The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Zoom ($ZM) Playing Out As Expected

Read MoreThe last time I looked at this name was in June 2021. You can view this article here. At the time, I was expecting another swing down to take place in a larger wave II correction. Lets take a look at the chart from June. Zoom Elliottwave June 2021 View: At the time, the structure was […]

-

Switzerland Index (SMI) Have Completed An Important Market Cycle.

Read MoreThe Swiss Market Index (SMI) is one of the other Capital Markets worldwide that is building motive wave from the lows of March 2020. We can clearly see that it has already completed 3 waves to the upside and we are correcting on wave 4 now. SMI September 16th Daily Chart Wave ((1)) ends at […]

-

SOXX Near To Complete A Market Cycle From December 2018

Read MoreSOXX is semiconductor ETF to provide concentrated exposure to the 30 largest US-listed semiconductor companies. This includes (i) manufacturers of materials with semiconductors that are used in electronic applications or in LED and OLED technology and (ii) providers of services or equipment associated with semiconductors. SOXX Daily Chart The market cycle began on December 2018 […]

-

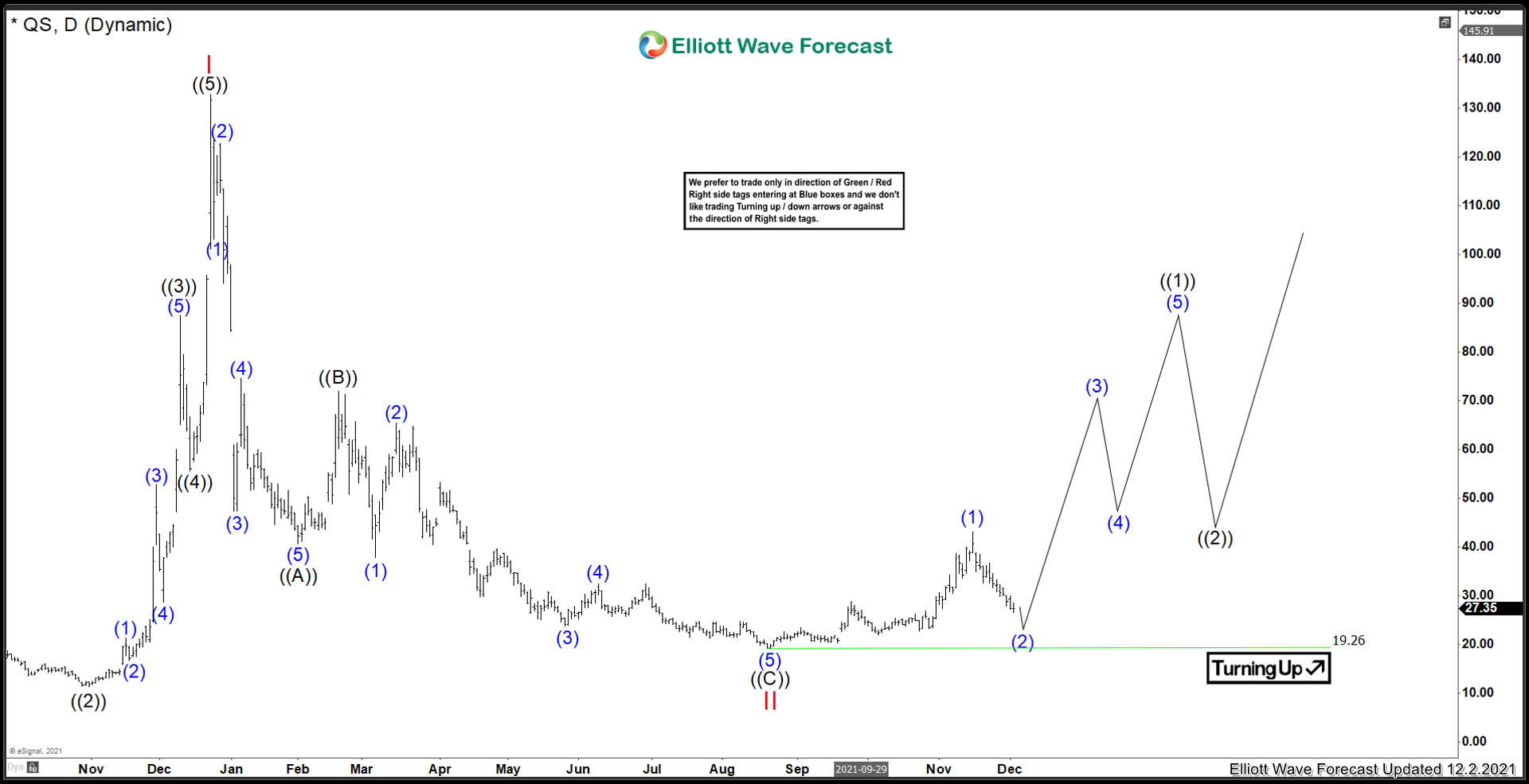

QuantumScape ($QS) finally ready to rally?

