The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Best Utility Stocks to Buy in 2024

Read MoreUtility stocks are companies that provide basics like gas, water, and electricity. One of the most sought-after stocks, utility stocks can never fail. Because the demand for the basics they provide is never-ending. With every passing day, these utilities are becoming a necessity rather than a comfort. No doubt they come with their set of […]

-

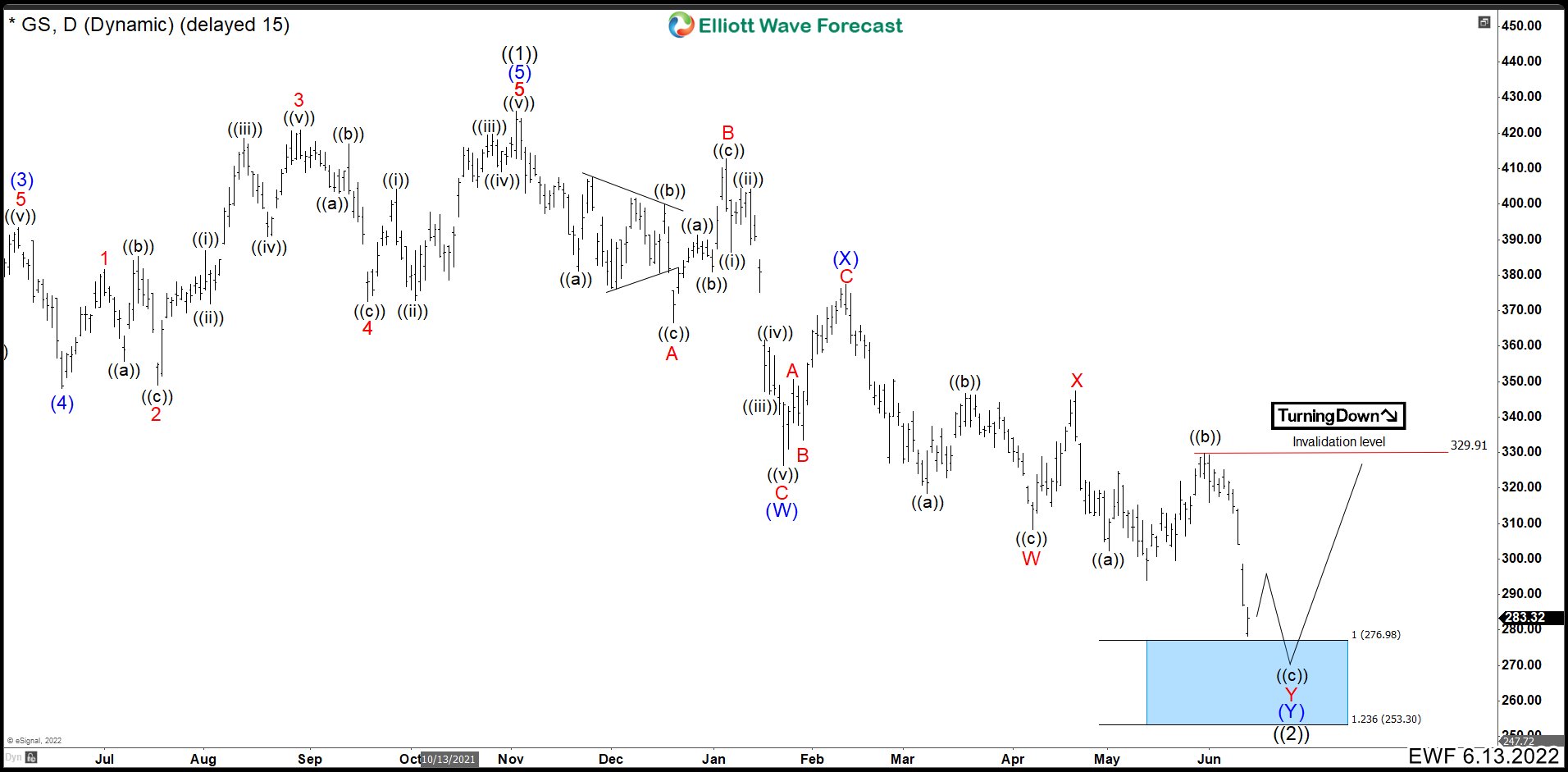

Goldman (GS) Hit Our Target And We See More Downside To Come

Read MoreThe Goldman Sachs Group, Inc. (GS) is an American multinational investment bank and financial services company headquartered in New York City. It offers services in investment management, securities, asset management, prime brokerage, and securities underwriting. The company invests in and arranges financing for startups, and in many cases gets additional business when the companies launch initial public offerings. Notable initial public offerings for which Goldman Sachs was the lead bookrunner include those of Twitter, Bumble, Robinhood Markets, Coupang, […]

-

Elliott Wave View: DAX Looking to Start a New Bullish Cycle

Read MoreRally from DAX from March 2022 low is unfolding as an impulse and can see more upside. This article and video look at the Elliott Wave path.

-

Best Consumer Staple Stocks to Buy Now

Read MoreConsumer staples are the basic goods we consume in our daily lives. All the companies that manufacture, distribute and sell products like food, beverages, and personal hygiene products fall under this category. The consumer staple industry is less prone to economic ups and downs. Stock trading advisory websites help investors make the right financial decisions. Types of […]

-

Elliott Wave View: FTSE Next Bullish Cycle

Read MoreFTSE is starting a new bullish cycle after ending the pullback on May 12. This article and video look at the short term Elliott Wave path.

-

$AOUT: American Outdoor Brands Towards New Rally

Read MoreAmerican Outdoor Brands, formerly known as Smith & Wesson Holding Corporation, is an US American manufacturer of outdoor sports and recreation products. The company holds currently 18 brands of outdoor equipment. Headquartered in Columbia, Missuri, USA, investors can trade it under the ticker $AOUT at NASDAQ. American Outdoor Brands Daily Elliott Wave Analysis 06.06.2022 The Daily […]