The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

SOXX Reacted From Our Minimum Target And It Is Looking For Support

Read MoreSOXX (iShares Semiconductor ETF) is passively managed to provide concentrated exposure to the 30 largest US-listed semiconductor companies. This includes (i) manufacturers of materials with semiconductors that are used in electronic applications or in LED and OLED technology and (ii) providers of services or equipment associated with semiconductors. SOXX Daily Chart December 2021 SOXX chart […]

-

Is Now A Good Time To Buy Snowflake Inc. (SNOW)?

Read MoreSnowflake Inc. is a cloud computing–based data warehousing company based in Bozeman, Montana. The firm offers a cloud-based data storage and analytics service, generally termed “data warehouse-as-a-service”. It allows corporate users to store and analyze data using cloud-based hardware and software. It runs on Amazon S3 since 2014, on Microsoft Azure since 2018 and on the Google Cloud Platform since 2019. The company was ranked first on the Forbes Cloud 100 in 2019. The […]

-

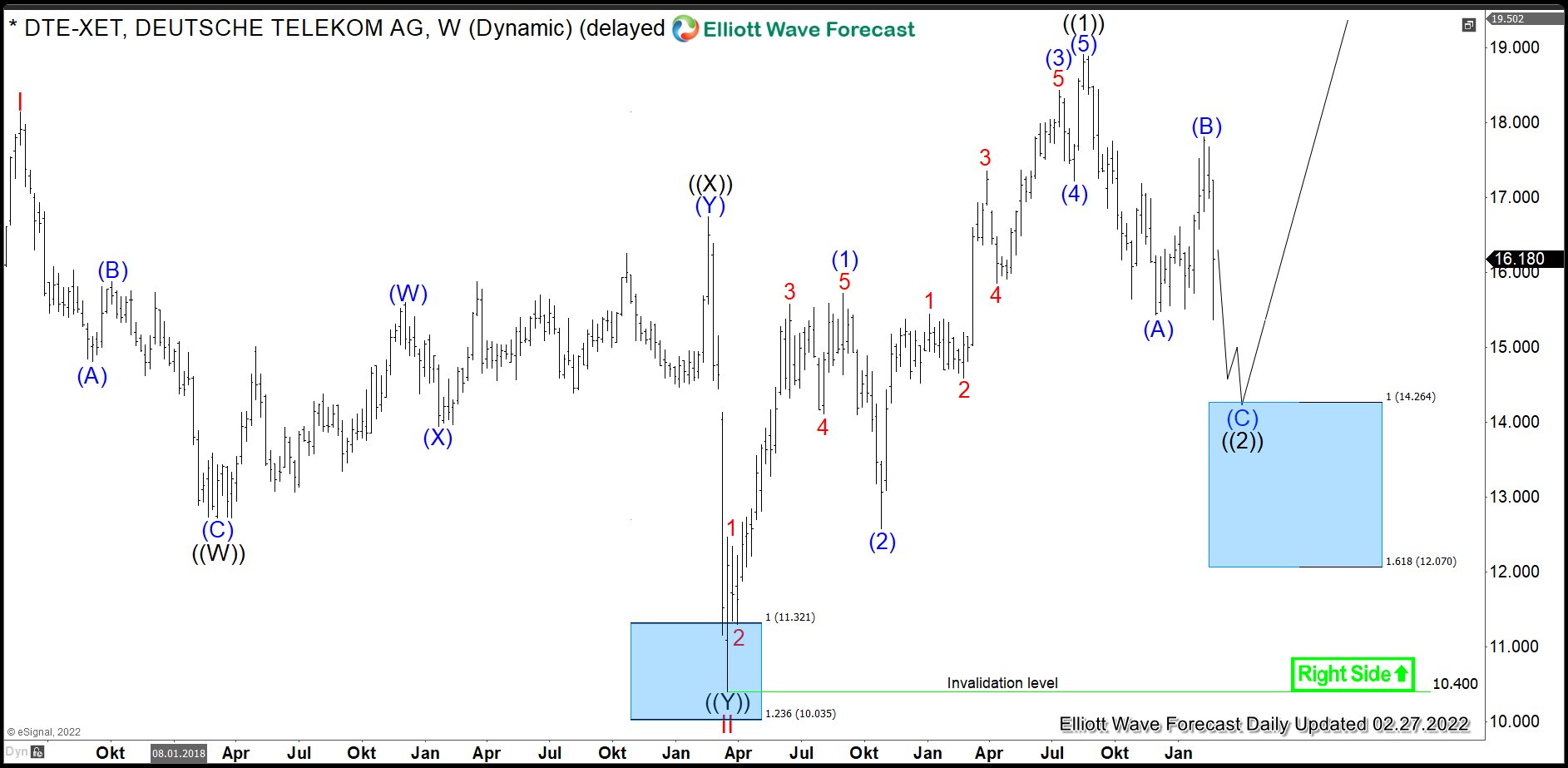

$DTE : Buying Short-Term Pullback in Deutsche Telekom

Read MoreDeutsche Telekom AG is a German telecommunications company and by revenue the largest telecommunications provider in Europe. Formed in 1995 and headquartered in Bonn, Germany, the company operates several subsidiaries worldwide. Deutsche Telekom is a part of both DAX30 and of SX5E indices. Even though the stock is highly appreciated by investors, the stock price […]

-

Elliott Wave View: IBEX Has Resumed Downside

Read MoreIBEX cycle from November 2021 peak is in progress as a 5 waves diagonal. This article and video look at the Elliott wave path.

-

Arcimoto ($FUV) Are the lows in?

Read MoreWhen I previously Arcimoto, back in July 2021, the stock looked promising for the next leg higher. The market had yet to confirm the view and the 7.27 low needed to hold. The market had other ideas and invalidated that low, which sets up the next potential bottom currently present in this chart. In […]

-

Elliott Wave View: S&P 500 (SPX) Rally Expected To Fail

Read MoreSPX shows bearish sequence from January 4 high favoring more downside. This article and video look at the Elliott Wave path of the Index.