The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

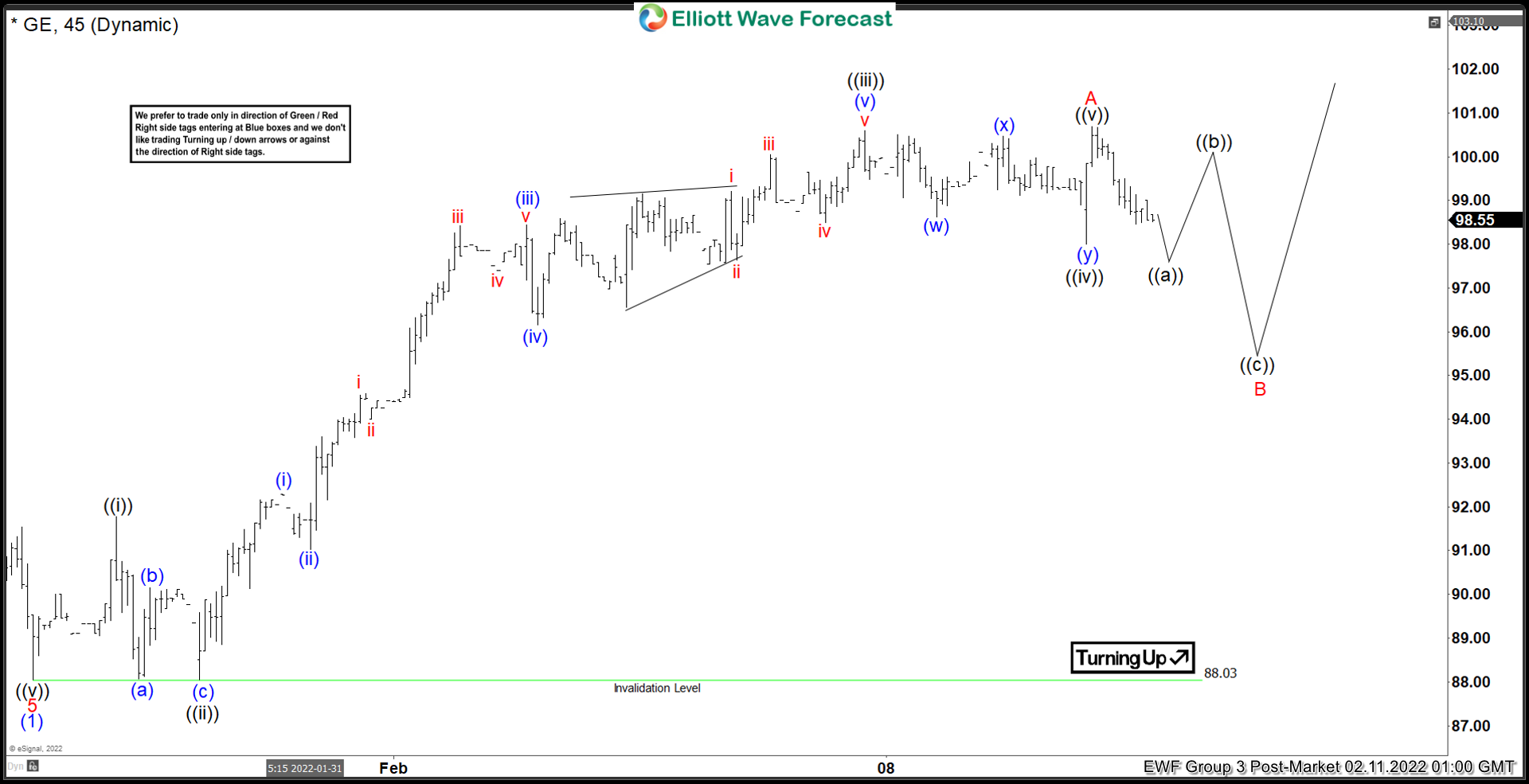

Elliott Wave View: General Electric (GE) Ended 5 Waves Rally

Read MoreGE (General Electric) is correcting cycle from January 27 low before the next leg higher. This article and video look at the Elliott Wave path.

-

Elliott Wave View: S&P500 (SPX) 5 Waves Rally Favors the Bulls

Read MoreSPX is looking to complete a 5 waves impulse from January 25 low which favors the bulls. This article and video look at the Elliott Wave path.

