The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

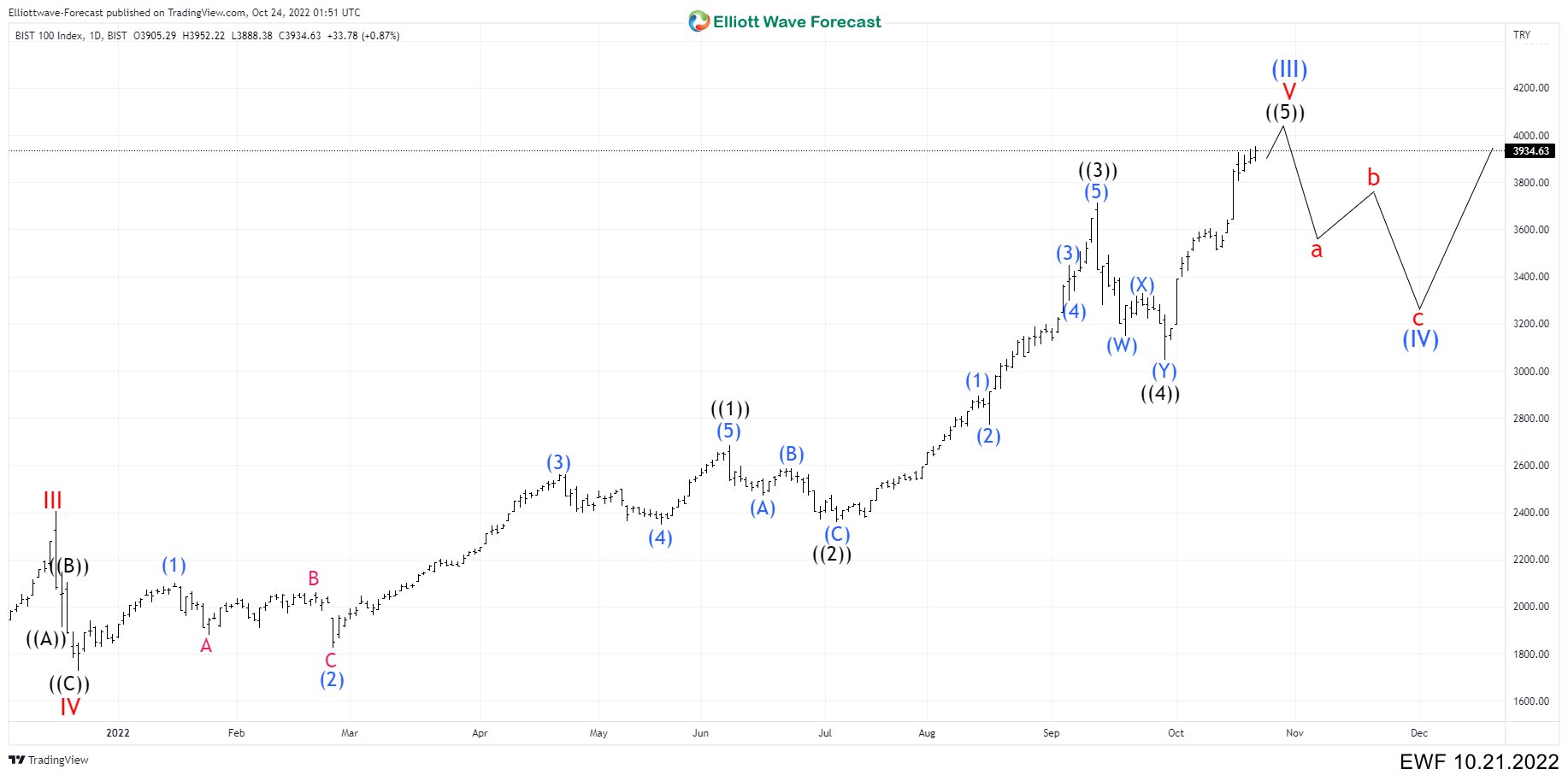

BIST (XU100) May Drop at Any Time To Test Wave ((4)) Again

Read MoreThe Borsa İstanbul (BIST or XU100) is the sole exchange entity of Turkey combining the former Istanbul Stock Exchange (ISE), the Istanbul Gold Exchange and the Derivatives Exchange of Turkey under one umbrella. It was established as an incorporated company with a founding capital of ₺423,234,000 (approx. US$240 million) on 2013 and began to operate […]

-

Bank of America ($BAC) Perfect Reaction Lower from Blue Box Area.

