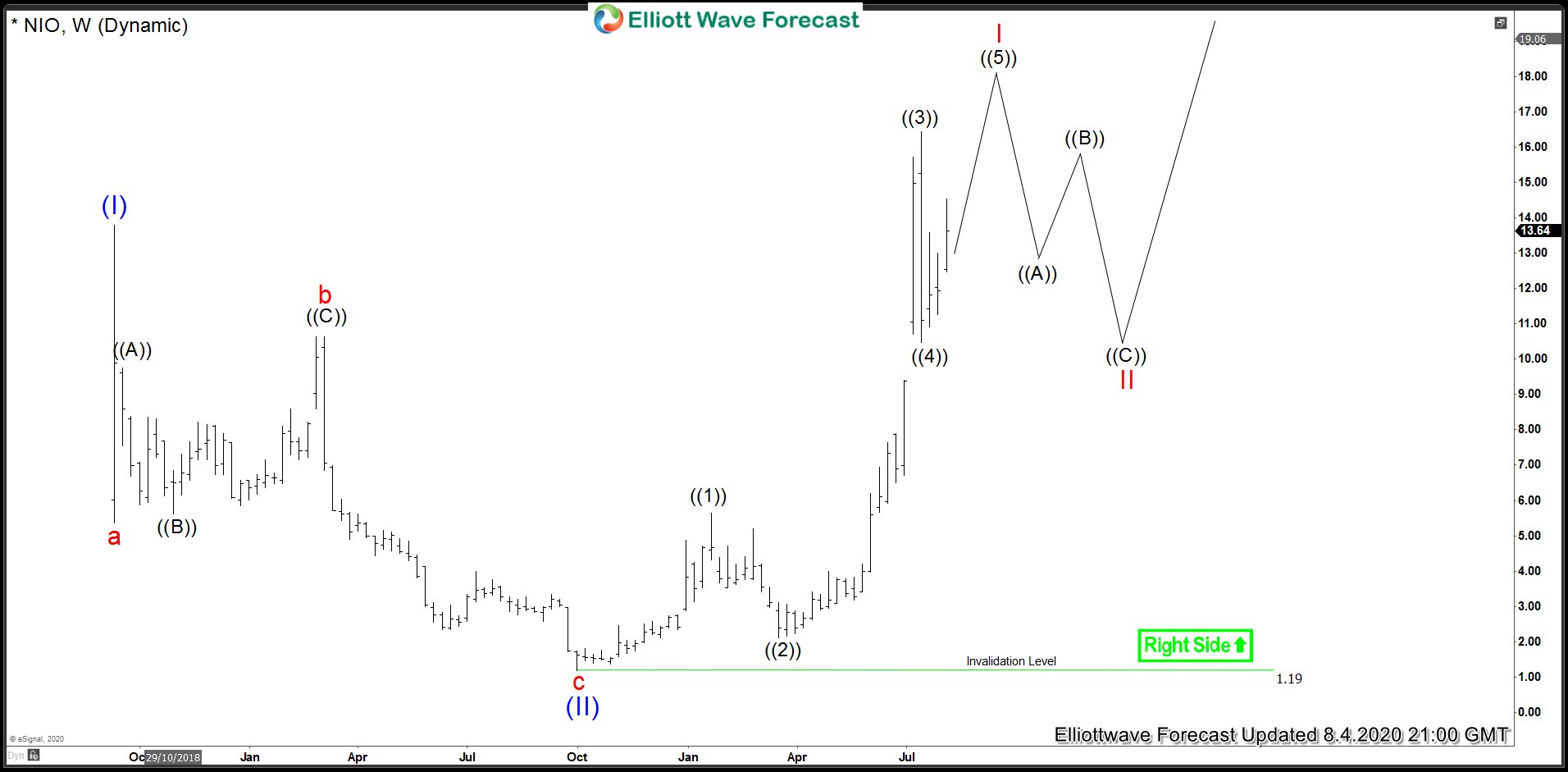

NIO (NYSE): Consolidating Gains Before a Break Higher

Read MoreCompany Profile. NIO Inc. is a pioneer in China’s premium electric vehicle market. We design, jointly manufacture, and sell smart and connected premium electric vehicles, driving innovations in next generation technologies in connectivity, autonomous driving and artificial intelligence. Nio held its U.S. IPO back in September of 2018, selling IPO shares at $6.26 and raising $1 billion. […]

