The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

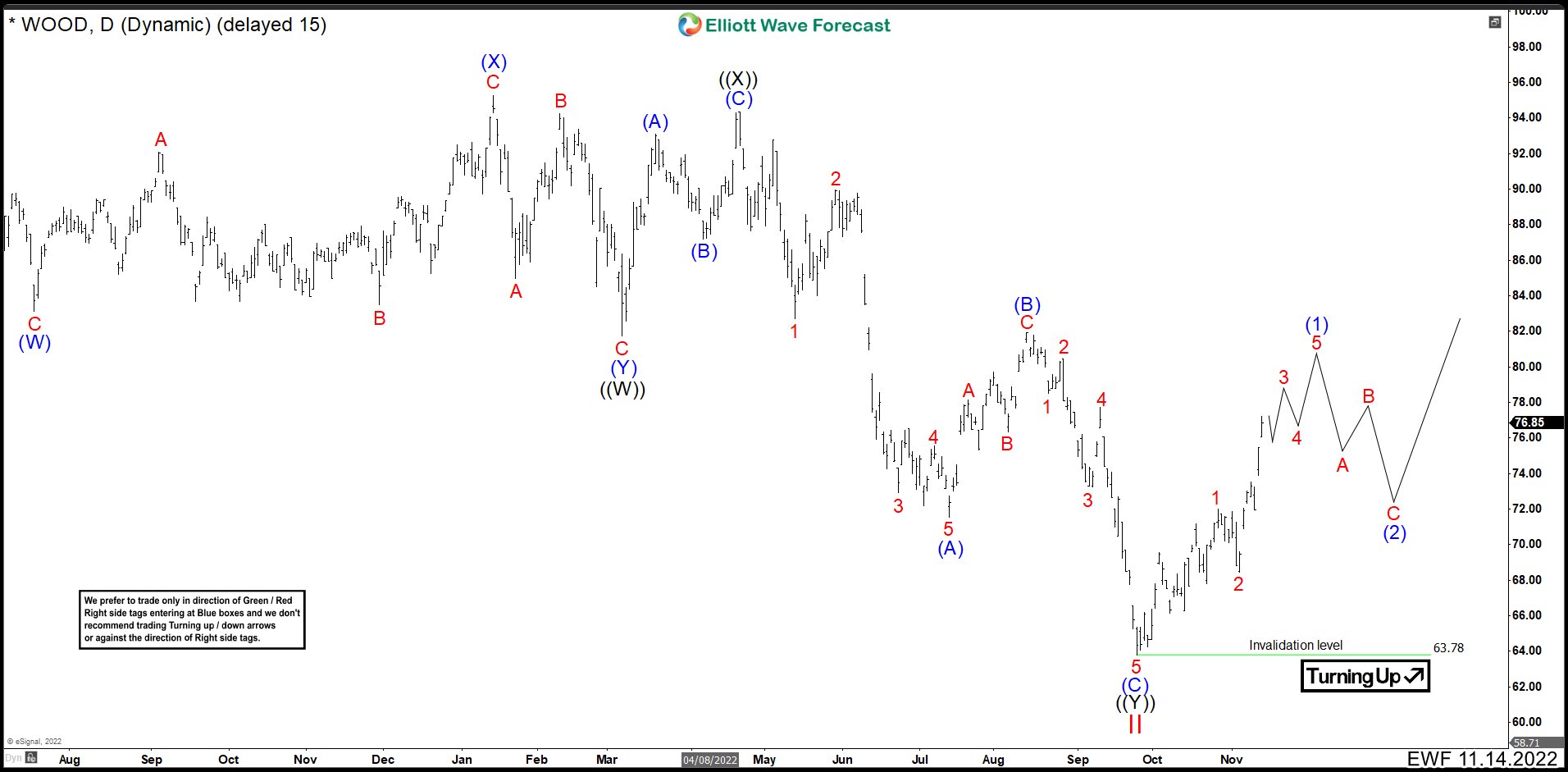

The Price Of Wood Could Already Have Started To Rise

Read MoreWOOD tracks the S&P Global Timber & Forestry Index, a cap-weighted index of the 25 largest forestry firms around the world. The fund starts with all the eligible securities from the S&P Global BMI that are classified under agriculture, forestry, homebuilding, and paper industry. ETF WOOD Daily Chart ETF WOOD ended an uptrend cycle in […]

