The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Google Buying The Dip At Blue Box Area

Read MoreIn this technical blog, we will look at the past performance of 4 hour Elliott Wave Charts of Google stock ticker symbol: $GOOGL. In which, the rally from 23 March 2020 low unfolded as an impulse structure with an extended wave three. Therefore, we knew that the structure in GOOGL is incomplete to the upside & another […]

-

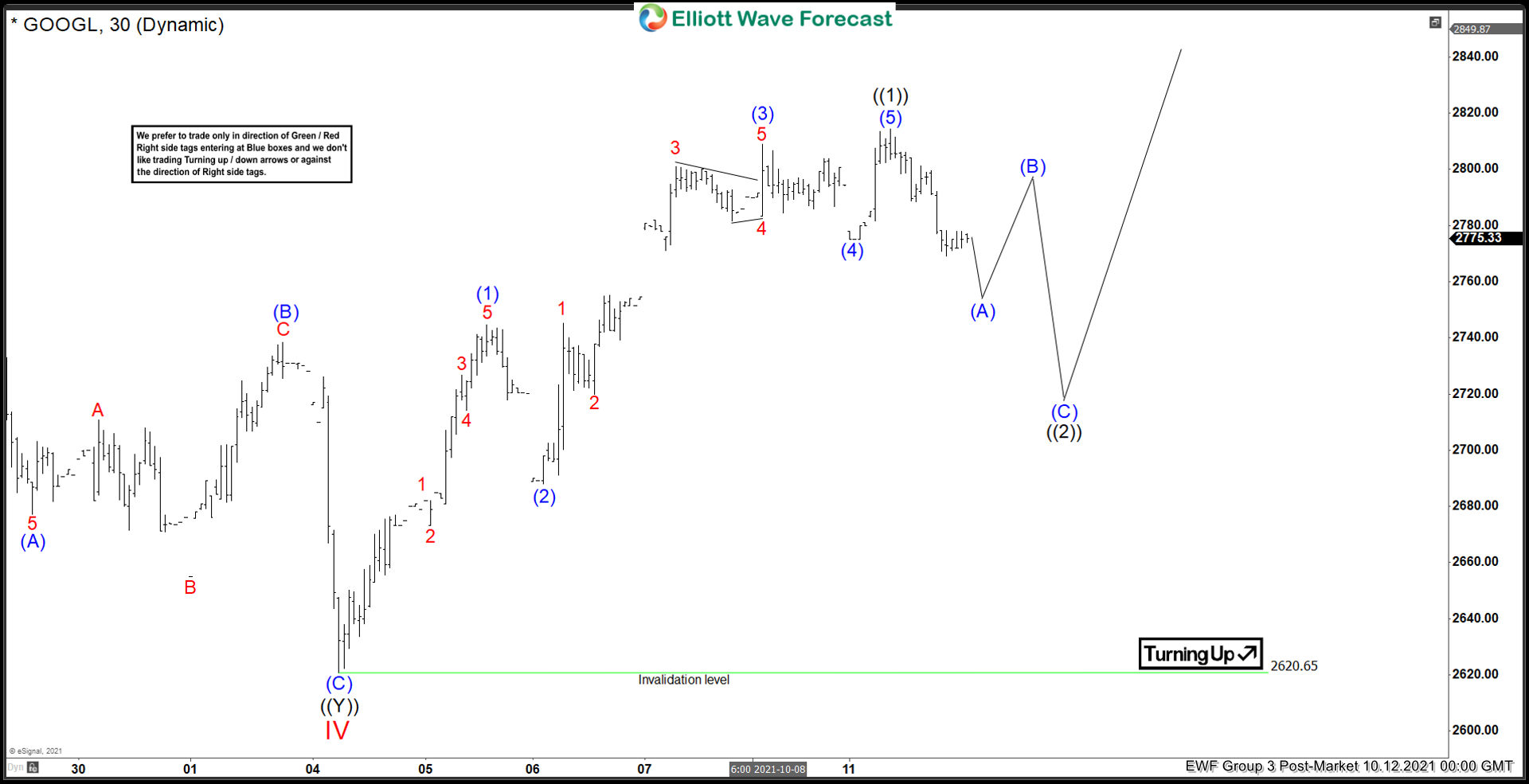

Elliott Wave View: Alphabet (GOOGL) Pullback Should Find Support

Read MoreAlphabet (GOOGL) Shows 5 waves rally from October 4 low, favoring more upside. This article and video look at the Elliotwave path.

