The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Elliott Wave Projects Further Downside in DAX

Read MoreDAX is correcting cycle from 9.28.2022 low and the Index can see further downside. This article and video look at the Elliott Wave path.

-

Best Metal Stocks to Buy Now

Read MoreInvesting in metals, like gold or silver, is a good choice not only because it will always be considered valuable, but because it also helps to protect your other investments. Metal stocks are shares in companies that explore for, mine, and refine metals such as copper, nickel, and zinc. Some metal stocks are unique because […]

-

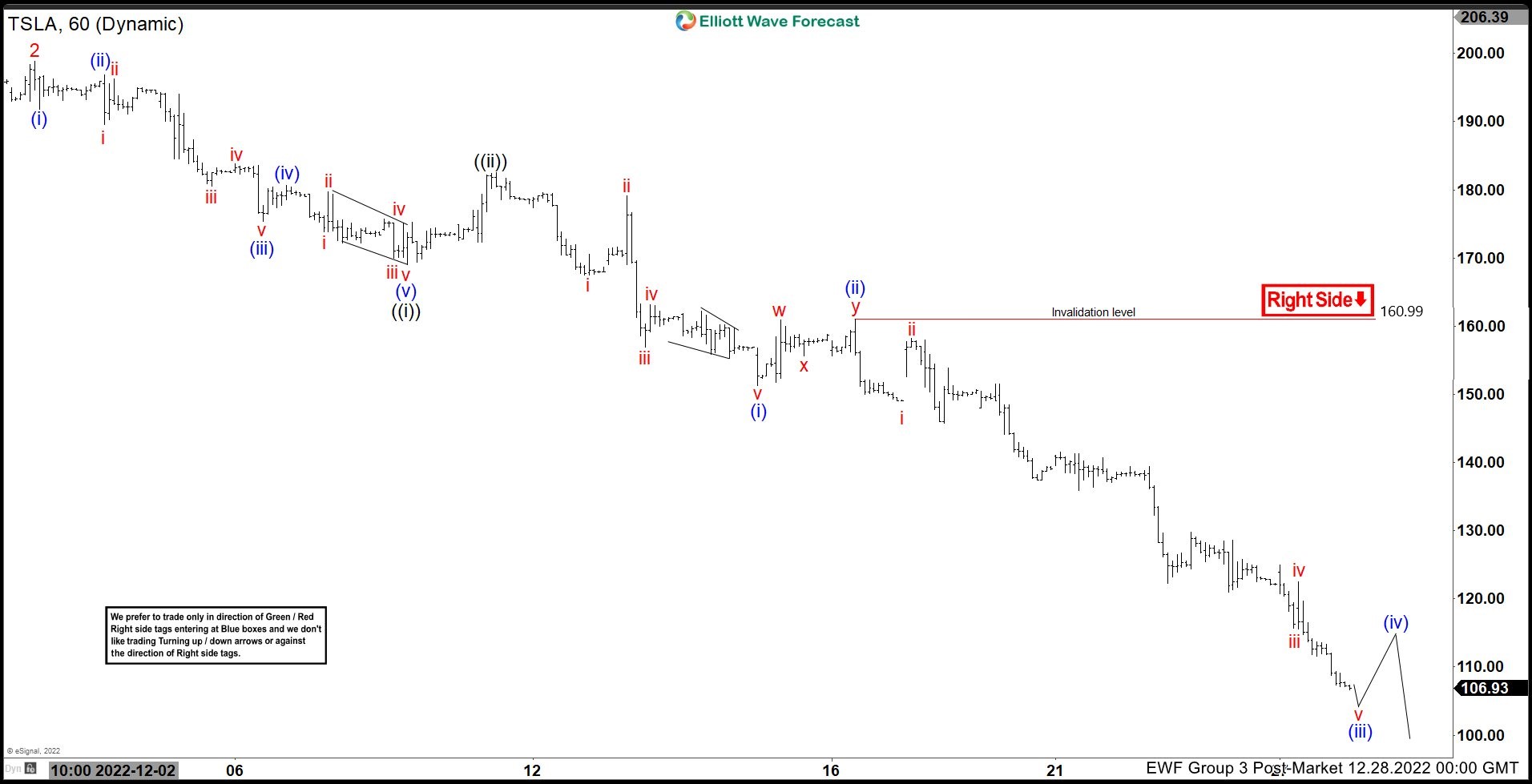

What Elliott Wave Say About How Low Tesla (TSLA) Can Go

Read MoreTesla (TSLA) declines in impulsive structure. This article and video look at the short term Elliott Wave path as well as finding the support zone.

