The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

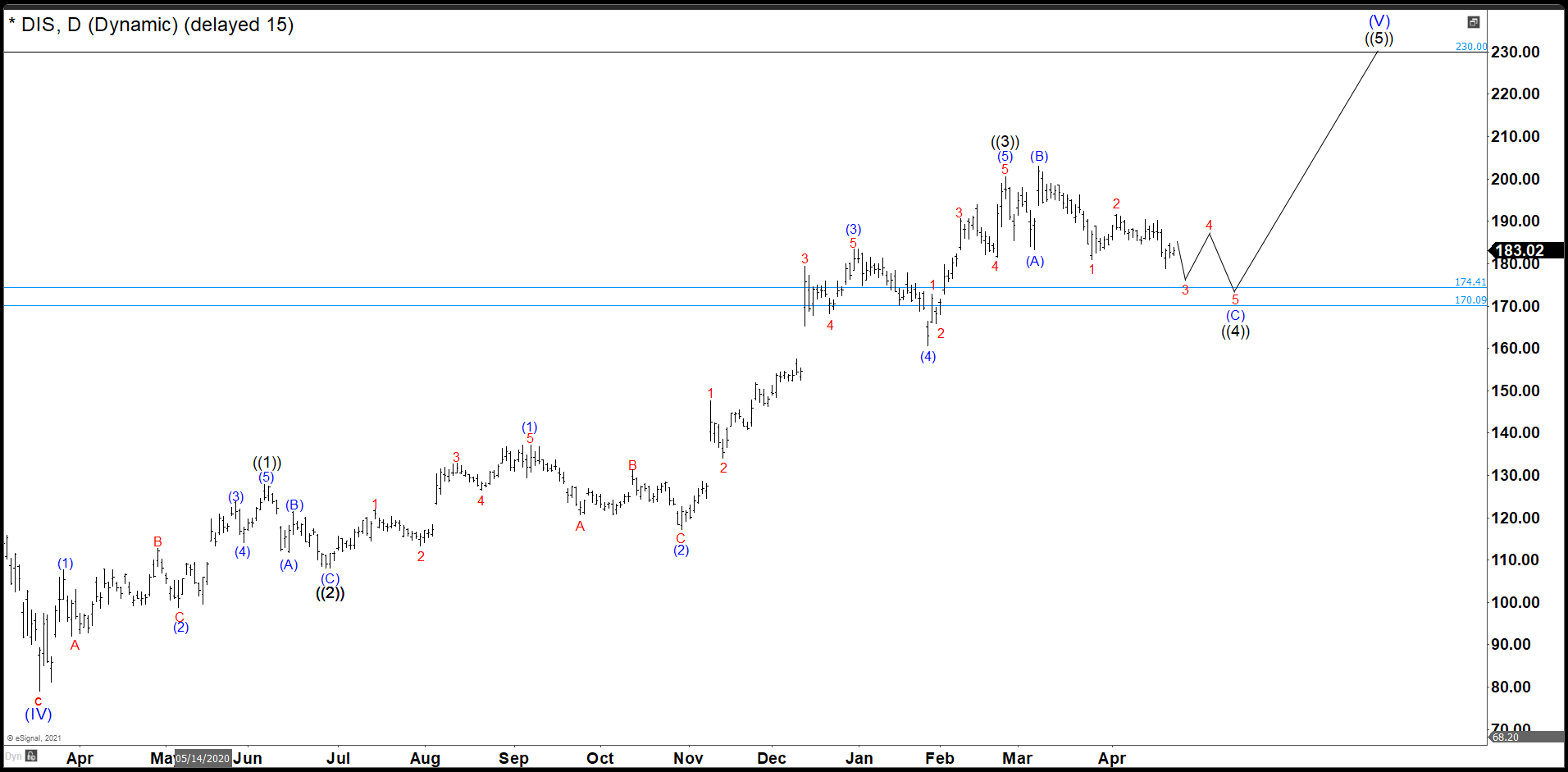

Disney Wave ((4)) Has Not Ended And Needs To Talk More

Read MoreSince the crash of March 2020, all stocks have tried to recover what they lost, and Disney was no exception. Disney did not only recover the lost, but It also reached historic highs. Now, we are going to try to build an impulse from the March 2020 lows with a target around $230. Target measured […]

