The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Elliott Wave View: Russell 2000 (RTY) Likely See Further Upside

Read MoreRussell (RTY) rally from June 17 low is impulsive and looking for more upside. This article and video look at the Elliottwave path.

-

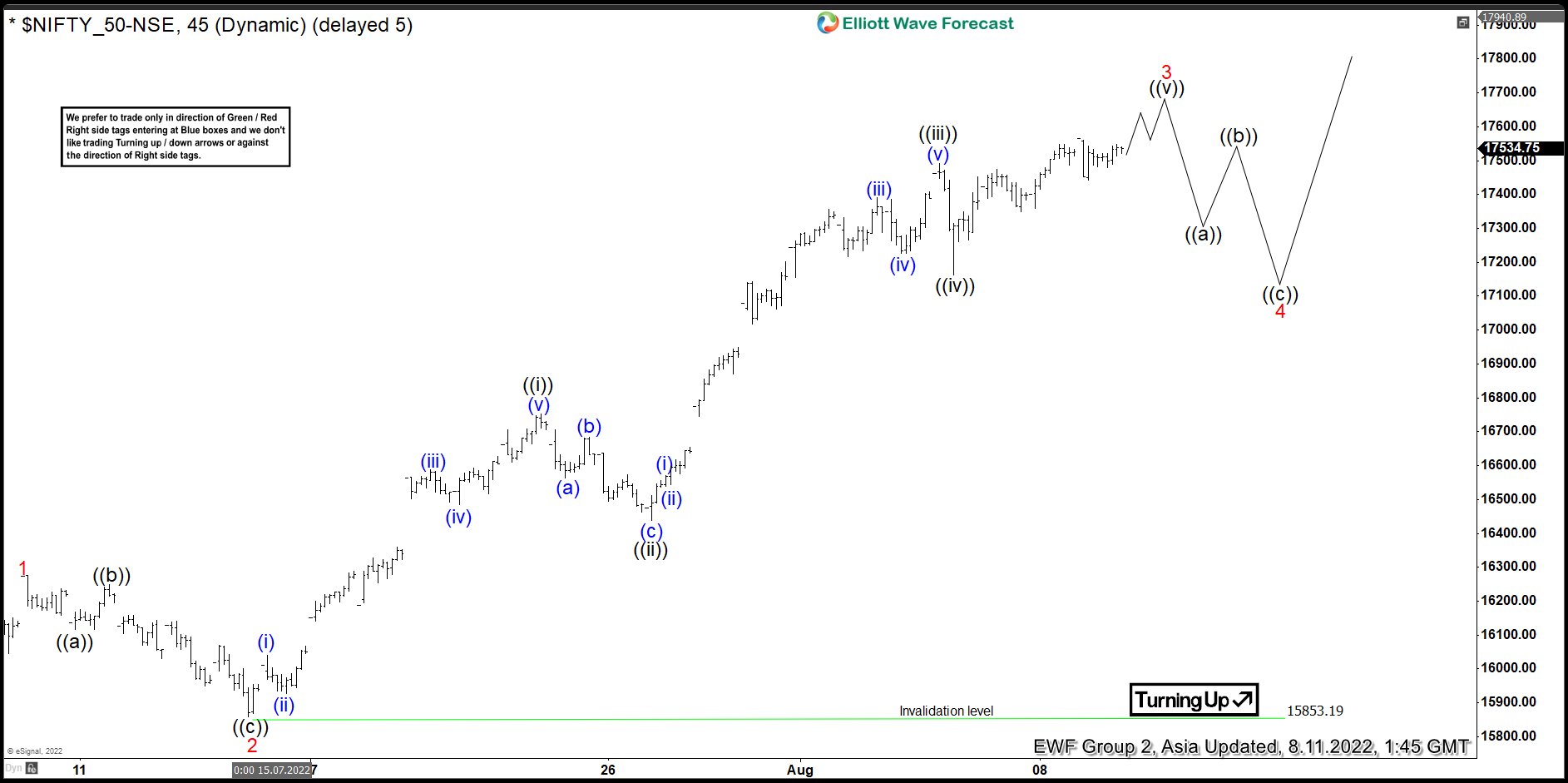

Elliott Wave View: Nifty Near Term Rally Should Extend

Read MoreNifty shows an impulsive rally from 6.17.2022 low and likely to see further upside. This article and video look at the Elliott Wave path.

-

Has Uber Technologies Inc.($UBER) Bottomed and Ready to Rally?

Read MoreGood day Traders and Investors. In today’s article, we are going to take a look at the Elliott Wave path in Uber Technologies Inc. ($UBER). Uber Technologies, Inc. ($UBER) is an American mobility service provider, allowing users to book a car and driver to transport them in a way similar to a taxi. It is based in San Francisco with operations in […]

-

CRWD Can Still See The Extreme From November 2021 Peak

Read MoreCrowdStrike Holdings, Inc ticker symbol CRWD. provides cybersecurity products and services to stop breaches. It offers cloud-delivered protection across endpoints, cloud workloads, identity, and data. Threat intelligence, managed security services, IT operations management, threat hunting, Zero Trust identity protection, and log management. CrowdStrike serves customers worldwide. In this technical blog, we will be going to […]

-

If You Missed To Buy Palantir ($PLTR) You Have A New Opportunity

Read MorePalantir Technologies (PLTR), Inc. is a holding company, which engages in the development of data integration and software solutions. It operates through the Commercial and Government segments. The Commercial segment offers services to clients in the private sector. The Government segment provides solutions to the United States (US) federal government and non-US governments. The firm […]

-

$RIO : Miner Rio Tinto Provides a Long-Term Opportunity

Read MoreRio Tinto Group is the world’s second largest metals and mining corporation which has its headquarters in London and Melbourne. Founded in 1873 and traded under tickers $RIO at LSE, ASE and also in US in form of ADRs, it is a component of both the FTSE100 and ASX200 indices. In terms of operations, Rio Tinto […]