The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

$ERA : Eramet Shows a High Potential to the Upside

Read MoreEramet is a French multinational mining and metallurgy company. The company produces non-ferrous metals and derivatives, nickel alloys and superalloys, as well as high-performance special steels. Founded in 1880 with the funding of the Rothschild family and headquartered in Paris, today, the company is largely owned by Duval family and the French state. Eramet is […]

-

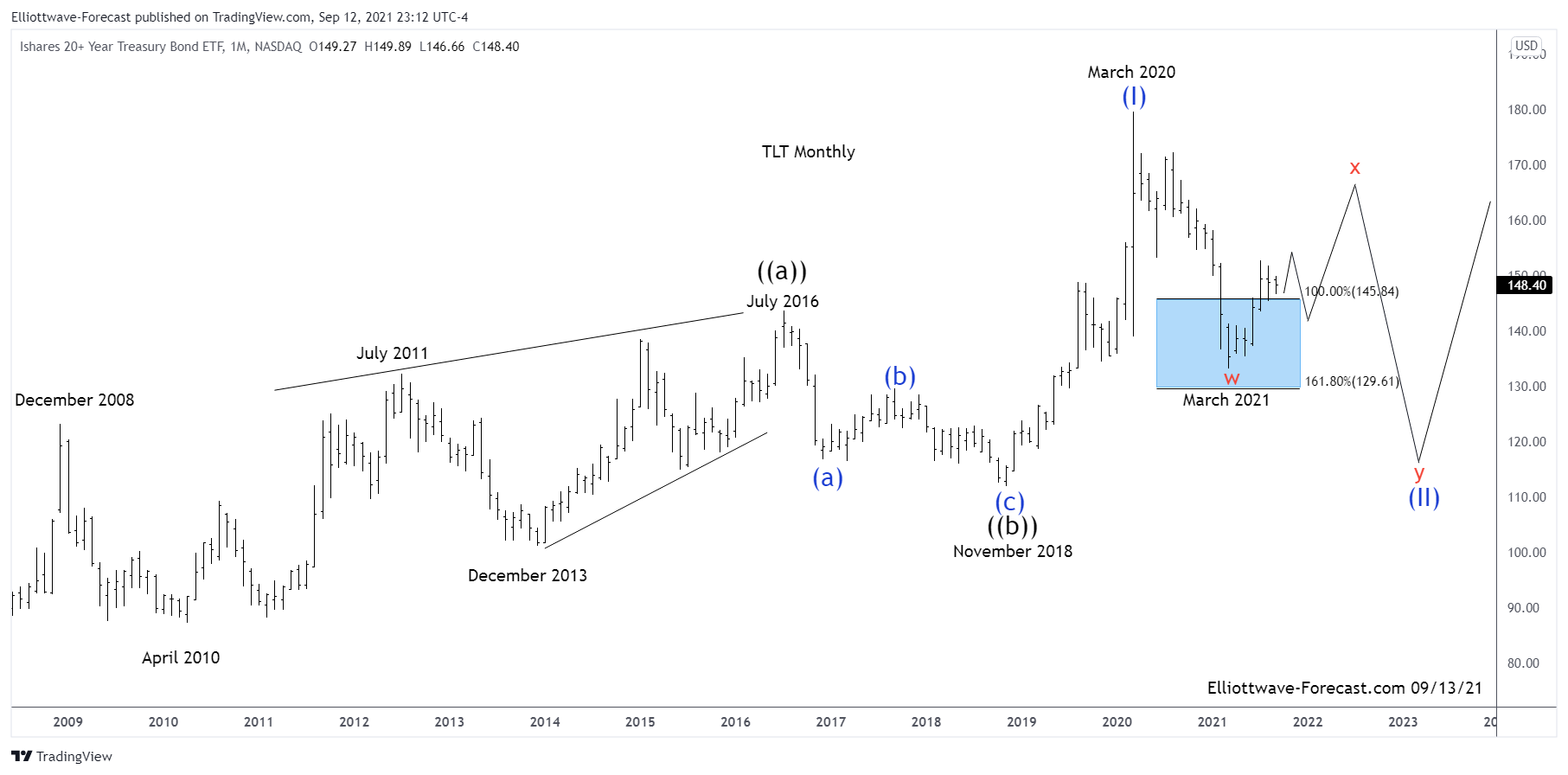

$TLT Can Bounce Further to Correct a Cycle From the March 2020 Highs

Read More$TLT Can Bounce Further to Correct a Cycle From the March 2020 Highs Firstly the ETF fund TLT inception date was on July 22, 2002. This instrument seeks to track the investment results of an index composed of or in U.S. Treasury bonds with maturities twenty years or more remaining. There is a lack of data before July […]

