The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

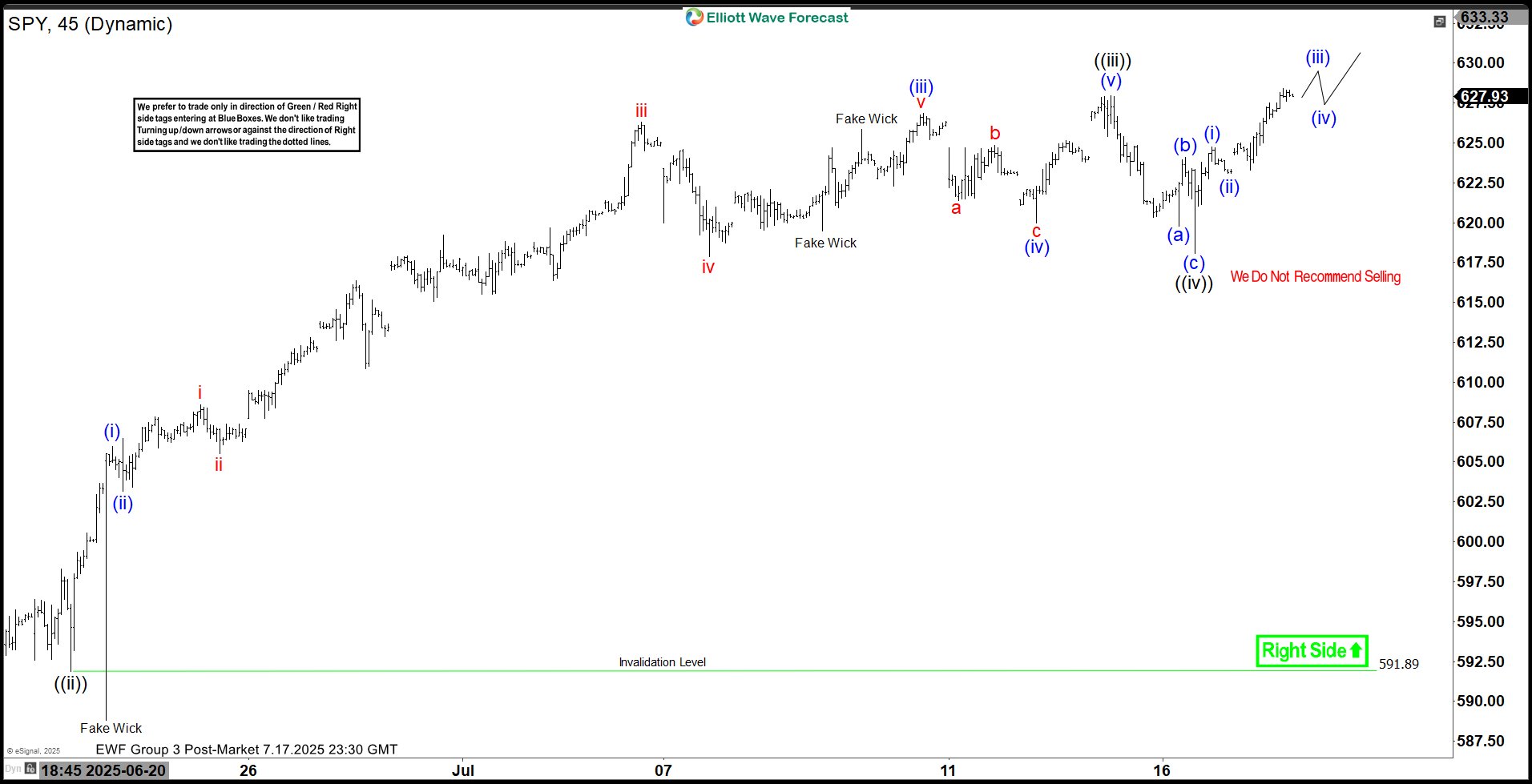

Elliott Wave Analysis: SPY Poised To Extend Higher In Bullish Sequence

Read MoreElliott Wave sequence in SPY (S&P 500 ETF) suggest bullish sequence in progress started from 4.07.2025 low. It expects two or few more highs to extend the impulse sequence from April-2025, while dips remain above 6.23.2025 low. SPY ended the daily corrective pullback in 3 swings at 480 low on 4.07.2025 low from February-2025 peak. […]

-

Elliott Wave Sequence Supports Rally In Dow Jones Futures (YM_F) From Extreme Area

Read MoreThe Dow Jones E-mini Futures (YM_F) favors impulsive rally from 4.07.2025 low of 36708. It is trading close to the previous high of 1.31.2025 of 45227. A break above that level will confirm the bullish sequence. Other US indices like Nasdaq & S & P 500 futures already confirmed the new high in daily, calling […]

-

EUROSTOXX Index (SX5E): A Classic Reaction Higher from Equal Legs

Read MoreIn this technical blog, we have looked at EUROSTOXX (SX5E) producing a classic reaction higher from equal legs area into the new highs.

