The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

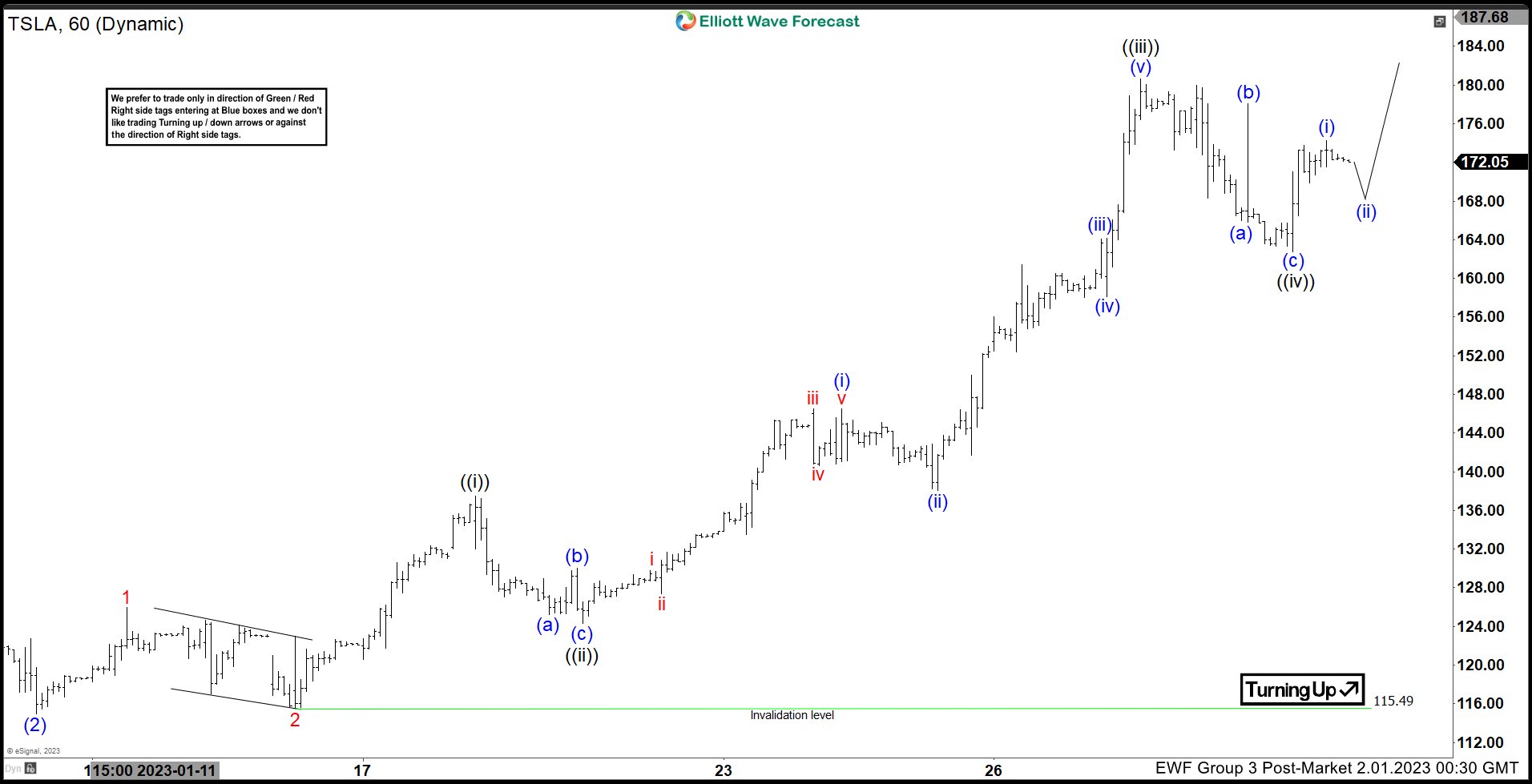

TESLA ($TSLA) Impulsive Rally Favors Upside

Read MoreTESLA (TSLA) showing short term Elliott wave impulsive sequence started from 1/06/2023 low. It should remain supported in 3, 7 or 11 swings and extend higher. Short term, it placed ((iv)) correction at 162.78 low against 1/19/2023 low and favors upside in ((v)) of 3 of (3). It proposed ended weekly correction at 101.20 low […]

-

AMD Starting To Turn Higher From The Blue Box Area

Read MoreIn this blog, we take a look at the past performance of AMD charts. In which, the stock provided a buying opportunity at the blue box area.