-

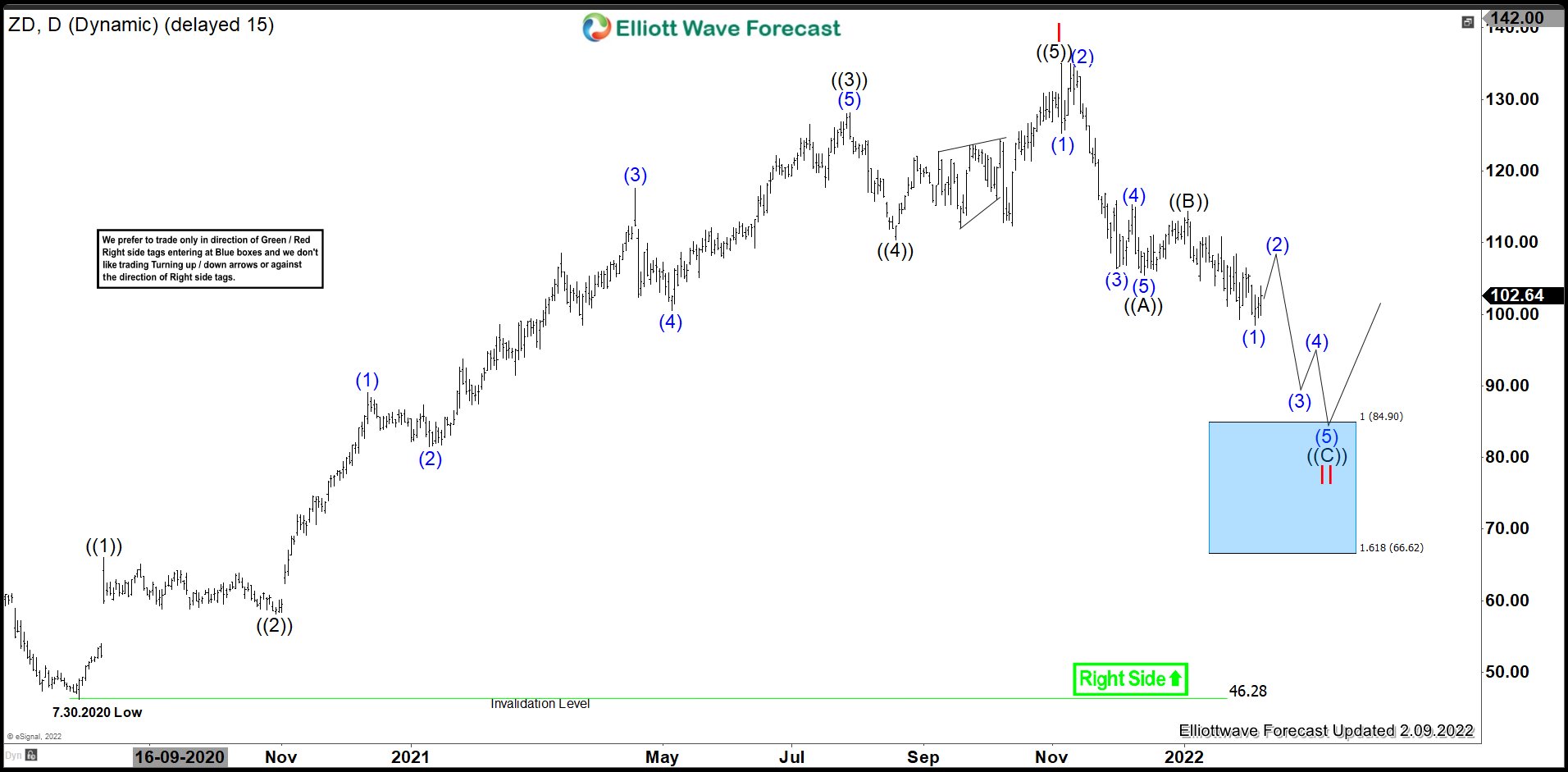

Elliott Wave View: ZD Expect To Pulling Back in II

Read MoreZiff Davis Inc ( ZD ) operates as a vertically focused digital media & internet company. It primarily invests in technology, entertainment, shopping, health & cybersecurity. It based in New York. It comes under Communication services sector & trades under “ZD” ticker at Nasdaq. ZD continue weakness during global sell off in early 2020, while […]

