The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

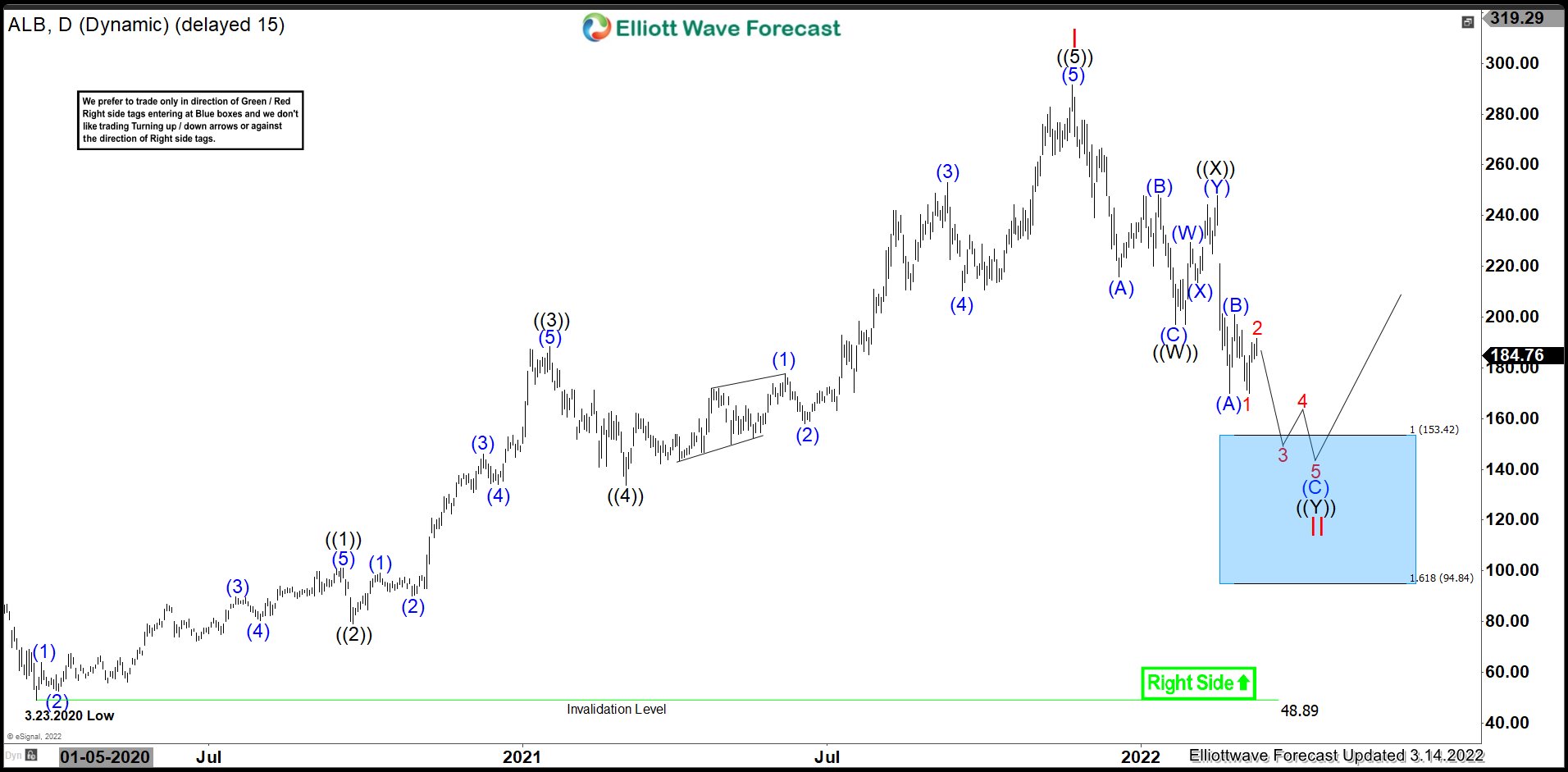

ALB : Pulling Back in II Before Next Rally

Read MoreAlbemarle Corporation (ALB) develops, manufactures & markets engineered specialty chemicals worldwide. It operates through three segments, Lithium, Bromine & Catalysts. It is based in Charlotte, NC, which comes under Basic Materials sector & trades under “ALB” ticker at NYSE. ALB made a short-term low at $48.89 on 3/23/2020. While above there it made ATH at […]