Read MoreGood day Traders and Investors. In today’s article, we will look at the past performance of 4 Hour Elliottwave chart of Bank of America ($BAC). The decline from 08.16.2022 high is unfolding as a 5 swings and made a lower low on 10.13.2022 which created a bearish sequence in the 4H timeframe. Therefore, we knew […]

-

$ERA : Eramet Provides an Opportunity Joining Big Rally

Read MoreEramet is a French multinational mining and metallurgy company. The company produces non-ferrous metals and derivatives, nickel alloys and superalloys, as well as high-performance special steels. Founded in 1880 with the funding of the Rothschild family and headquartered in Paris, today, the company is largely owned by Duval family and the French state. Eramet is […]

-

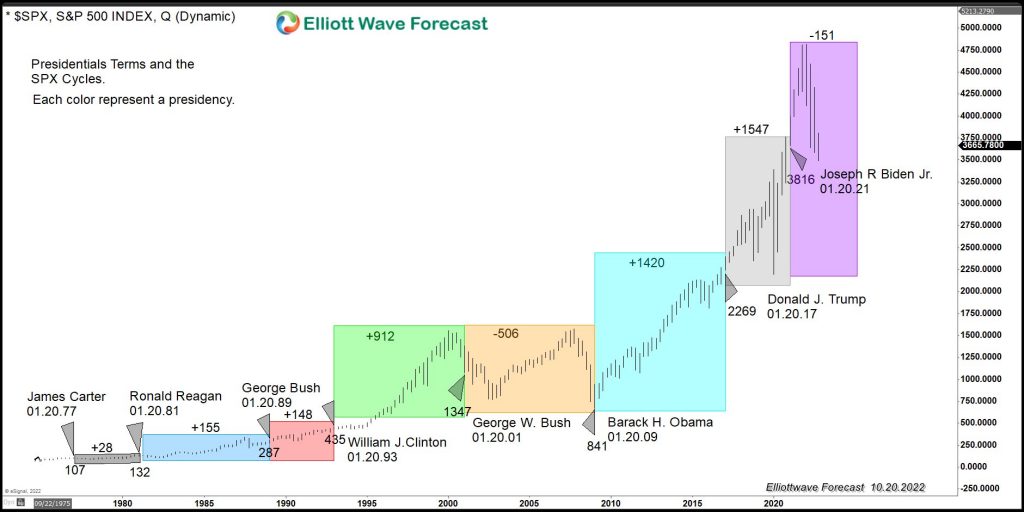

US Presidential Cycles and the SPX Performance

Read MoreA lot has been said and written about both the Democrat and Republican economic plans for a better economy. We believe in free enterprise and limited regulation, allowing humans to create and expand at their own will for the better but there is a vast difference between the two parties regarding the economic agenda. Most […]

