The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

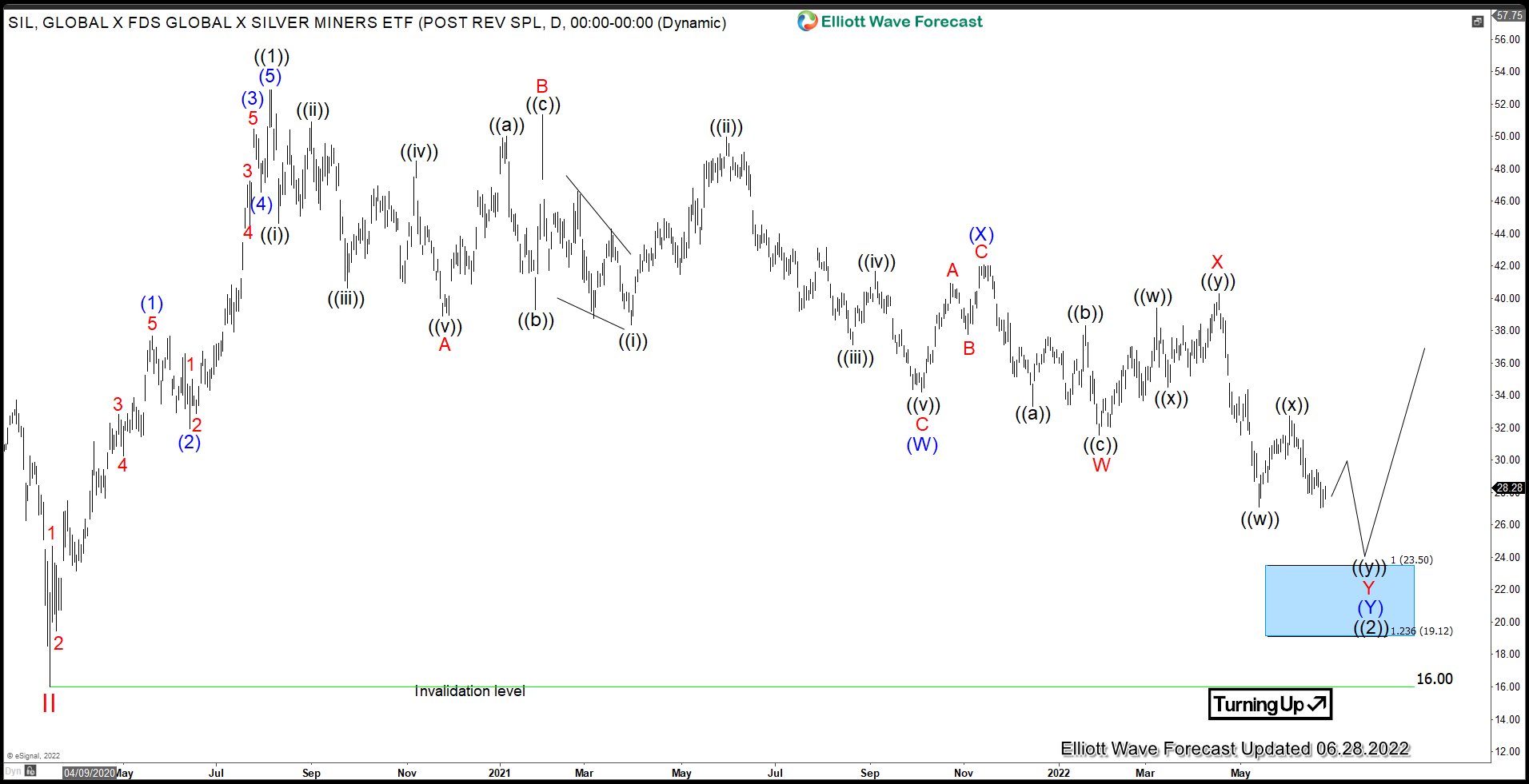

Silver Miners (SIL) Pullback Nearing Support

Read MoreSince bottoming on March 2020 low, Silver Miners ETF (SIL) has continued to extend lower to correct the cycle from March 2020 low. The correction looks to be in the form of a double Below is what a double three structure looks like: A double three is a 3-3-3 structure, labelled as WXY. The first […]

