The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Elliott Wave View: Pullback in DAX Should Find Buyers

Read MoreDAX has scope to extend pullback in 7 swing structure. This article and video look at the Elliott Wave path of the Index.

-

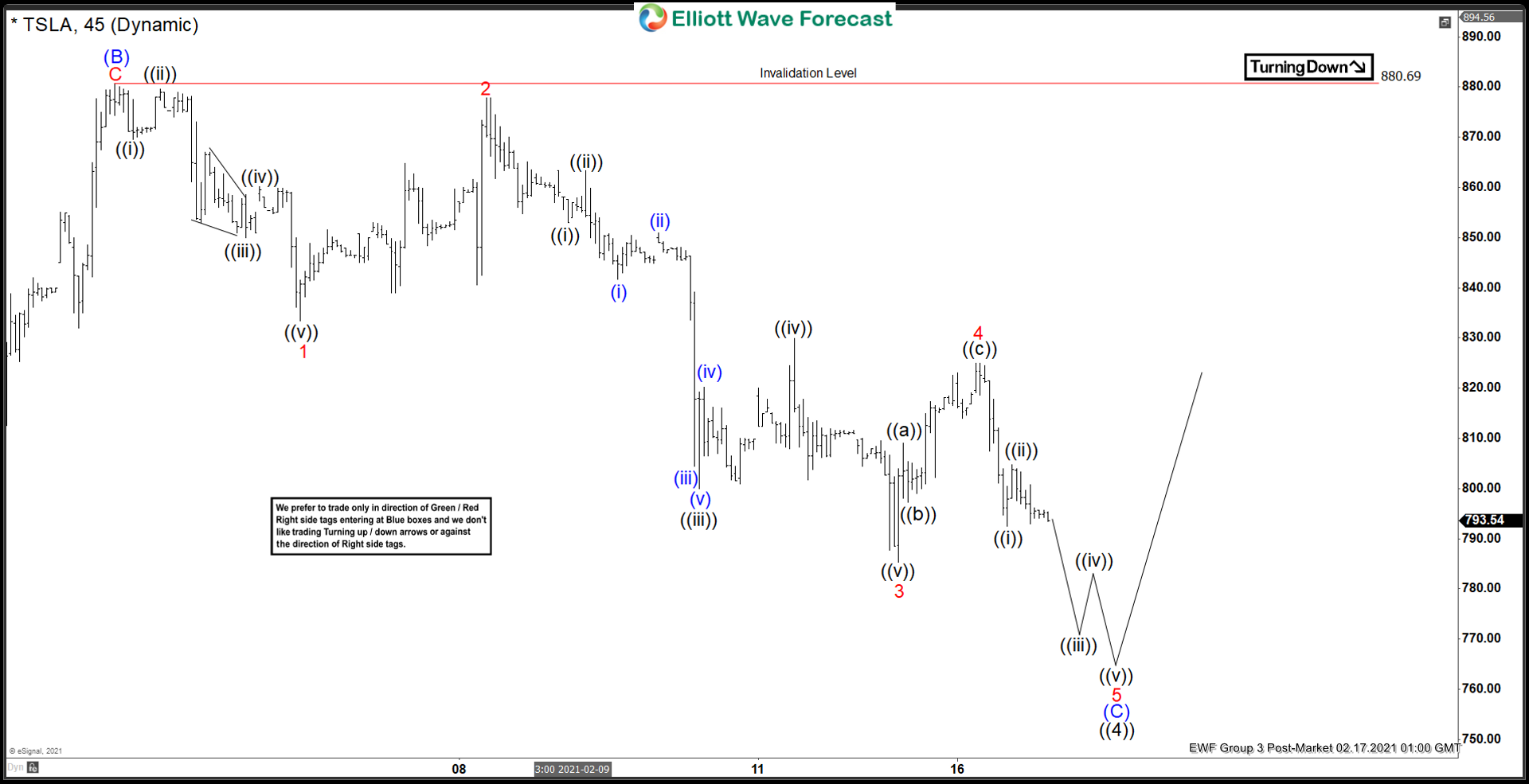

Elliott Wave View: Tesla (TSLA) Approaching Support

Read MoreTesla is approaching support area where buyers can be seen. This article and video look at the short term Elliott Wave path.