-

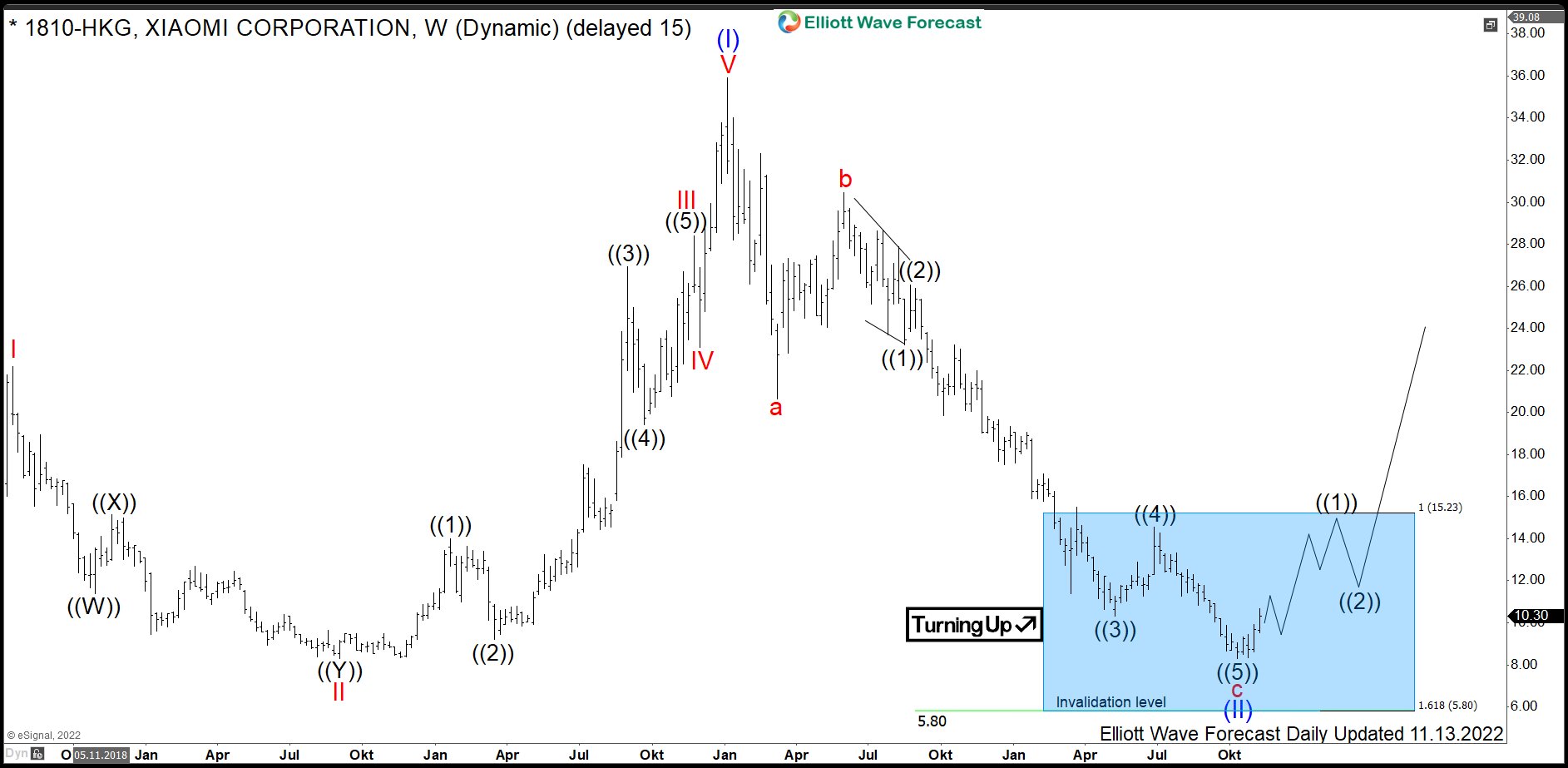

$1810: Electronics Giant Xiaomi Trading in Buying Area

Read MoreXiaomi Inc. is a Chinese designer and manufacturer of consumer electronics and software. Behind only Samsung and since 2021 surpassing Apple, it is the second largest manufacturer of the smartphones in the world. Most of them run the MIUI operating system. It is also a major manufacturer of appliances including televisions, smartwatches, flashlights, unmanned aerial […]

-

Elliott Wave View: Apple (AAPL) Rally as a Flat

Read MoreApple (AAPL) is correcting cycle from 10.28.2022 high as a flat. This article and video look at the Elliott Wave path for the stock.