-

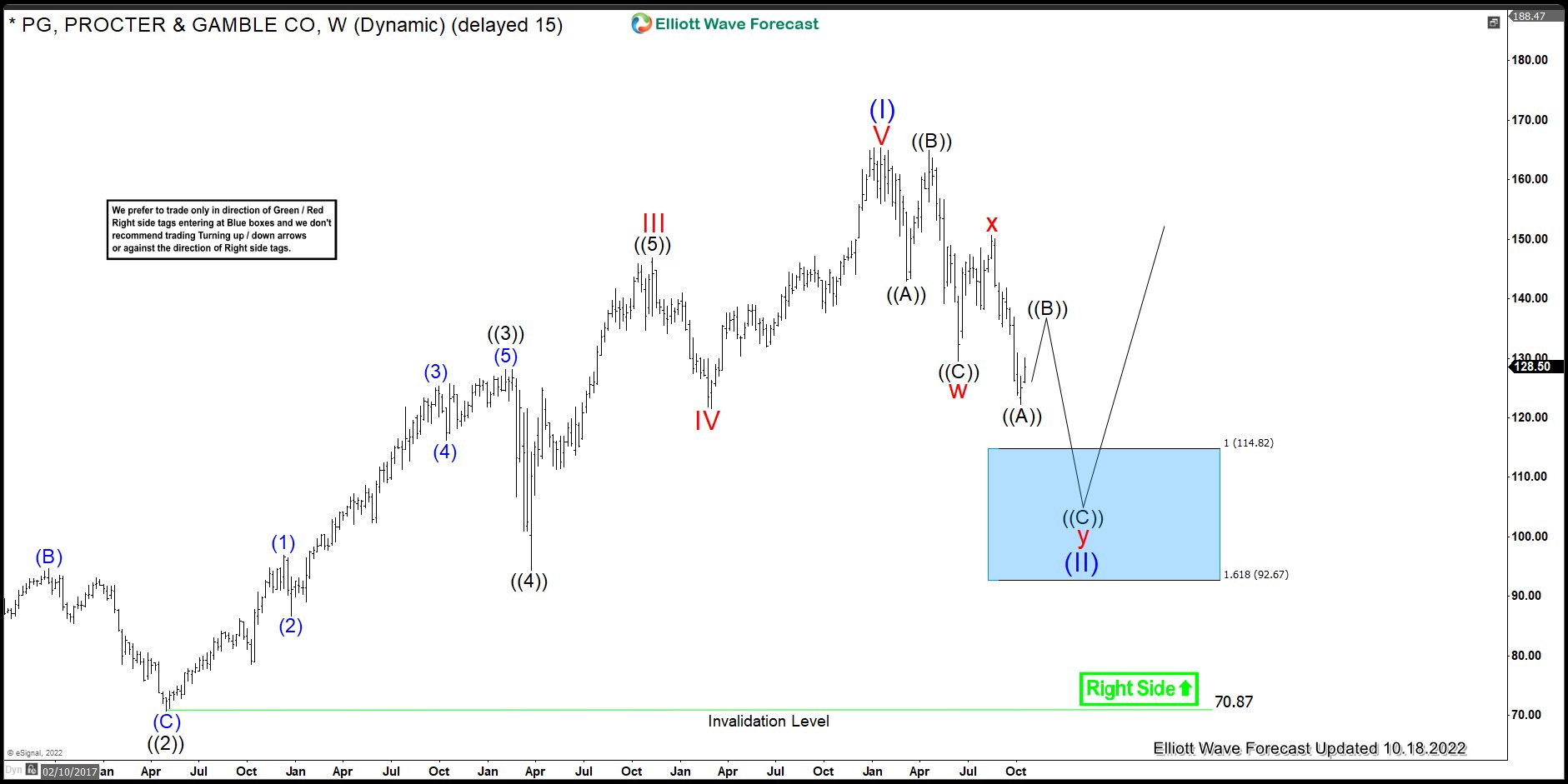

Procter & Gamble ( PG ) Looking To Reach Extreme From The Peak

Read MoreThe Procter & Gamble ticket symbol: PG is a company focused on providing branded consumer packaged goods to consumers across the world. The Company operates through five segments: Beauty, Grooming, Health Care, Fabric & Home Care, and Baby, Feminine & Family Care. The Company sells its products in approximately 180 countries and territories primarily through […]

