The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

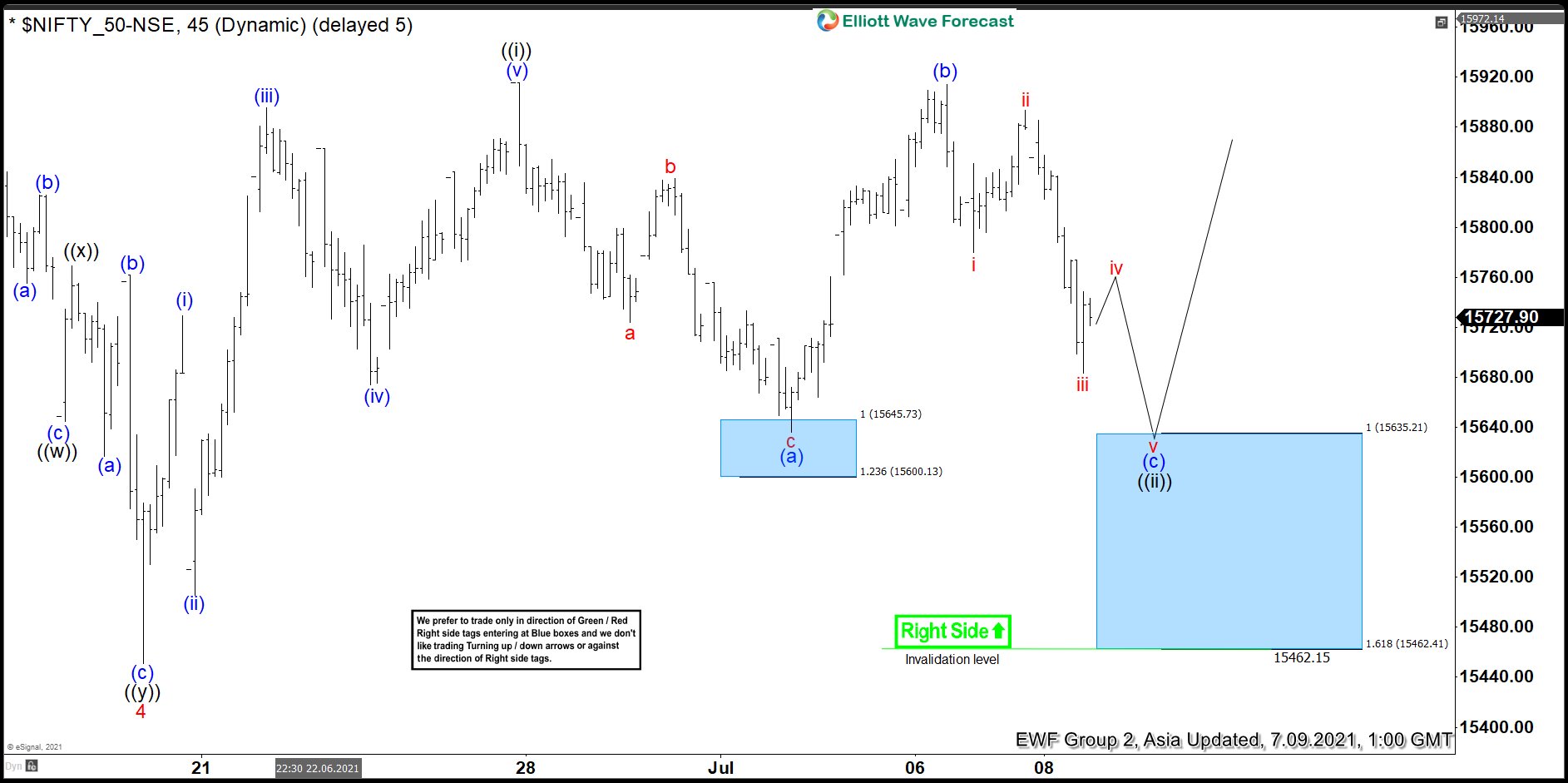

Elliott Wave View: Nifty Approaching Support Area

Read MoreElliott Wave View in Nifty suggests the rally from January 29, 2021 low is unfolding as a 5 waves impulsive Elliott Wave structure. Up from January 29 low, wave 1 ended at 15431.75 and pullback in wave 2 ended at 14151.40. Index resumes higher in wave 3 towards 15901.60 and dips in wave 4 ended […]

