The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Indonesia Energy Corp ($INDO) Ready For The Next Leg Higher?

Read MoreIndonesia Energy Corp stock has experienced a breathtaking rally since the lows set in January 2022. There are a few small companies that are making big moves with the swing in Crude Oil (like $IMPP which I covered here recently). But is this massive move meant to last? Today I’ll take a look at Indonesian […]

-

EMN : Expect II Correction Before Next Rally

Read MoreEastman Chemical Company (EMN) operates as specialty materials company globally. It serves transportation, personal care, wellness, food, feed, agriculture, building & construction, water treatment, energy, consumables, durables & electronic markets. It is based in Kingsport, Tennessee, comes under Basic Materials sector & trades as “EMN” ticker at NYSE. EMN made low of $34.44 on 3/18/2020 […]

-

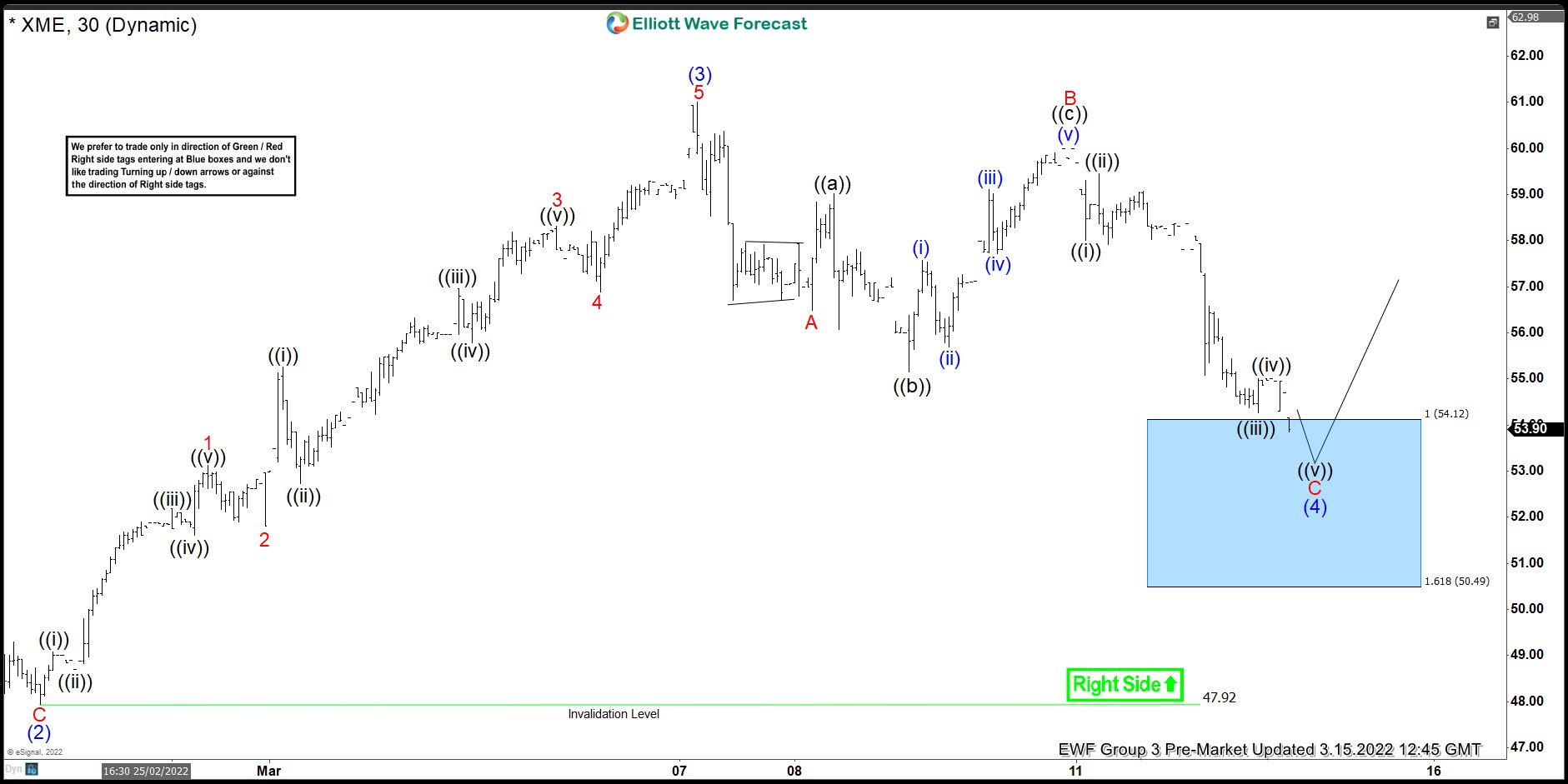

XME Reacting Higher From Elliott Wave Blue Box Area

Read MoreIn this blog, we take a look at the past performance of the 1hr Elliott wave charts of XME. In which, our members took advantage of the blue box area.

