The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

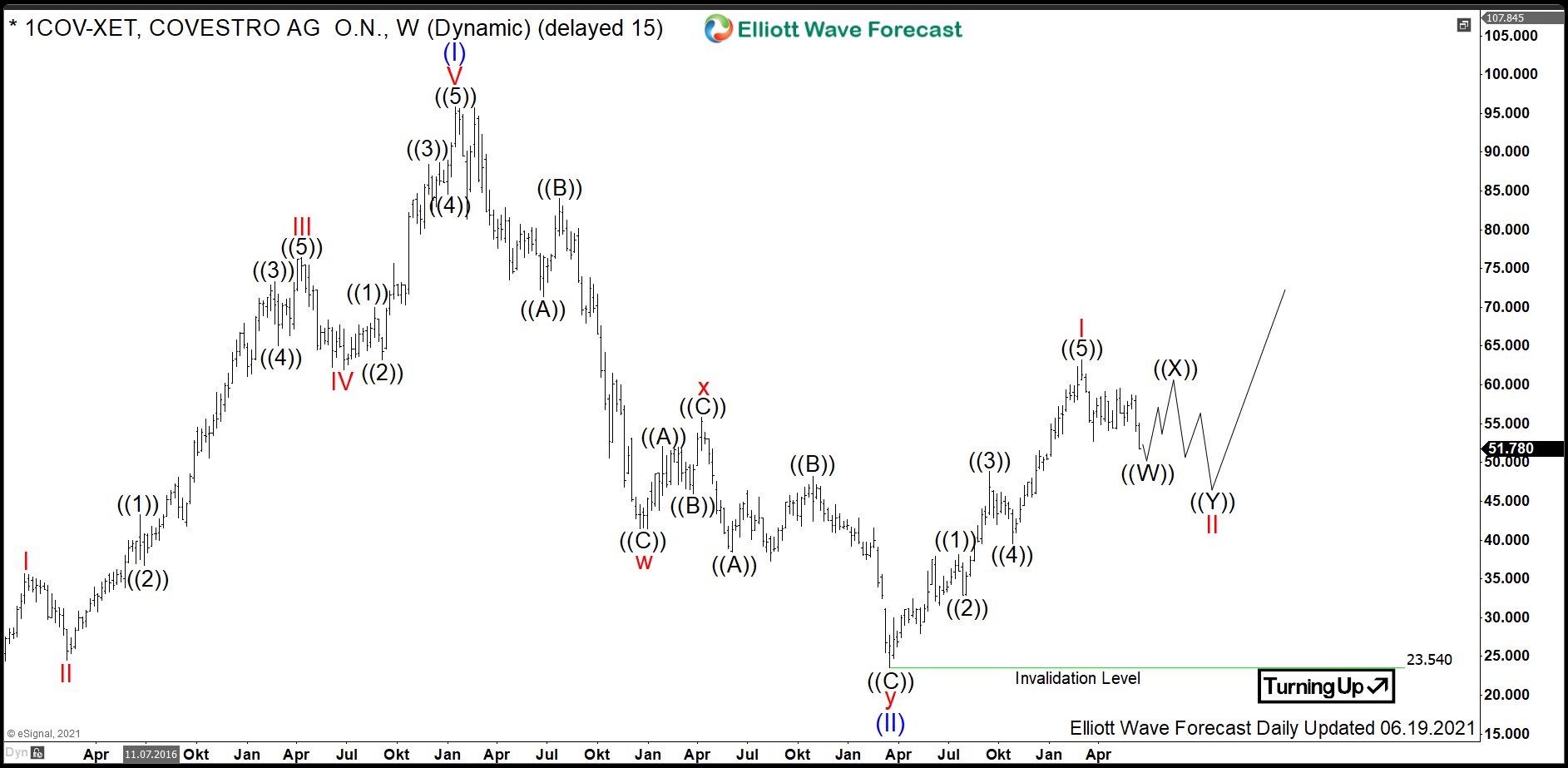

$1COV : Material Science Stock Covestro Offers a Great Opportunity

Read MoreCovestro AG (formerly, Bayer MaterialScience) is a German company which produces a variety of polycarbonate and polyurethane based raw materials. The products include coatings and adhesives, polyurethanes for thermal insulation and electrical housings, polycarbonate based highly impact-resistant plastics (Makrolon) and more. Formed in 2015 as a spin off from Bayer, Covestro is headquartered in Leverkusen, […]