-

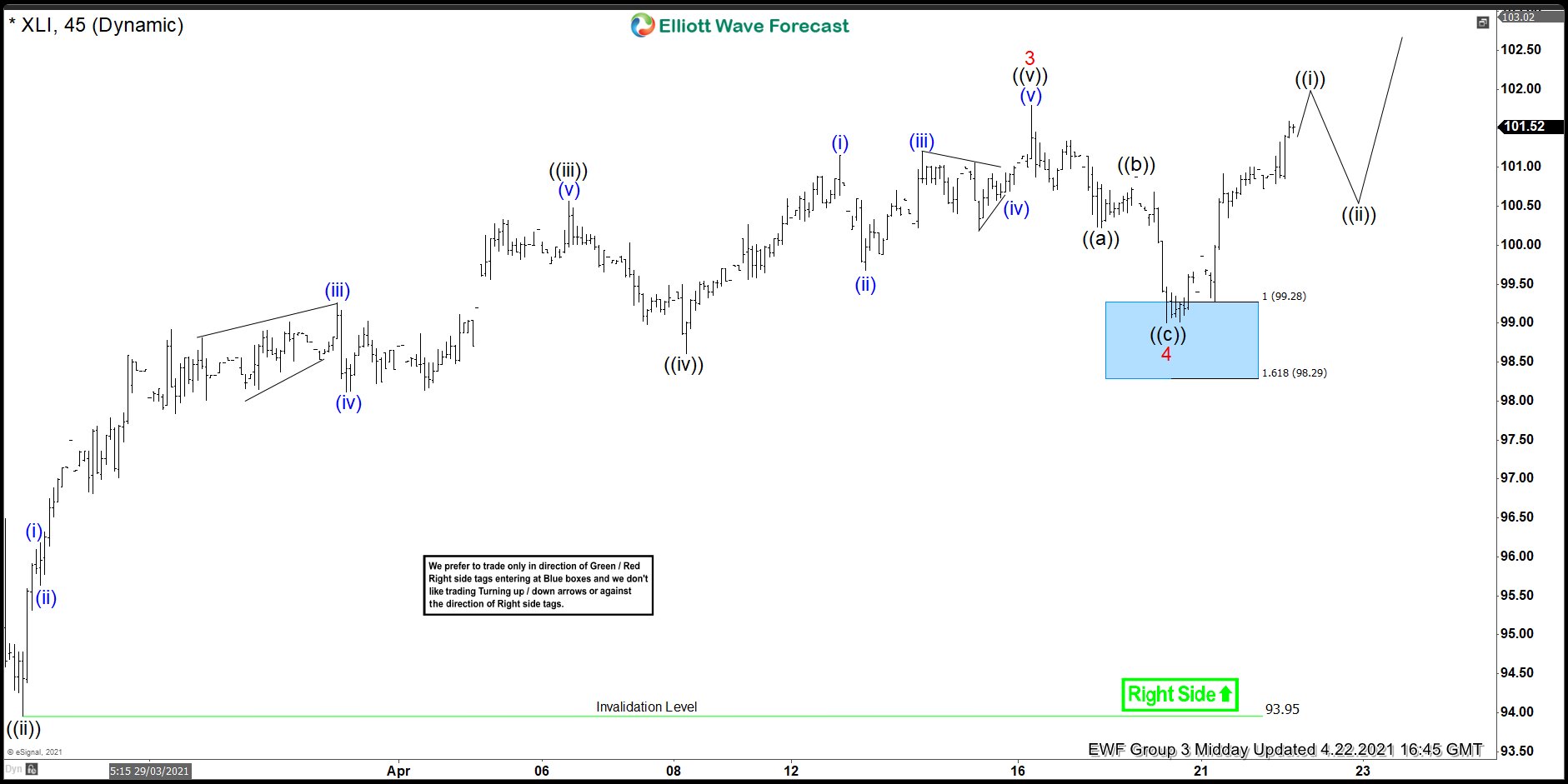

XLI Found Buyers At The Blue Box And Reacted Higher

Read MoreXLI is an exchange traded fund (ETF) that tracks performance of the U.S industrial sector. In this blog, we look at an Elliott Wave analysis of the recent short term. Below, we have an Elliott Wave 1 hourly chart from 4/21/2021, wherein the ETF peaked at red wave 3 area. As per Elliot Wave theory, […]

-

Torchlight Energy Resources ($TRCH) Moving Higher

Read MoreOil has hard a remarkable rally from the March 2020 low, and further upside is favoured to take place in the energy sector still. There is one energy producer that has vastly outperformed many other producers, Torchlight Energy Resources. From an all time low of 21 cents set in September 2020, to the recent peak […]

-

Elliott Wave View: S&P 500 E-Mini Futures (ES) Ready for New All-Time High

Read MoreS&P 500 E-Mini Futures (ES) rally from March 5 low is in progress as an impulse. This article and video look at the Elliott Wave path.

