The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

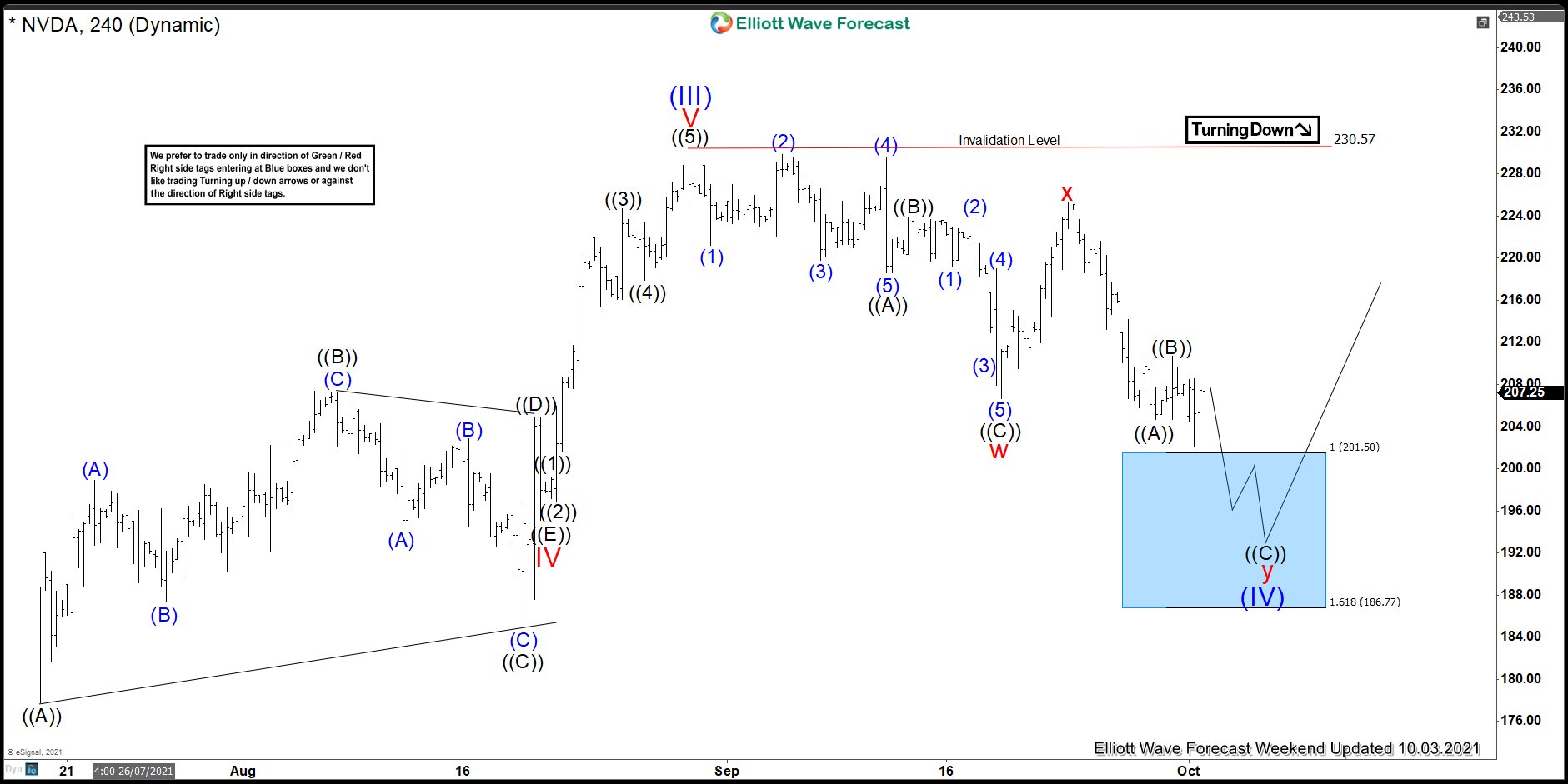

NVDA Made New All-Time Highs From Blue Box Area

Read MoreIn this blog, we take a look at the past performance of NVDA 4hr charts. In which, the stock made new all-time highs from the blue box area.

-

Elliott Wave View: FTSE Extending in Wave 5

Read MoreFTSE rally from September 20 low is in progress as an impulse. This article and video look at the Elliott Wave path of the Index.