-

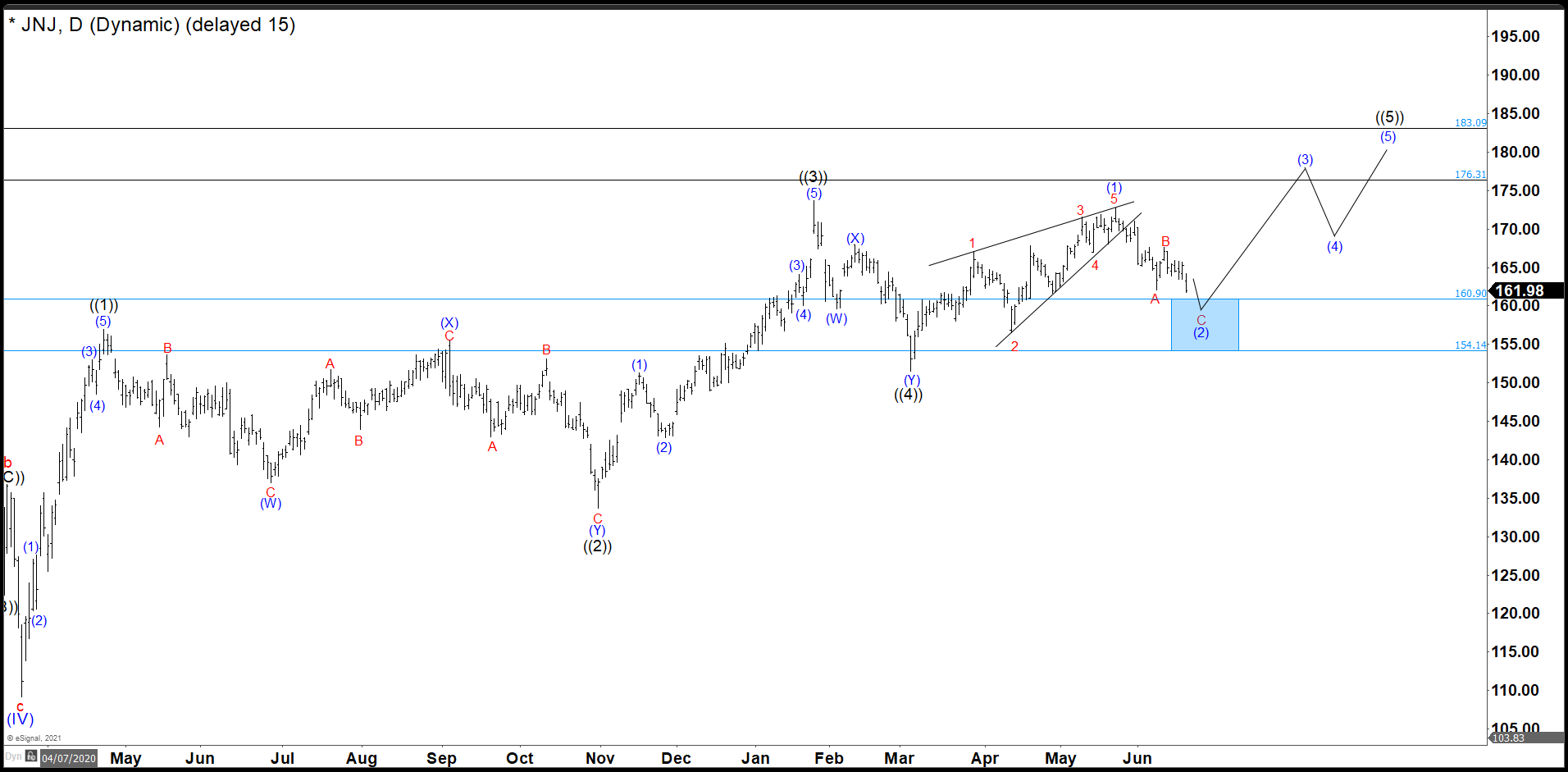

JNJ Is Ending An ABC Correction As Wave (2)

Read MoreSince the crash of March 2020, all stocks have tried to recover what they lost and JNJ was no exception. Johnson & Johnson did not only recover the lost, but It also reached historic highs. Now, we are going to try to build a wedge from the March 2020 lows with a target above $176. […]