-

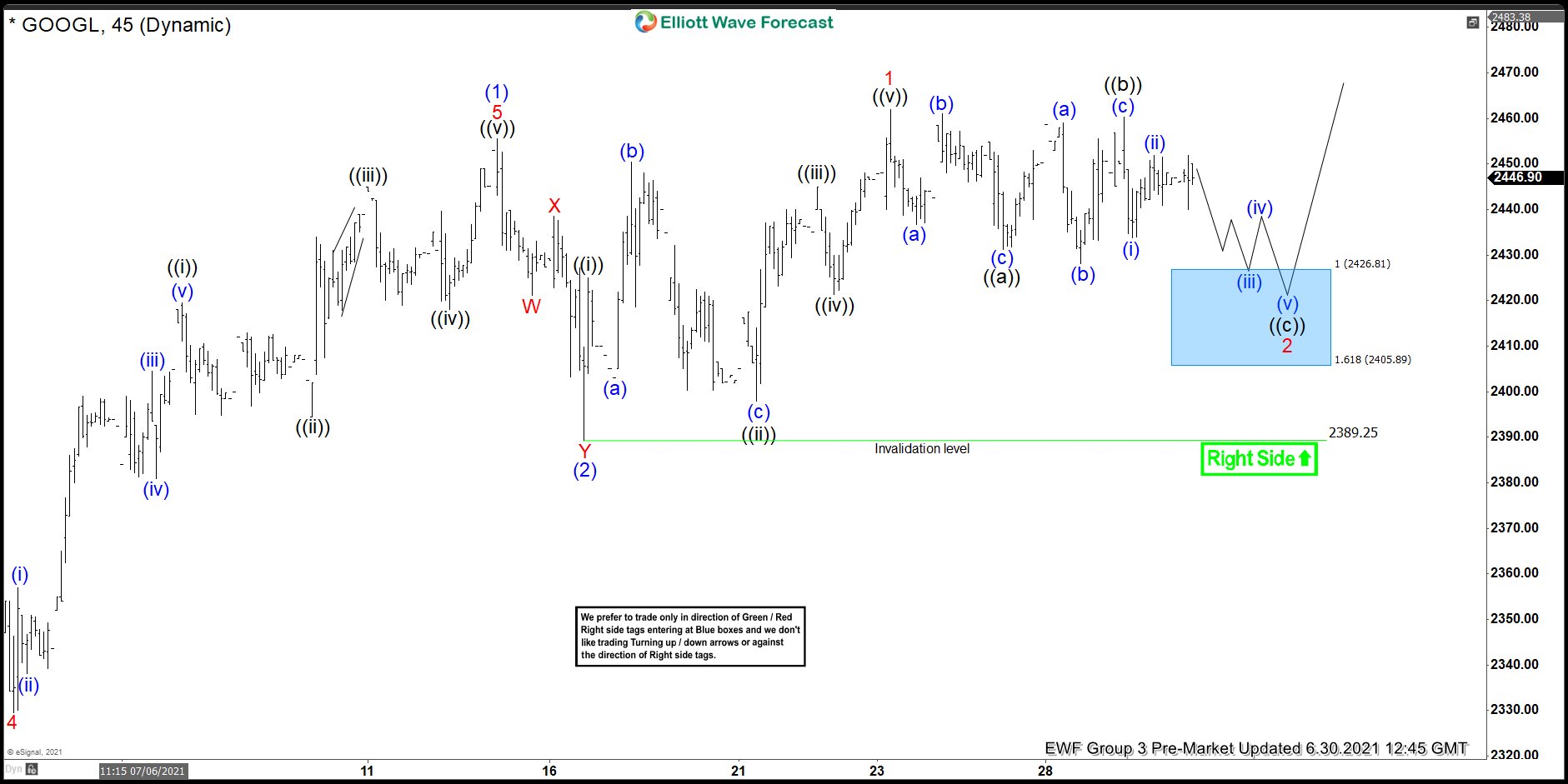

Google Elliott Wave View: Made New Highs From Blue Box Area

Read MoreIn this blog, we take a look at the past performance of 1 hour Elliott Wave chart of Google In which our members took advantage of the blue box areas.