-

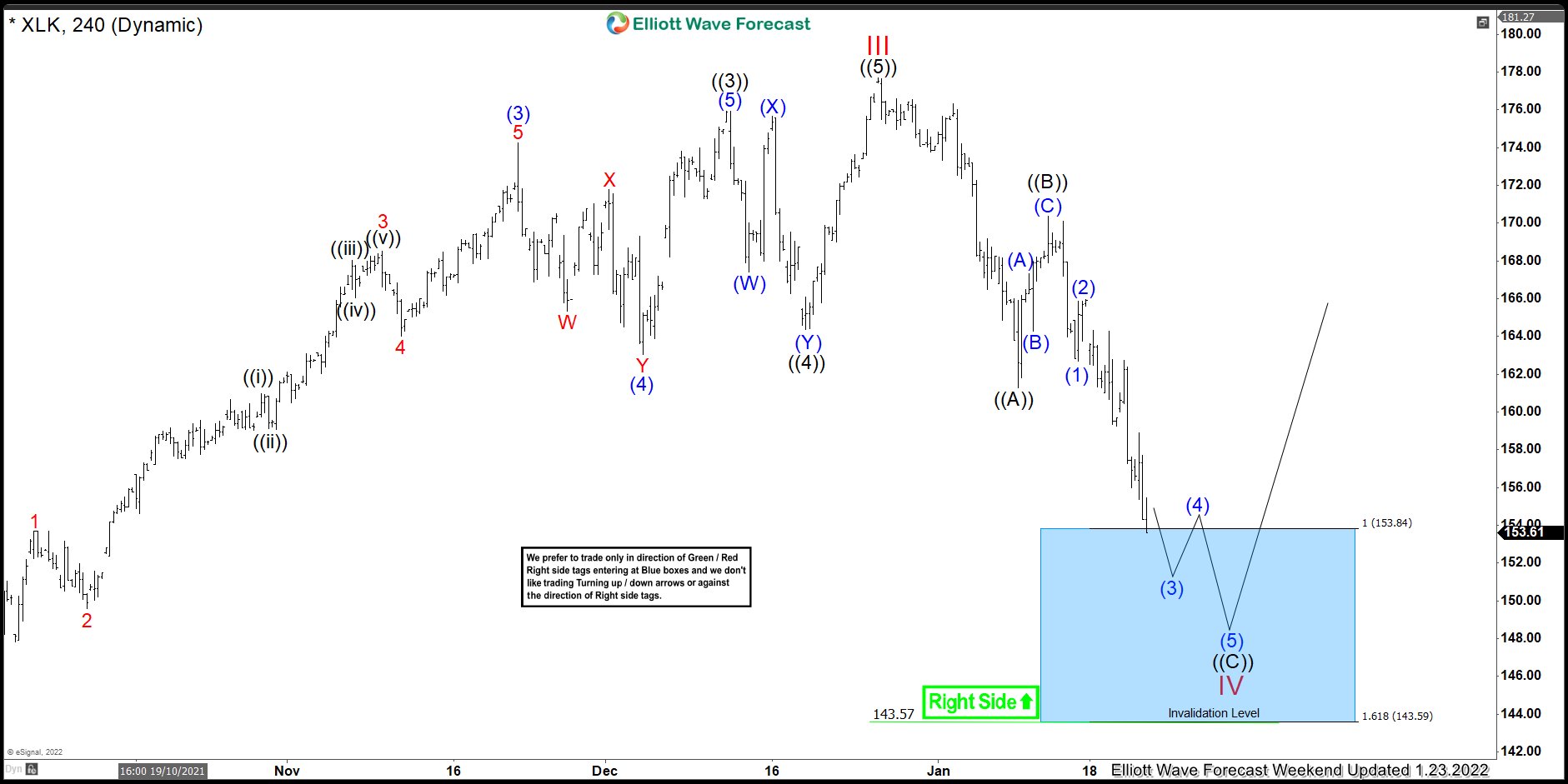

XLK Provided the Buying Opportunity At The Blue Box Area

Read MoreIn this blog, we take a look at the past performance of XLK 4hr charts. In which, the stock made new all-time highs from the blue box area.