-

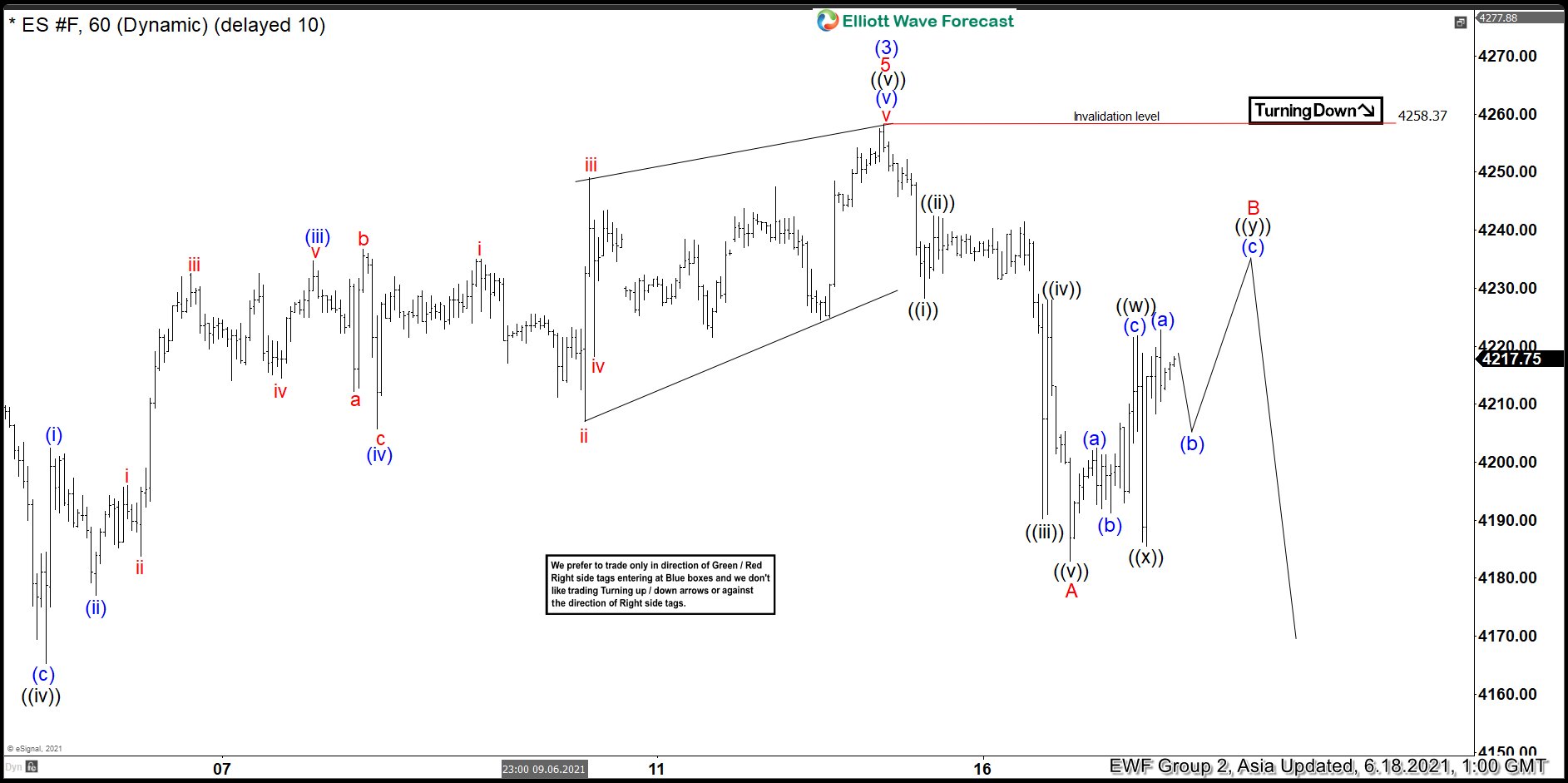

Elliott Wave View: S&P 500 E-Mini Futures (ES) Looking to Pullback

Read MoreS&P 500 E-Mini Futures (ES) is correcting cycle from February low. This article and video look at the Elliott Wave path of the Index.

-

XLV Made New Highs After Ending Flat Correction

Read MoreIn this blog, we take a look at the past performance of 1hr Elliott Wave charts of XLV, In which our members took advantage of the blue box areas.

-

Elliott Wave View: CADJPY Further Correction Lower Likely

Read MoreCADJPY shows 5 waves lower from June 1 peak suggesting further downside likely. This article and video look at the Elliott Wave path.