-

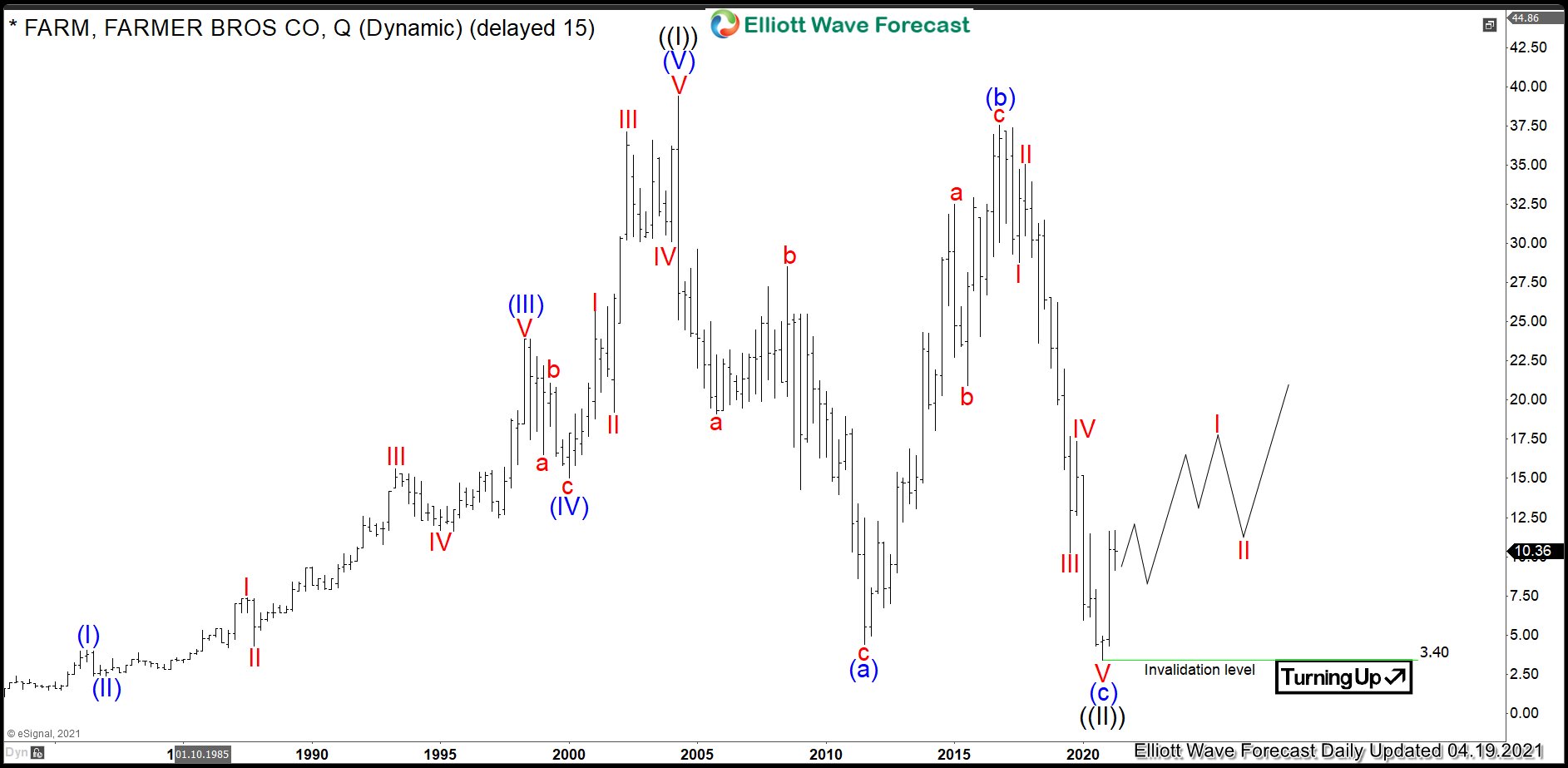

$FARM : Coffee Company Farmer Brothers Should See a Bullish Run

Read MoreFarmer Bros. Co is an U.S. american coffee foodservice company based in Nortlake, Texas, USA. Founded in 1912 and traded under tickers $FARM at Nasdaq, it is a component of the Russel2000 index. Farmer Brothers specializes in the manufacture and distribution of coffee, tea and other food items. Currently, we can see coffee and other […]