-

Pan American Silver (PAAS) Has Started the Next Bullish Leg

Read MorePan American Silver Corporation (ticker: PAAS) is engaged in the production and sale of silver, gold, zinc, lead and copper. It also has other related activities, including exploration, extraction, processing, refining and reclamation. The company operates 10 mining sites, including La Colorada, Dolores, Huaron, Morococha, San Vicente, Manantial Espejo, Shahuindo, La Arena, Timmins and Escobal. In […]

-

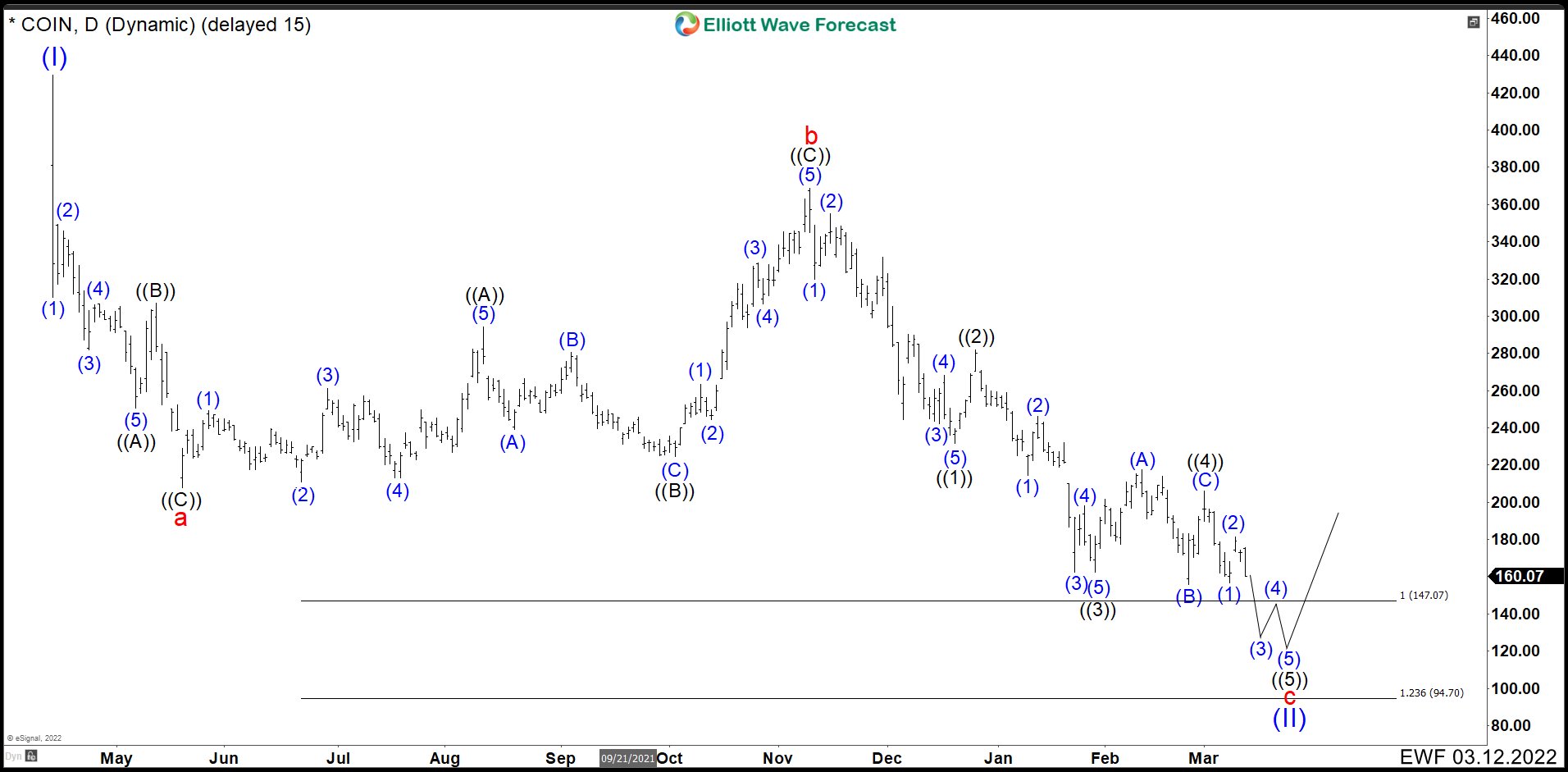

COIN Is Under Pressure Due Cryptos Fall Since November 2021

Read MoreCoinbase Global, Inc., branded Coinbase (COIN), is an American company that operates a cryptocurrency exchange platform. Coinbase is a distributed company; all employees operate via remote work and the company lacks a physical headquarters. It is the largest cryptocurrency exchange in the United States by trading volume. The company was founded in 2012 by Brian Armstrong and Fred Ehrsam. COIN Daily Chart March 2022 Coinbase […]

