The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

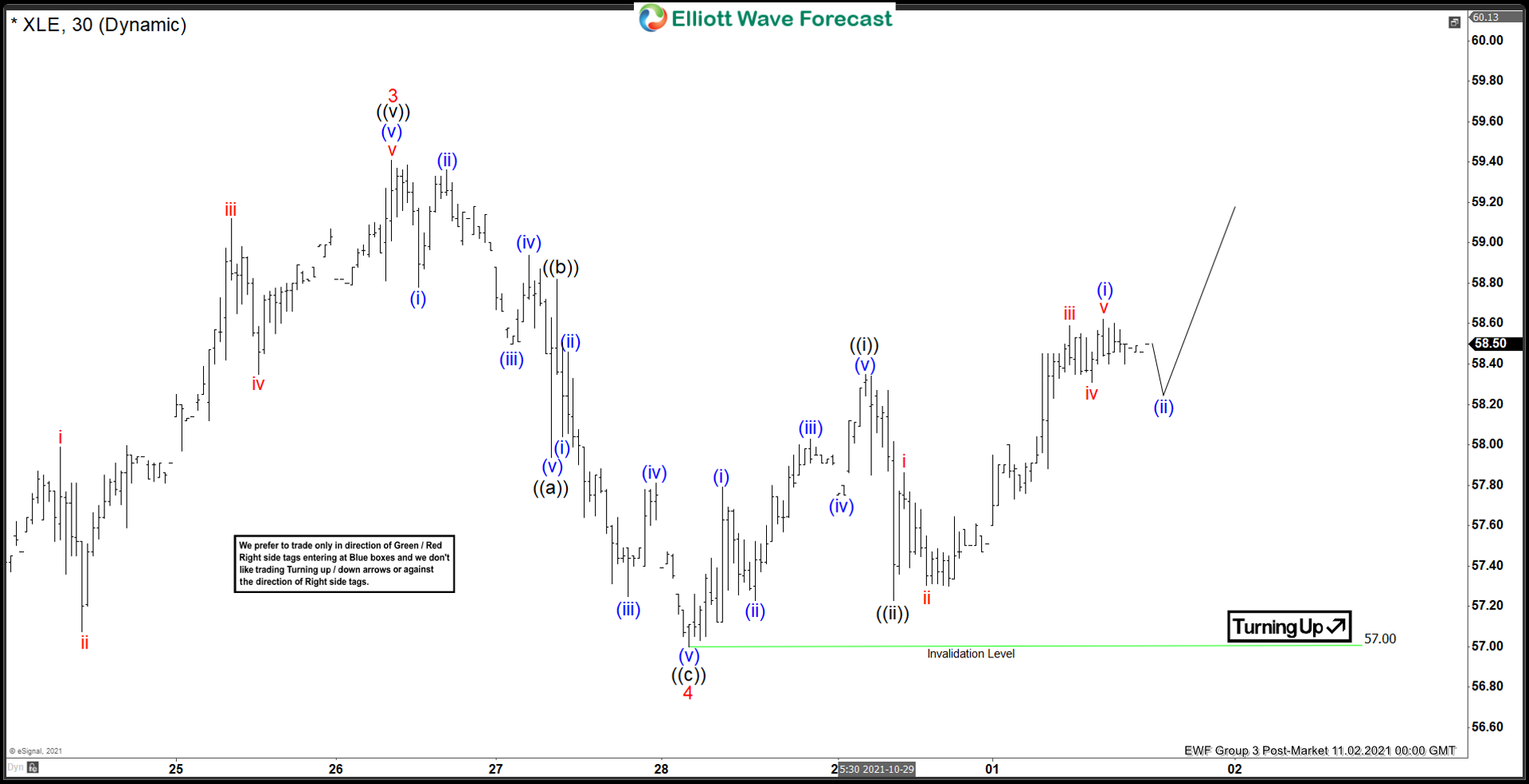

Elliott Wave View: Energy ETF (XLE) Wave 5 In Progress

Read MoreEnergy ETF (XLE) shows Impulsive structure from August 2021 low and looking for more upside. This article and video look at the Elliott Wave path.

