The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

SPX ( S&P500) Elliott Wave View : Forecasting The Path

Read MoreHello fellow traders. In this article we’re going to take a quick look at the Elliott Wave charts of SPX ( S&P500) , published in members area of the website. As our members know SPX is showing higher high sequences in the short term cycle from the October 13th low. The index is looking for […]

-

RRR : Should It Be Ready For Next Rally ?

Read MoreRed Rock Resorts Inc., (RRR) develops & operates casino & entertainment properties in the US. It operates through two segments, Las Vegas Operations & Native American Management. It is based in Las Vegas, comes under Consumer Cyclical sector & trades as “RRR” ticker at Nasdaq. As discussed in previous blog, RRR finished wave I at […]

-

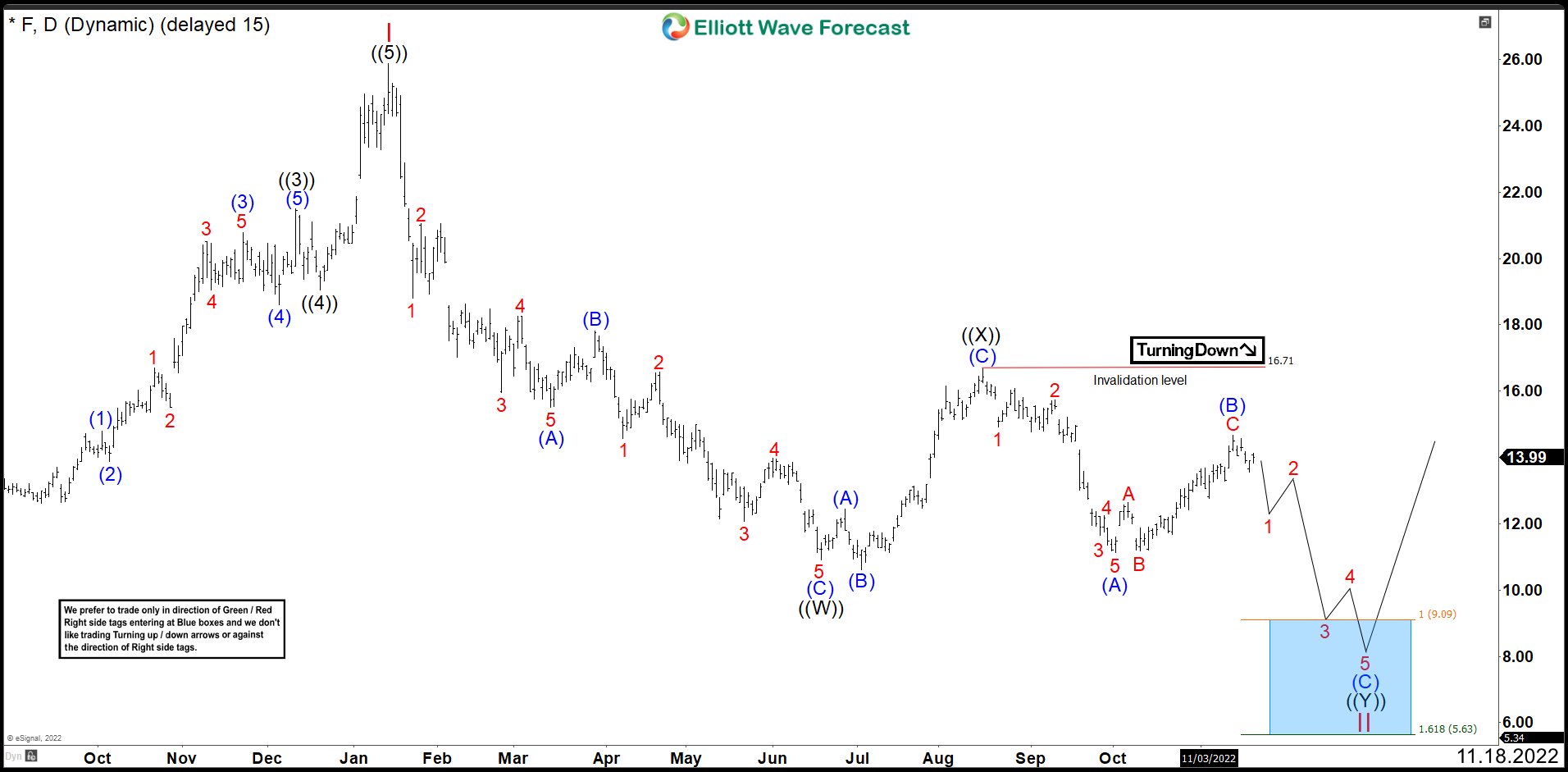

FORD (F) Is Entering in a Double Correction And Needs More Downside

Read MoreFord Motor Company is an American multinational automobile manufacturer headquartered in Dearborn, Michigan, United States. It was founded by Henry Ford and incorporated on June 16, 1903. The company sells automobiles and commercial vehicles under the Ford brand, and luxury cars under its Lincoln luxury brand. FORD July Daily Chart Last July, we showed that Ford (F) ended the bullish cycle from March 2020 at 25.86 […]