-

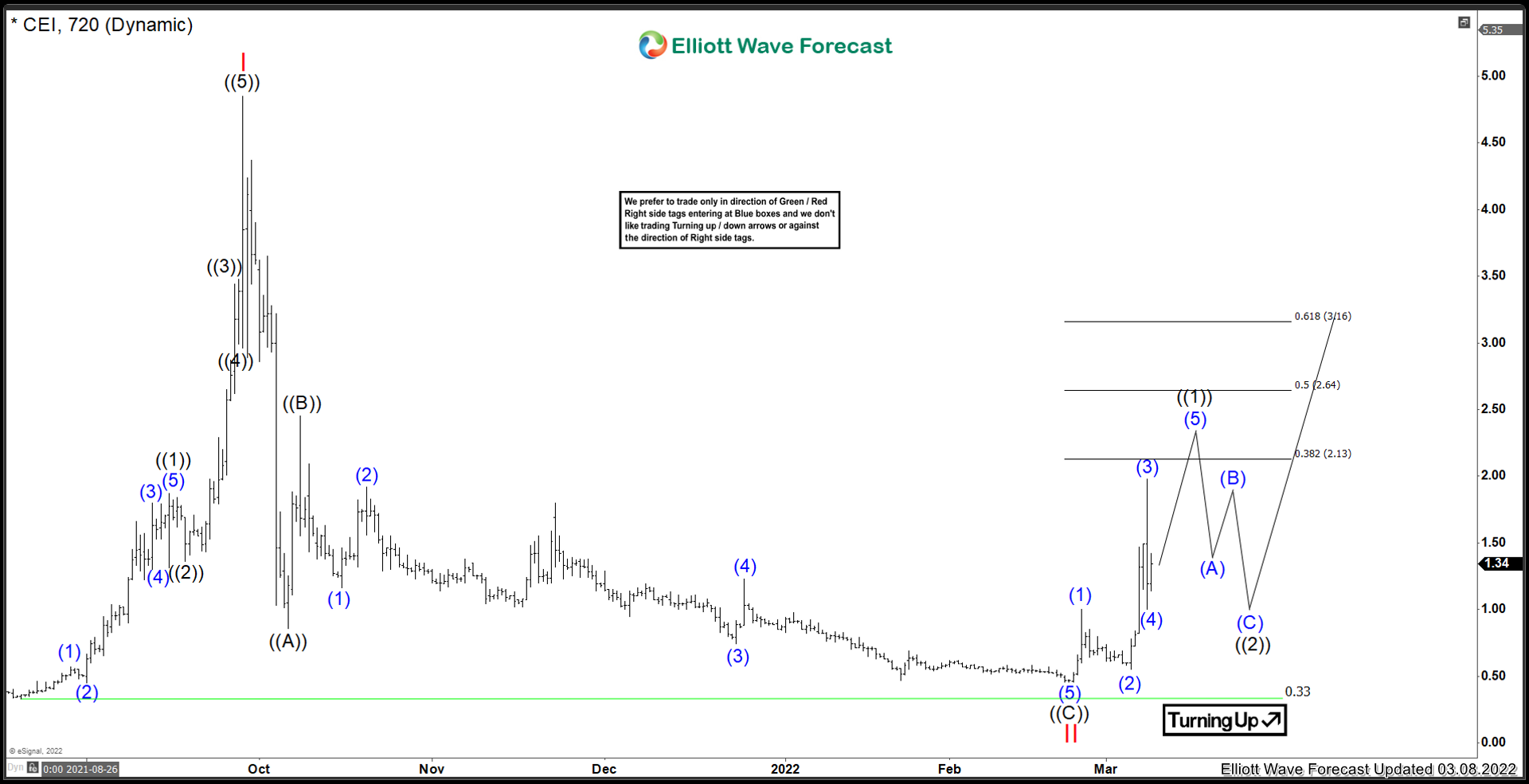

Camber Energy Inc. ($CEI) Is The Bottom Set?