-

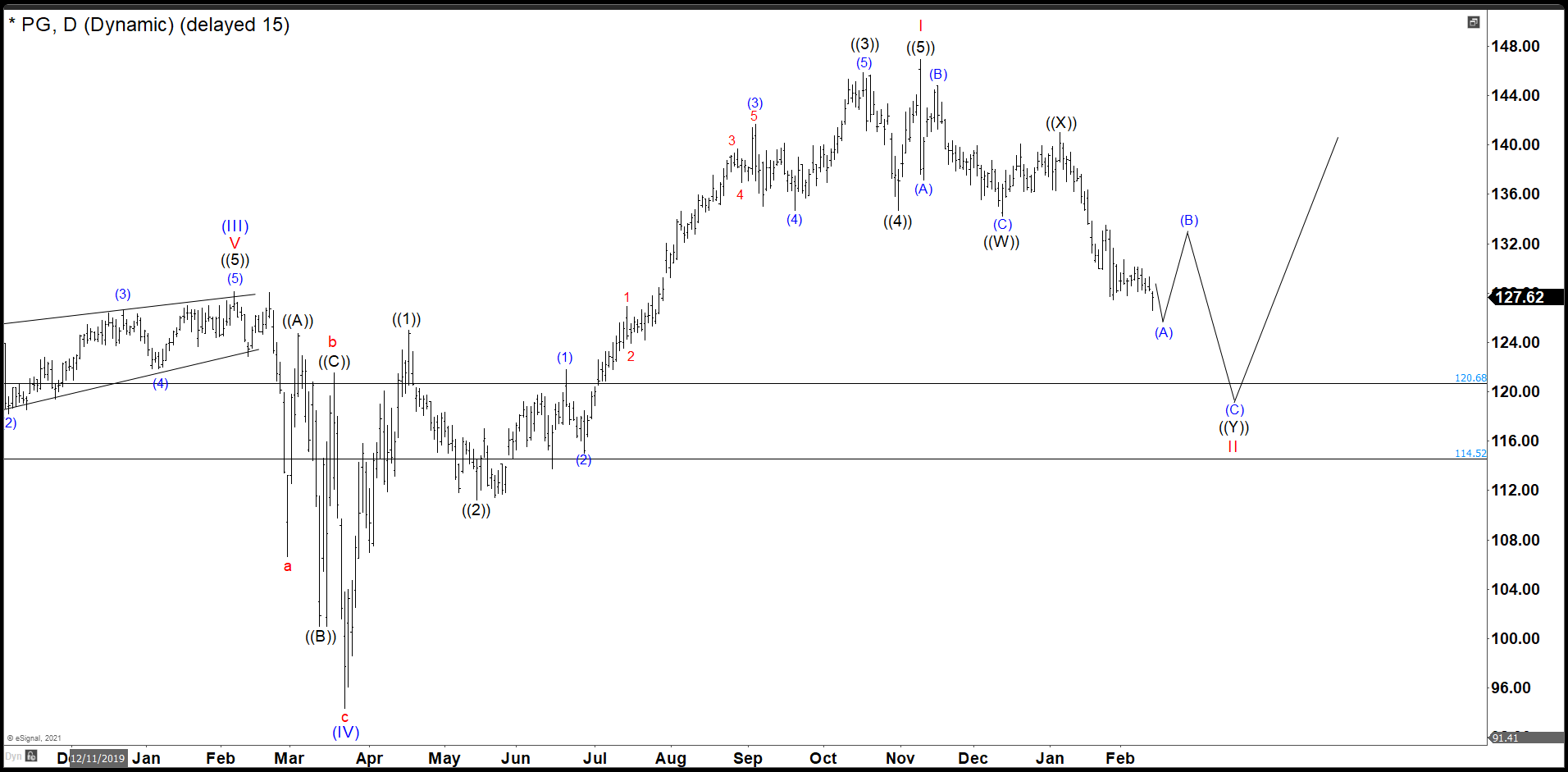

Building An Impulse In P&G After Complete Wave II

Read MoreSince the crash of March 2020, all stocks have tried to recover what they lost and P&G was no exception. P&G did not only recover the lost, but It also reached historic highs Now, we are going to try to build an impulse from wave II when it is completed with a target around to […]

-

$CPER Copper Index Tracker Long Term Cycles

Read More$CPER Copper Index Tracker Long Term Cycles Firstly the CPER Copper Index Tracking instrument has an inception date of 11/15/2011. There is data in the HG_F copper futures before this going back many years. That shows copper made an all time high on February 15th, 2011 at 4.649. Translated into this instrument, it is mentioned on […]