-

Alnylam (ALNY) Eyes for ((3)) Rally Toward $368–$469 Zone

Read MoreAlnylam Pharmaceuticals Inc., (ALNY) discovers, develops & commercializes therapeutics based on ribonucleic acid interference. It comes under Healthcare – Biotech sector & trades as “ALNY” ticker at Nasdaq. ALNY favors rally in bullish weekly sequence & expect continuation against April-2025 low. It favors rally in ((3)) of III against 4.07.2025 low & pullback in 3, […]

-

Advanced Micro Devices $AMD Soars 90% from Blue Box Area, With $154 Target Still Ahead

Read MoreHello everyone! In today’s article, we’ll examine the recent performance of Advanced Micro Devices ($AMD) through the lens of Elliott Wave Theory. We’ll review how the reaction from the April 2025 blue box areas unfolded as an impulsive 5 waves and discuss what’s next. Let’s dive into the structure and expectations for this stock. ABC correction (Zig-Zag) 5 Wave […]

-

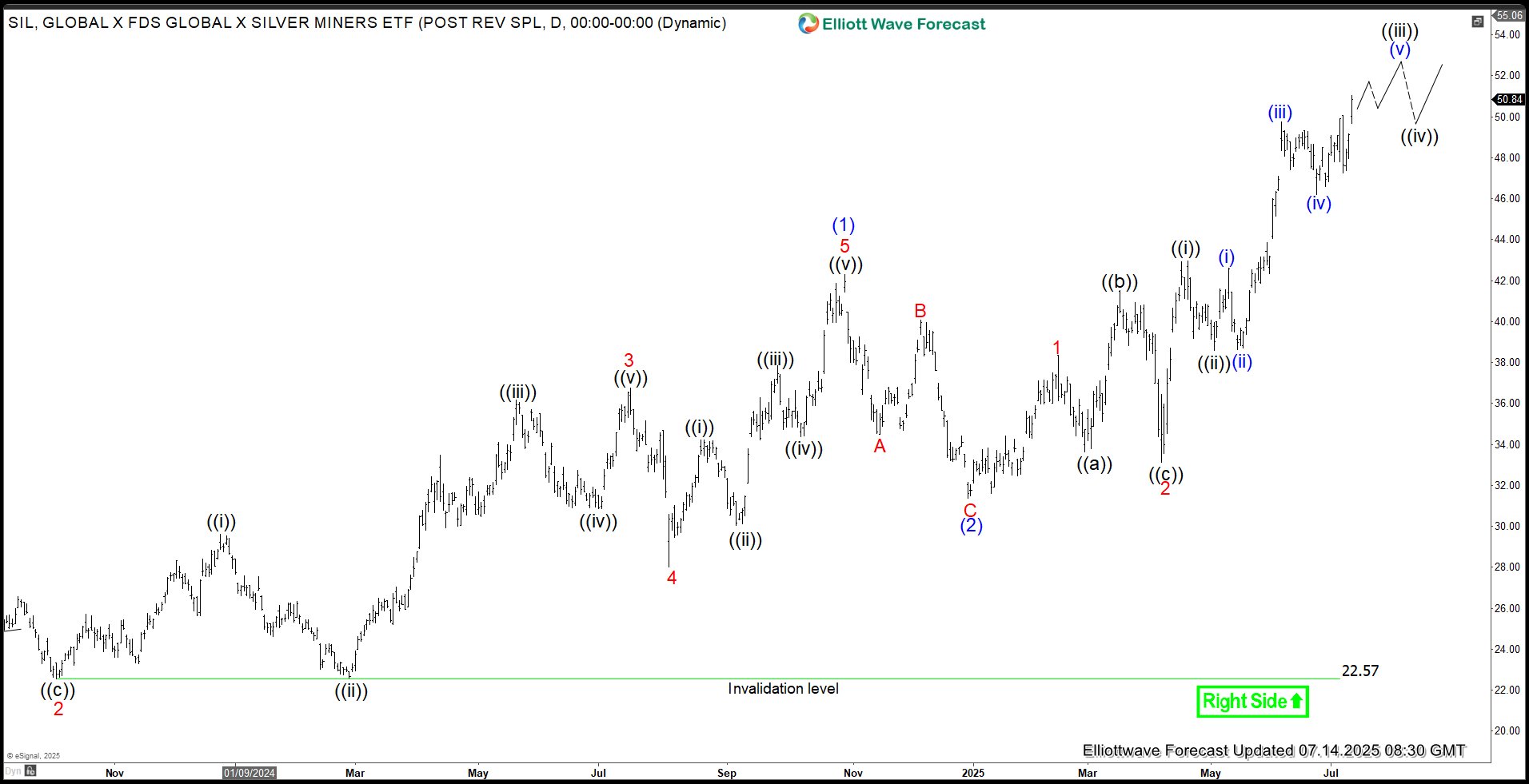

Silver Miners ETF (SIL) Acceleration Phase Has Begun

Read MoreSilver Miners ETF (SIL) has resumed the rally and it’s likely now in the acceleration phase of the impulse. This article looks at the Elliott Wave path.