The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Elliott Wave View: Exxon Mobil (XOM) Should See Further Downside

Read MoreExxon Mobil (XOM) shows incomplete bearish sequence from 6.8.2022 high looking for more downside. This article and video look at the Elliott Wave path.

-

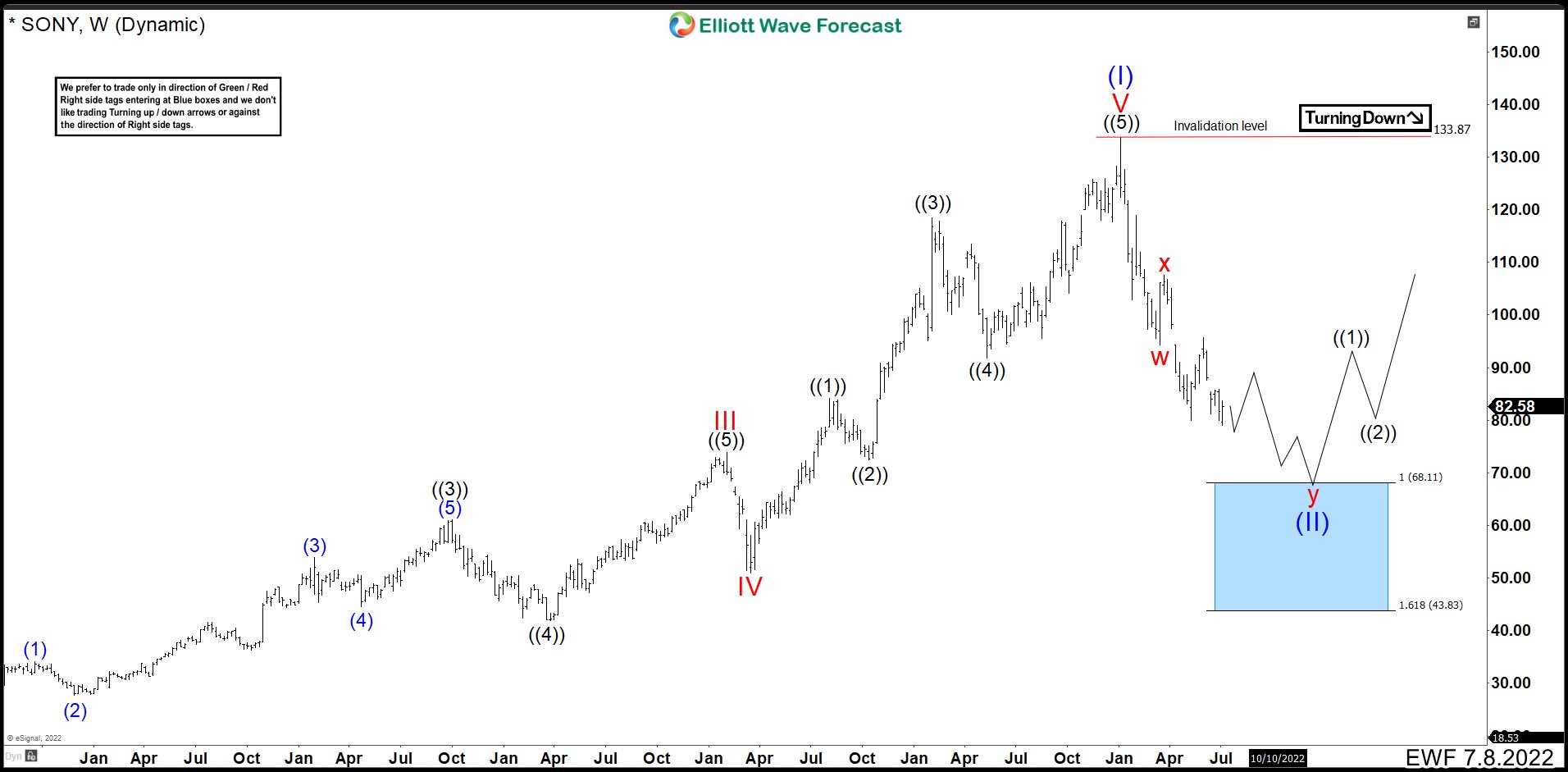

SONY Must Be Further Bearish In This Year, But How?

Read MoreSony Group Corporation, commonly known as Sony and stylized as SONY, is a Japanese multinational conglomerate corporation headquartered in Kōnan, Minato, Tokyo, Japan. As a major technology company, it operates as one of the world’s largest manufacturers of consumer and professional electronic products, the largest video game console company and the largest video game publisher. […]