Read MoreThe last time I looked at this chart was spring of 2021, in April. At the time, I was looking for continued downside to take place before resuming higher. You can view this article here. What happened after I analyzed this chart? Pretty much as expected. Lets take a look at the view back in […]

-

Elliott Wave View: S&P 500 (SPX) Correcting Larger Degree

Read MoreSPX ended cycle from March 2020 and correcting that cycle in larger degree 3, 7, 11 swing. This article and video look at the Elliott Wave path.

-

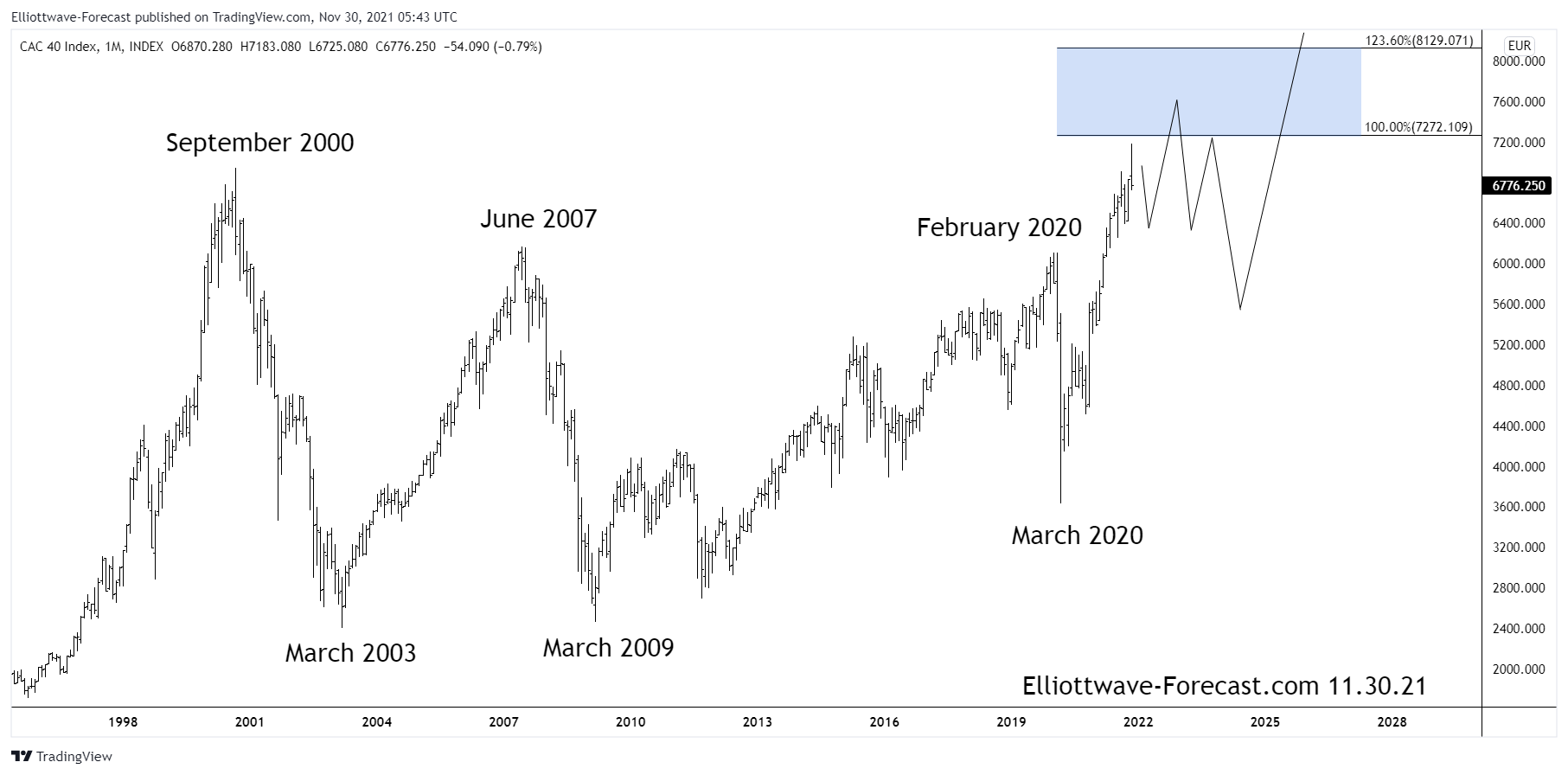

$CAC40 Index Longer Term Swings & Bullish Cycles

Read More$CAC40 Index Longer Term Swings & Bullish Cycles Firstly the CAC 40 index has been trending higher with other world indices where in September 2000 it put in an all time high. From there it followed the rest of the world indices lower into the March 2003 lows which was a larger degree pullback. From […]