The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

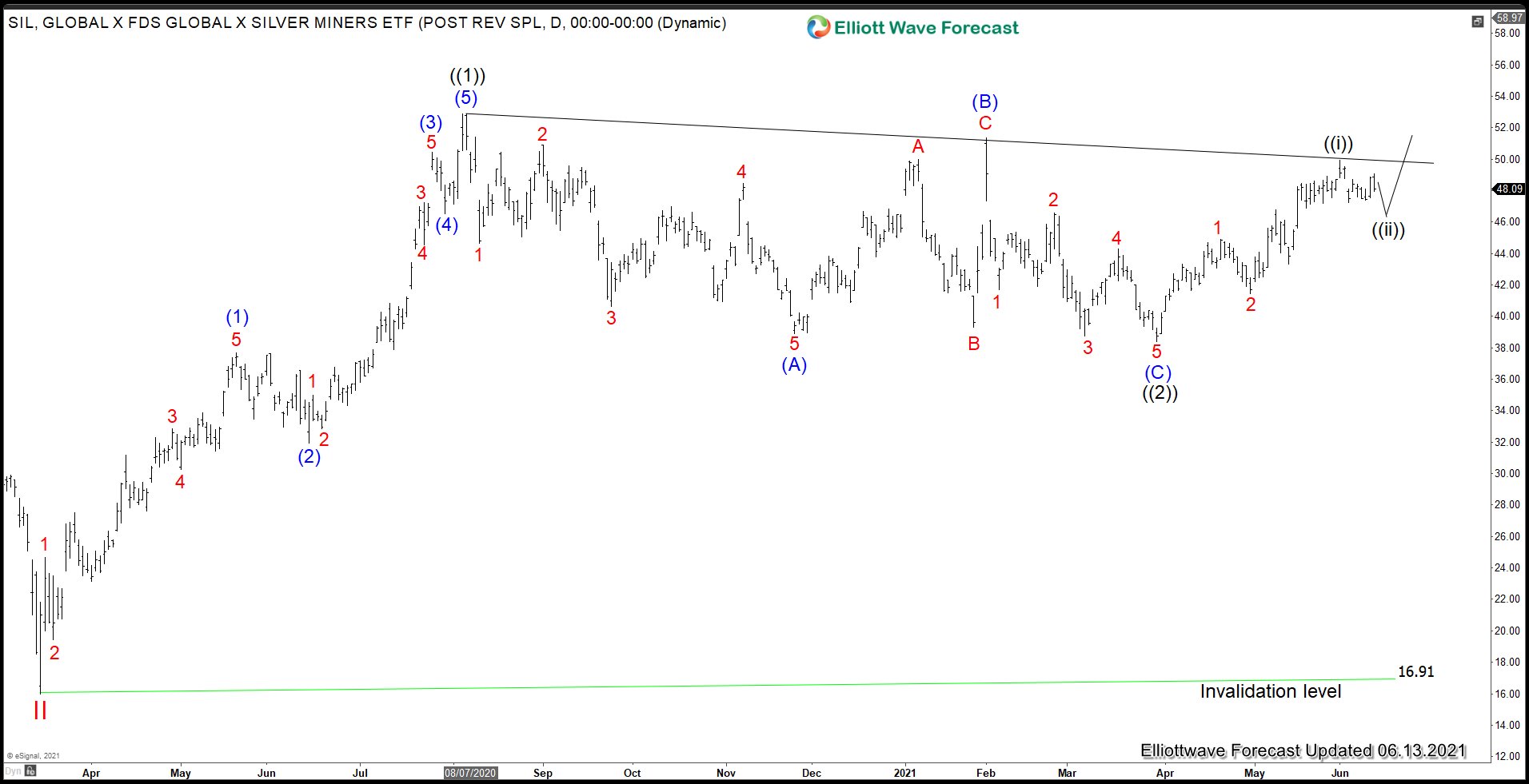

Silver Miners ETF (SIL) Looking for A Breakout

Read MoreSilver Miner ETF (SIL) has been consolidating for 10 months. In the next few months, the ETF may start the next major breakout to the upside The key areas remain to be around $52. A break and close above this level could start the next major bullish rally. The ETF still remains to be one […]

