The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Russell Futures: Sellers Appear after Elliott Wave FLAT Structure

Read MoreIn this article, we look at how Russell Futures correction from 12.1.2021 low ended up taking the form of an Elliott Wave FLAT correction. We will look at various 4 hour charts presented to members of Elliottwave-Forecast between 12.5.2021 and 1.10.2022 and why we were convinced strong rally from 12.20.2021 was part of a FLAT […]

-

Draft Kings ($DKNG) Poised For A Bounce

Read MoreDraft Kings had a stellar 2020 and beginning of 2021, but is now correcting the entire cycle from the IPO. But where can this stock find support for a bounce? First, lets take a look at what this company does: ““DraftKings is an American daily fantasy sports contest and sports betting provider. The company allows users to enter daily and […]

-

$BNP : French Banking Giant BNP Paribas Provides an Opportunity

Read MoreBNP Paribas is a French international banking group being within 10 largest banks in the world. Headquartered in Paris, it is a merger of Banque Nationale de Paris (BNP) and Paribas. BNP Paribas is a part of Euro Stoxx 50 (SX5E) and CAC40 indices. Investors can trade it under the ticker $BNP at Euronext Paris […]

-

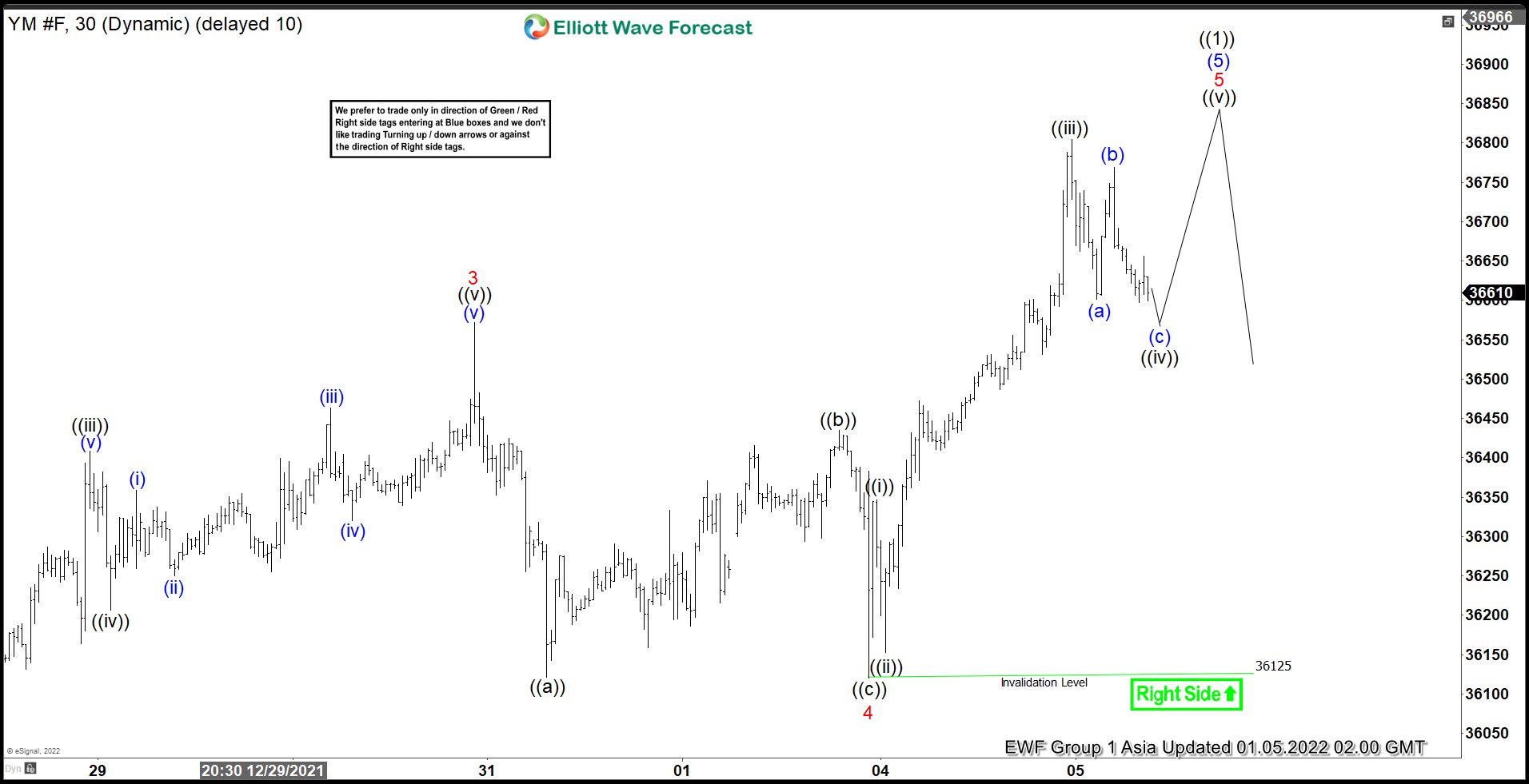

Elliott Wave View: Dow Futures (YM) Ending Wave 5

Read MoreDow Futures (YM) shows an impulsive structure from December 2, 2021 low and soon can see pullback. This article and video look at the Elliott Wave path.