-

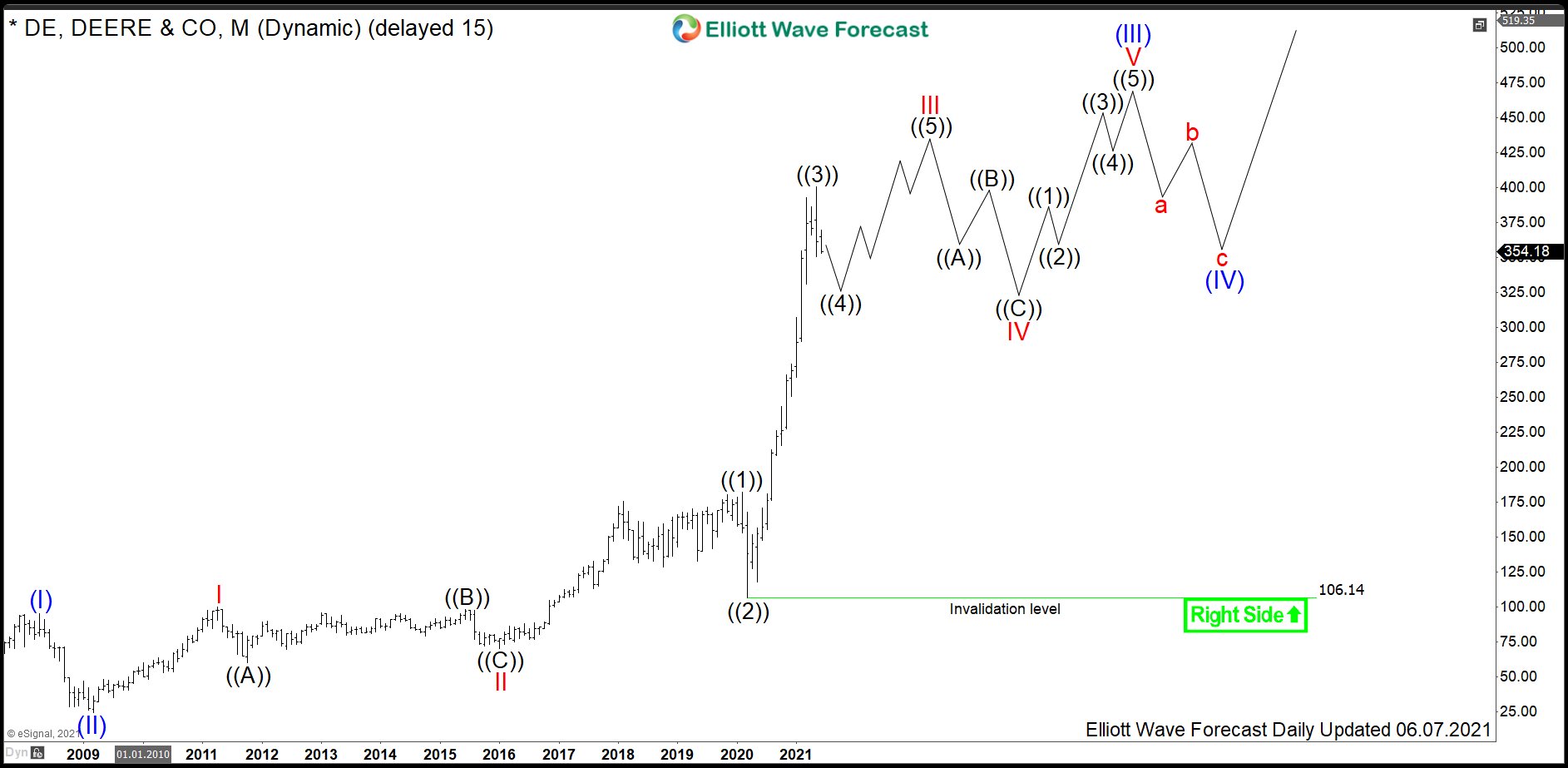

$DE: John Deere Should Continue Showing Strength

Read MoreJohn Deere is an American corporation that manufactures acricultural, construction and forestry machinery, diesel engines and drivertrains. Founded in 1837 and based in Moline, Illinois, USA, the stock being a component of the S&P500 index can be traded under ticker $DE at NYSE. Currently, we can see agriculture commodities like wheat and corn on the […]