-

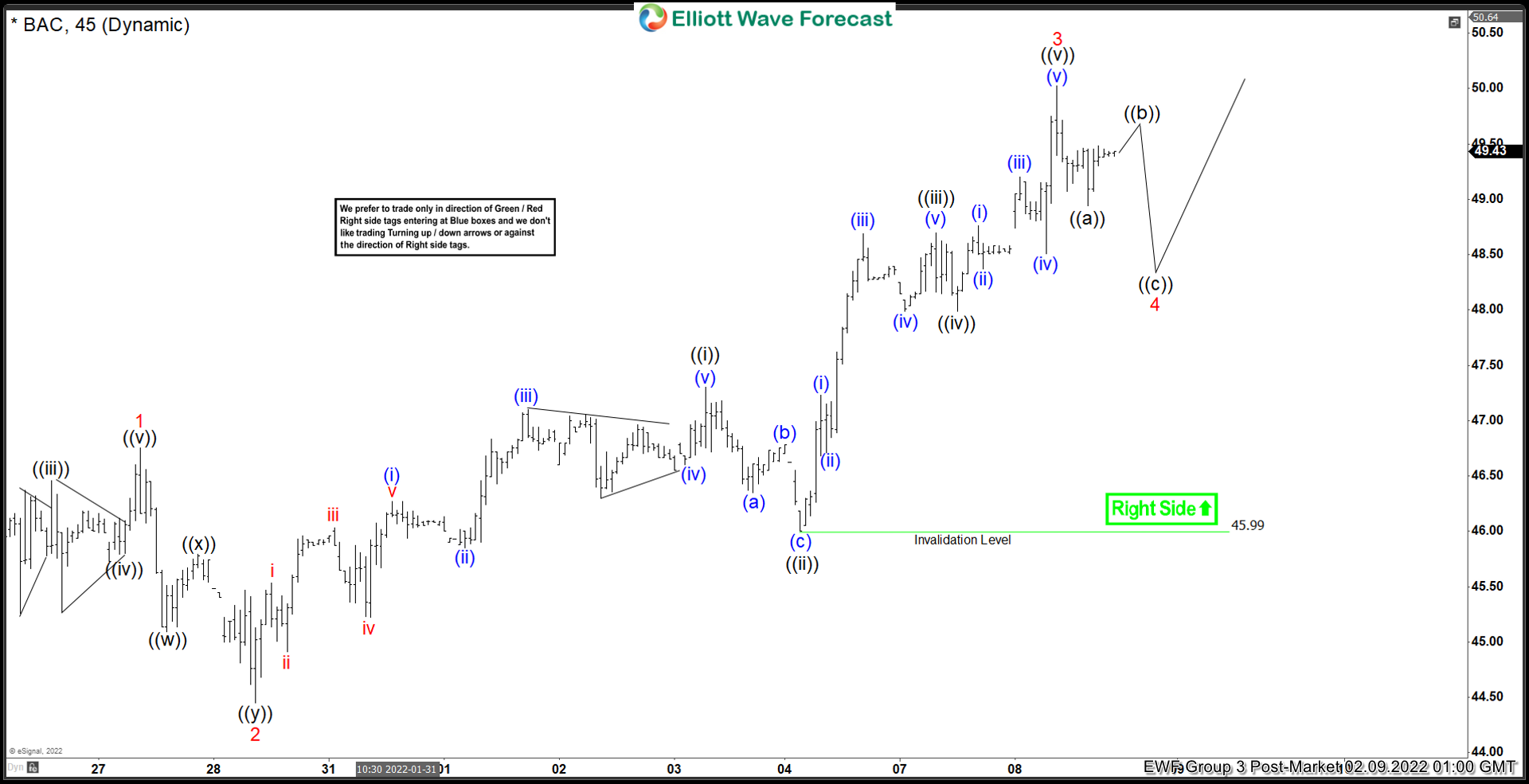

Elliott Wave View: Bank of America (BAC) Looking to Extend Higher

Read MoreBAC is looking to complete an impulse move from January 24, 2022 low looking for more upside. This article and video look at the Elliott Wave path.