-

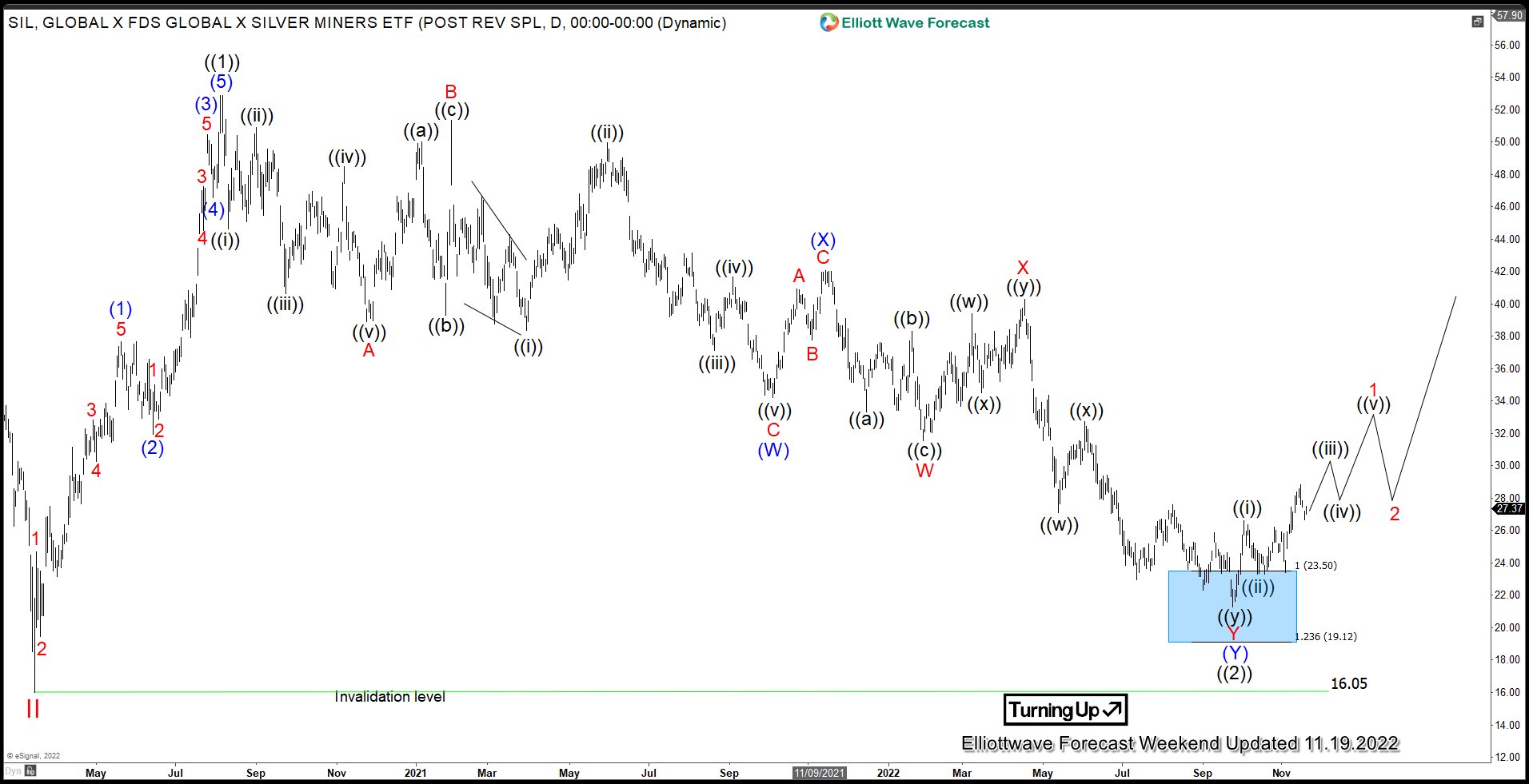

Elliott Wave View: SIL (Silver Miners) May Have Bottomed

Read MoreSilver Miners ETF (SIL) may have ended the correction to the cycle from March 2020 low. The correction took the form of a double as the chart below shows: A double three is labelled as WXY. The first leg wave W and the third leg Y both subdivide into 3 corrective waves. The subdivision of […]