-

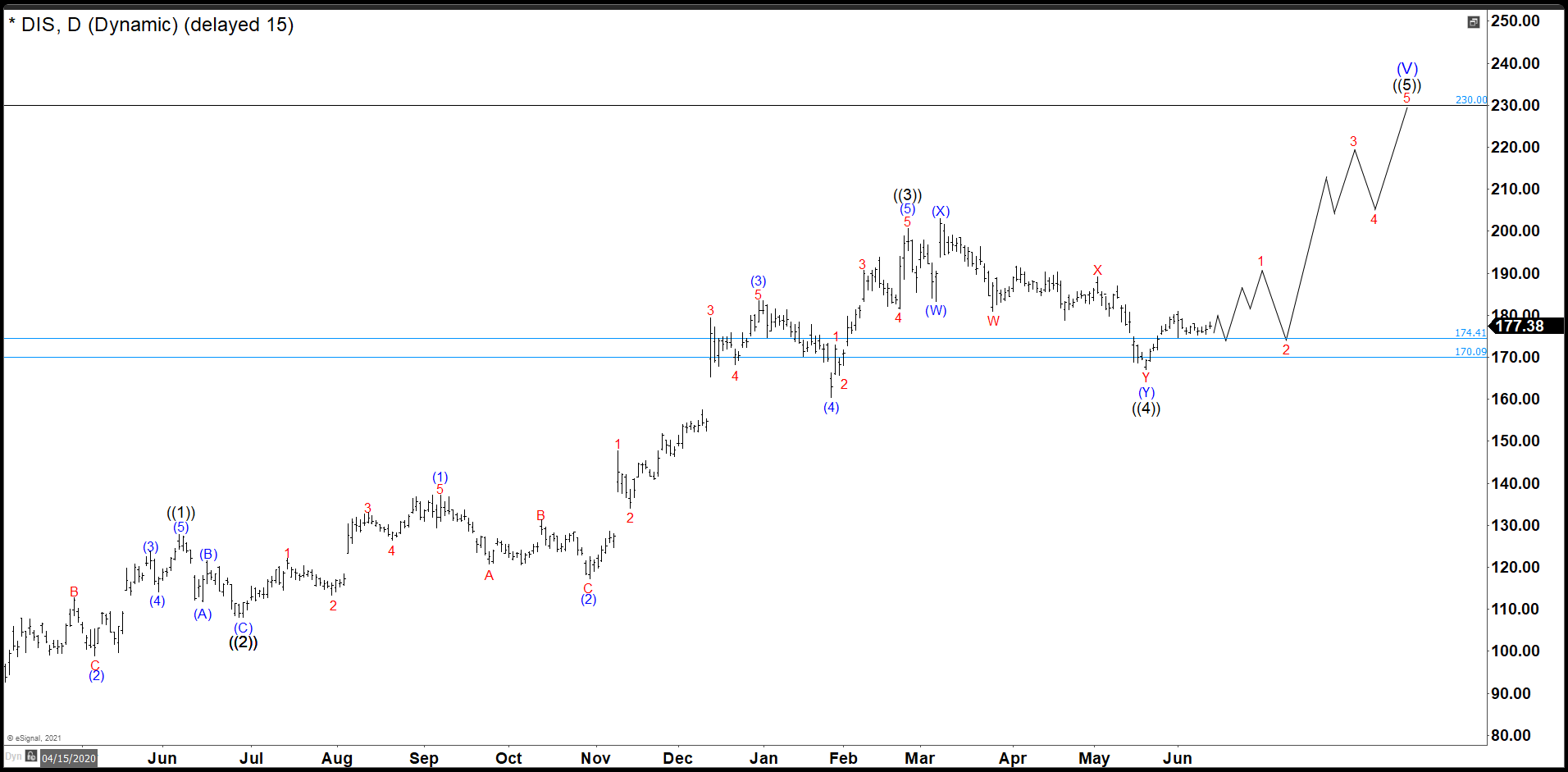

Disney Seems To Have Ended The Wave ((4)) Pullback

Read MoreSince the crash of March 2020, all stocks have tried to recover what they lost, and Disney was no exception. Disney did not only recover the lost, but It also reached historic highs. Now, we are going to try to build an impulse from the March 2020 lows with a target around $230. Target measured […]

-

Elliott Wave View: Gold (XAUUSD) Preparing for Next Bullish Leg

Read MoreGold (XAUUSD) is getting ready for the next bullish leg. This article and video look at the short term Elliott Wave path for the metal.

