The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Do Not Buy NIO Stock Until It Breaks October 2022 Low

Read MoreNio Inc. (NIO) is a Chinese multinational automobile manufacturer headquartered in Shanghai, specializing in designing and developing electric vehicles. The company develops battery-swapping stations for its vehicles, as an alternative to conventional charging stations. The company has raised over $5 billions from investors. In 2021, it plans to expand to 25 different countries and regions by 2025. NIO Daily […]

-

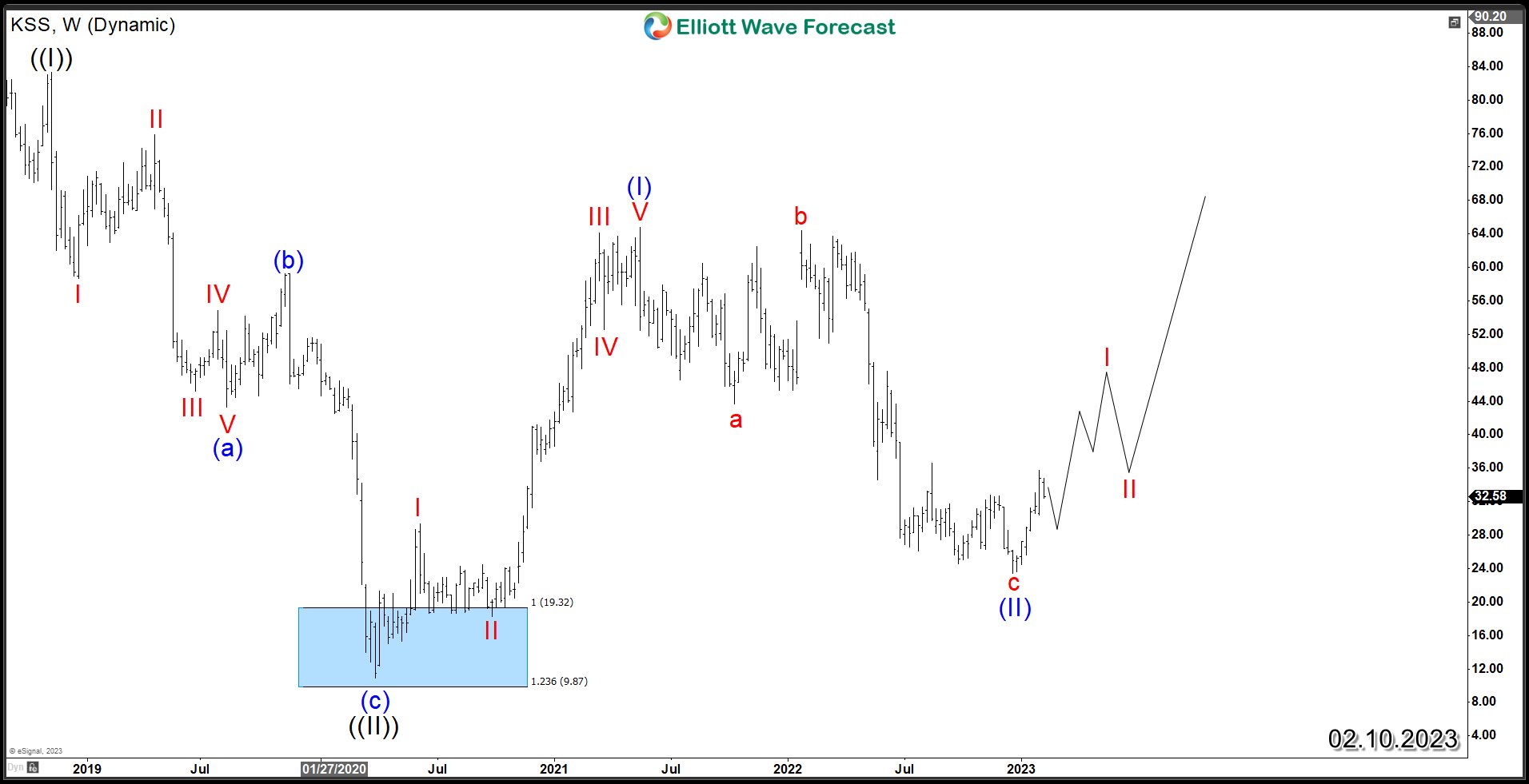

Kohl’s Corporation (KSS) Found a Technical Macro Bottom

Read MoreKohl’s stock trades on NYSE under ticker KSS and has been public since 1992, showing growth and fluctuations. Kohl’s Corporation operates over 1,100 US department stores and is based in Wisconsin. The company was founded in 1962 and faces growing competition from online retailers. It’s adapting to the changing retail landscape by expanding online presence […]