-

MicroStrategy ($MSTR) Continues to move higher

Read MoreThe last time I charted this name was back in the summer of 2021 (article can be viewed here). At the time, the price of the stock was 646.00. I was looking for some continuation higher against the low set in May 2021. Firstly, in short summary, MSTR is a large holder of bitcoin, essentially […]

-

Elliott Wave View: GATO Should Extend Higher

Read MoreGatos Silver, Inc (GATO) engages in the exploration, development & production of the precious metals. It primarily explores the Silver Ores including Zinc, Lead, Copper & Gold Ores. It’s flagship asses is the Cerro Los Gatos mine located at the Los Gatos District in Chihuahua state, Mexico. It comes under Basic Materials sector & trades […]

-

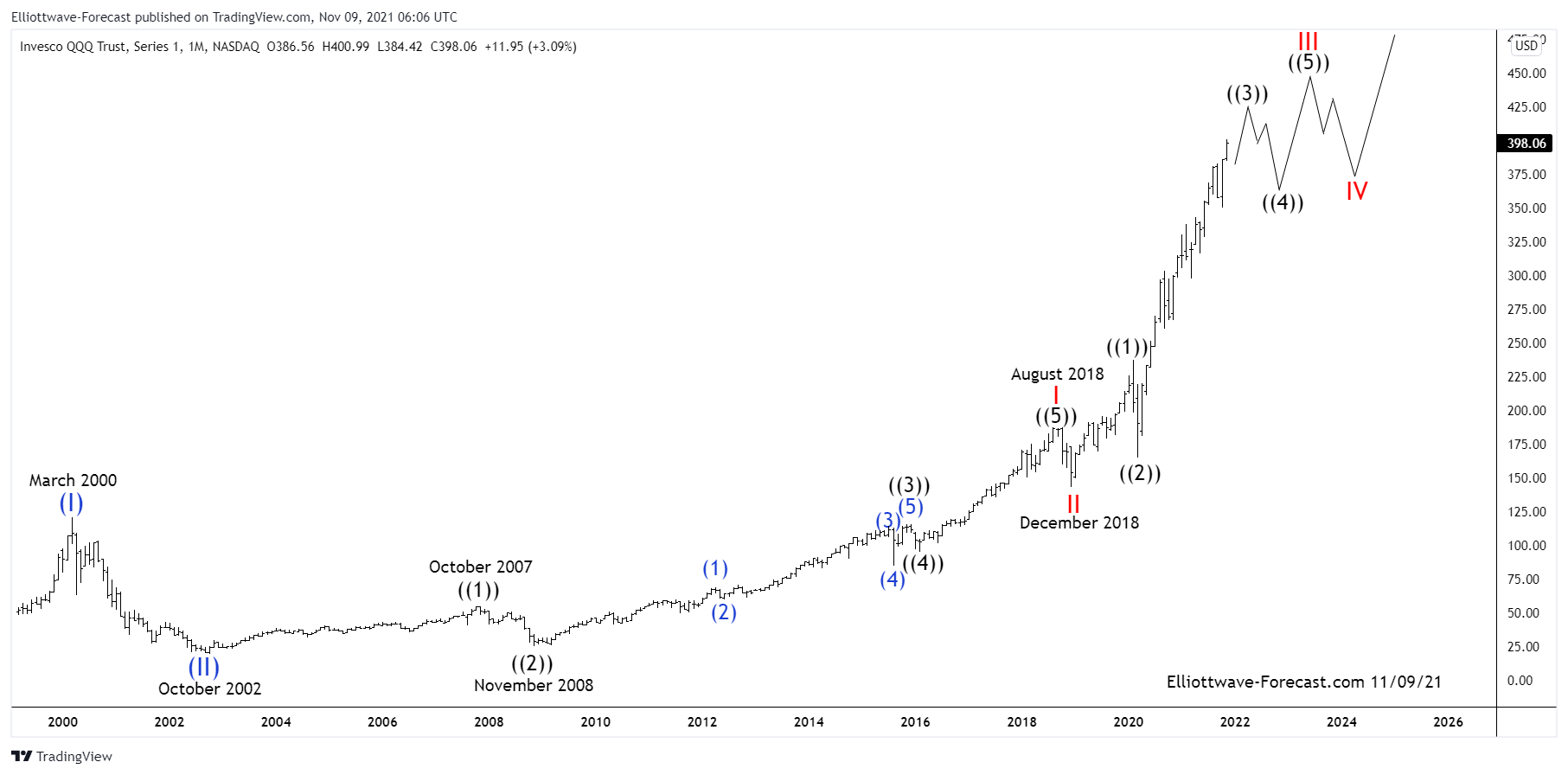

$QQQ ETF Elliott Wave & Long Term Cycles

Read More$QQQ ETF Elliott Wave & Long Term Cycles Firstly the QQQ instrument inception date was in March 1999. That was before it ended a larger cycle up from the all time lows in March 2000. The ETF instrument mirrors the price movement of the Nasdaq index. As shown below from the March 2000 highs the […]