-

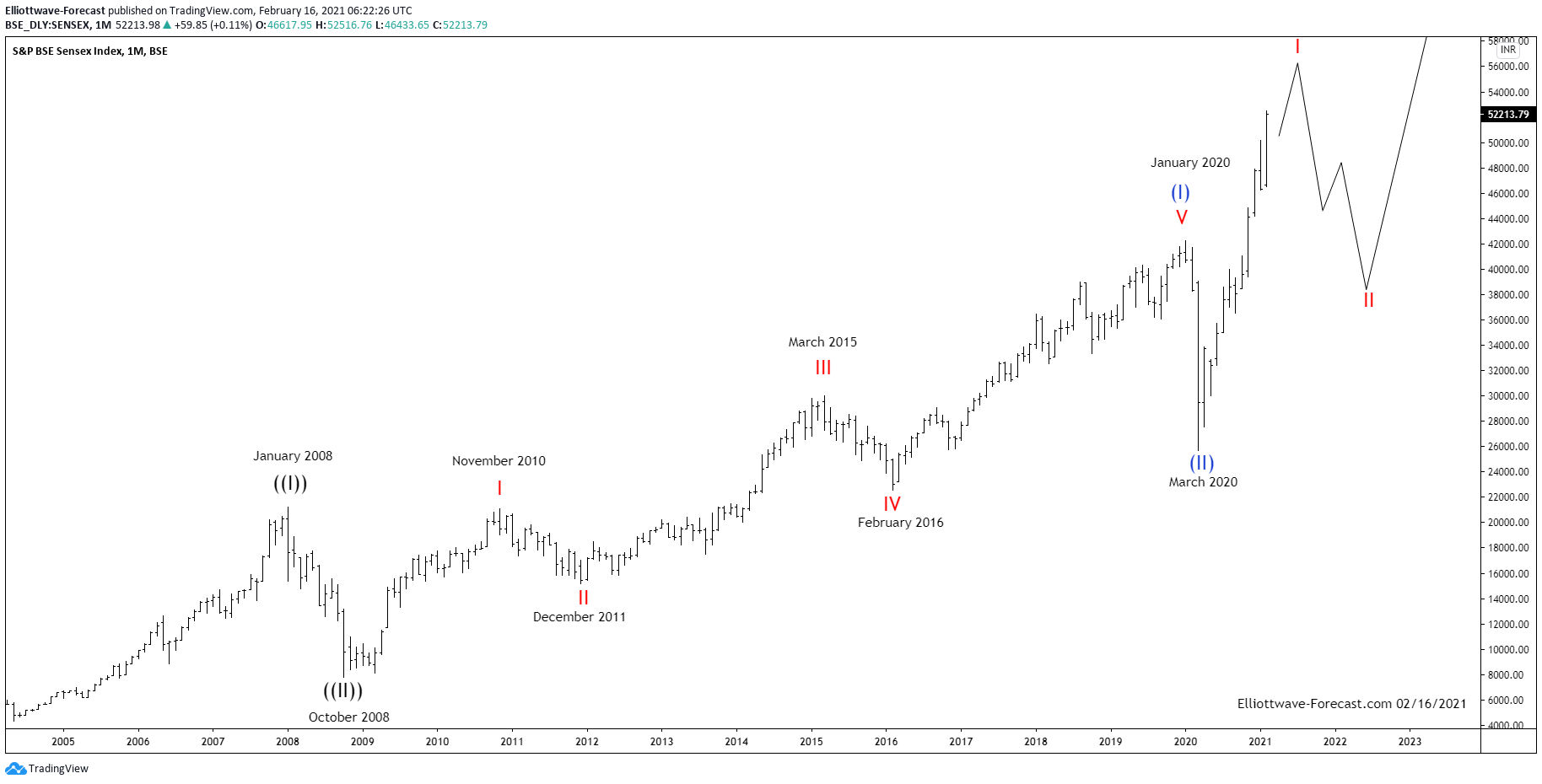

Sensex Index Long Term Bullish Cycles & Elliott Wave

Read MoreSensex Index Long Term Bullish Cycles & Elliott Wave The Sensex Index has been trending higher with other world indices. Firstly in it’s base year 1978 to 1979 the index’s point value was set at 100. From there it rallied with other world indices trending higher into the January 2008 highs. It then corrected the bullish […]

