The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Gold (XAUUSD) Soars to All-Time Highs: Elliott Wave Outlook and Next Target

Read MoreGold (XAUUSD) continues to break to record higher. This article and video look at the Elliott Wave path for the metal and potential target.

-

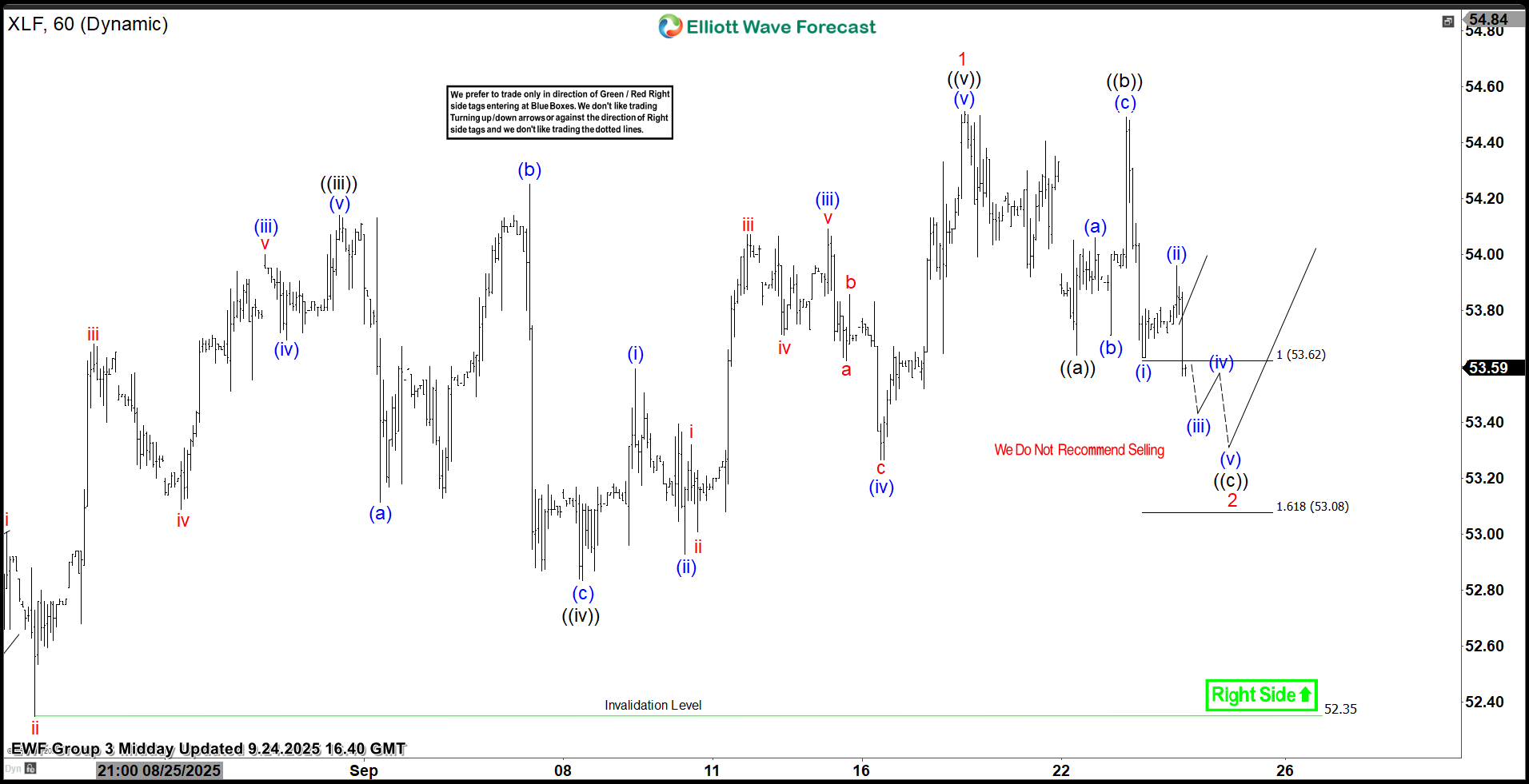

Financial Select Sector $XLF Extreme Areas Offering Buying Opportunities

Read MoreHello everyone! In today’s article, we’ll examine the recent performance of Financial Select Sector ($XLF) through the lens of Elliott Wave Theory. We’ll review how the rally from the August 01, 2025 low unfolded as a 5-wave impulse followed by a 3-swing correction (ABC) and discuss our forecast for the next move. Let’s dive into the structure and expectations for this ETF. […]