-

$KGH: Metals Producer KGHM Should Continue Higher

Read MoreThe stock of KGHM Polska Miedź S.A. is attracting a high attention of investors and traders. It has demonstrated an impressive rally since our initial article from August 2020. As a matter of fact, advance of indices on the one hand and powerful acceleration in commodities like copper and silver on the other have provided a double […]

-

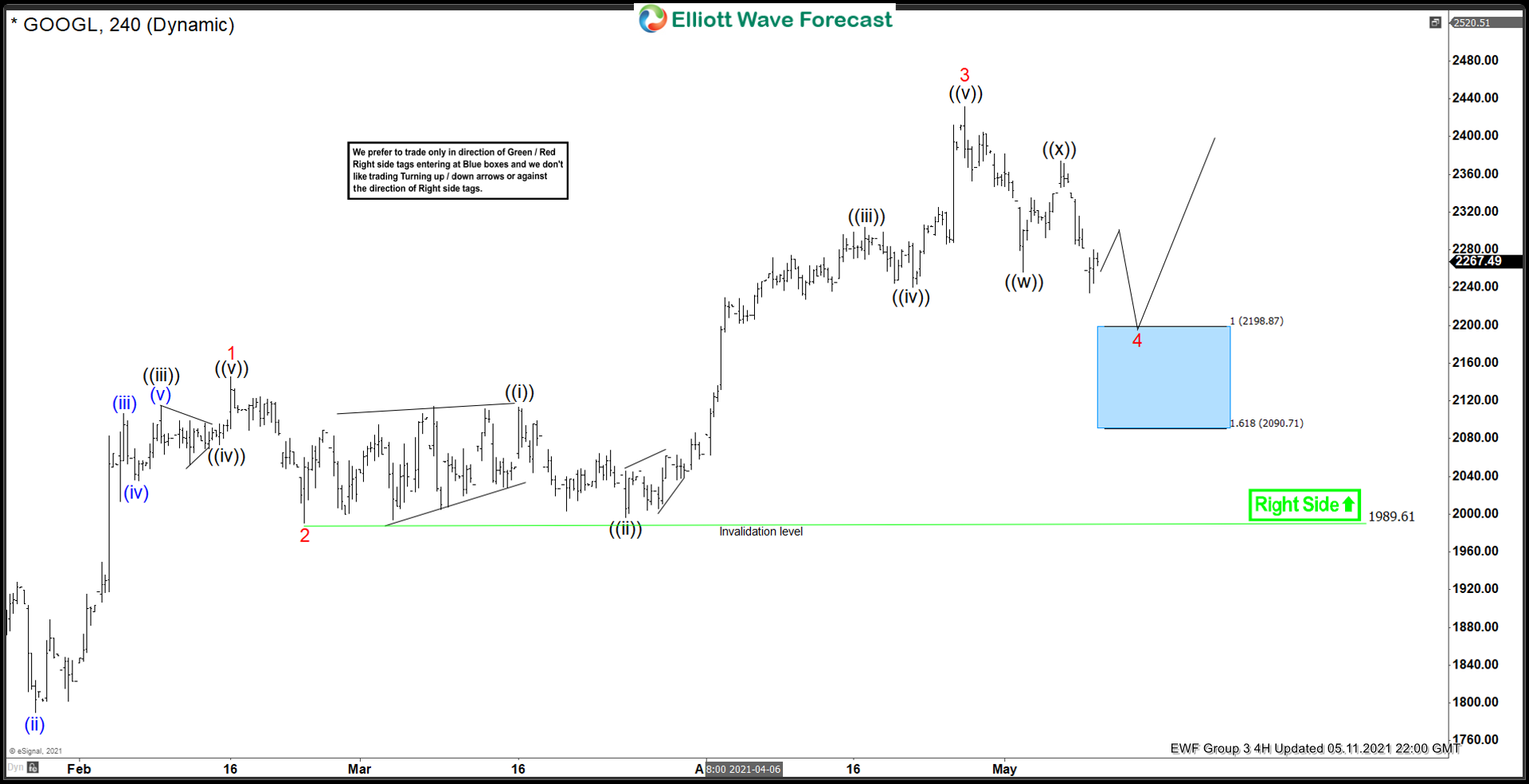

GOOGL Showing Perfect Reaction Higher From Blue Box Area

Read MoreIn this blog, we take a look at the past performance of 4hr Elliott Wave charts of GOOGL, In which our members took advantage of the blue box areas.

