The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

S&P 500 ETF (SPY) Advances with Nested Structure in Wave (5)

Read MoreS&P 500 ETF (SPY) extends higher in wave (5) from April 2025 low. This article and video look at the Elliott Wave path for the ETF.

-

AIZ’s 17-Year Bullish Cycle Attract Buyers From Blue Box

Read MoreAssurant Inc. AIZ has maintained a bullish cycle since November 2008, characterized by higher highs and lows. In such a price action sequence, traders should look to buy dips. This post will analyze the current price position within the trend and potential higher targets for traders. Assurant Inc. (NYSE: AIZ) is a leading global provider […]

-

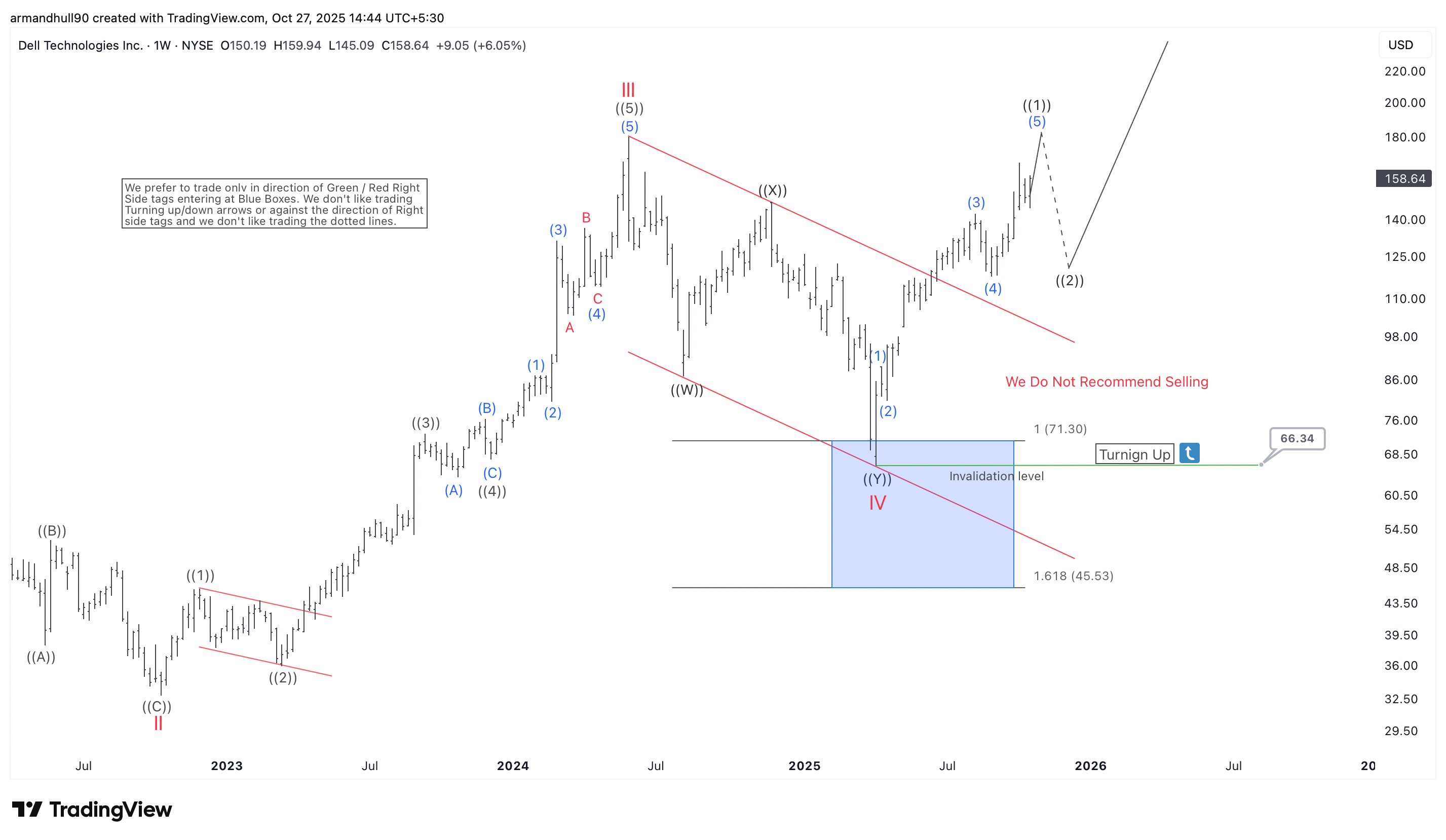

Dell Technologies Elliott Wave Analysis: Wave IV Completion Signals Start of a New Bullish Cycle

Read MoreAfter completing a three-leg correction within the blue box and breaking out of the red channel, Dell Technologies (NYSE: DELL) resumes its next impulsive bullish phase. Dell Technologies (NYSE: DELL) shows a strong Elliott Wave structure on the weekly chart, suggesting that a long-term uptrend is in progress. The larger count reveals that the stock […]

-

PLTR Last Leg? Why Palantir Could Be Approaching a Critical Correction

Read MorePalantir Technologies Inc. (PLTR) continues to dominate the AI-driven data analytics space, recently surging over 130% year-to-date to trade near $184.63. Investors have responded enthusiastically to its expanding government contracts, including a $10 billion U.S. Army deal and a £1.5 billion defense partnership with the U.K. These wins have propelled Palantir’s Q2 earnings past expectations, […]

-

Cameco (CCJ) – Impulse Structure Unfolding from April 2025 Base

Read MoreCameco (CCJ) is breaking to new all-time high in impulsive structure from April 2025 low. This article and video look at the Elliott Wave path.

-

Apple (AAPL) Elliott Wave Buying Setup Explained

Read MoreHello fellow traders. In this technical article, we are going to present Elliott Wave trading setup of Apple (AAPL) . The stock completed its corrective decline precisely at the Equal Legs area, also known as the Blue Box. In the following sections, we’ll break down the Elliott Wave structure in detail and explain the setup. AAPL […]