-

Best Pharmaceutical Stocks to Buy in 2024

Read MoreThe world around us needs pharmaceuticals to survive and function on a normal basis. The pharmaceutical industry is part of the wider healthcare sector, and these companies are active all year round, no matter the global situation. The global pharmaceutical market has experienced significant growth in recent years. As of end-2020, the total global pharmaceutical […]

-

Bit Digital ($BTBT) Priming a wave 3 breakout

Read MoreThe last time I analyzed Bit Digital was in August 2021 (article can be read here). At the time, I had called the low in Red II, and was looking for an impulsive leg up to take place. Bit Digital is one of the worlds largest bitcoin miners. Before moving their operations to North America, […]

-

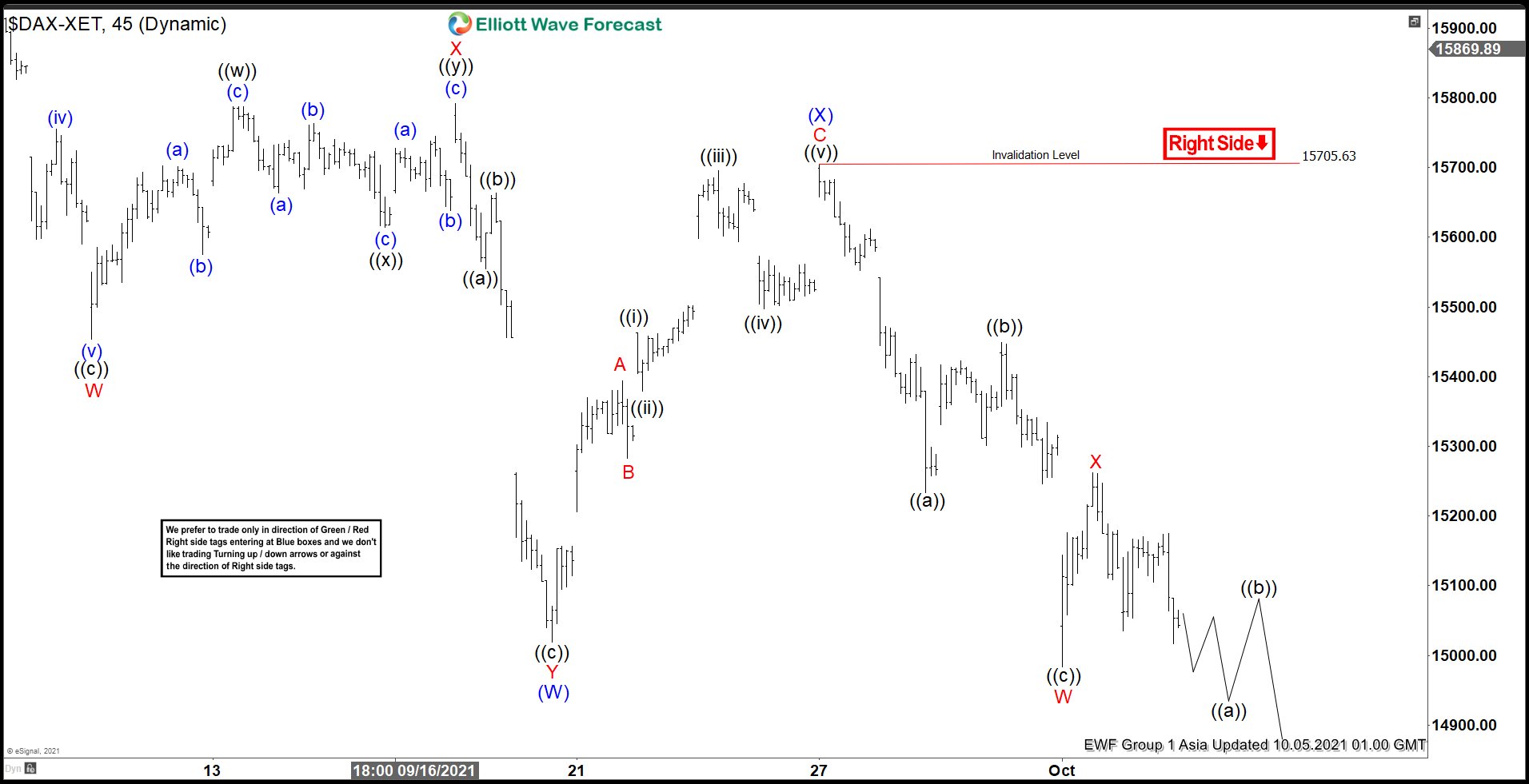

Elliott Wave View: DAX Rally Should Fail

Read MoreDAX shows bearish sequence from August 13, 2021 peak favoring more downside. This article and video look at the Elliott Wave path.

-

Disney Ended A Cycle And A Double Three Is In Play

Read MoreSince the crash of March 2020, all stocks have tried to recover what they lost, and Disney was no exception. Disney did not only recover the lost, but It also reached historic highs. Now, we are going to try to build an impulse from the March 2020 lows with a target around $230. Target measured […]