-

IREN Ltd Stock Strong Bullish Elliott Wave Breakout

Read MoreIren Ltd, a vertically integrated data center business, is powering the future of Bitcoin and AI with renewable energy. Strategically located across renewable-rich US and Canadian regions, the company has also powered an 850% stock surge since April. This rally decisively shattered previous all-time highs in September, confirming a powerful bullish regime. Today, we dissect […]

-

Gold Miners Junior (GDXJ) Strong Nesting Impulse in Progress

Read MoreThe GDXJ (VanEck Junior Gold Miners ETF) tracks a market-cap-weighted index of global junior gold and silver mining companies, offering investors exposure to smaller, high-growth potential firms in the precious metals sector. Recent Elliott Wave analysis suggests GDXJ is in a bullish phase, with the monthly chart indicating a grand super cycle wave ((II)) low […]

-

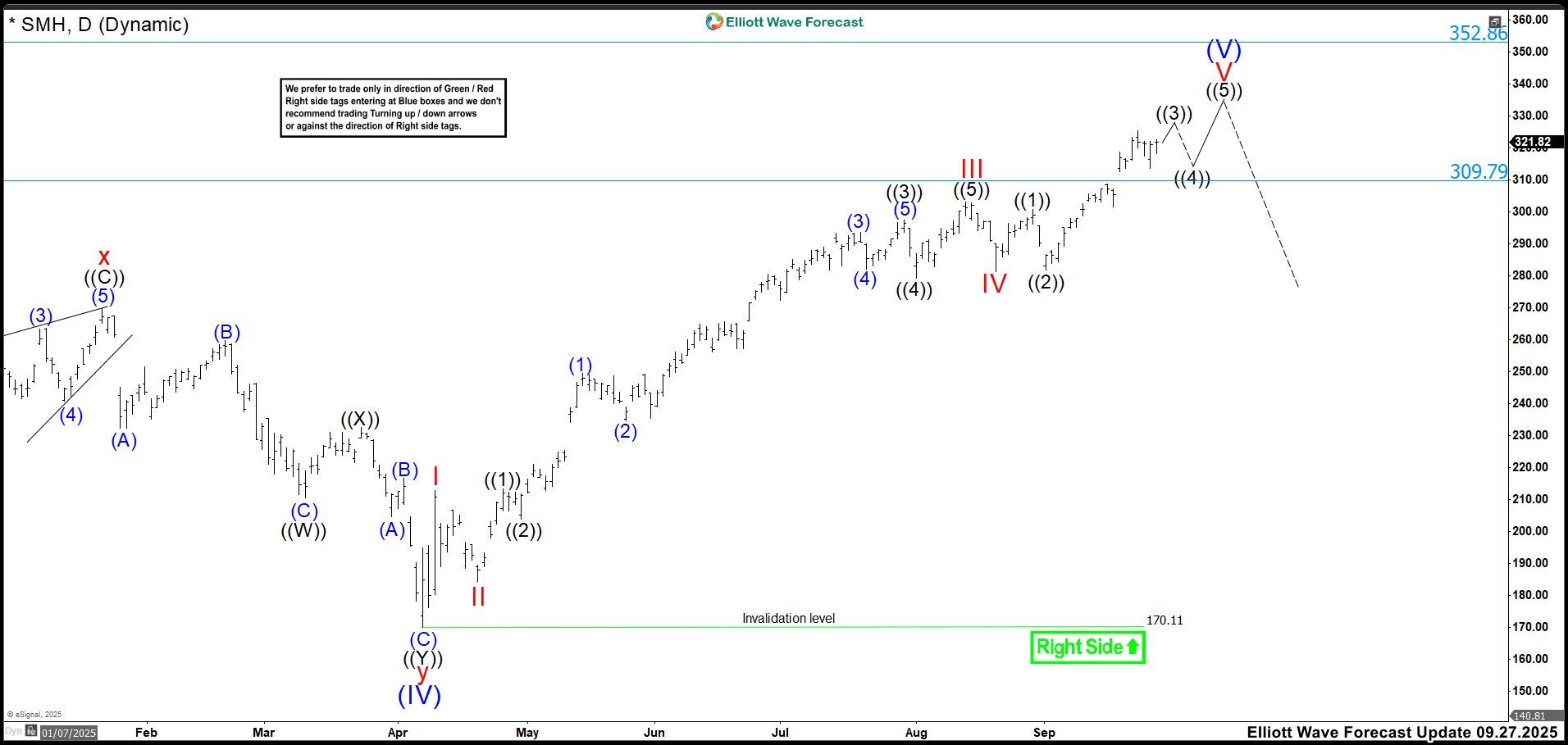

Extreme SMH Zone: Hold Tight or Take Profits?