Read MoreThe last time I analyzed Camber Energy was back in September 2021. At the time I was looking for a peak to materialize and then pull back against the rally from the lows set in August 2021. The stock vastly outperformed where I was expecting it to peak, however, the pullback did materialize as anticipated. […]

-

CRTO : Pulling Back In II

Read MoreCriteo S.A. (CRTO), is a technology company, provides marketing & monetization services on the internet in North & South America, Europe, Middle East, Asia-Pacific & Africa. It is based in Paris, France. It comes under Communication services sector & trades under “CRTO” ticker at Nasdaq. CRTO made all time low at $5.89 in March-2020 during […]

-

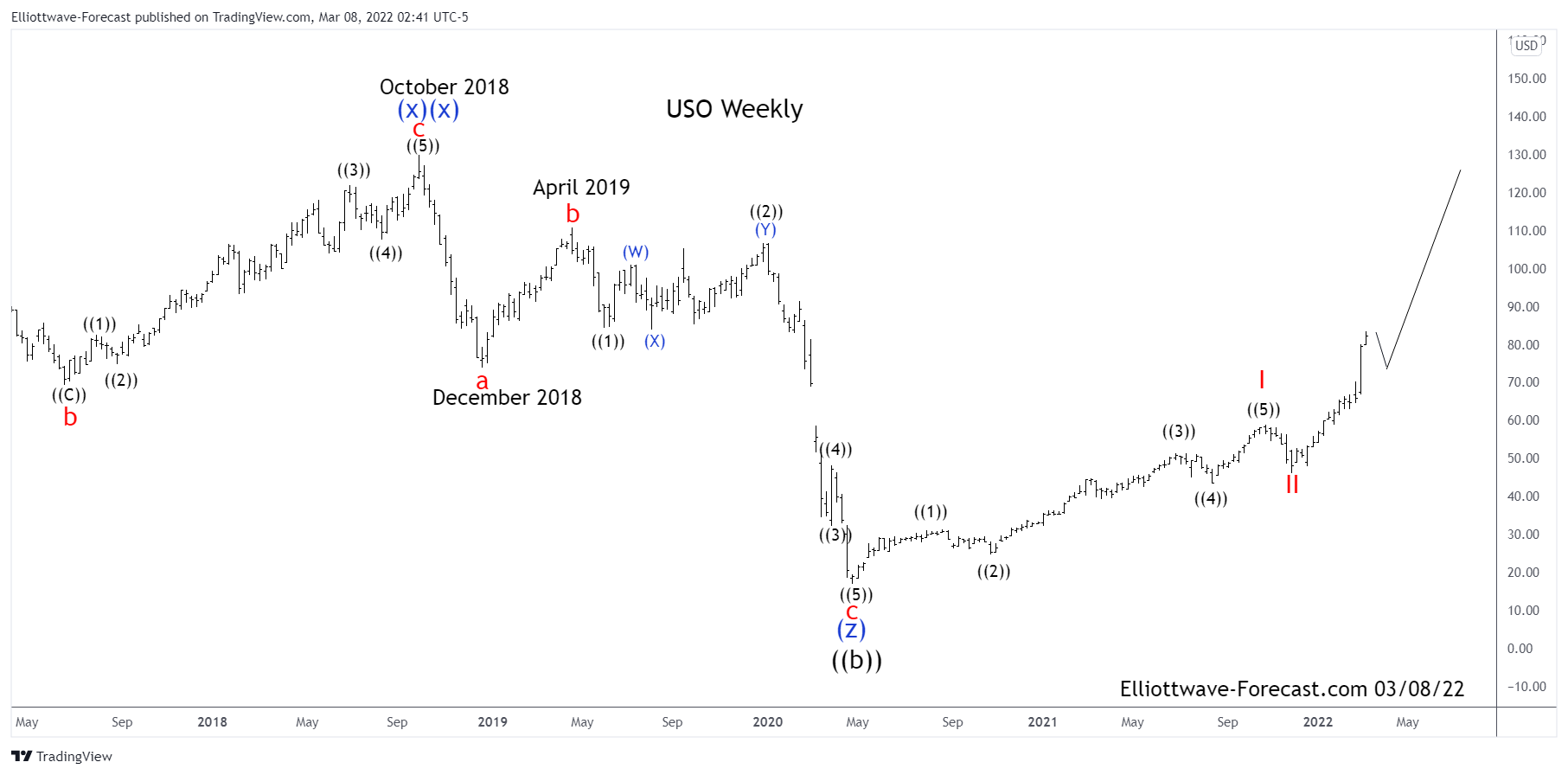

Long Term Cycles & Elliott Wave Analysis $USO United States Oil Fund

Read MoreLong Term Cycles & Elliott Wave Analysis $USO United States Oil Fund Firstly the USO instrument inception date was 4/10/2006. CL_F Crude Oil put in an all time high at 147.27 in July 2008. USO put in an all time high at 953.36 in July 2008 noted on the monthly chart. The decline from there into […]