-

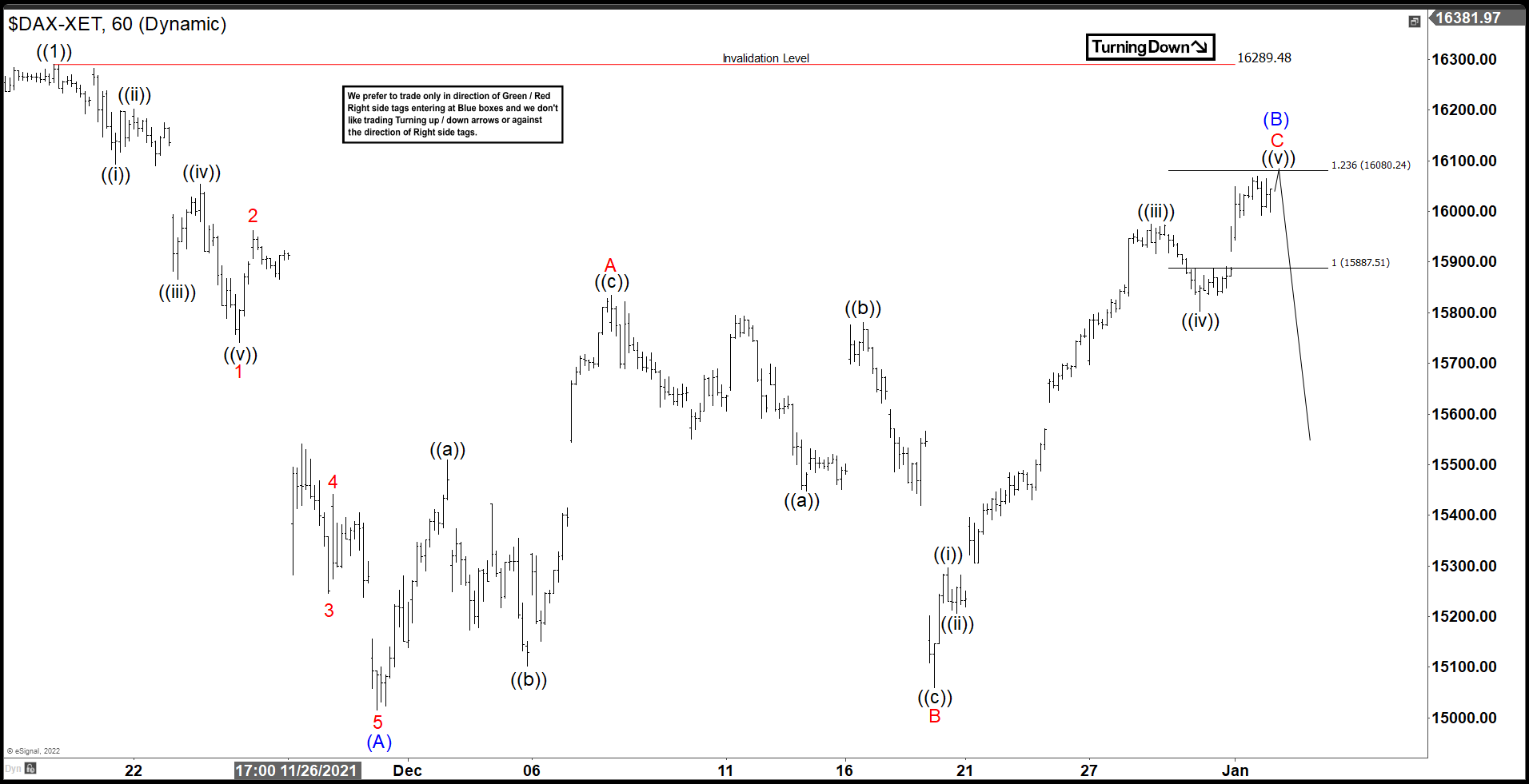

Elliott Wave View: DAX Close to Pullback

Read MoreDAX is close to ending the flat structure from November 30 low and see a pullback. This article and video look at the Elliott Wave path.

-

XLY Reacting Higher After Ending Double Correction

Read MoreIn this technical blog, we will look at the past performance of 4 hour Elliott Wave Charts of XLY. In which, the rally from 18 March 2020 low unfolded as a nest and showed a higher high sequence. Therefore, we knew that the structure in XLY is incomplete to the upside & should see more upside. […]