-

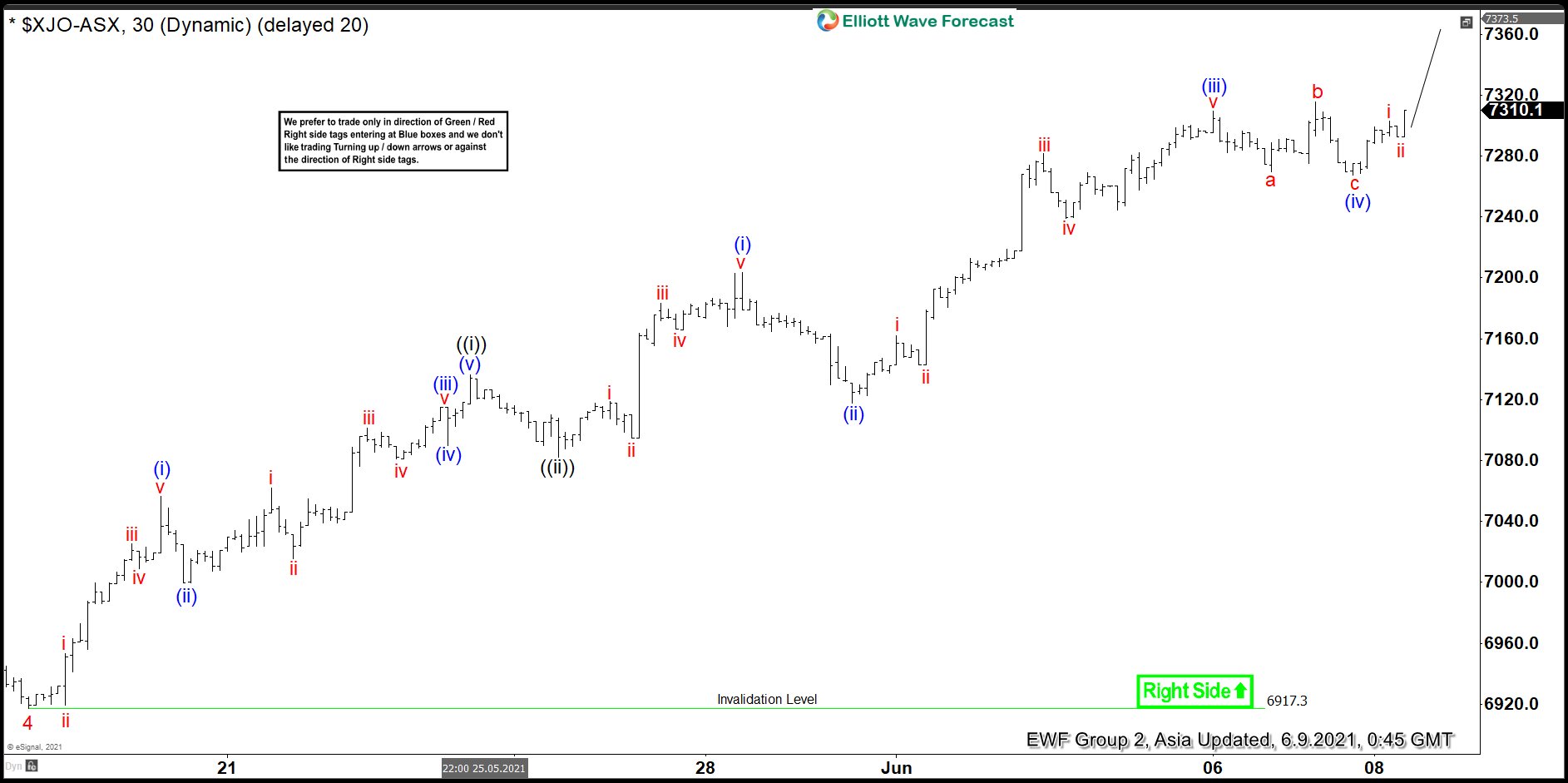

Elliott Wave View: ASX 200 (XJO) Looking to Complete Wave 5

Read MoreASX 200 (XJO) is looking to complete a 5 waves impulse move from February 1, 2021 low. This article and video look at the Elliott Wave path.