-

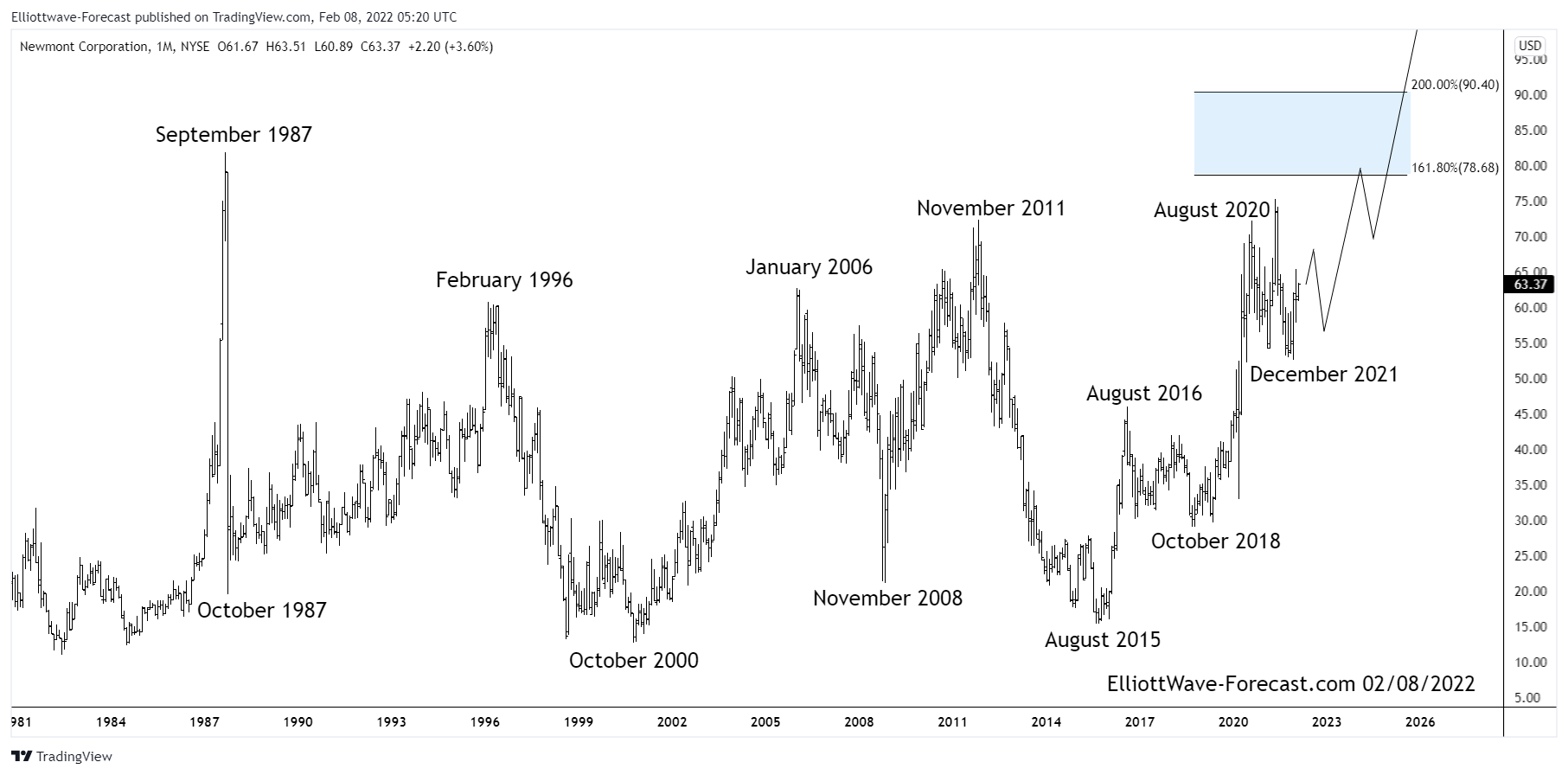

The Newmont Corporation Longer Term Bullish Cycles $NEM

Read MoreThe Newmont Corporation Longer Term Bullish Cycles $NEM Firstly from the beginning of price data from back in the 1970’s not shown on the chart, the price trend was obviously up. It ended that bullish cycle in September 1987 and pulled back really hard during the October 1987 crash. Price stabilized from there several years […]