-

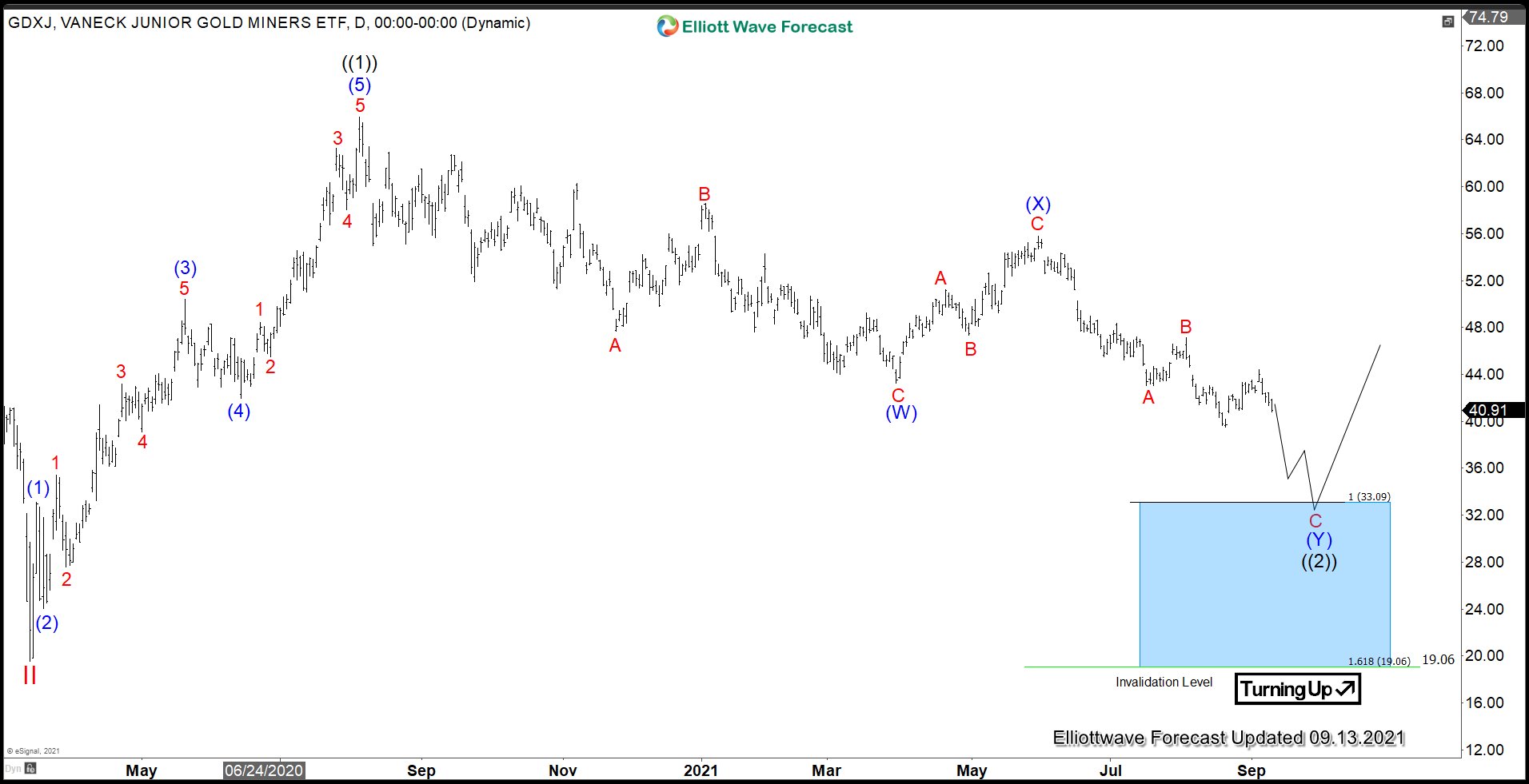

Potential Support and Turn Higher in GDXJ

Read MoreGold and related Index such as Gold Miners Junior (GDXJ) have been in steady decline / sideways in the past 14 months. GDXJ in particular continues to correct lower after forming the high at 65.95 on August 2020. In this article, we will take a look at the potential support area for the ETF. We […]

-

Alcoa Hit Our Minimum Target. Possible Ending Diagonal In Progress

Read MoreSince March 2020 crash, Alcoa (AA) has risen in share value around 800% and with the high prices of the Aluminum it must continue rising its value. Besides, AA has built an incomplete impulse and it needs to keep the rally to develop the whole structure. We are considering a target above $47.00 dollars in […]

-

P&G Is Developing An Impulse To Complete Wave ((3)) of III

Read MoreSince the crash of March 2020, all stocks have tried to recover what they lost and P&G was no exception. P&G did not only recover the lost, but It also reached historic highs. Now, we are going to try to build an impulse from wave II with a first target to $154.00 next $167.50 and […]

-

Berkshire Hathaway Is Developing Wave (5) To Complete Wave ((3))

Read MoreAll stocks tried to recover what they lost and Berkshire Hathaway was not exception since the crash of March 2020. BRK.B did not only recover the lost, but It also reached historic highs. Now, it is building an impulse from March 2020 lows and we are going to follow to determinate the best area to […]