-

NQ_F: Forecasting Elliott Wave ((iii)) Higher In NASDAQ Futures

Read MoreHello Traders, in this blog we will see how we were able to forecast in advance the wave ((iii)) higher in NQ_F. Nasdaq has been one of the weakest Indices within 2022 and has been seeing a relief bounce rally as of recent. We will see below how here at Elliott Wave Forecast were able […]

-

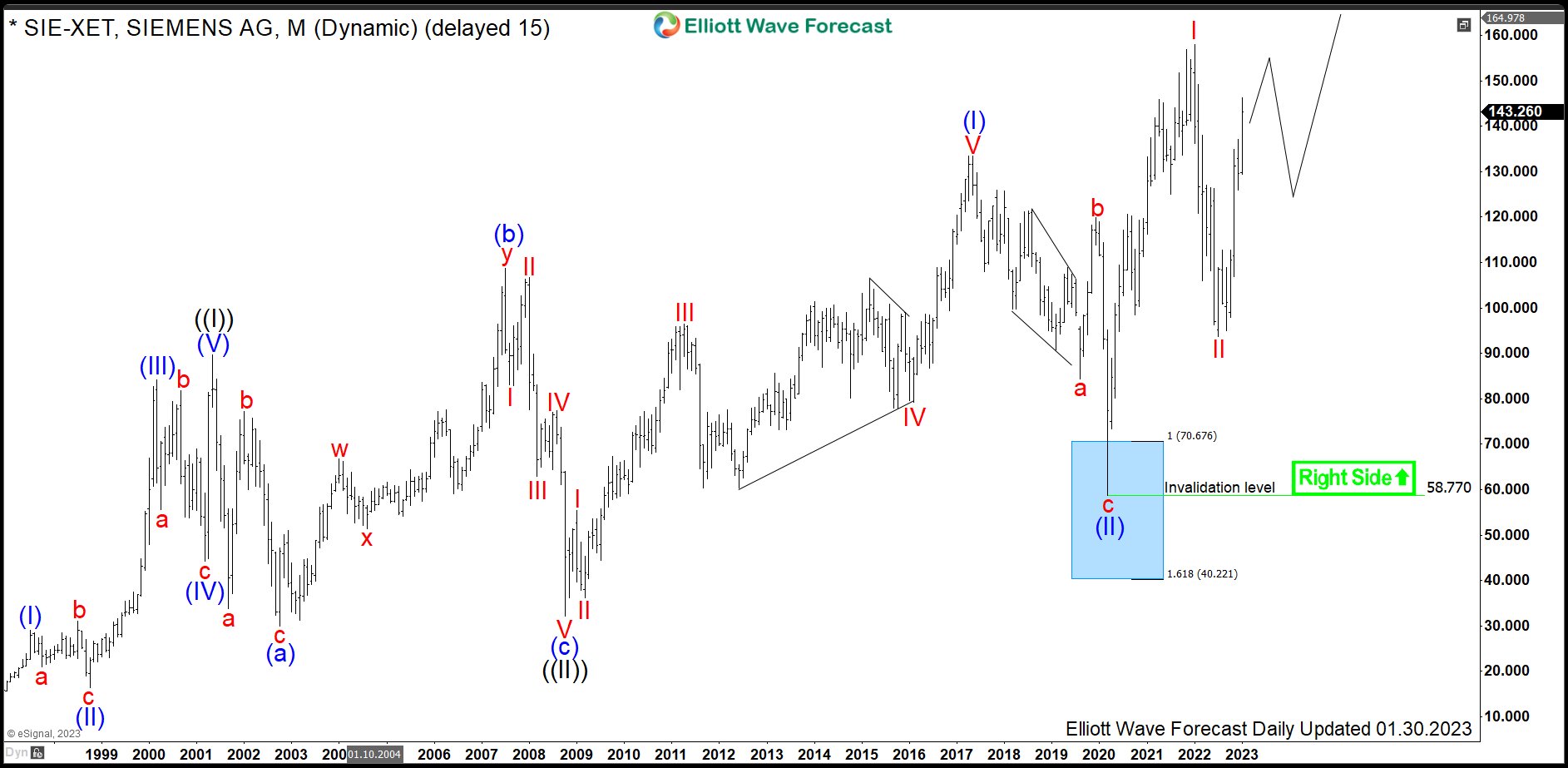

$SIE: Siemens Demonstrates Impulsive Move Higher

Read MoreSiemens SE is a German multinational conglomerate company and by revenue the largest industrial manufacturing enterprise in Europe. Company’s principal business divisions are Industry, Energy, Healthcare, Infrastructure & Cities. Founded in 1847 and headquartered in Munich, Germany, the company employs approx. 385’ooo people worldwide. Siemens is a part of both DAX40 and of SX5E indices. […]

-

ASML : Should It Be Ready For Next Rally ?

Read MoreASML Holding N.V., (ASML) develops, produces, markets, sells & services advanced semiconductor equipment systems consisting of lithography, metrology & inspection related systems for memory & logic chipmakers. It operates in Japan, South Korea, Singapore, Taiwan, China, Netherlands, Europe, US & others Asian countries. It is based in Veldhoven, Netherlands, comes under Technology sector & trades […]

-

JPMorgan (JPM) Missed The Blue Box And Rally As Expected

Read MoreJPMorgan Chase & Co. (JPM) is an American multinational investment bank and financial services holding company headquartered in New York City and incorporated in Delaware. As of December 31, 2021, JPMorgan Chase is the largest bank in the United States, the world’s largest bank by market capitalization, and the fifth-largest bank in the world in […]