-

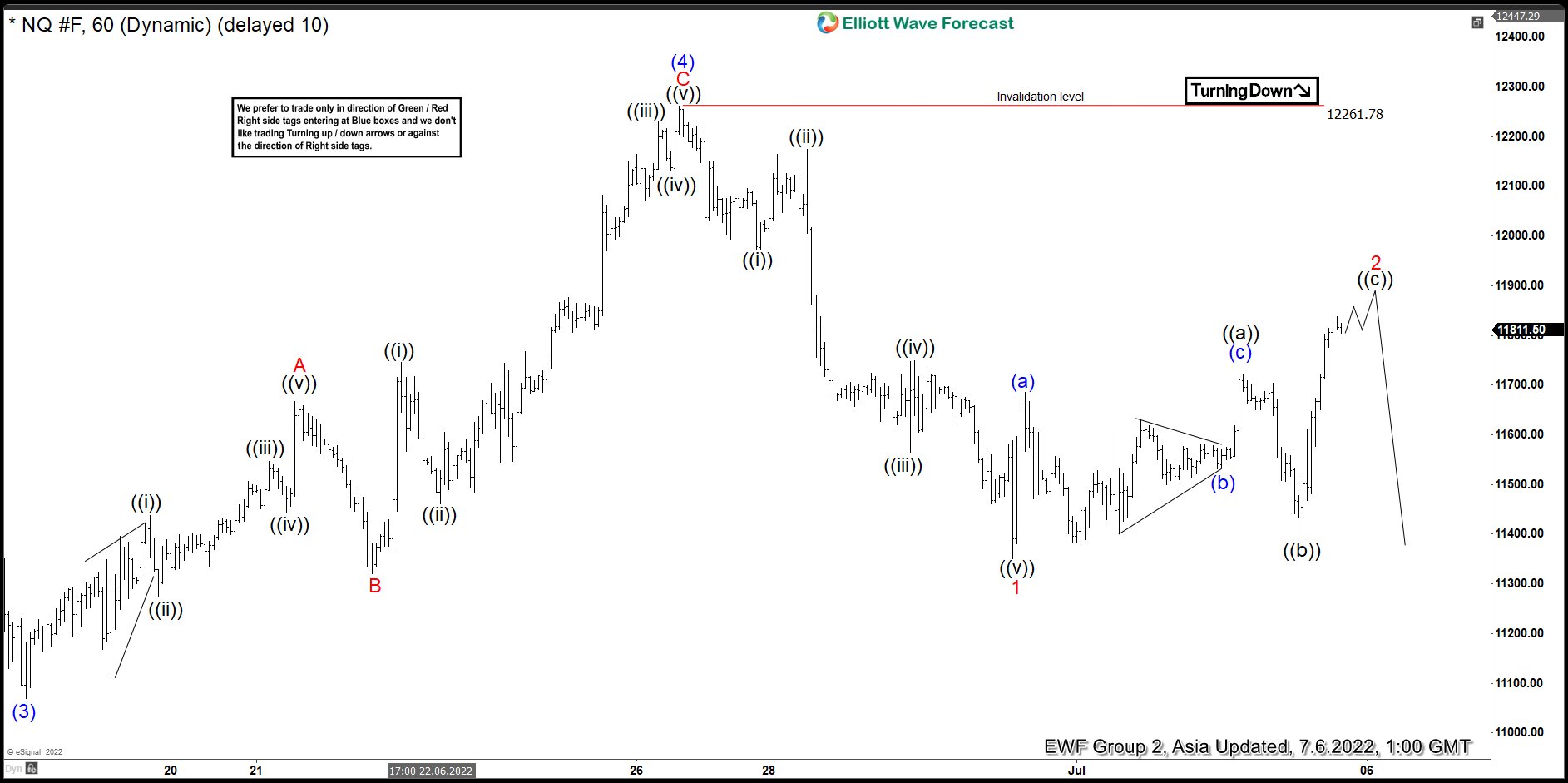

Elliott Wave View: Nasdaq Rally Remains Corrective

Read MoreShort term Elliott Wave view in Nasdaq suggests the decline to 11068.5 ended wave (3). Wave (4) corrective rally ended at 12261.78 with internal subdivision as a zigzag Elliott Wave structure. Up from wave (3), wave A ended at 11678.25 and pullback in wave B ended at 11320.50. Final leg higher wave C ended at […]

-

Best Hydrogen Stocks to Watch in 2024

Read MoreWhat are Hydrogen Stocks? Hydrogen stocks are companies focusing on the production of hydrogen fuel cells. These companies primarily include those that produce hydrogen fuel cells, although many also sell hydrogen gas and alternative energy production equipment. Hydrogen is the most abundant element on earth. But it does not exist as a gas. Therefore, it […]

-

NTR : Favors Short Term Weakness Before Turning Higher

Read MoreNutrien Ltd., (NTR) provides crop inputs & services. It offers potash, nitrogen, phosphate & sulphate products, & financial solutions. The company also distribute through approximately 2000 retails locations in US, Canada, South America & Australia. It is based in Canada, comes under Basic Materials sector & trades as “NTR” ticker at NYSE. NTR started impulse […]

-

EMN – Favors Flat Correction Before Turning Higher

Read MoreEastman Chemical Company (EMN) operates as specialty materials company globally. It serves transportation, personal care, wellness, food, feed, agriculture, building & construction, water treatment, energy, consumables, durables & electronic markets. It is based in Kingsport, Tennessee, US, comes under Basic Materials sector & trades as “EMN” ticker at NYSE. EMN favors a flat correction since […]