-

Enphase Energy (ENPH) Looking to End 5 Waves Rally

Read MoreEnphase Energy (NASDAQ: ENPH) is a technology company with headquarter in Fremont, California. Enphase designs and manufactures software-driven home energy solutions for the solar industry. It designs, develops, manufactures, and sells home energy solution that connect solar generation, energy storage, and management on one intelligent platform. Over the past 3 years, ENPH increases sales 42.4% on […]

-

Resonant Inc. ($RESN) Bottoming For Higher

Read MoreResonant, like so many other stocks, has enjoyed a large rally off the March 2020 low. However, this stock has already corrected that cycle, and may be ready to move higher. Lets take a look at the company profile: “Resonant (NASDAQ: RESN) is transforming the market for RF front-ends (RFFE) and disrupting the RFFE supply […]

-

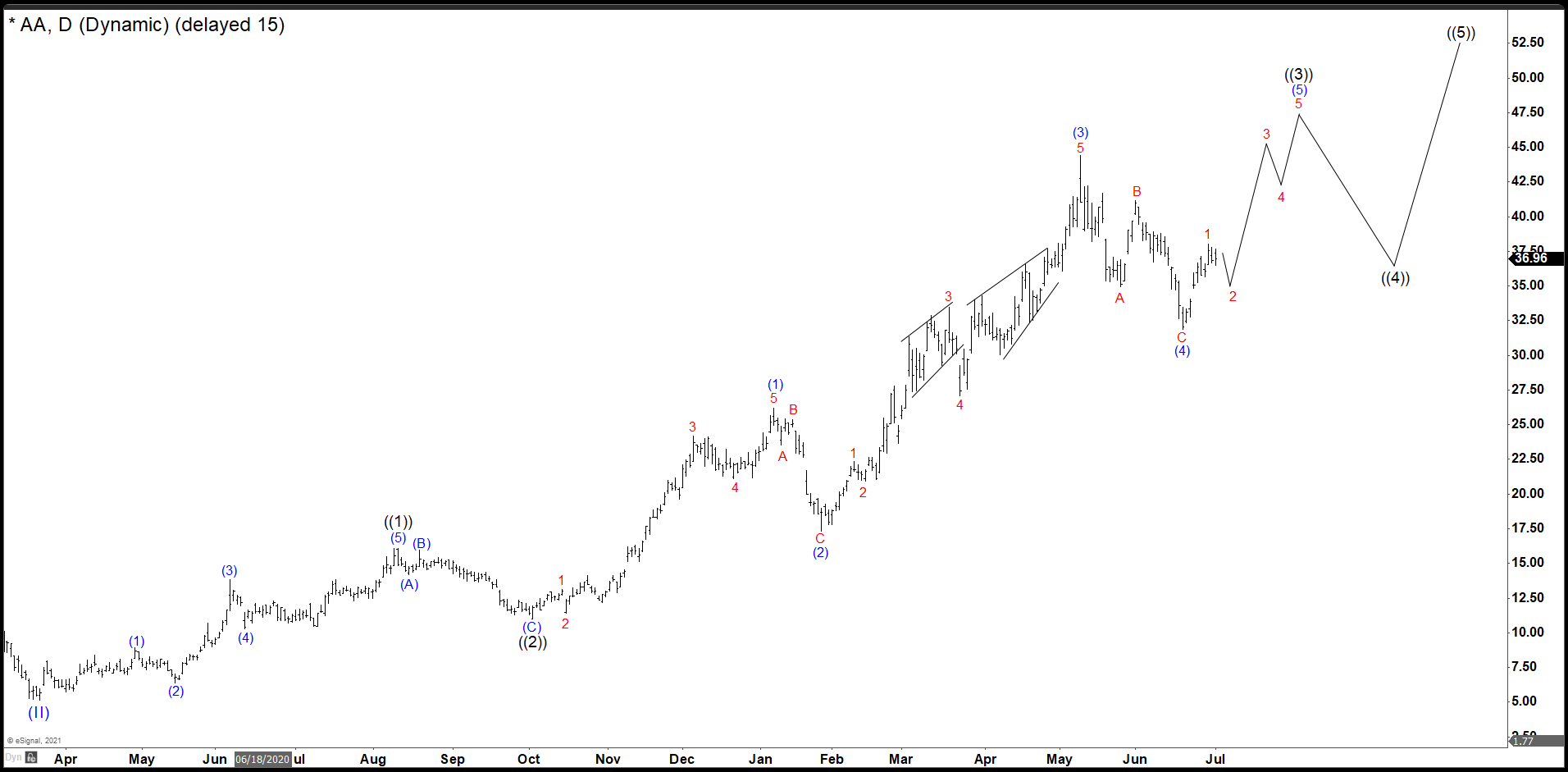

Aluminum Is A Rocket Since March 2020 And Alcoa Knows That

Read MoreSince March 2020 crash, Alcoa (AA) has risen in share value around 800% and with the high prices of the Aluminum it must continue rising its value. Moreover, AA has built an incomplete impulse and it needs to keep the rally to develop the whole structure. We are considering a target above $47.00 dollars in […]