-

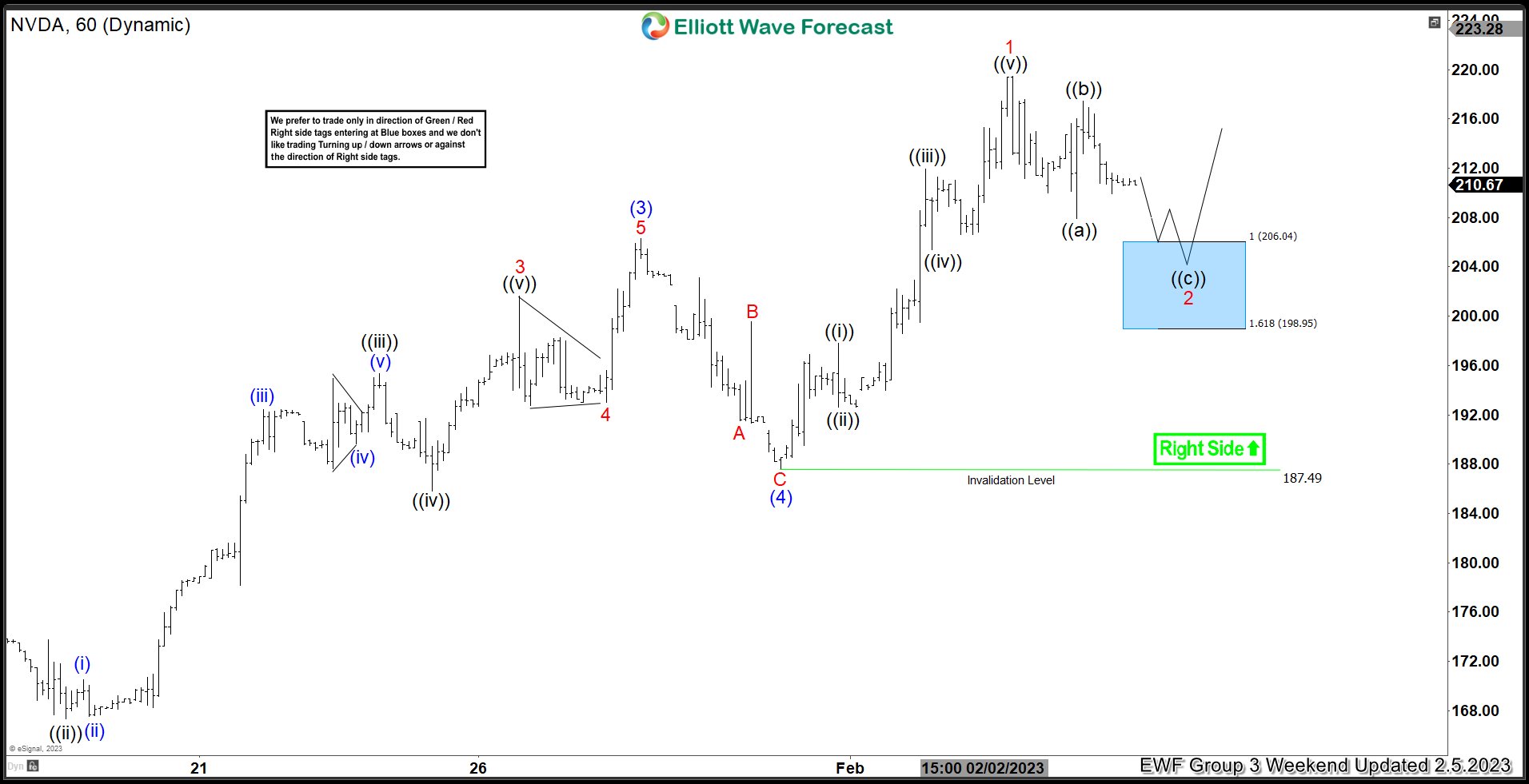

NVDA Blue Box Offered Short-term Buying Opportunity

Read MoreIn this blog, we take a look at the past performance of NVDA charts. In which, the stock provided a buying opportunity at the blue box area.