Read MoreThe VanEck Semiconductor ETF (SMH) trades within the forecasted extreme zone of 309.83 to 353.03, showing signs of technical overheating. Analysts expect an average 12-month price target of 343.93, with bullish projections reaching up to 451.50. Strong demand for semiconductors—driven by AI, electric vehicles, and cloud infrastructure—continues to push momentum. All major moving averages, from […]

-

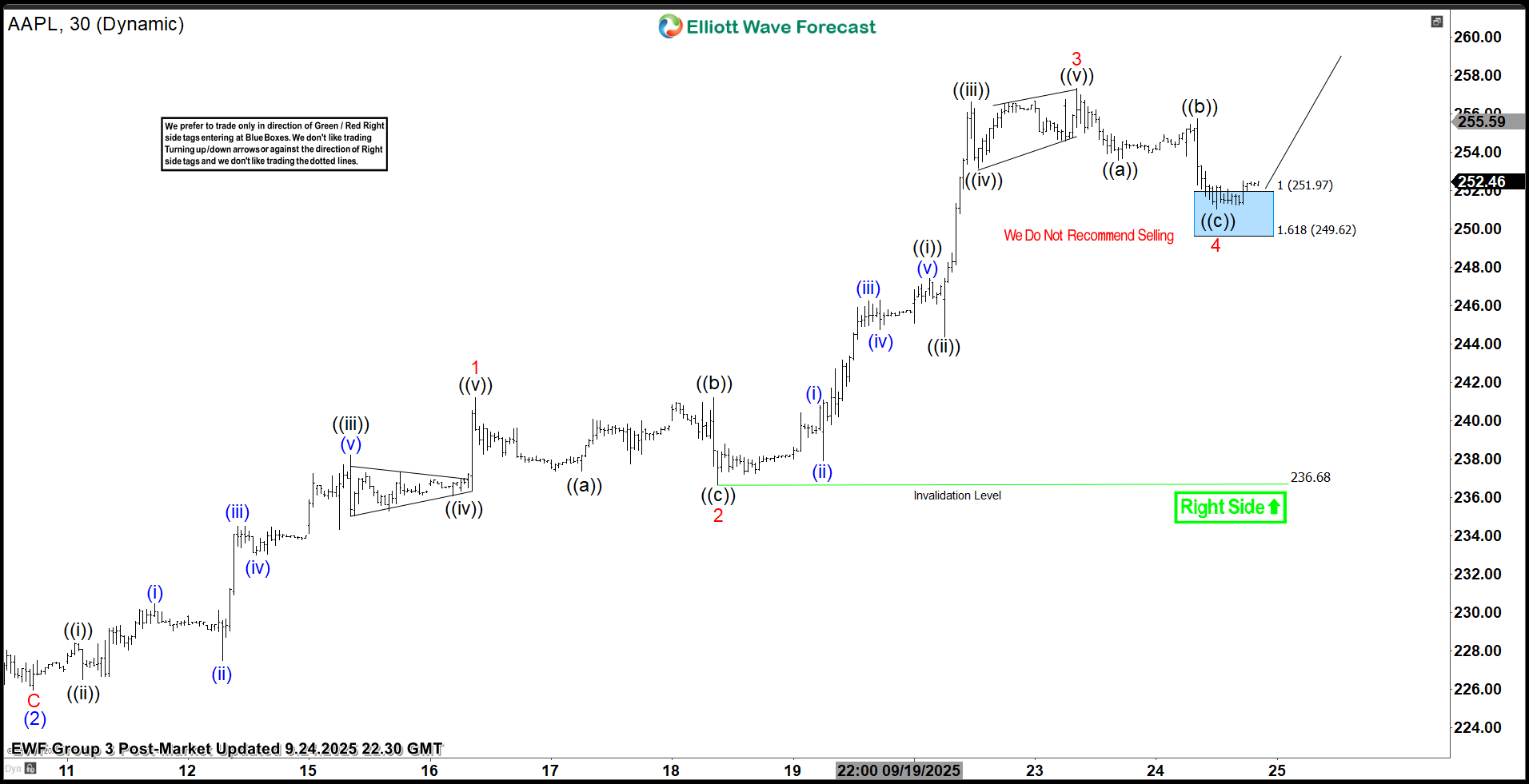

Apple (AAPL) Targets Higher to Finish Wave 5

Read MoreApple (AAPL) is looking to extend higher to complete wave 5. This article and video look at the Elliott Wave path for the stock.