-

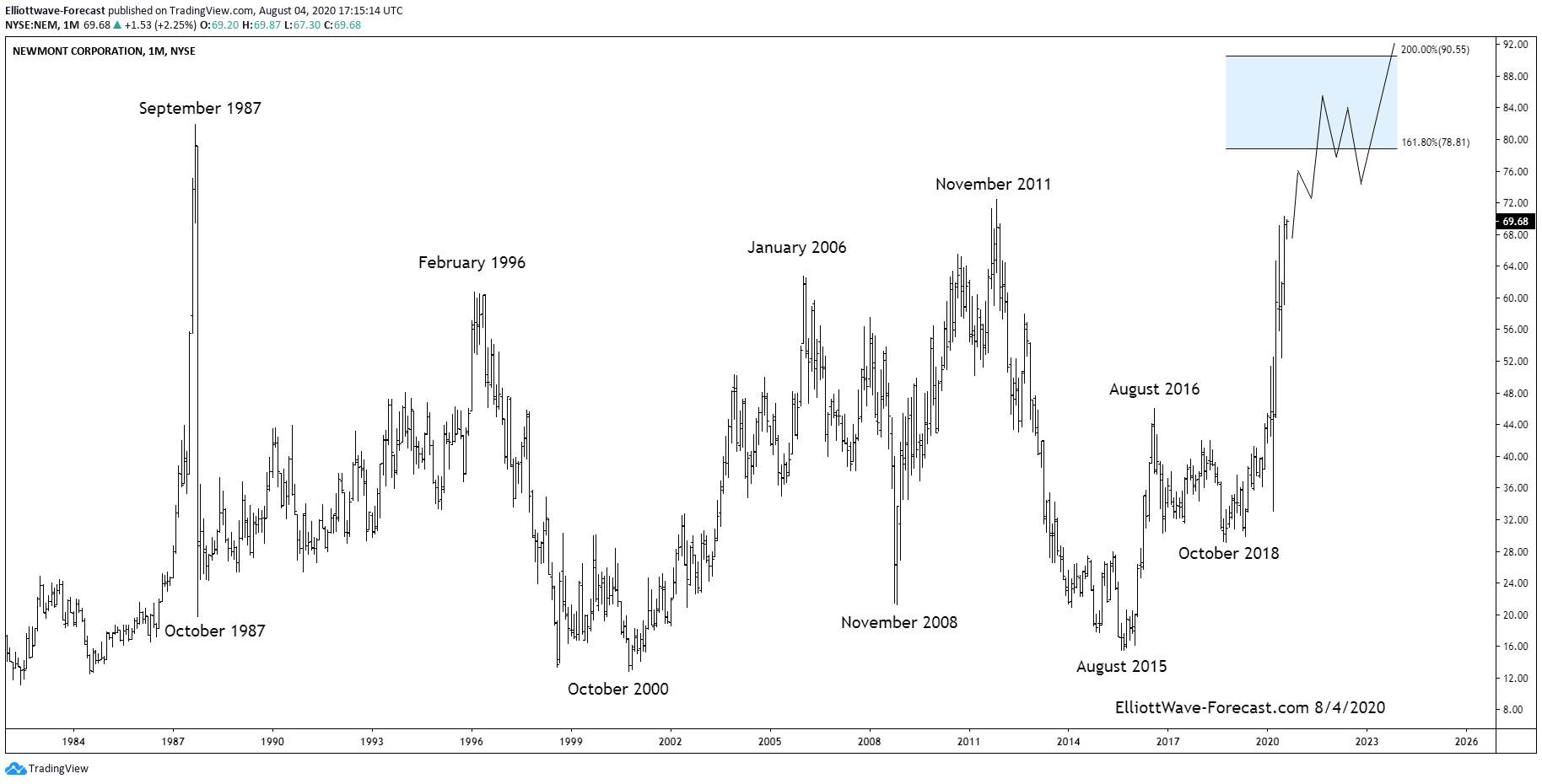

$NEM The Longer Term Bullish Cycles of Newmont Corporation

Read More$NEM The Longer Term Bullish Cycles of Newmont Corporation Firstly from the beginning of price data from back in the 1970’s not shown on the chart, the price trend was obviously up. It ended that bullish cycle in September 1987 and pulled back really hard during the October 1987 crash. Price stabilized from there several […]

-

Elliott Wave View: DAX Finds Support after Pullback

Read MoreDAX ended the cycle from July 21 high at blue box. From there, DAX has turned higher. While above July 30 low, expect dips in 3,7,11 swings to find support.