-

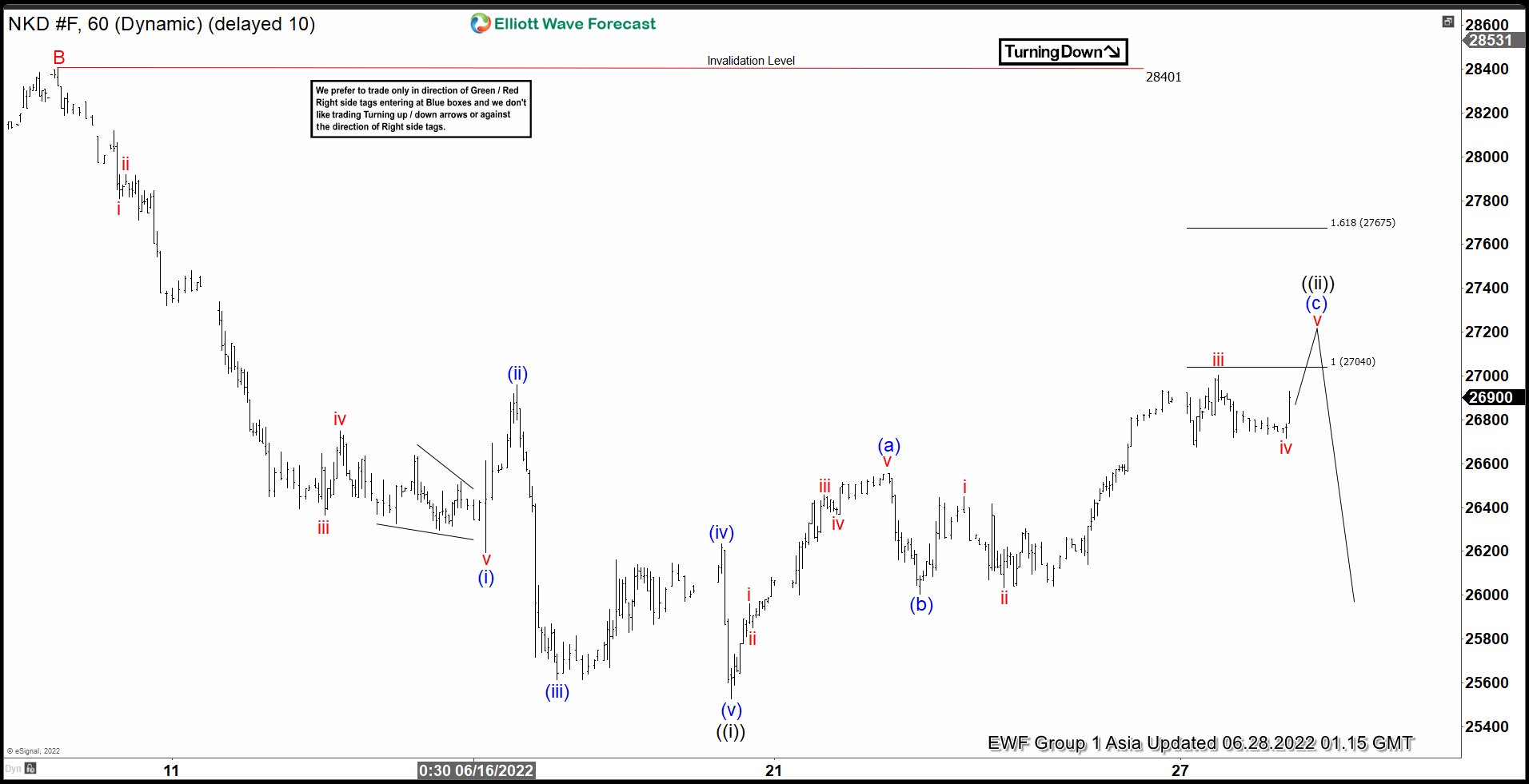

Elliott Wave View: Nikkei Zigzag Rally Approaching Target

Read MoreNikkei is correcting cycle from 6/9/2022 peak before turning lower. This article and video look at the short term Elliott Wave path.

-

COF : Expect Short Term Weakness Before Resumes Upside

Read MoreCapital One Financial Corporation., (COF) operates as the financial services holding company for the Capital One Bank & National Association. Capital One & National Association provides various financial products & services in the US, Canada and UK. It operates through three segments, credit card, consumer banking & commercial banking. It comes under Financial services sector […]