-

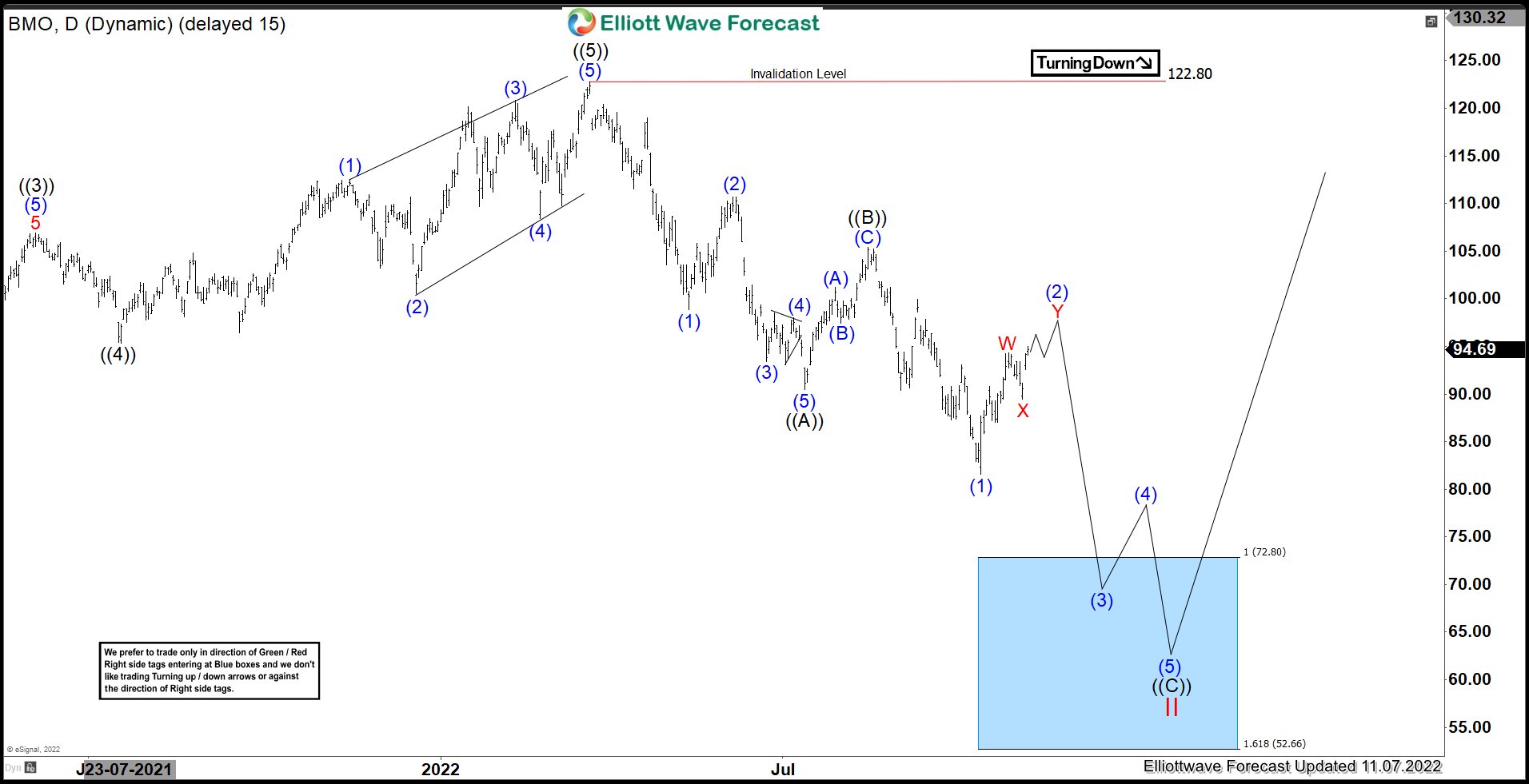

BMO – Expect Correcting Lower Towards Support Zone

Read MoreBank of Montreal (BMO) provides diversified financial services primarily in North America. The company’s personal banking products & services include checking & savings accounts, credit cards, mortgages, financial & investment advice services & commercial banking products & services. It is based in Montreal, Canada, comes under Financial services sector & trades as “BMO” at NYSE. […]

