The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

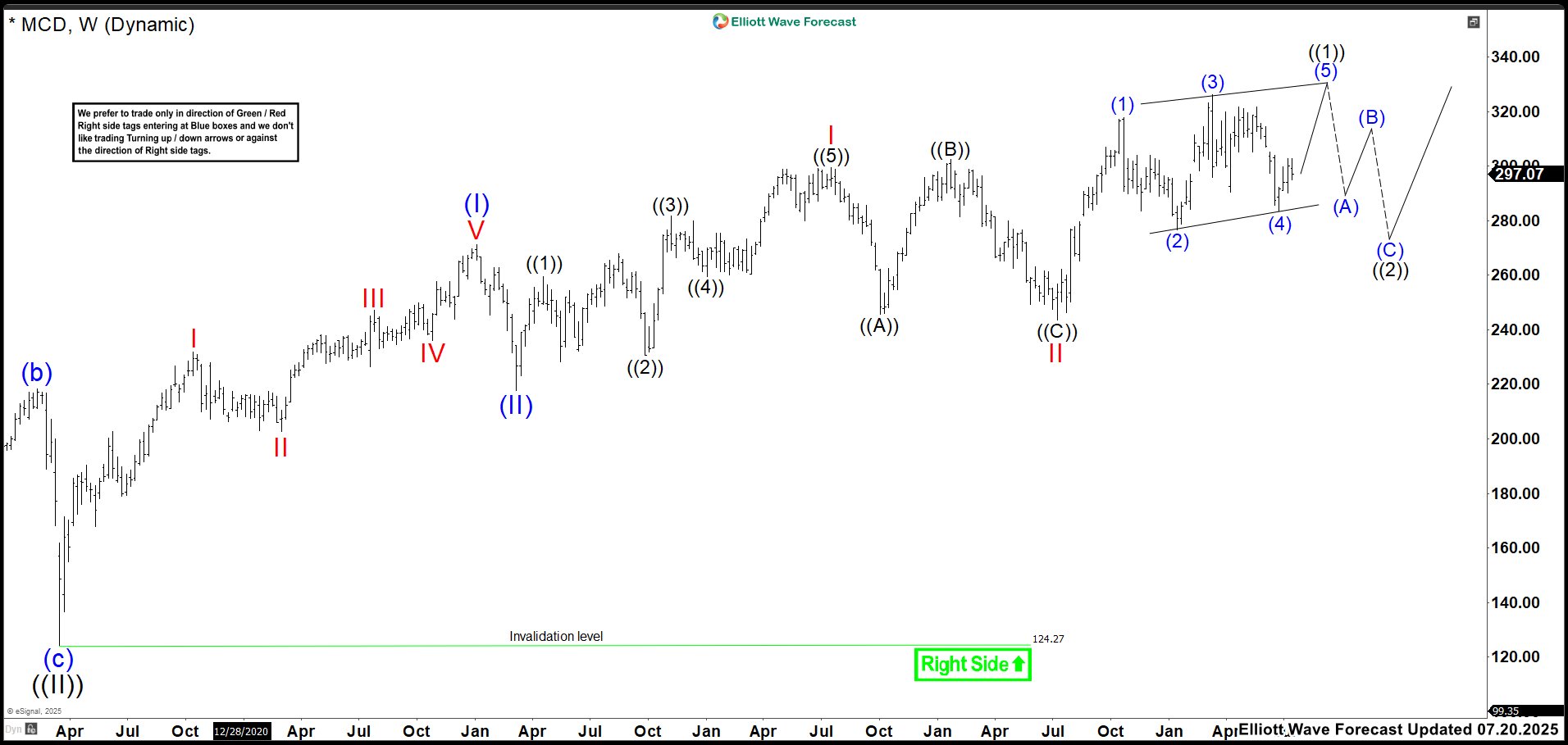

McDonald’s (MCD): Final Push Before Diagonal Ends

Read MoreMcDonald’s (MCD) stock is holding steady near $298, showing resilience despite mixed consumer trends and pricing pressures. Financially, the company remains strong with a market cap above $213 billion, a dividend yield of 2.37%, and nearly 50 consecutive years of dividend increases. Its Q2 earnings are expected on July 28, with analysts projecting modest profit growth. […]

-

Elliott Wave View: Nasdaq Futures (NQ_F) Poised To Extend Higher

Read MoreThe Nasdaq Futures (NQ_F) favors higher in bullish impulse sequence from April-2025 low. It already broke above December-2024 high & expect short term pullback in 3, 7 or 11 swings to remain supported. Impulse sequence unfolds in 5, 9, 13, 17, 21….. swings count. It ended daily corrective pullback in double correction at 16460 low […]

-

Bullish Bounce: YM_F Dow Futures Rebound from Blue Box Zone

Read MoreIn this technical blog, we will look at the YM_F Dow futures rebound from blue box zone. Producing a perfect bullish bounce as expected.

-

Elliott Wave Sequence In NVIDIA (NVDA) Suggests Rally From Support Area

Read MoreNvidia (NVDA) continues rally to new all-time highs from April-2025 low and reinforcing a robust bullish outlook. In daily, it ended 7 swings pullback at 86.62 low in 4.07.2025 low started from 1.07.2025 high. Above April-2025 low, it confirmed higher high bullish sequence & pullback in 3, 7 or 11 swings should remain supported. Since April-2025 […]

-

Is SoFi Technologies (SOFI) Set For Major Breakout?

Read MoreSoFi Technologies, Inc., (SOFI) provides various financial services in the US, Latin America, Canada & Hong Kong. It operates through three segments; Lending, Technology Platform & Financial services. It comes under Financial Services sector & trades as “SOFI” ticker at Nasdaq. SOFI is showing 5 swings higher from December-2022 low as the part of impulse […]

-

Meta Platforms Inc. $META Blue Box Area Offers A Buying Opportunity

Read MoreHello everyone! In today’s article, we’ll examine the recent performance of Meta Platforms Inc. ($META) through the lens of Elliott Wave Theory. We’ll review how the decline from the June 30, 2025, high unfolded as a 7-swing correction (WXY) and discuss our forecast for the next move. Let’s dive into the structure and expectations for this stock. 7 Swing WXY […]