The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Datadog ($DDOG) Calling the dip and bounce

Read MoreThe last time I took a look at Datadog was a few months ago. At the time, my favoured view was looking for a pullback to correct the low from May 2021. You can view this article here. Lets take a look at the expectation in December 2021. DataDog Elliottwave View December 2021: As mentioned […]

-

Russian Stock Market Index RTSI in Front of a Huge Rally?

Read MoreRTSI is a Russian stock market index representing 50 most important companies on the Moscow Stock Exchange. From the introduction in 1995 until May 2008, RTS index has performed very well. Then, the index remains sideways while American indices are rallying. One of the reasons for this lagging behavior could be the highly depressed commodity […]

-

$MRNA: Moderna Provides an Opportunity for Next Rally

Read MoreModerna, Inc. is an US American pharmaceutical and biotechnology company. Founded in 2010 and headquartered in Cambridge, Massachusetts, USA, it is a part of NASDAQ100 and S&P500 indices. Investors can trade it under the ticker $MRNA at NASDAQ. The company’s only commercial product is the COVID-19 vaccin. Moreover, it has a portfolio of vaccine candidates […]

-

BWA : Expect Pulling Back in II Before Next Rally Resumes

Read MoreBorgWarner Inc (BWA) provides solutions for combustion, hybrid & electric vehicles worldwide. The company operates through four segments, Air management, E-propulsion & drivetrain, Fuel injection & Aftermarket. It is based in Auburn Hills, Michigan. It comes under Consumer cyclical sector & trades as “BWA” ticker at NYSE. BWA favored ended larger correction in weekly at […]

-

SIG : Expect To Pulling Back in II

Read MoreSignet Jewelers Limited (SIG) engages in the retail sale of diamond jewelry, watches & other products. It is based in Hamilton, Bermuda, comes under Consumer Cyclical sector & trades as “SIG” ticker at NYSE. SIG made intermediate low at $5.60 during Covid pandemic early last year. Thereafter it started higher high sequence as impulse up, […]

-

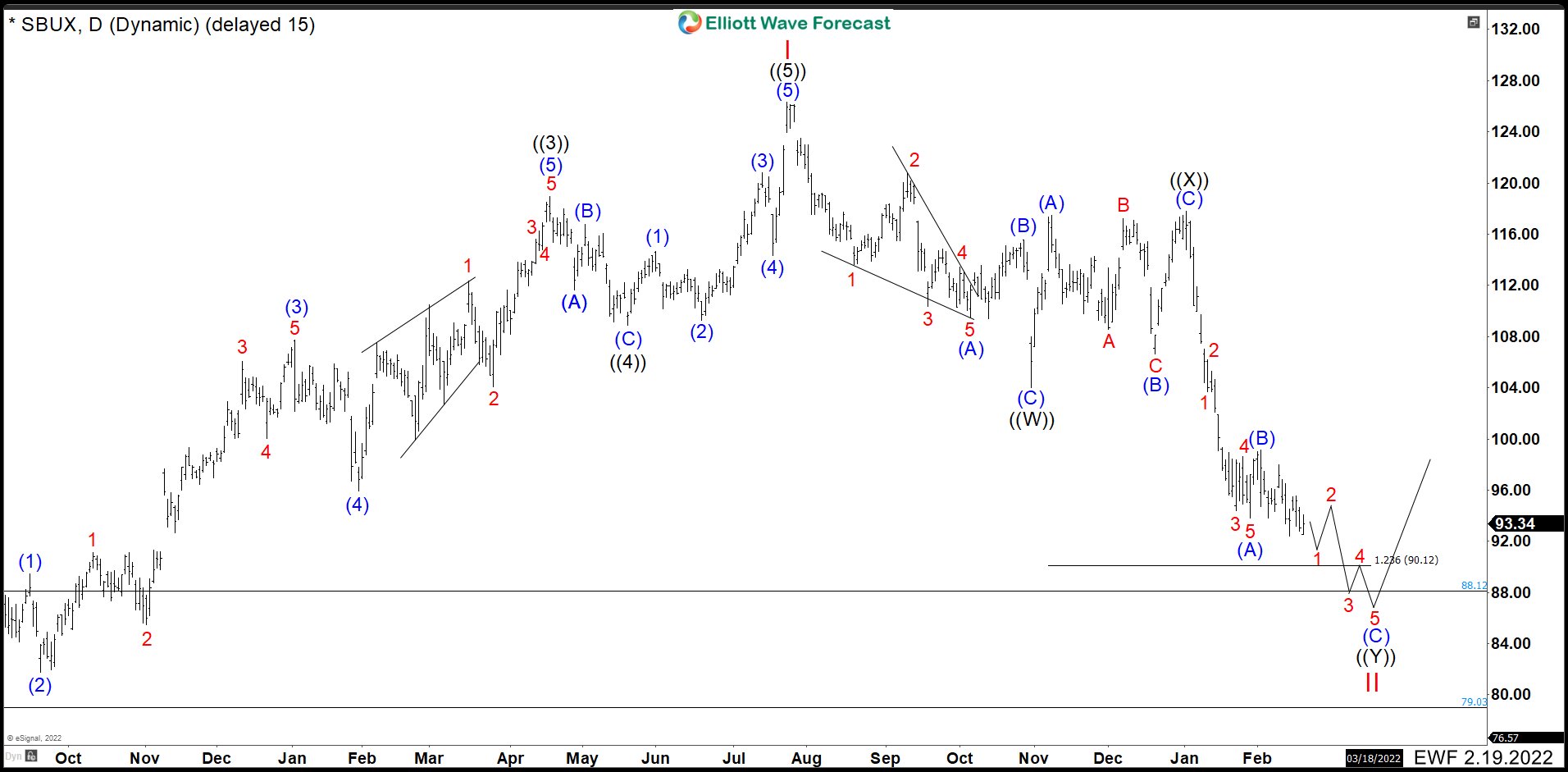

Starbucks (SBUX) Is Looking For Support And Buyers Will Appear

Read MoreStarbucks Corporation (SBUX) is an American multinational chain of coffeehouses and roastery reserves. It is the world’s largest coffeehouse chain. As of November 2021, the company had 33,833 stores in 80 countries, 15,444 of which were located in the United States. Out of Starbucks’ U.S.-based stores, over 8,900 are company-operated, while the remainder are licensed. Starbucks (SBUX) Daily Chart Starbucks (SBUX) […]