-

Elliott Wave View: FNKO Should Extend Lower

Read MoreFunko, Inc. ( FNKO ) is a pop culture consumer products company, which designs, sources & distributes the licensed products across the globe. It trades under FNKO ticker at Nasdaq. Since 2017 in daily, FNKO made all time low at $3.12 during sell off across the global markets in early last year. Thereafter it started […]

-

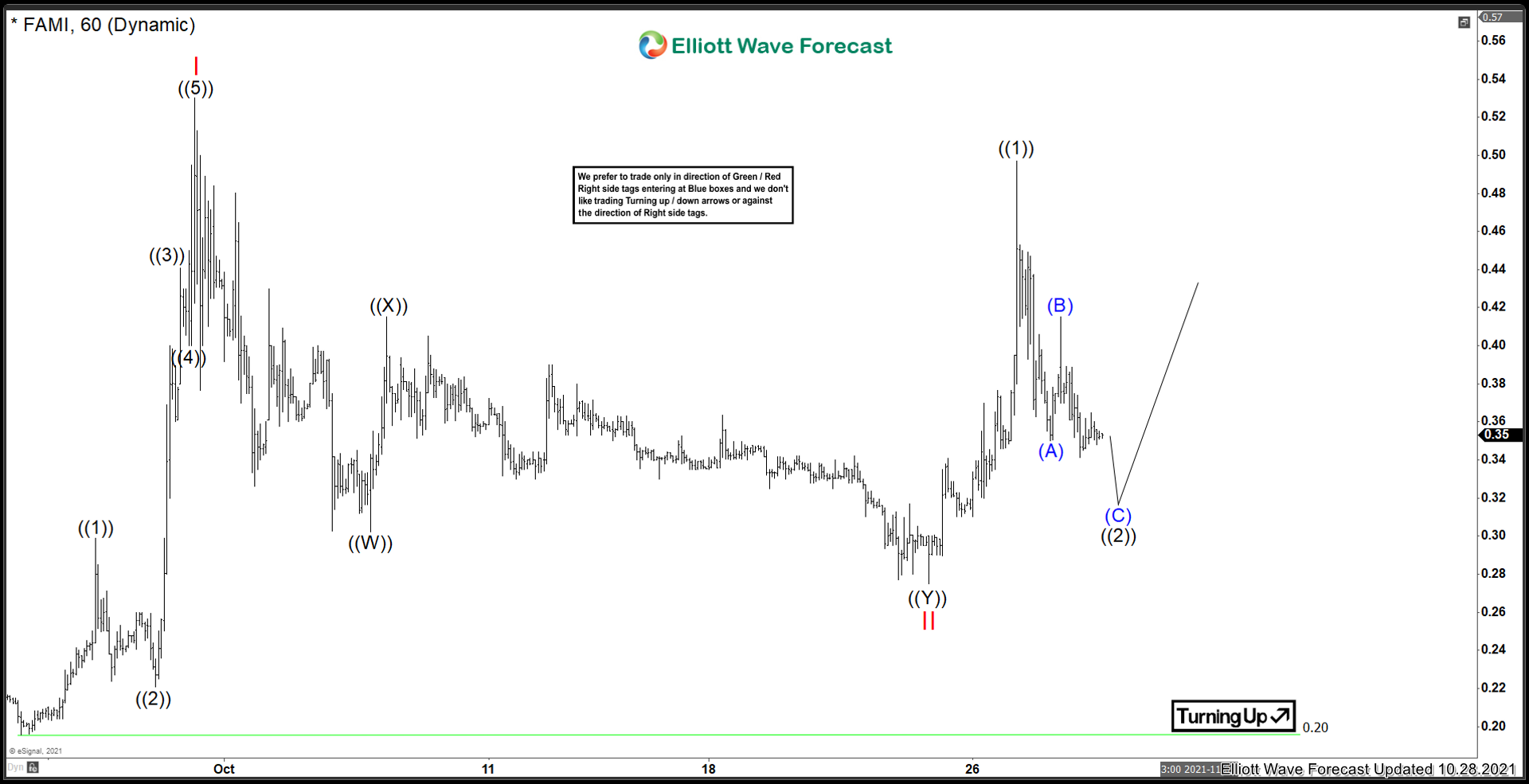

Farmmi ($FAMI) Will Bulls Take Control?

Read MoreContinuing along the meme stock theme, next up is the Farmmi company. This company is little known until recently, when massive volume started to take place. It caught the eye of the reddit community and another meme stock was born. Lets take a look at what the company does: “Farmmi is a company that processes […]

-

Best Long Term Stocks to Invest in 2024

Read MoreEver since the financial crisis of 2008 and the Great Recession, there has been a lot of focus on the long-term investment approach. Also, long-term investments have been beneficial for traders around the world. The Global Top 10 companies include the companies Apple and Amazon, which are companies that started small and have grown over […]

-

Elliott Wave View: FTSE in wave 4 Pullback

Read MoreFTSE rally from September 20 is unfolding as an impulse and can see further upside. This article and video look at the Elliott Wave path.

-

Best Gold Stocks to Invest in 2024

Read MoreGold has always been a valuable commodity and a good investment. By investing in gold investors can hedge against inflation and deflation, both. Also, gold is an excellent way to diversify your portfolio. Gold has maintained its value in every decade. Hence, it’s considered a safe form of investment as compared to currency and other […]