The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Best OTC Stocks to Buy Now

Read MoreWhat are OTC Stocks? OTC stands for over-the-counter. Over-the-counter stocks are not traded on a public-exchanges like the New York Stock Exchange. Instead, they are traded through a broker-dealer network. OTC is often called unlisted stocks as they cannot meet the listing requirements of a public exchange. OTC stocks are considered riskier investments as they […]

-

BAM : Expect More Downside Before Next Rally Resumes

Read MoreBrookfield Asset Management (BAM) is an alternative asset manager & REIT/Real Estate Investment Manager firm focuses on real estate, renewable power, infrastructure & venture capital & private equity assets. It manages a range of public & private investment products & services for institutional & retail clients. It based in Toronto, Canada, comes under Financial services […]

-

Gold Miners Juniors $GDXJ Support Area

Read MoreThe last few weeks and months have been pretty hard for the market. Other than select commodities, everything else in the market has been selling off due to the Fed’s tightening plan. The rate hikes and quantitative tightening plan cause a selloff in all asset classes including stocks, bonds, as well as precious metals. Gold […]

-

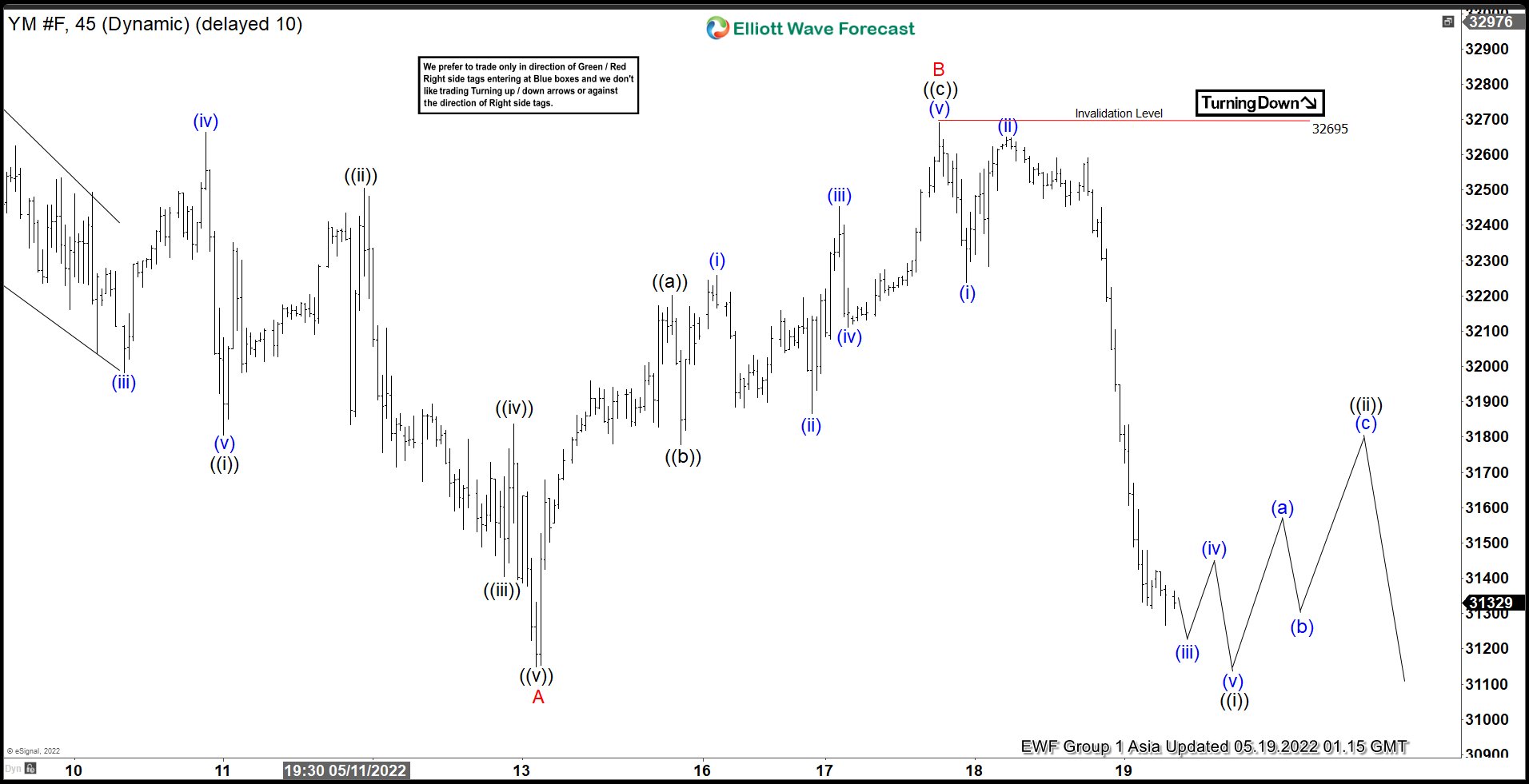

Elliott Wave View: Dow Futures ($YM) Extending Lower

Read MoreDow Futures (YM) has sold off and resume the next leg lower. This article and video look at the Elliott Wave path for the Index.