-

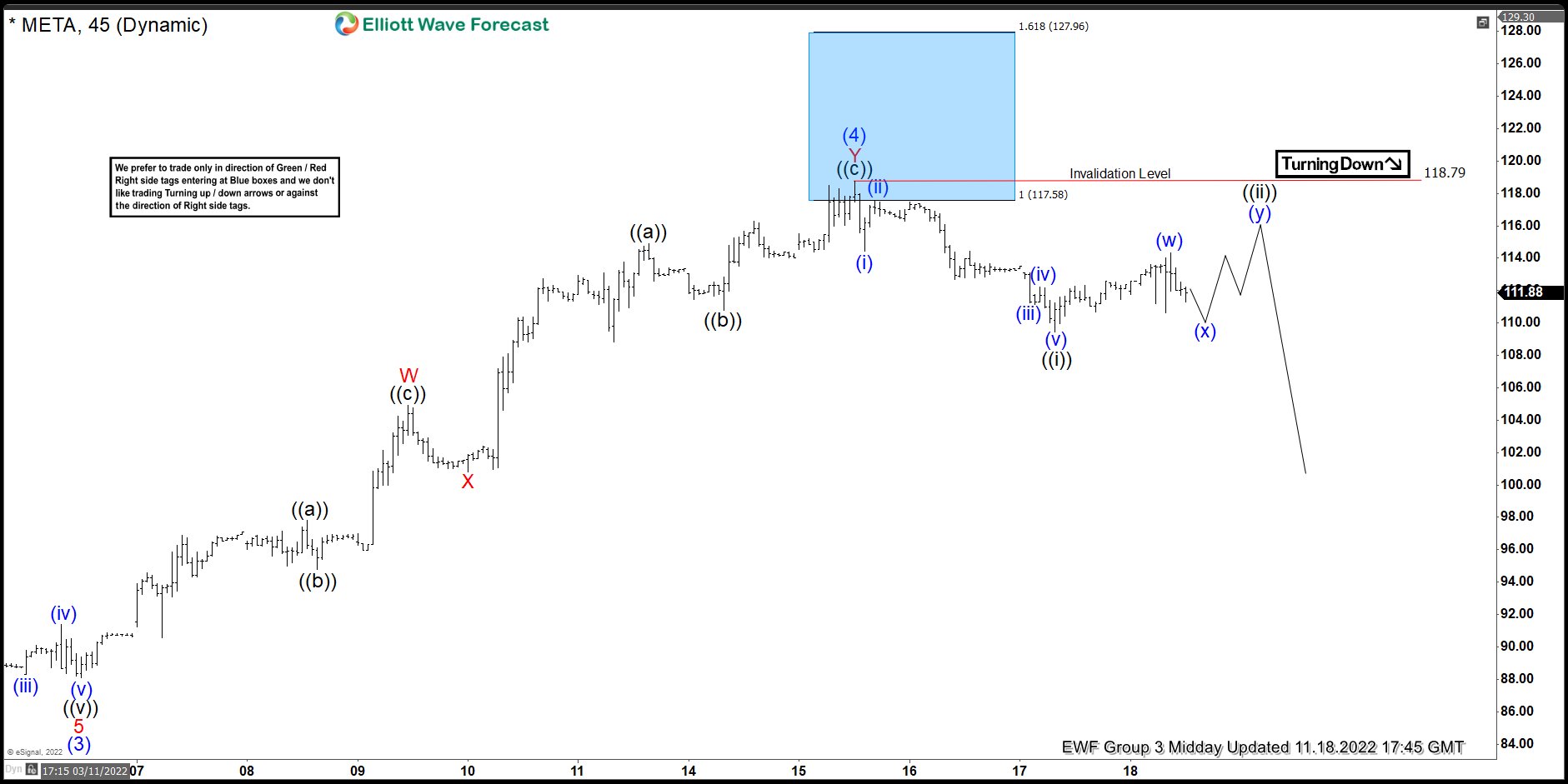

Meta Platforms, Inc. ($META) Provides Another Opportunity from Blue Box area.

Read MoreGood day Traders and Investors. In today’s article, we will look at the past performance of 1 Hour Elliottwave chart of Meta Platforms, Inc. ($META). The decline from 10.26.2022 high unfolded as 5 swings making a lower low within the 4H cycle from August 2022 peak which created a bearish sequence in the 1H timeframe. Therefore, we […]

-

10 Best Nuclear Energy Stocks to Buy Now

Read MoreThe energy crisis of 2021 left the whole economy shaken as market players saw a spike in oil prices. And with it followed an immediate rise in the value of energy stocks. Moreover, Russia’s invasion of Ukraine and the exclusion of energy from sanctions made all the European countries recognize the huge dependence on natural […]