-

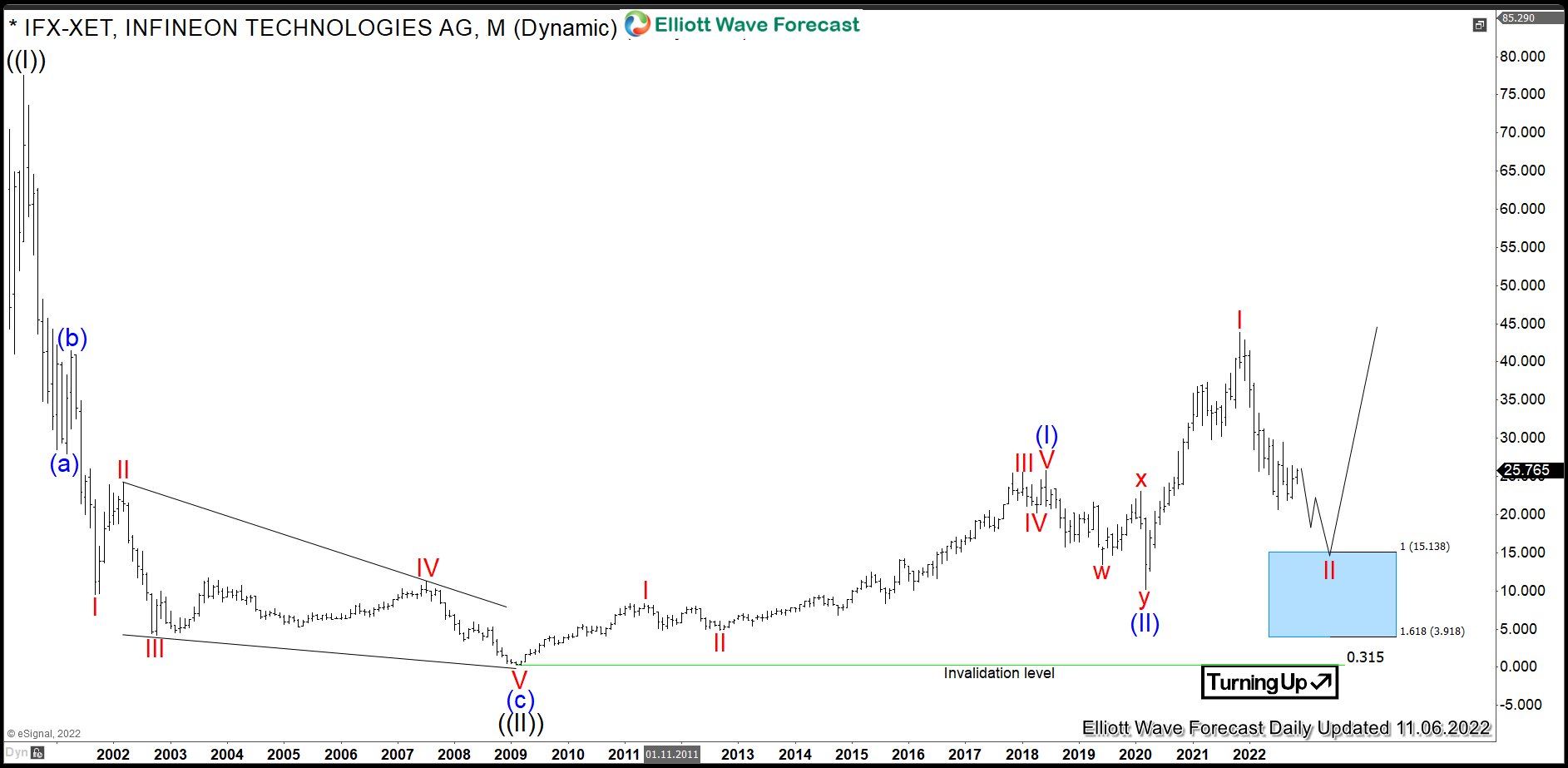

$IFX: Infineon Technologies Provides an Opportunity in a Pullback

Read MoreInfineon Technologies AG is a German semiconductor manufacturing corporation. It has been founded 1999 as a spin-off from Siemens AG and the headquarteres of the company are in Neubiberg, Germany. Today, Infineon belongs to the DAX index and one can trade it under the ticker $IFX at Frankfurt Stock Exchange. The company is the world leader in automotive […]

-

Nike Inc. ($NKE) Perfect Reaction Lower from Blue Box Area.

Read MoreGood day Traders and Investors. In today’s article, we will look at the past performance of 4 Hour Elliottwave chart of Nike Inc. ($NKE). The decline from 08.16.2022 high unfolded as 5 swings which created a bearish sequence in the 4H timeframe. Therefore, we knew that the structure in $NKE is incomplete to the downside […]