-

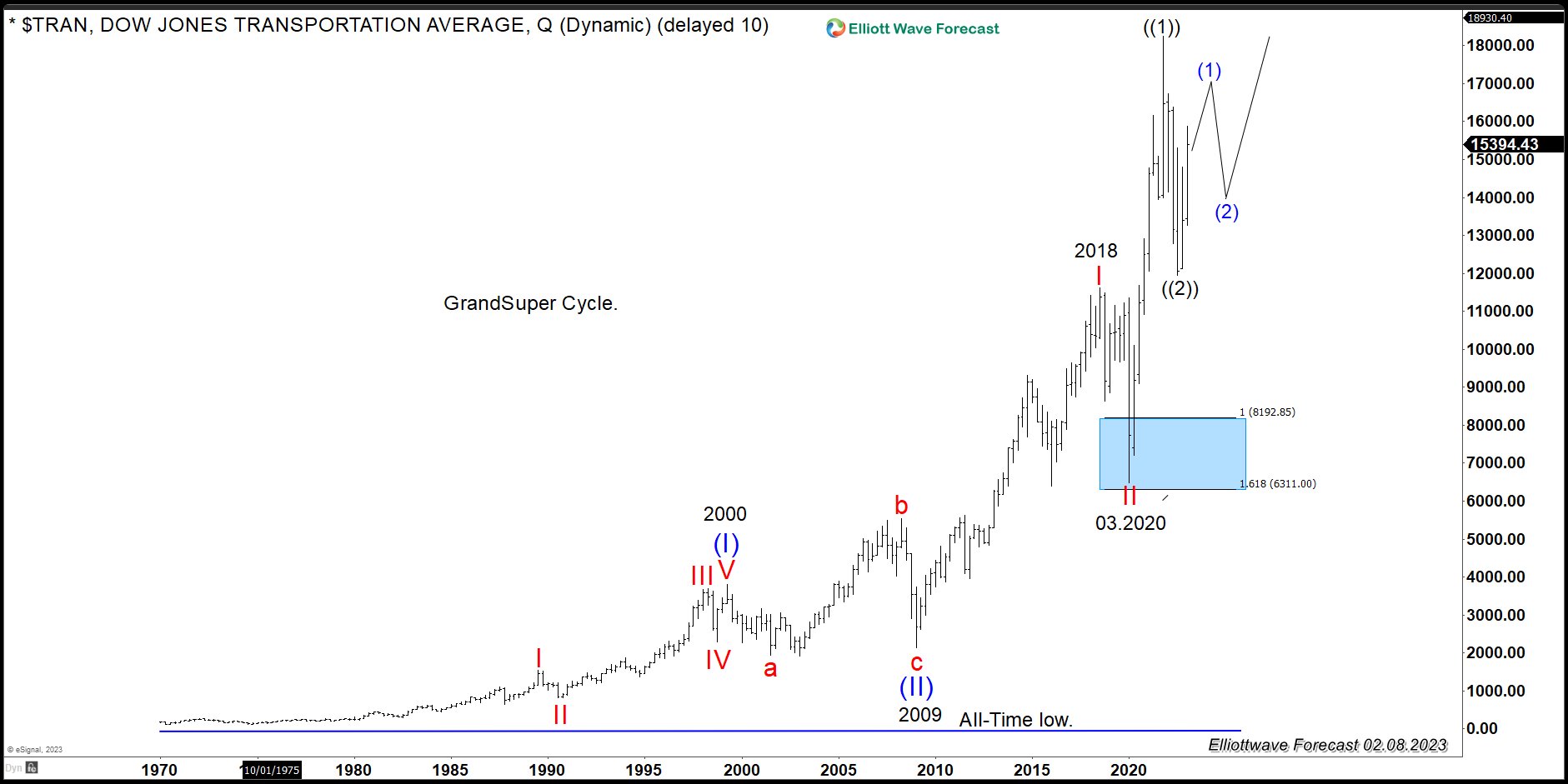

$TRAN (Dow Jones Transportation): The Sector Should Extend Higher Soon

Read More#TRAN (Dow Jones Transportation) is trading in an interesting swing sequence. It shows five swings advance in Grand Super Cycle degree. The idea that five waves or swings develop from the all-time lows make the sector bullish overall. However, we favor a nest, a series of I-II with a higher extension still to come. A […]

-

Microsoft Higher High Sequence Suggested Buying On Dips

Read MoreIn this blog, we take a look at the past performance of Microsoft charts. In which, the stock provided a buying opportunity at the blue box area.