-

Microsoft Elliott Wave Sequence Favors Extension Lower

Read MoreMicrosoft Corporation is an American multinational technology corporation producing computer software, consumer electronics, personal computers, and related services headquartered at the Microsoft Redmond campus located in Redmond, Washington and listed on NASDAQ stock exchange with the ticker symbol (MSFT). The series of rate hikes by the Fed has provided a challenge for the World Indices […]

-

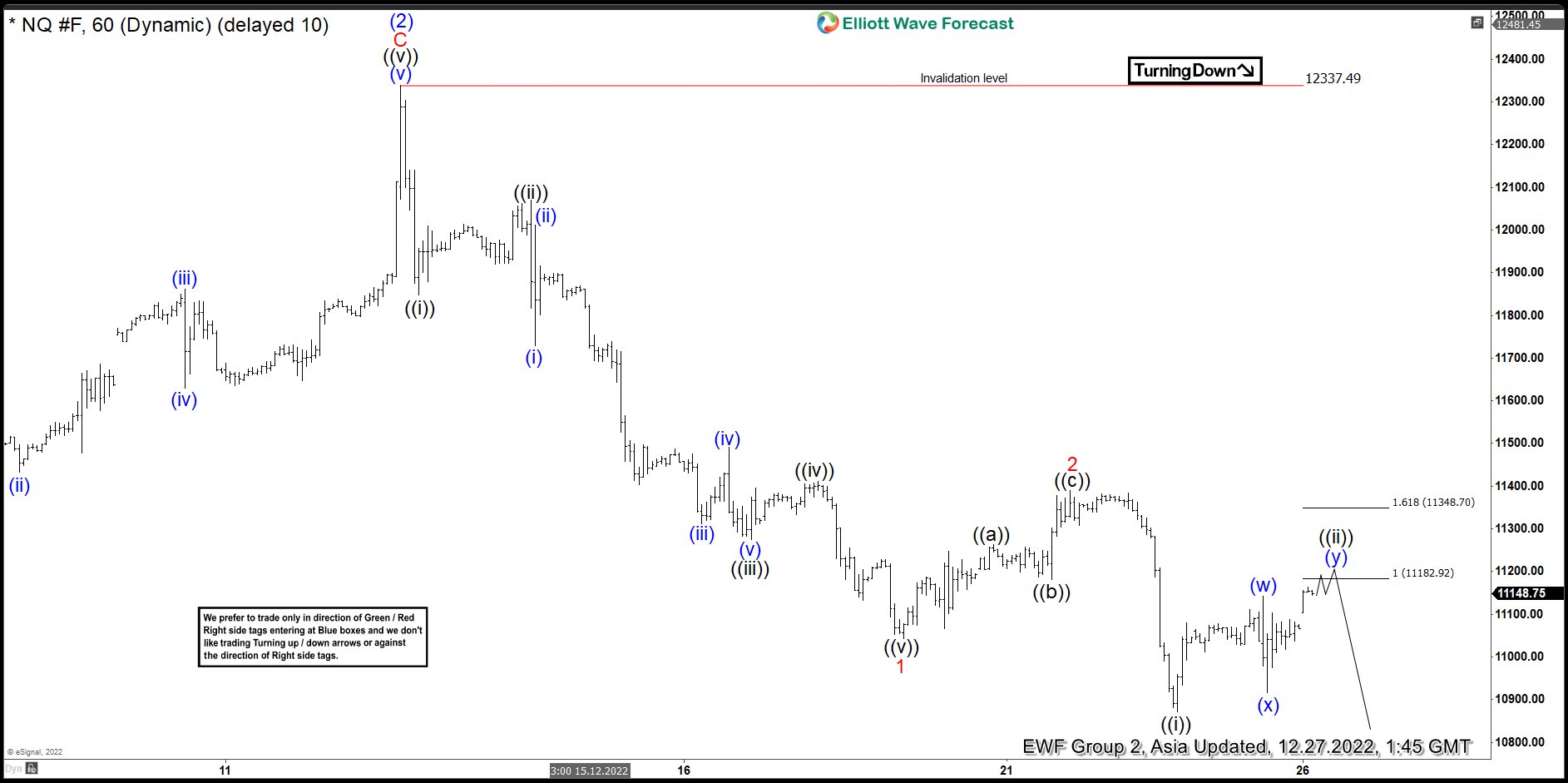

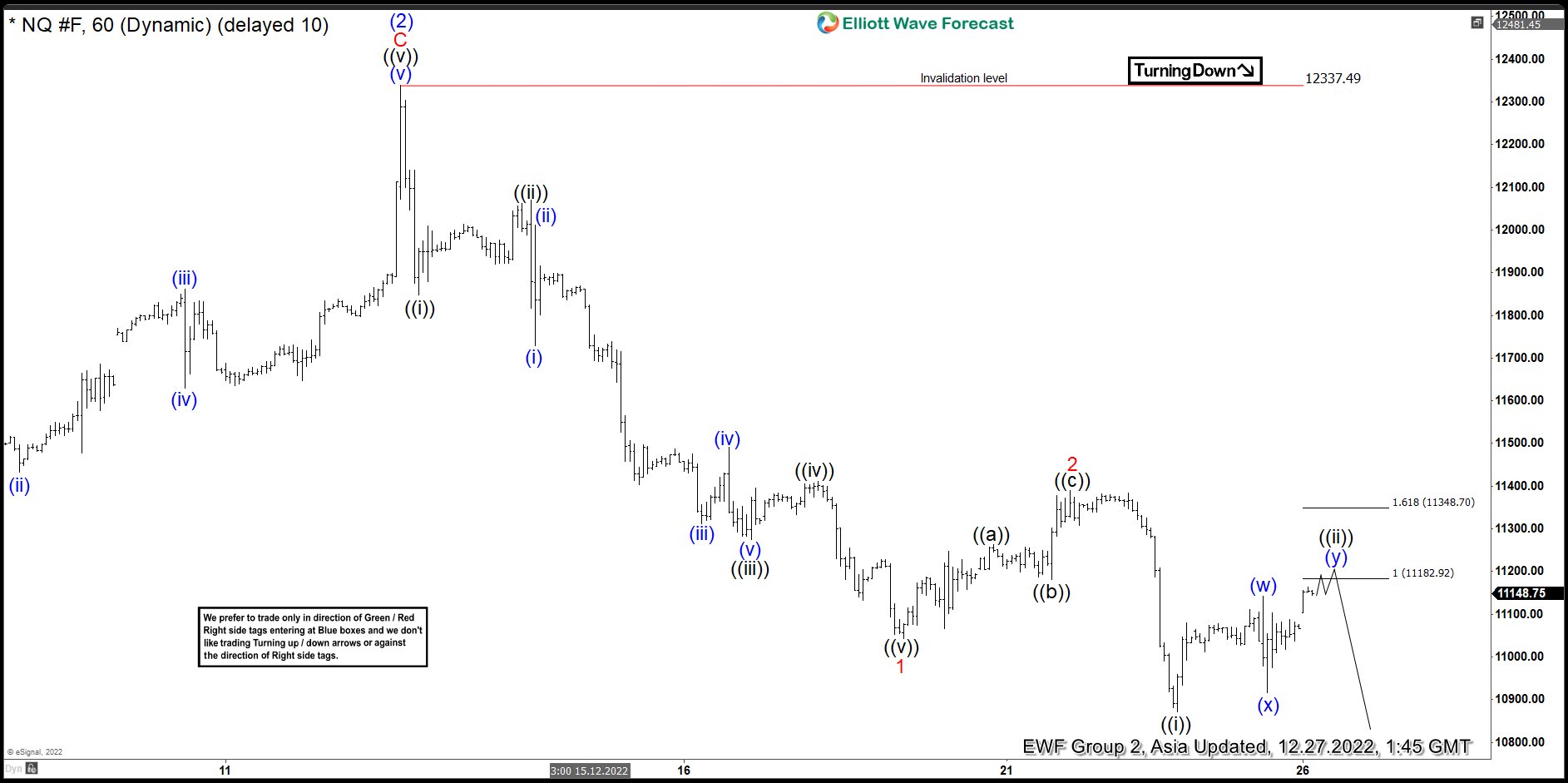

NASDAQ Reacting Lower From Elliott Wave Equal Legs Area

Read MoreIn this technical blog, we will look at the past performance of the 1-hour Elliott Wave Charts of NASDAQ ticker symbol: $NQ_F. In which, the decline from 13 December 2022 high ended 5 waves in an impulse sequence and showed a lower low sequence in a lower time frame charts. Therefore, we knew that the […]

-

Elliott Wave Forecasts Rally in Nasdaq (NQ) to Fail for Further Downside

Read MoreNasdaq (NQ) rally likely fails in 3, 7, 11 swing for further downside against 12.13.2022 high. This article and video look at the Elliott Wave path.