-

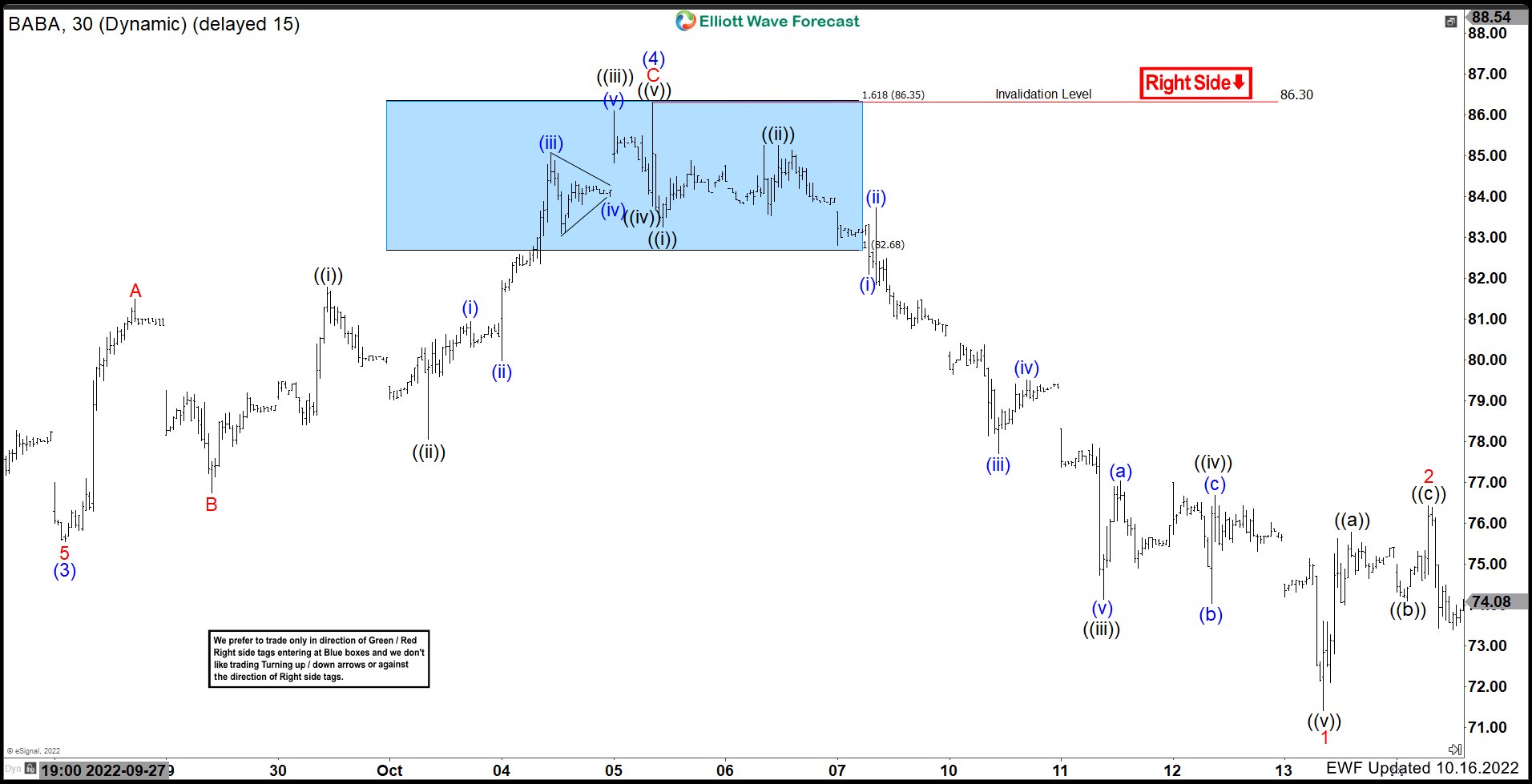

Alibaba ($BABA) Perfect Reaction Lower from Blue Box Area.

Read MoreGood day Traders and Investors. In today’s article, we will look at the past performance of 1 Hour Elliottwave chart of Alibaba ($BABA). The decline from 06.09.2022 high is unfolding as a 5 swings and made a lower low on 09.16.2022 which created a bearish sequence in the 4H timeframe. Therefore, we knew that the […]