-

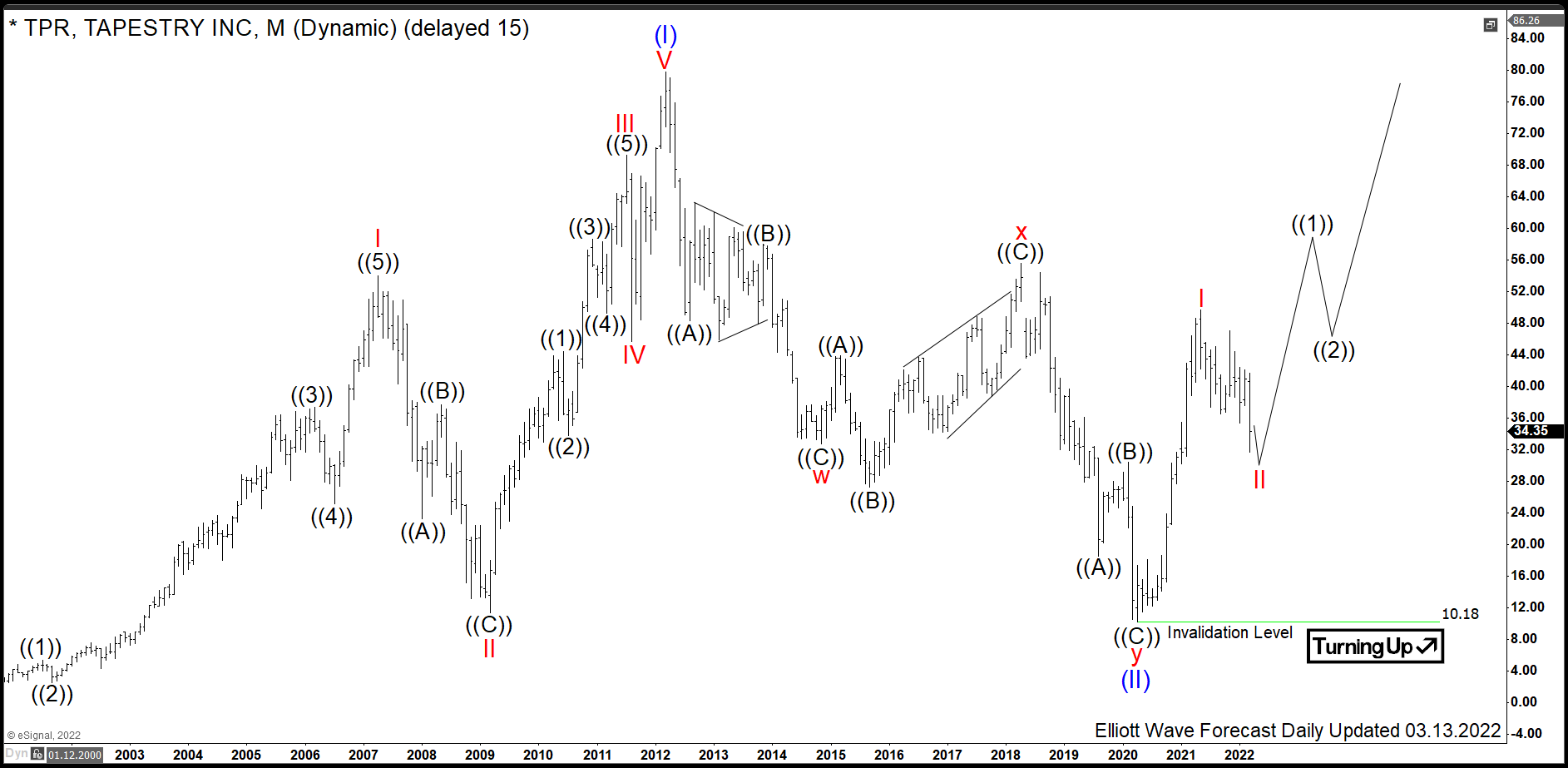

$TPR: Luxury Fashion Stock Tapestry Offers an Opportunity

Read MoreTapestry, Inc. (formerly: Coach, Inc.) is a multinational luxury fashion holding company based in New York City, USA. The parent company owns three brands: Coach New York, Kate Spade New York and Stuart Weitzman. The stock of the company being a component of the S&P500 index can be traded under ticker $TPR at NYSE. Currently, […]

-

Is AMC Correction Done Or Needs One More Low?