-

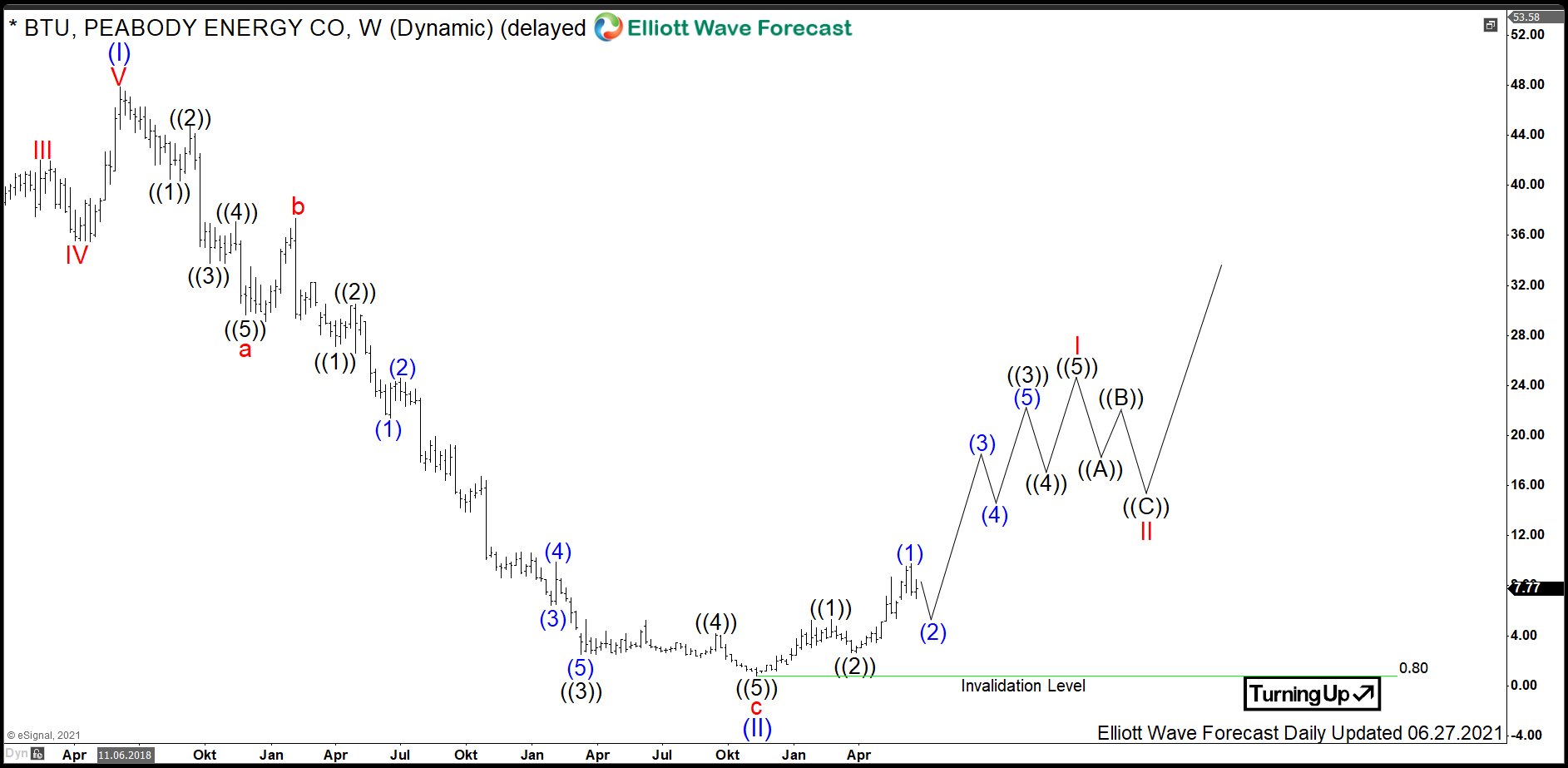

$BTU : Largest Private Coal Producer Peabody Energy Turns Higher

Read MorePeabody Energy, Inc. is the largest private sector coal company in the world. It mines, sales and distributes coal to such major markets like electricity generation and steel making. Founded in 1883, the company has its headquarters in St. Louis, Missouri, USA. Being part of the Russel2000 index, one can trade it under the ticker […]