The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Uranium ETF (URA) Starts the Next Leg Higher

Read MoreUranium ETF (ticker: URA) spent the entire 2002 doing correction but this year it is ready to resume higher. This ETF invests in Uranium as well as several mining companies. With many countries looking for alternatives to fossil fuel, Uranium presents a viable alternative. Last year, there was a flurry of news about different countries […]

-

Elliott Wave Suggests FTSE Should Extend Higher

Read MoreFTSE shows bullish sequence from 10.13.2022 low favoring more upside. This article and video look at the Elliott Wave path for FTSE.

-

DAX Looking to End 5 Waves Elliott Wave Impulse

Read MoreDAX rallies as a 5 waves impulse structure from 12.20.2022 low. This article and video look at the Elliott Wave path for the Index.

-

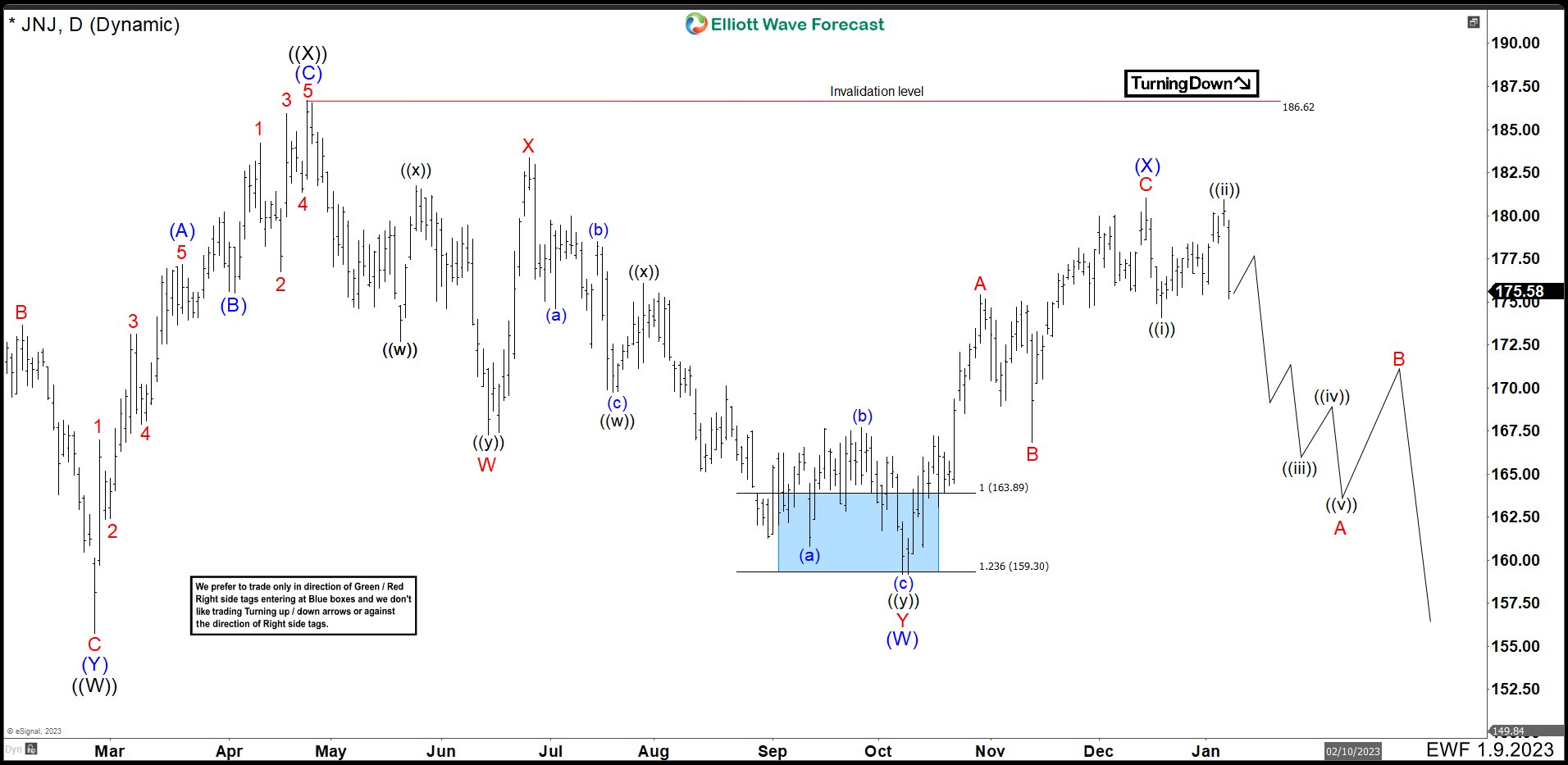

JNJ Could Have Started A Bearish Movement To End Wave II Correction.

Read MoreJohnson & Johnson (JNJ) is an American multinational corporation founded in 1886 that develops medical devices, pharmaceuticals, and consumer packaged goods. Its common stock is a component of the Dow Jones Industrial Average, and the company is ranked No. 36 on the 2021 Fortune 500 list of the largest United States corporations by total revenue. […]

-

Five Waves Rally in $GDXJ Suggests Bottom in Place

Read MoreGold Miners Junior (ticker: GDXJ) spent the past two years in a deep correction, but it looks to have found the bottom on 9.26.2022 low at 25.80 as the second chart (the Daily chart) below shows. The rally from 9.26.2022 low is in 5 waves (impulsive), suggesting that the bottom is likely in place and […]

-

Wells Fargo & Company (WFC) : Expects Sideways To Lower In Correction

Read MoreWells Fargo & Company (WFC) as diversified financial services company, provides banking, investment, mortgage, consumer & commercial finance products & services in the US & internationally. It operates through four segments, consumer banking & lending, commercial banking, corporate & investment banking & wealth & investment management. It is based in San Francisco, CA, comes under […]