The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Swiss Market Index (SMI) Has Ended Wave ((4)) Looking Last Push Higher

Read MoreThe Swiss Market Index (SMI) is one of the other Capital Markets worldwide that is building motive wave from the lows of March 2020. We can clearly see that it has already completed 3 waves to the upside and we are correcting on wave 4 now. SMI Old Daily Chart Chart from September 16th, Wave […]

-

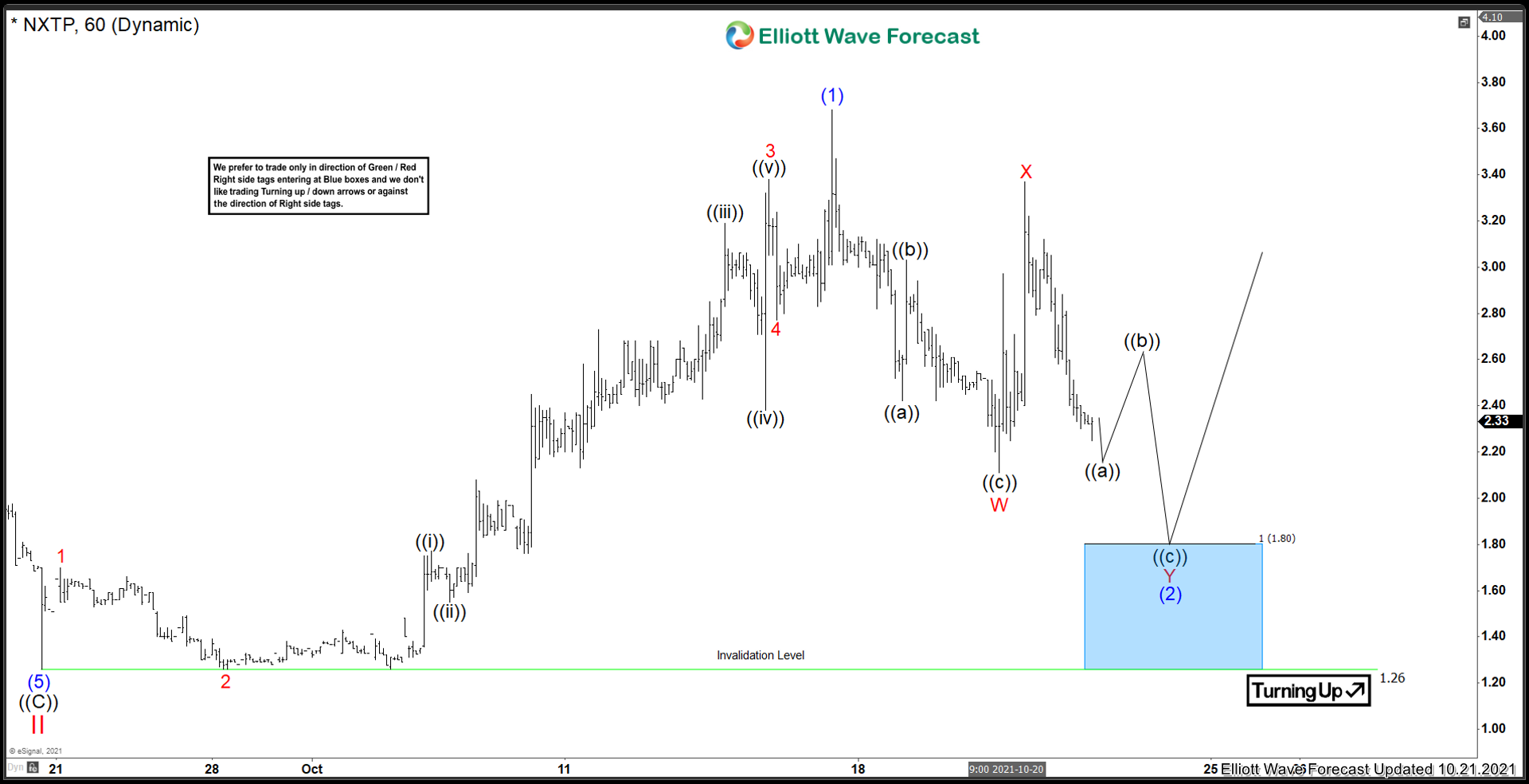

Nextplay Technologies Inc ($NXTP) Priming To Move Higher

Read MoreThere is no shortage of Meme stocks these days to trade. Zac Morris is a trader who has a large following on Twitter. Lately, his stock picks have had the “wall street bets” effect where retail floods in to create large surges in price. I decided to take a look at his latest pick, Nextplay […]

-

Elliott Wave View: Technology ETF (XLK) Looking to Break to New High

Read MoreXLK cycle from October 5 low is in progress as an impulse looking for more upside. This article and video look at the Elliott Wave path.