-

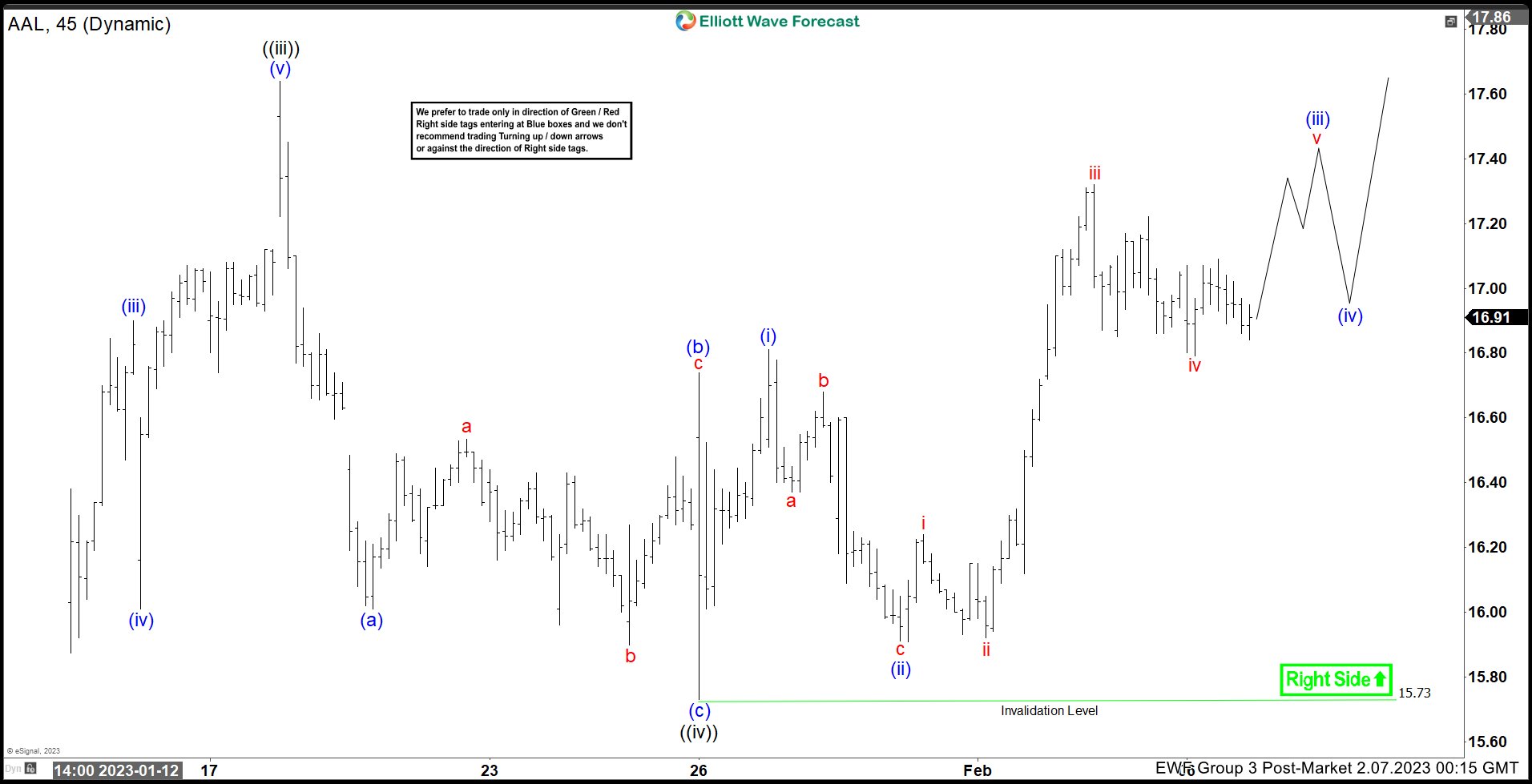

American Airlines (AAL) Elliott Wave View Favoring the Upside

Read MoreAmerican Airlines (AAL) rallies in impulsive structure from 10.3.2022 low favoring more upside. This article and video look at the Elliott Wave path.