The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

$MPW: Medical Properties Trust Reacting from Monthly Blue Box

Read MoreMedical Properties Trust is a real estate investment trust that invests in healthcare facilities subject to NNN leases. Founded in 2003 and headquartered in Birmingham, Alabama, USA, it is a part of S&P400 mid-cap index. Investors can trade it under the ticker $MPW at NYSE. The company owns 438 properties in the United States, Germany, […]

-

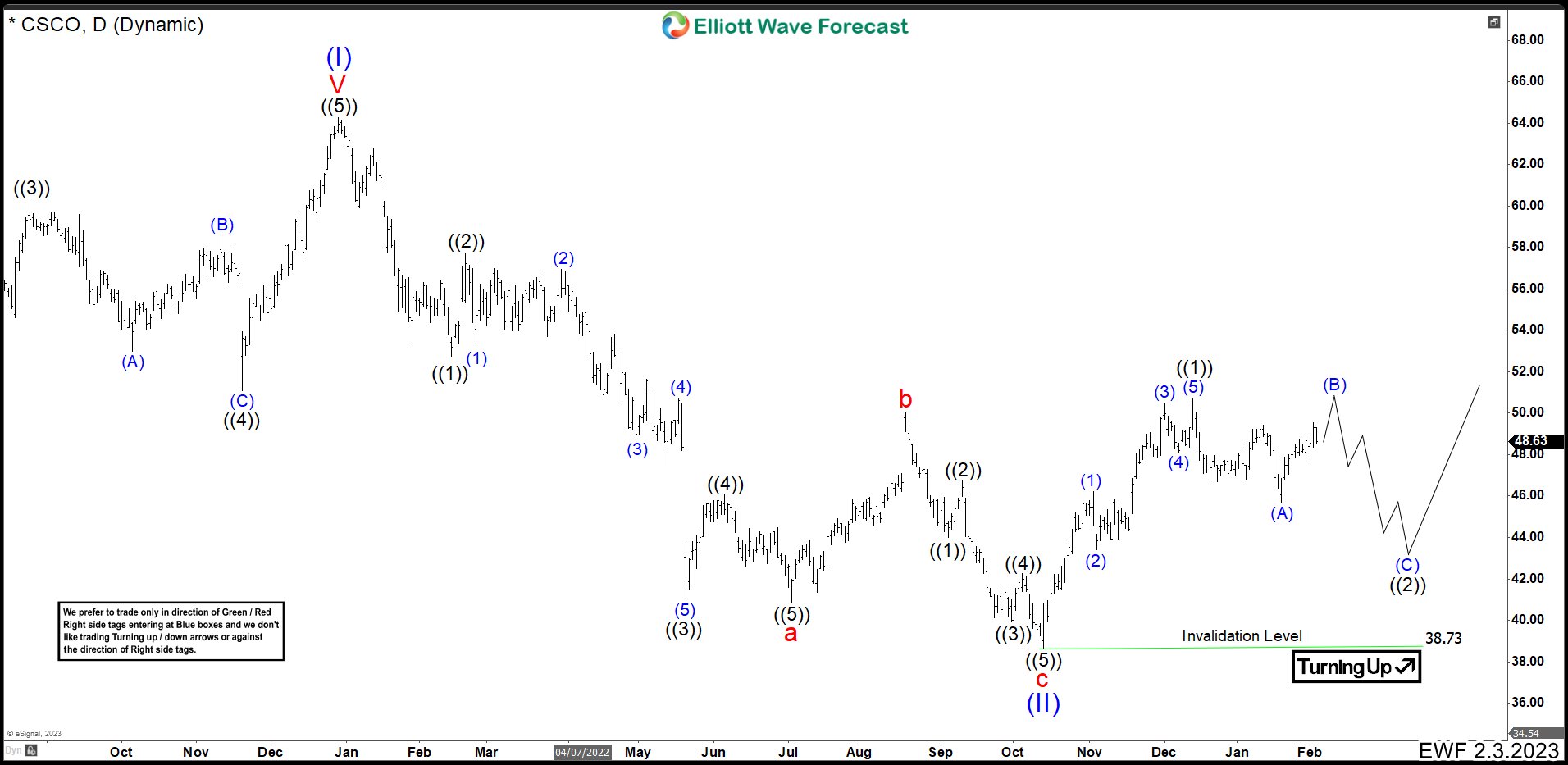

Cisco (CSCO) Ended a Bearish Cycle And It Should Continue With Rally.

Read MoreCisco Systems, Inc., commonly known as Cisco (CSCO), is an American-based multinational digital communications technology conglomerate corporation headquartered in San Jose, California. Cisco develops, manufactures, and sells networking hardware, software, telecommunications equipment and other high-technology services and products. Cisco specializes in specific tech markets such as: the Internet of Things (IoT), domain security, videoconferencing, and energy management with leading products including Webex, OpenDNS, Jabber, Duo Security, and Jasper. CSCO Daily Chart February 2023 At the end of 2021, Cisco finished […]

-

DE: Impulsive Rally Favors Upside

Read MoreDeere & Company (DE) manufactures & distributes various equipment worldwide. The company operates through four segments: Production & Precision Agriculture, small Agriculture & Turf, Construction & Forestry, & Financial services. The company is based in Illinois, US, comes under Industrials sector & trades as “DE” ticker at NYSE. DE is showing higher high sequence as […]

-

Chevron ($CVX) Provides a Blue Box Opportunity.