-

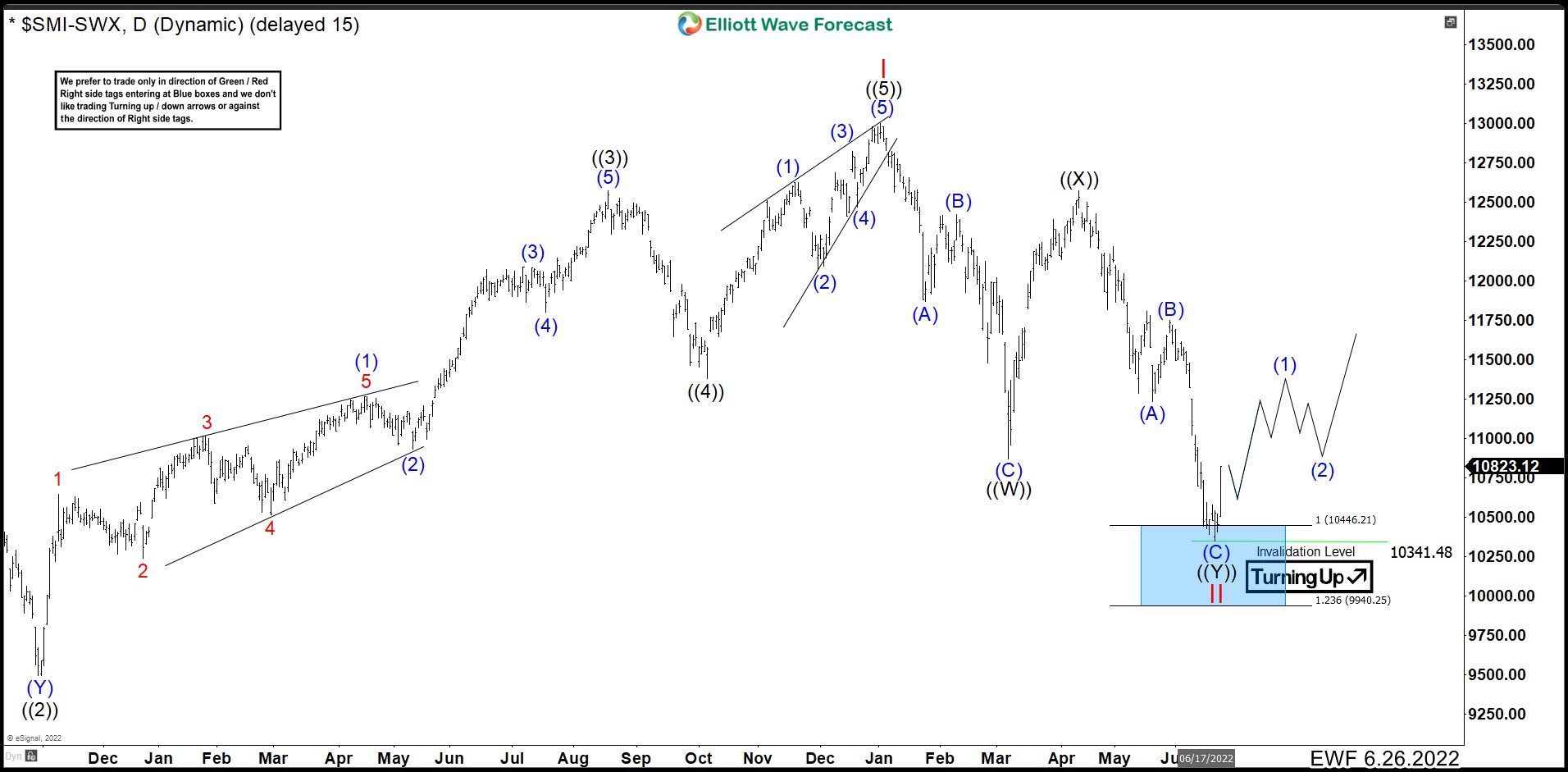

Bull Market Could Have Arrived to Swiss Index (SMI)

Read MoreThe Swiss Market Index (SMI) is one of the other Capital Markets worldwide that was building a motive wave from the lows of March 2020. That impulse we called wave I and we believe correction as wave II could be done already after reach a blue box in Daily chart. SMI October 22nd Daily Chart […]

-

10 Best Fintech Stocks to Buy in 2024

Read MoreWhat is Fintech? The word Fintech comprises of two words: “Fin” and “Tech”. It refers to Financial Technology. Financial Technology is an emerging technology within traditional financial services. It is an advanced technology that provides various type of software that is used for financial product and services. By using the stock signals, you can avoid hours of […]

-

Elliott Wave View: Further Downside in Nasdaq

Read MoreNasdaq is correcting cycle from 6/3/2022 before the next leg lower. This article and video look at the Elliott Wave path of the Index.