The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

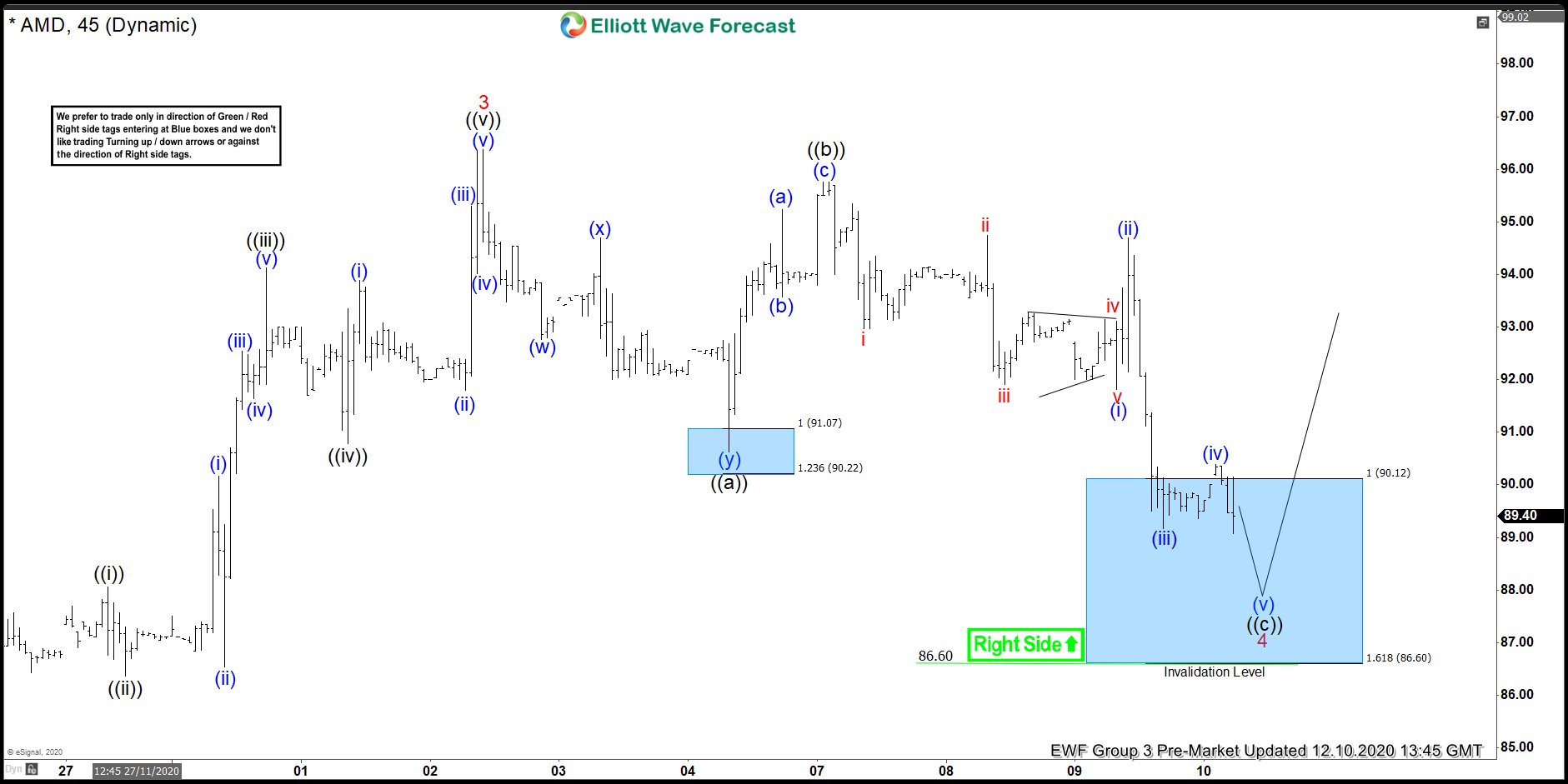

AMD Resuming Higher After Ending Flat Correction

Read MoreIn this blog, we take a look at the past performance of 1 hour Elliott Wave charts of AMD In which our members took advantage of the blue box areas.

-

Arcimoto ($FUV) Bullish Trend Intact

Read MoreArcimoto off the March 2020 low has been on an amazing rally. With the stock price rallying from $1 to $20, it has enjoyed a 2000% gain in under a year. Arcimoto is an electric vehicle company headquartered in Eugene, Oregon. Arcimoto manufactures and sells the Fun Utility Vehicle, or FUV, a tandem two-seat, three-wheeled electric vehicle. They […]

-

$FXE Long Term Cycle and Elliott Wave

Read More$FXE Long Term Cycle and Elliott Wave Firstly as seen on the weekly chart shown below the instrument made a high in April 2008. There is data back to December 2005 in the ETF fund. Data correlated in the EURUSD foreign exchange pair suggests the high in April 2008 was the end of a cycle up […]

-

Silver Miners (SIL) Close to Ending Correction

Read MoreOne of the best ways to play the silver rally, if one believes in the bullish thesis, is through the Silver Miner ETF (SIL). The share price of these publicly traded mining companies usually climb faster than the precious metals that they produce during the bull market phase of the underlying metal. Since forming a […]

-

Will Santa Claus Rally Come This Year?

Read MoreThe Santa Claus rally is a capital market phenomenon that happens from December 28 to January 2 of the following year. It named in 1972 by Yale Hirsc who noticed an unusual upward movement in the market in that period of time. This event is so recurrent for years that it earned its own name […]

-

Elliott Wave View: Nike (NKE) Extending to New All-Time High

Read MoreNike (NKE) continues to make a new all-time high and cycle from Oct 30 low is incomplete. DIps should find support in 3, 7, or 11 swing.