-

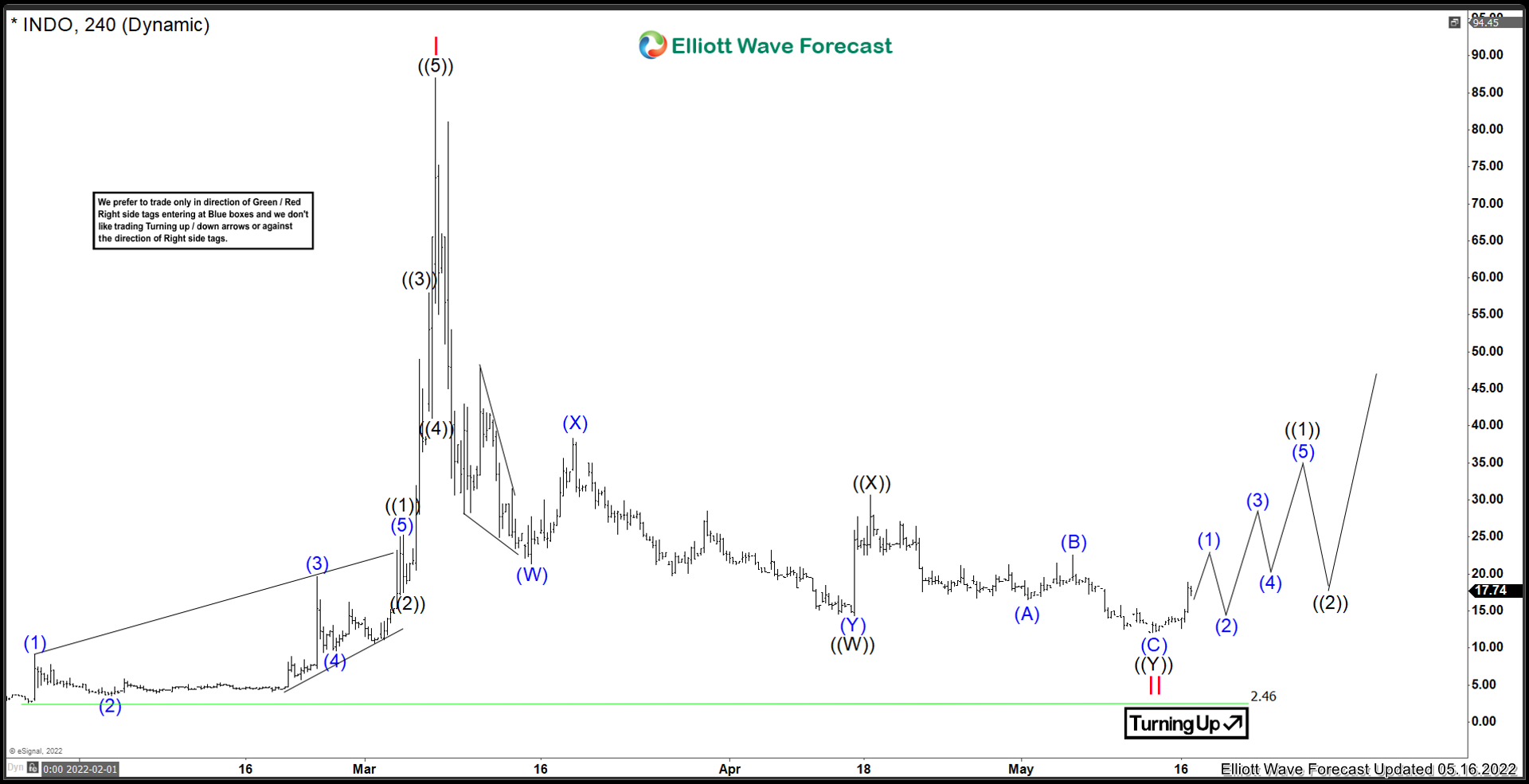

Indonesia Energy Corp ($INDO) Is the Bottom Set?

Read MoreThe last time I covered Indonesia Energy Corp was back in March 2022. The instrument had already done a 3 waves pullback from the peak, and was looking like a bottom was under way. Before I get into the charts, lets again take a look at what this company does: “Indonesia Energy Corp is an […]

-

Best Metaverse Stocks to Buy in 2024

Read MoreWhat is Metaverse? Metaverse refers to a complex web of virtual worlds and platforms. Much of our lives revolve around online communications and platforms. Moreover, the rise of gaming, digital experiences, and digital collectibles has increased the trend of virtual worlds. Metaverse has become the hottest topic of 2022. The credit goes to the news […]