-

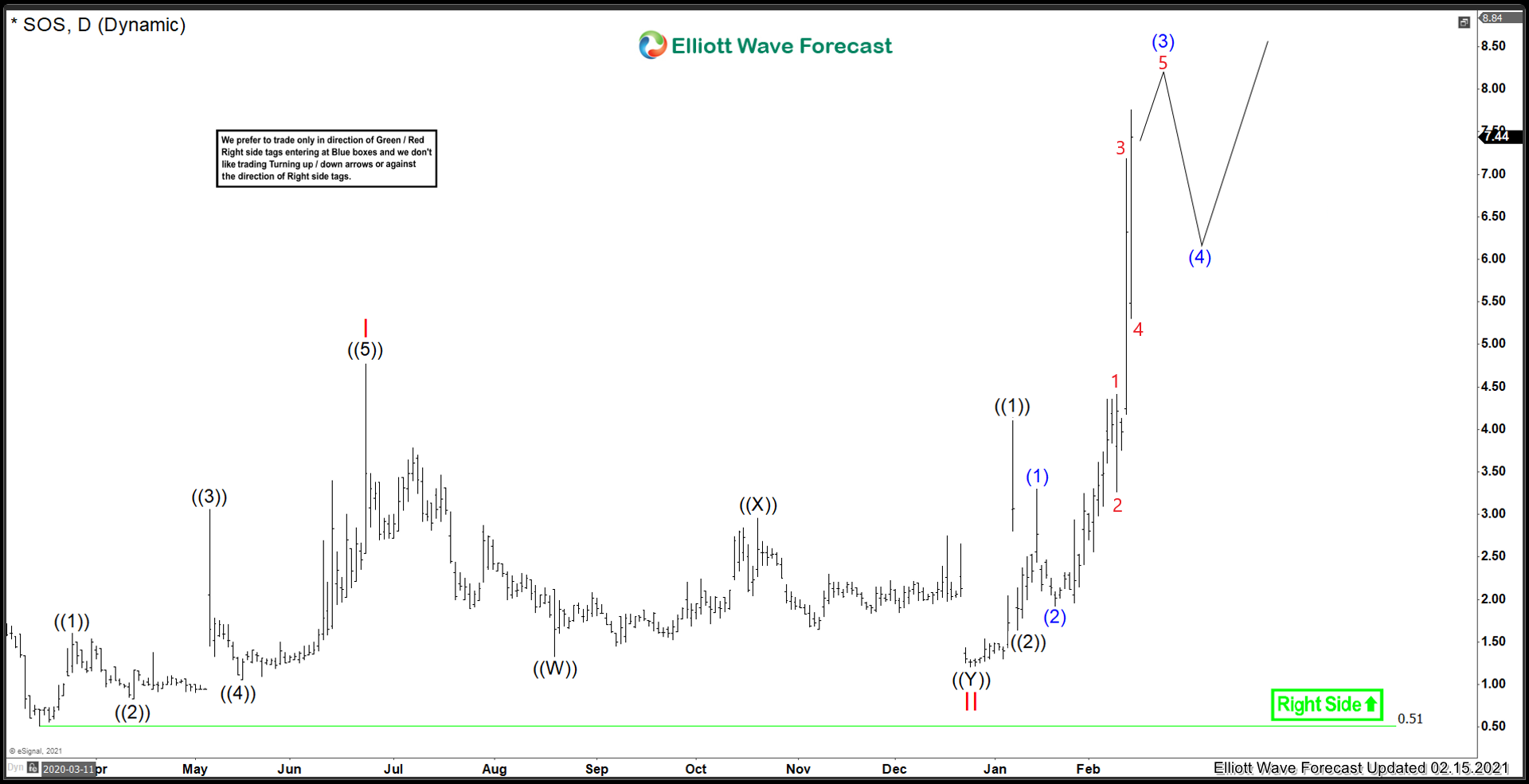

SOS Limited ($SOS) Breaking Out Higher

Read MoreIt seems these days there is no shortage of companies riding the coat tails of the Bitcoin and blockchain. SOS is a company based out of China, that has been involved in blockchain sector for some time. However, recently has shifted focus to mining for Bitcoin. Lets take a look at what they do: “SOS is […]