-

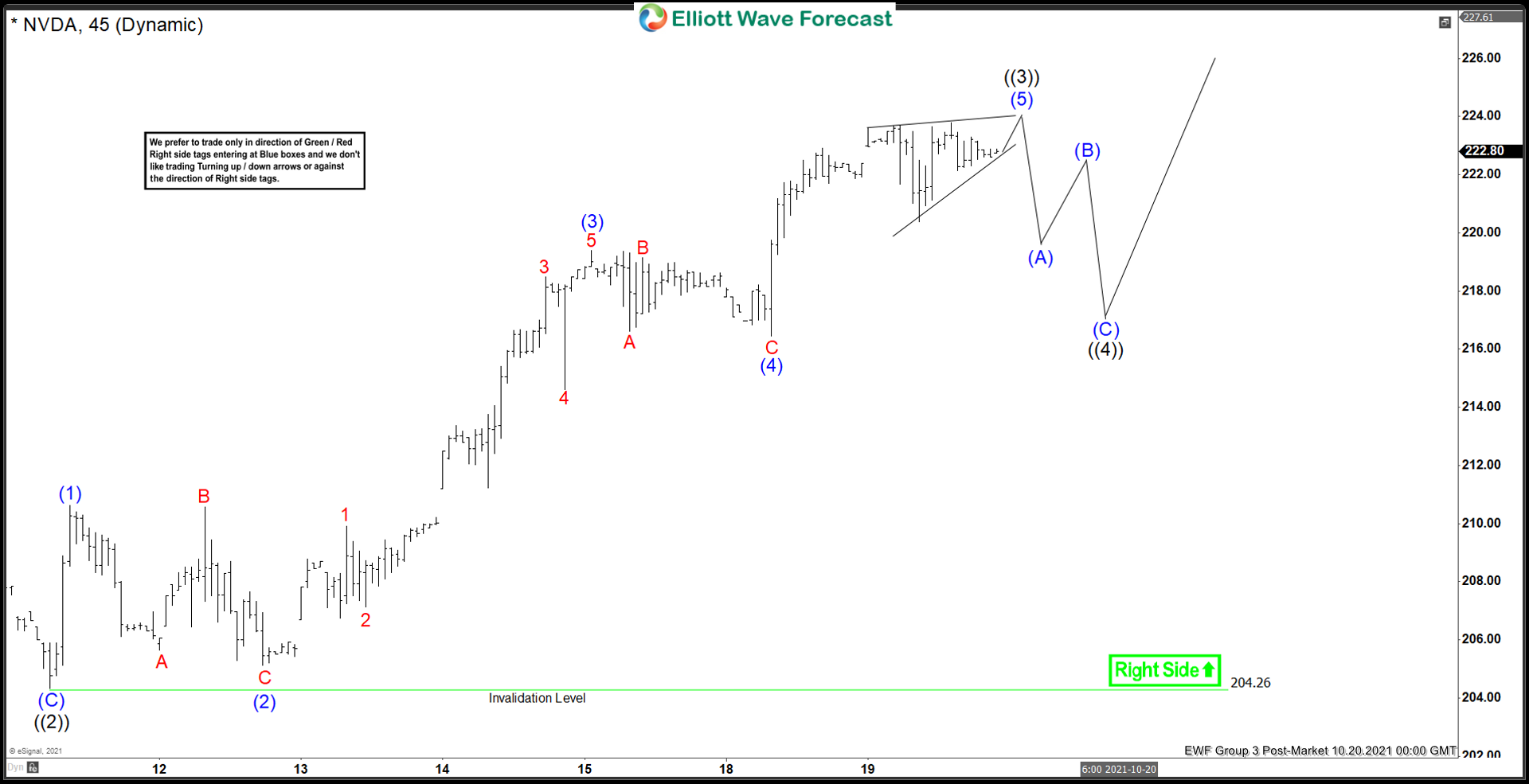

Elliott Wave View: Bullish Move in Nvidia (NVDA) Should Extend

Read MoreNvidia (NVDA) cycle from October 5 low remains in progress as impulse favoring more upside. This article and video look at the Elliott Wave path.