-

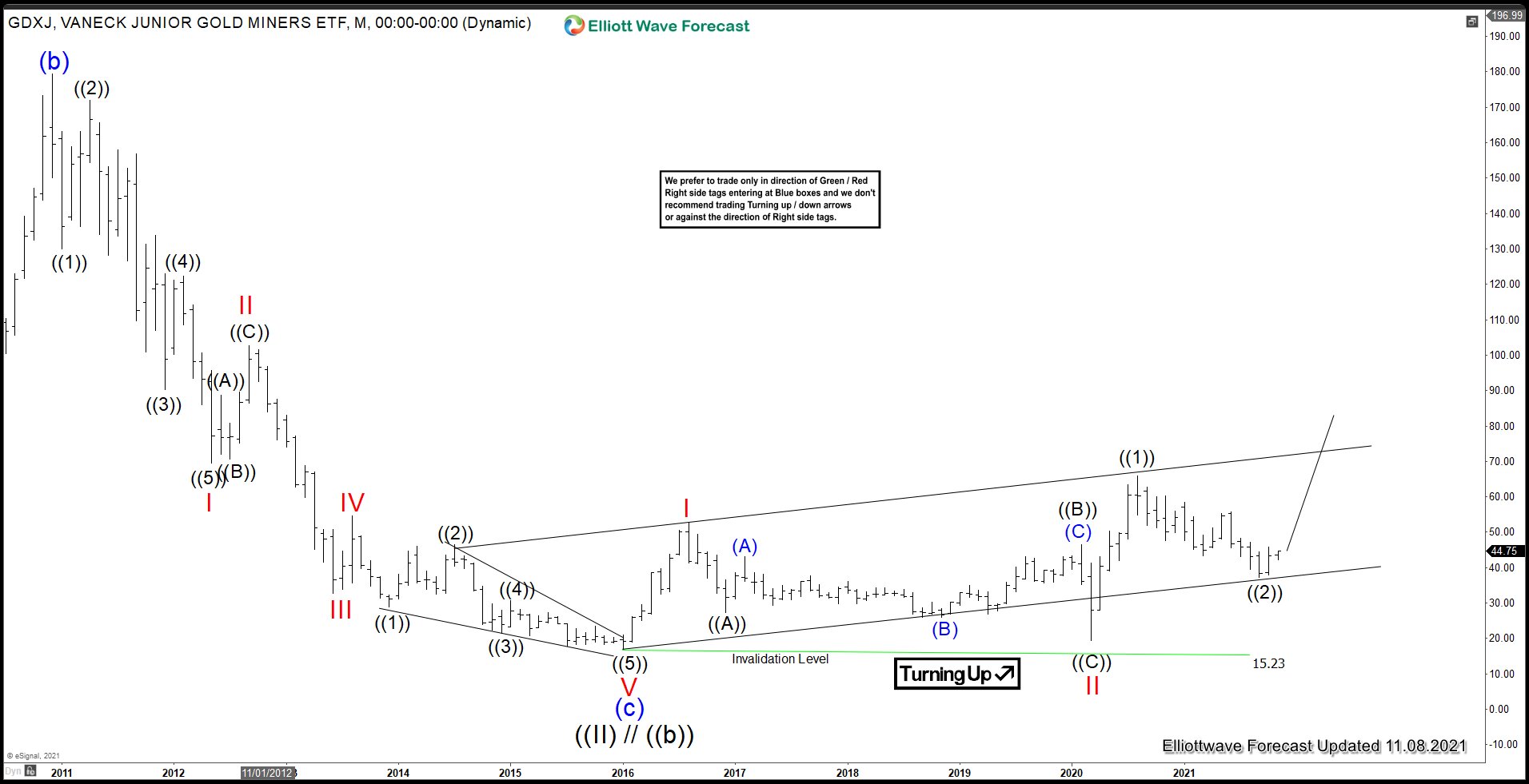

Junior Gold Miners (GDXJ) Have Ended Correction

Read MoreGold and related miners formed a high on August 2020 and they have pulled back for more than 1 year. In our last article from 2 months ago, we provided a support area of $18.5 – $32.6. It looks like Gold Miners did not quite reach the 100% extension area and already ended the correction. This […]