Read MoreGood Day Traders, In this technical blog, we are going to take a look at the Elliott Wave path in Chevron ($CVX). Chevron Corporation is an American multinational energy corporation predominantly in oil and gas. It is the second-largest direct descendant of Standard Oil, and originally known as the Standard Oil Company of California, it is headquartered in San Ramon, California, and active […]

-

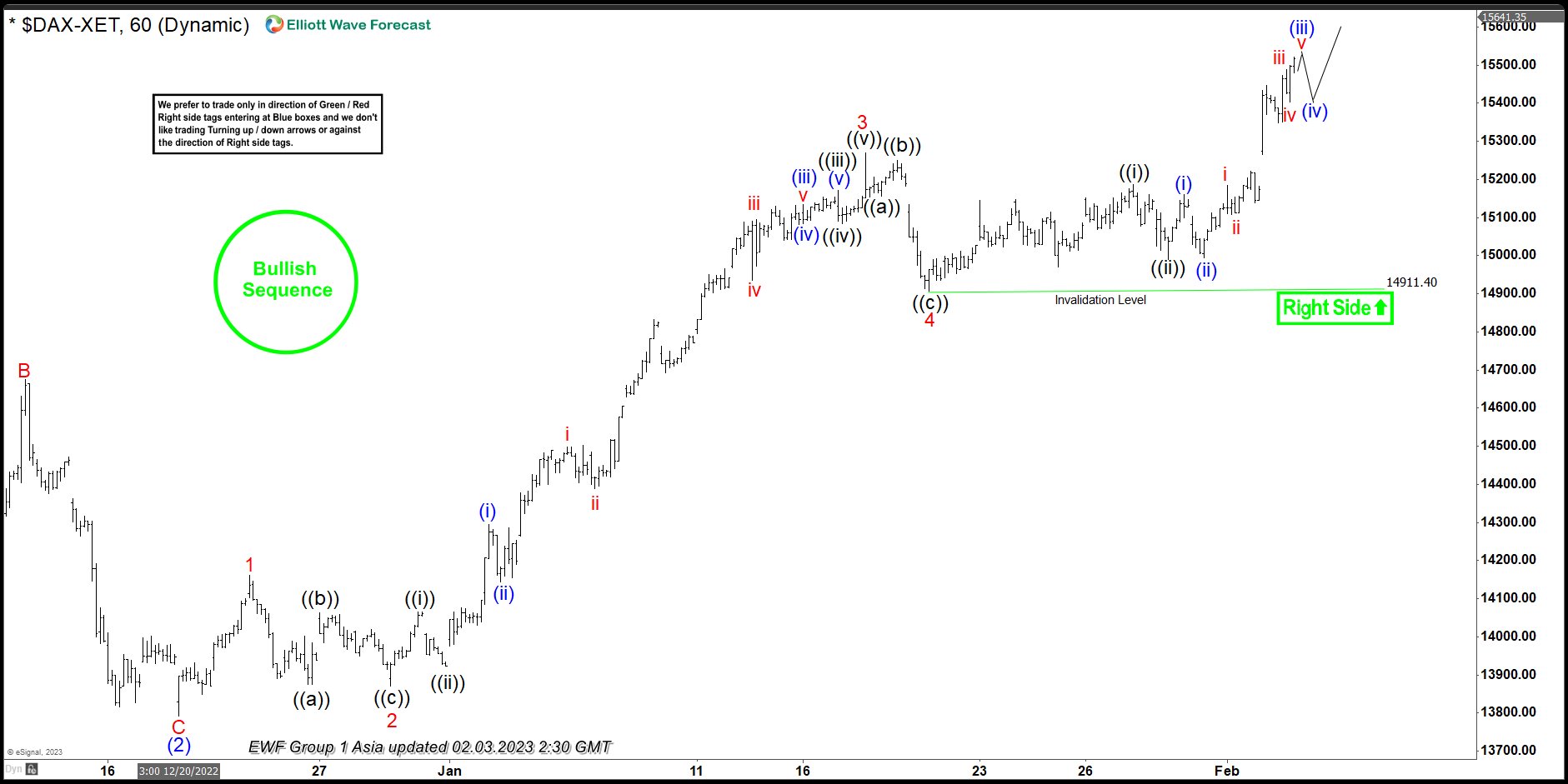

DAX Impulsive Rally Favors Upside And Remain Supported

Read MoreDAX is showing bullish impulsive Elliott wave sequence started from September-2022 low. It placed (1) at 14584.6 high and (2) at 13791.5 low on 12/20/2022. Above there, it favors higher in wave (3) and favors higher. It already showing higher high sequence favors short term strength to continue, while dips remain above 1/30/2023 low of ((ii)). In […]

-

S&P 500 (SPX) Bullish Elliott Wave Sequence Favors Upside

Read MoreS&P 500 (SPX) showing short term bullish Elliott wave sequence against October-2022 low. It proposed ended wave II correction at 10/13/2022 low of 3528.7 against daily sequence. Above there, it placed (1) at 4087.3 and (2) at 3764.5 low on 12/22/2022. It confirms higher high bullish sequence above (1) high, calling for further strength to continue. […]