-

Elliott Wave View: OLN Expect Short Term Upside

Read MoreOlin Corporation ( OLN ) manufactures & distributes Chemical products in the US, Europe & other countries. OLN is based in Clayton, Missouri. It trades under OLN ticker at NYSE. It comes under the Basic Materials sector as Specialty Chemicals industry. OLN – Elliott wave view from March-2020 low: In daily, OLN started a higher […]

-

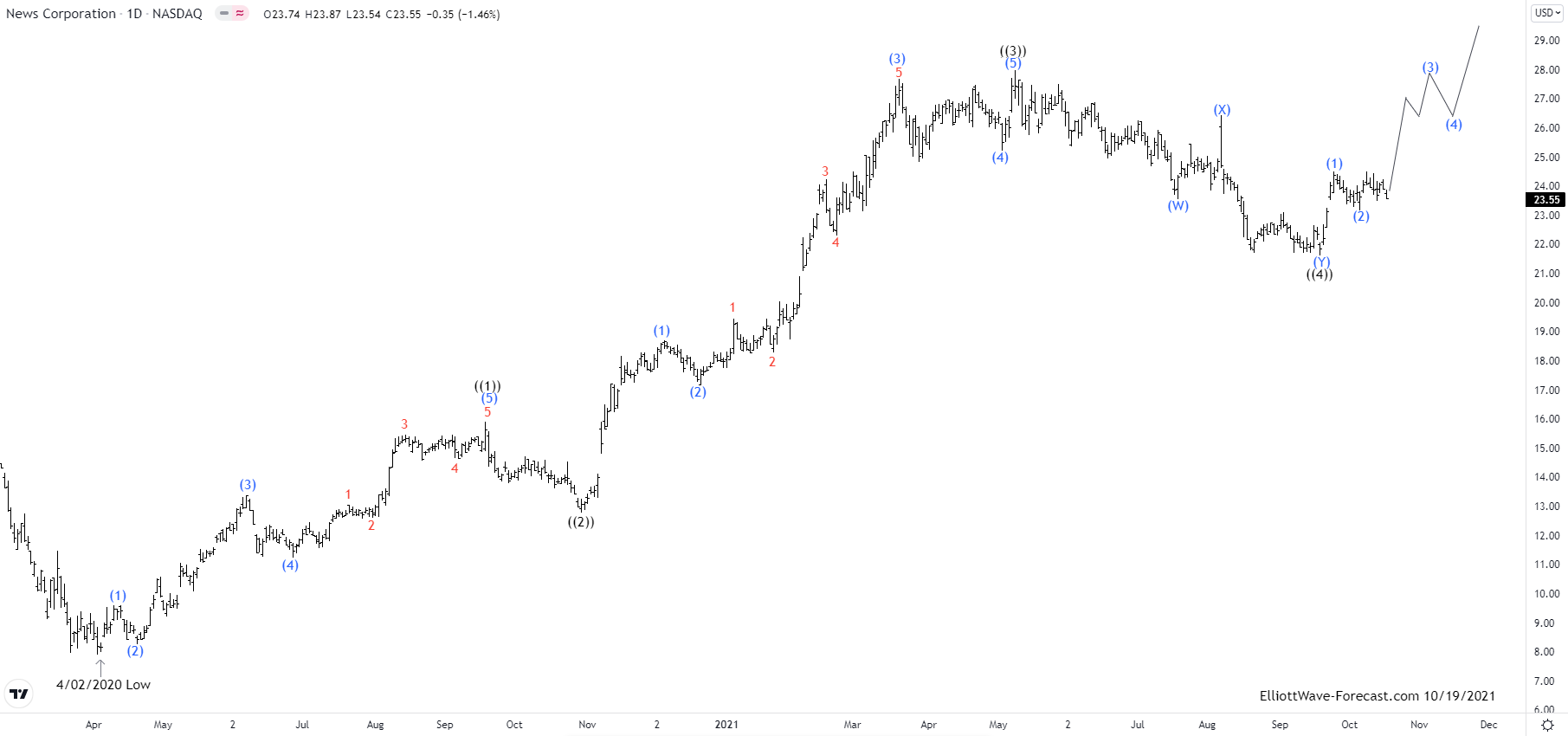

Elliott Wave View: NWSA Pullback should supported

Read MoreNews Corporation ( NWSA ) is a Media & Information Services company focuses on creating & distributing content worldwide. It operates in different segments like Digital estate services, subscription based video services, Dow Jones services, book publishing, news media & others. It trades under NWSA ticker at Nasdaq. NWSA Daily Elliott Wave View from April-2020 […]