-

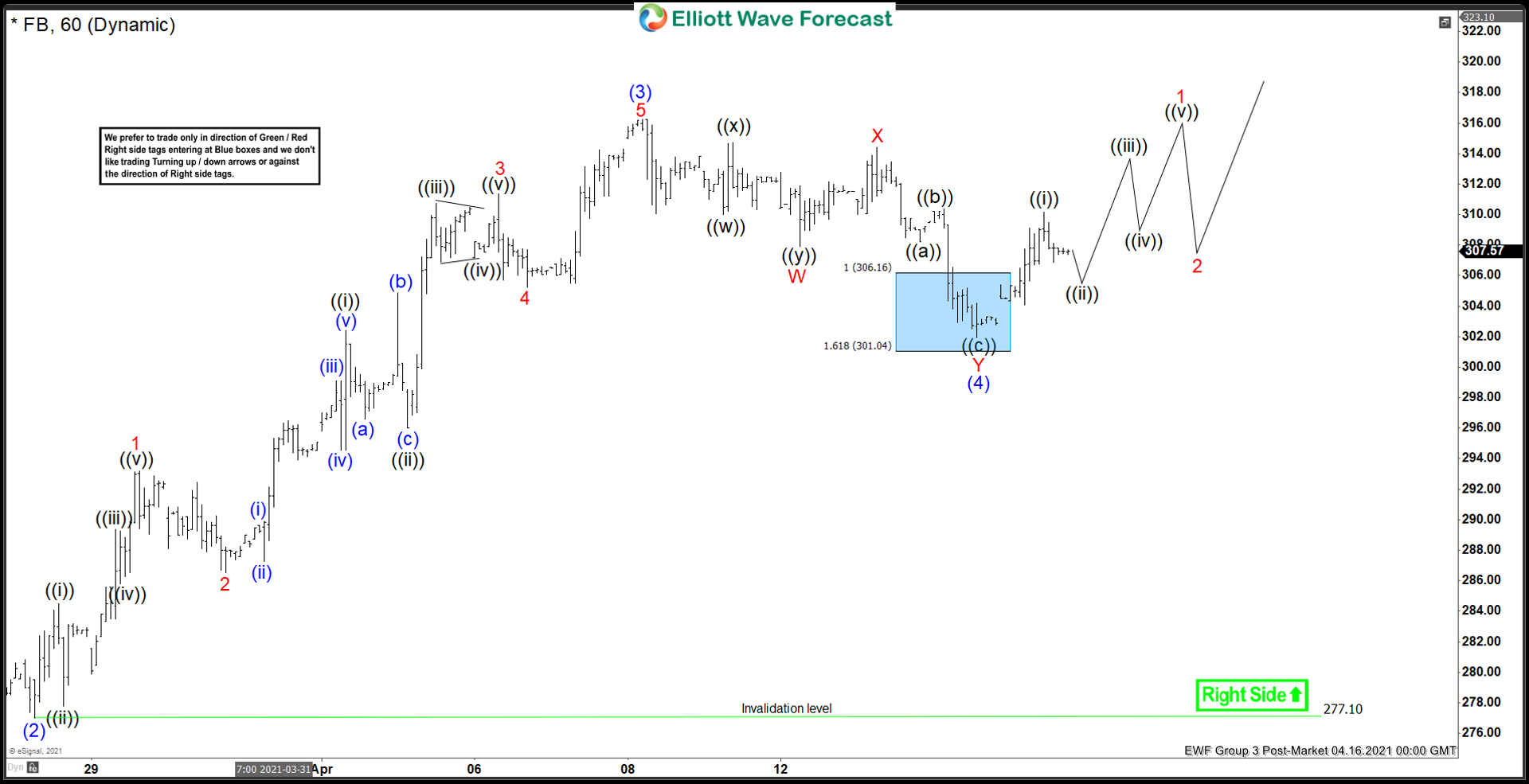

Facebook (FB) Should Continue The Rally From Blue Box Area

Read MoreToday we look at Facebook (FB) after reaching the blue box, and its potential to continue higher Looking at the 1 hour chart from 4/14/2021 below, we see a five wave sequence up from the $277.10 levels. This move completed a cycle in red wave 3. Within the red wave 3 itself, we see a […]