Read MoreAMC Entertainment Holdings, Inc. is an American movie theater chain headquartered in Leawood, Kansas, and the largest movie theater chain in the world. Founded in 1920, AMC has the largest share of the U.S. theater market ahead of Regal and Cinemark Theatres. It has 2,866 screens in 358 theatres in Europe and 7,967 screens in 620 […]

-

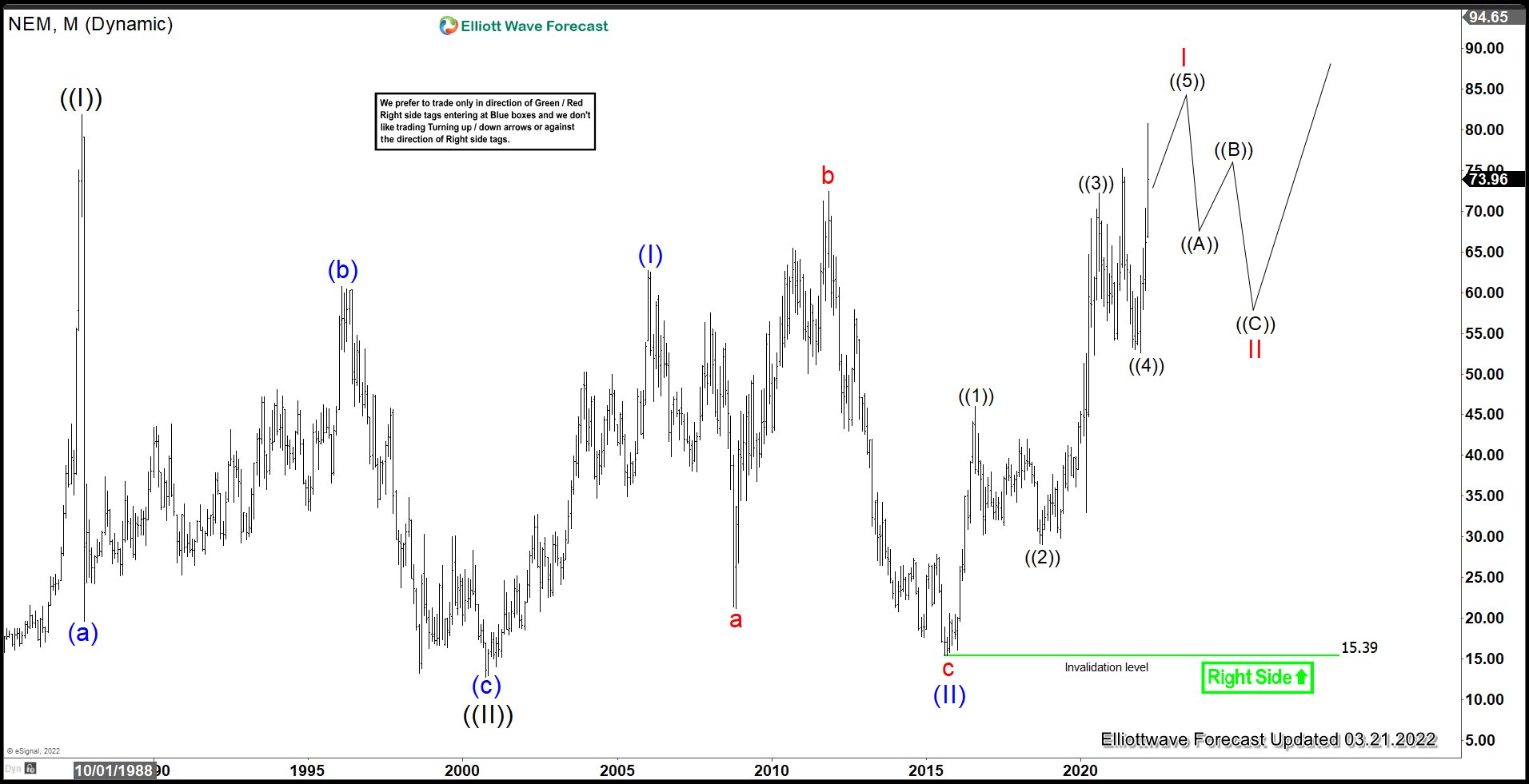

Newmont Mining (NEM) Leading Miners to the Upside

Read MoreNewmont Mining (ticker: NEM) is the world’s largest gold mining company, based in Greenwood Village, Colorado, United States. It has ownership of gold mines in Nevada, Colorado, Ontario, Quebec, Mexico, the Dominican Republic, Australia, Ghana, Argentina, Peru, and Suriname. Newmont is the only gold producer listed in the S&P 500 Index. The company is leading […]